Beyond the Hype | What’s Really Fueling the Zen Technologies Share Price?

Let’s be honest. If you pull up a chart of the zen technologies share price from the last few years, it looks less like a stock and more like a rocket launch. It’s the kind of graph that makes you lean closer to your screen, squint, and mutter, “Wait… is that right?” For years, it was just another small-cap stock puttering along, a name most people in the market would barely register. And then, everything changed.

It’s a vertical climb. A hockey stick. A testament to something shifting, not just within the company, but within India itself.

I’ve been watching Indian markets long enough to see hype cycles come and go. We’ve had the infra boom, the IT wave, the pharma frenzy. But this feels… different. This isn’t just about a single company hitting a lucky streak. To really understand the story here, you have to zoom out from the stock ticker and look at the bigger picture. A much, much bigger picture.

It’s Not Just a Stock, It’s a Story of a Changing India

The single most important phrase you need to know to understand Zen’s trajectory is Atmanirbhar Bharat . Self-Reliant India. It’s a government mandate, a national mission, and the single biggest tailwind for domestic defence companies. For decades, India was one of the world’s largest importers of military hardware. We bought our jets from France, our rifles from Russia, our helicopters from the US. The idea of a homegrown company providing cutting-edge military tech seemed… quaint.

But that’s precisely what changed. The government push to design, develop, and manufacture defence equipment within India turned the entire sector on its head. Suddenly, companies like Zen Technologies, which had been developing niche solutions for years, were no longer just participants; they were strategic assets. The import embargo on certain defence items and a clear preference for Indian-made goods created a protected, high-growth environment. I keep coming back to this point because it’s the fundamental bedrock of Zen’s entire re-rating. You simply cannot analyze the company without understanding this policy shift.

And so, the money that used to flow out of the country for defence procurement is now being channeled inwards. It’s finding its way to companies that can deliver. And Zen, it turns out, can deliver some pretty fascinating stuff.

The Real “Zen” Magic | Simulators, Drones, and the Future of Warfare

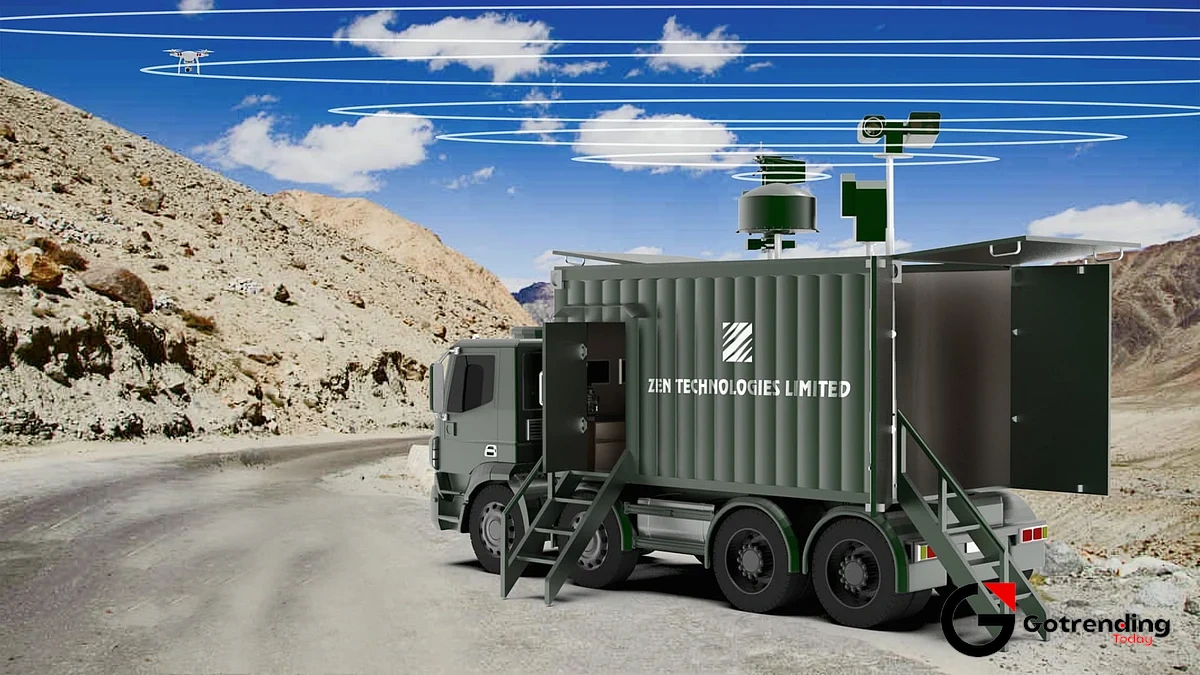

So what does this Hyderabad-based company actually do? If you think it’s just about building drones, you’re only scratching the surface. Actually, that’s not quite right. Their drone and Zen Technologies anti-drone system portfolio is a huge part of their current success, but their soul, their origin story, is in simulation.

Think about it this way: training a tank crew or a fighter pilot is incredibly expensive and dangerous. You’re using live ammunition, burning thousands of litres of fuel, and putting multi-million dollar equipment at risk. Zen’s genius was in creating hyper-realistic training simulators that replicate the real thing. We’re talking about sophisticated systems driving simulators, weapons simulators, even parachute simulators that allow soldiers to train in a safe, cost-effective, and endlessly repeatable environment. It’s like the world’s most advanced video game, but with real-world consequences for national security. It’s a far cry from a casual game of PUBG, but the principle of immersive, realistic training is something gamers would instantly understand. You can learn more about why people are drawn to such immersive experiences on sites like GoTrendingToday .

And then there are the drones. The conflicts in Ukraine and the Middle East have proven that the future of warfare involves swarms of cheap, effective unmanned aerial vehicles (UAVs). This has created a two-sided market. First, the need for our own drone capabilities. Second, and perhaps even more urgently, the need for effective anti-drone systems. Zen is playing on both sides of this fence. Their anti-drone technology, which can detect, track, and neutralize hostile drones, is one of the hottest areas in modern defence. This isn’t science fiction; it’s a critical requirement on every modern battlefield, and the Zen Technologies order book reflects that growing demand.

So, What’s the Catch? A Look at the Zen Technologies Future Outlook

Now, for a dose of reality. Is this a one-way ticket to the moon? Of course not. The incredible run-up in the zen technologies share price means that a lot of this future growth is already priced in. You’re not getting in on the ground floor anymore; you’re buying a ticket after the rocket has already cleared the launchpad.

The biggest risk here is the nature of the business itself. Zen is heavily, almost entirely, dependent on government contracts. These orders can be massive, but they can also be “lumpy.” They don’t come in a smooth, predictable stream. There can be long periods of quiet followed by a flurry of big announcements. This can lead to volatility. Any policy change, delay in payments, or budget cut from the Ministry of Defence could have a direct impact. You can get a sense of the government’s priorities by looking at official sources, like the Indian Ministry of Defence website, which outlines their focus on indigenous production.

Furthermore, success attracts competition. While Zen has a first-mover advantage and strong government ties, other players in the private sector, and even large public sector undertakings (PSUs), are eyeing the same pie. The world of defence sector stocks India is getting more crowded. Zen will need to keep innovating to stay ahead.

But even with those risks, the story is undeniably compelling. This isn’t just about financials or order books. It’s about a small Indian company riding a massive geopolitical and domestic policy wave, moving from a niche player to a critical part of the nation’s security apparatus. And that, more than anything, is what has captured the market’s imagination.

Frequently Asked Questions About Zen Tech

Is Zen Technologies a good long-term buy?

That’s the million-dollar question, isn’t it? The answer depends entirely on your risk appetite. The company is fundamentally strong and perfectly positioned to benefit from the ‘Make in India’ defence theme. However, the stock has had a massive run-up, so it’s not cheap. A long-term investor would be betting that its growing order book and expansion into new-age warfare tech like anti-drone systems will justify and exceed its current valuation. It’s less of a value play and more of a growth story.

What exactly does Zen Technologies do besides drones?

This is a great question because their core is often misunderstood. Their foundation is in training simulators. They build everything from virtual tank driving simulators to small arms training systems that mimic recoil and sound. This core expertise in software and hardware integration is what allowed them to pivot so effectively into the Zen Technologies drone technology and anti-drone space. They are, at their heart, a defence-focused technology and simulation company.

Is the zen technologies share price just a bubble from defence hype?

It’s easy to see why someone would think that. The price action has been explosive. While there’s certainly an element of “hype” or market sentiment driving all defence sector stocks India , Zen’s rise is backed by tangible numbers. You can look at their quarterly results and the growth in their confirmed order book. Unlike a pure bubble, there’s a real business with real contracts and real revenue growth underneath the soaring price. The question is whether the growth can continue at a pace that justifies the current market capitalization.

How do I check my allotment status if I apply for a new stock IPO?

While Zen Technologies is already a listed company, many people getting interested in stocks like it might also be looking at Initial Public Offerings (IPOs). Typically, you can check your allotment status on the registrar’s website for that specific IPO or through your brokerage account. For those new to the process, resources like this guide can be helpful in understanding the steps involved in the Indian market.