TVS Credit Bandhan Explained

Okay, let’s talk TVS Credit Bandhan . You’ve probably seen the name floating around, maybe even wondered what it’s all about. It’s more than just a financial product; it’s a specific collaboration designed to bring financial inclusion to folks, especially in rural and semi-urban India. But here’s the thing: understanding why it matters and how it works can be a game-changer for many. So, let’s dive deep, shall we?

What Exactly Is TVS Credit Bandhan?

Simply put, TVS Credit Bandhan is a business correspondence model where TVS Credit partners with local entities (the ‘Bandhan’ part, meaning ‘bond’ or ‘connection’) to extend financial services. It’s not about setting up shiny new branches everywhere – that’s expensive and time-consuming. Instead, it leverages existing local networks, infrastructure and expertise to reach customers who might otherwise be excluded from the formal financial system. Think of it as a smart shortcut to financial inclusion.

The core idea? Bring financial services to the customer’s doorstep via trusted community partners. These could be self-help groups (SHGs), microfinance institutions (MFIs), or even established local businesses with a strong community presence. By working together, TVS Credit can tap into a pre-existing network of trust and understanding, making it easier to offer loans, insurance, and other financial products to those who need them most.

Why Does This Matter? (The Real Impact)

This is where things get interesting. Financial inclusion isn’t just a buzzword; it’s about empowering individuals and communities. In a country like India, where a significant portion of the population lives in rural areas with limited access to traditional banking services, initiatives like TVS Credit Bandhan play a vital role. Consider the small farmer who needs a loan to buy seeds, or the artisan who needs capital to expand their business. Traditional banks might see them as too risky or too difficult to reach. That’s where TVS Credit Bandhan steps in.

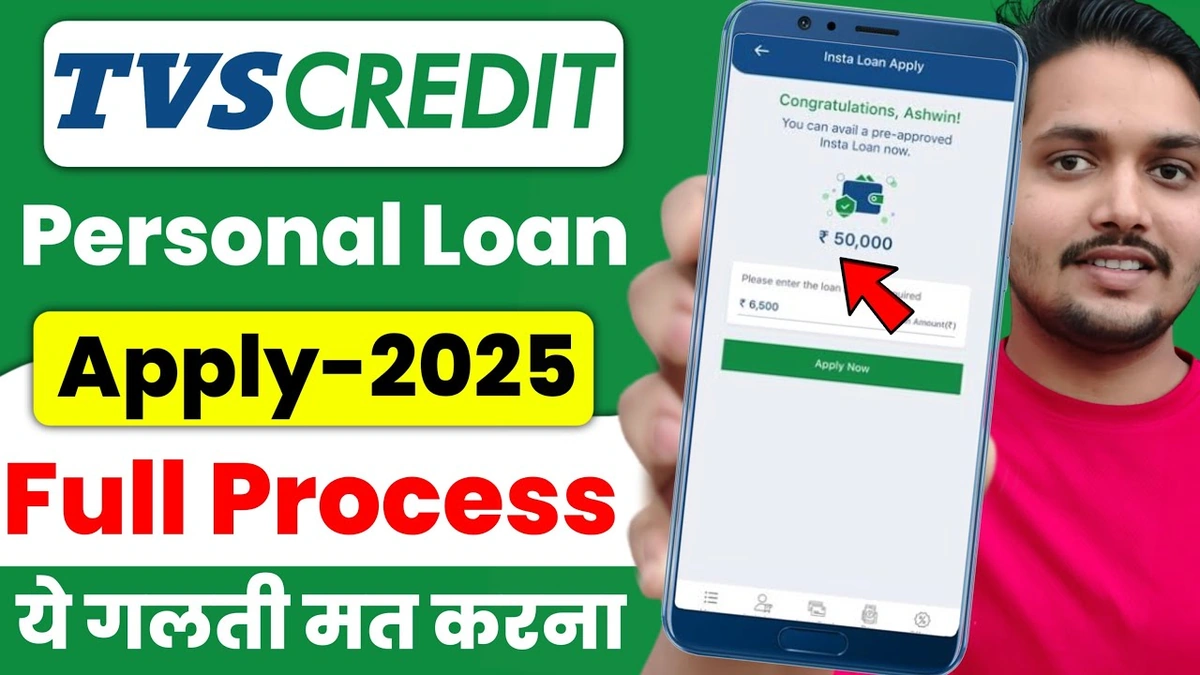

Here’s the thing: access to credit can break the cycle of poverty, fuel entrepreneurship, and drive economic growth at the grassroots level. And it’s not just about loans. Insurance products offered through this model can provide a safety net for vulnerable families, protecting them from unexpected financial shocks due to illness, accidents, or natural disasters. In essence, it’s about building a more resilient and equitable society, one loan at a time. TVS Credit leverages technology, too. Think mobile apps for loan applications, digital payment systems, and data analytics to assess risk and personalize financial solutions. This makes the process more efficient, transparent, and accessible for both the customer and the partner organization.

How Does It Actually Work? (The Nitty-Gritty)

Let’s break it down: TVS Credit identifies and partners with a local organization that already has a strong presence in the community. TVS Credit provides the financial products, technology, and training. The partner organization acts as a facilitator, connecting TVS Credit with potential customers, assisting with loan applications, and providing local support. So, the interest rate is a key component that directly impacts the affordability and accessibility of these financial products. The customer service aspect is the backbone, the prompt and efficient service contributes significantly to customer satisfaction and loyalty. And, let’s not forget loan repayment options . This also plays a critical role in the success and sustainability of the TVS Credit Bandhan model.

But, and this is crucial, the partner organization isn’t just a glorified salesperson. They play a vital role in educating customers about financial literacy, responsible borrowing, and the importance of timely repayment. This ensures that customers are empowered to make informed decisions and avoid falling into debt traps. It’s about building long-term relationships based on trust and mutual benefit. What fascinates me is how this model fosters economic growth for both the end consumer and the local partner, creating a positive feedback loop of local development.

Addressing Potential Challenges

Now, let’s be honest: no model is perfect. The TVS Credit Bandhan model faces its own set of challenges. One of the biggest is managing risk. Partnering with multiple local organizations means dealing with varying levels of operational efficiency, financial stability, and ethical standards. TVS Credit needs to have robust due diligence processes in place to ensure that partners are reliable and trustworthy. Another challenge is ensuring transparency and preventing exploitation. There’s a risk that some partner organizations might take advantage of vulnerable customers by charging excessive fees or engaging in unethical lending practices. Regular audits, customer feedback mechanisms, and strict regulatory oversight are essential to mitigate this risk. TVS Credit must focus on robust risk management to ensure its financial stability. Partnership agreements need to be carefully crafted, ensuring alignment in goals and ethical standards.

And, of course, there’s the challenge of maintaining customer service standards. As the network expands, it becomes increasingly difficult to ensure that all customers receive the same level of quality service. Investing in training, technology, and monitoring systems is crucial to address this challenge.

The Future of Financial Inclusion in India

TVS Credit Bandhan is a powerful example of how innovative partnerships can drive financial inclusion in India. By leveraging local expertise, technology, and a commitment to responsible lending, this model has the potential to transform the lives of millions of people. I initially thought this was straightforward, but then I realized the deep impact it can have on rural development by bringing financial opportunities to underserved areas. Models like thisare essential to unlock the full potential of India’s economy and build a more inclusive and prosperous society. The key lies in continuous innovation, collaboration, and a relentless focus on customer needs.

FAQ

Frequently Asked Questions

What types of loans are typically offered under the TVS Credit Bandhan program?

Typically, the program offers a range of loans including two-wheeler loans, used car loans, and small business loans tailored to the needs of the rural and semi-urban population.

How can I find a TVS Credit Bandhan partner in my area?

You can visit the TVS Credit website or contact their customer service to find a list of authorized partners in your region.

What if I have trouble with my loan application through a Bandhan partner?

You should first contact the partner directly to resolve the issue. If unresolved, reach out to TVS Credit customer service for assistance.

Are there any specific eligibility criteria to avail of loans through this program?

Eligibility criteria vary depending on the loan type but generally include KYC documents, income proof, and a good credit history.

How does TVS Credit ensure the ethical practices of its Bandhan partners?

TVS Credit conducts regular audits and provides training to its partners to ensure they adhere to ethical lending practices and regulatory guidelines.