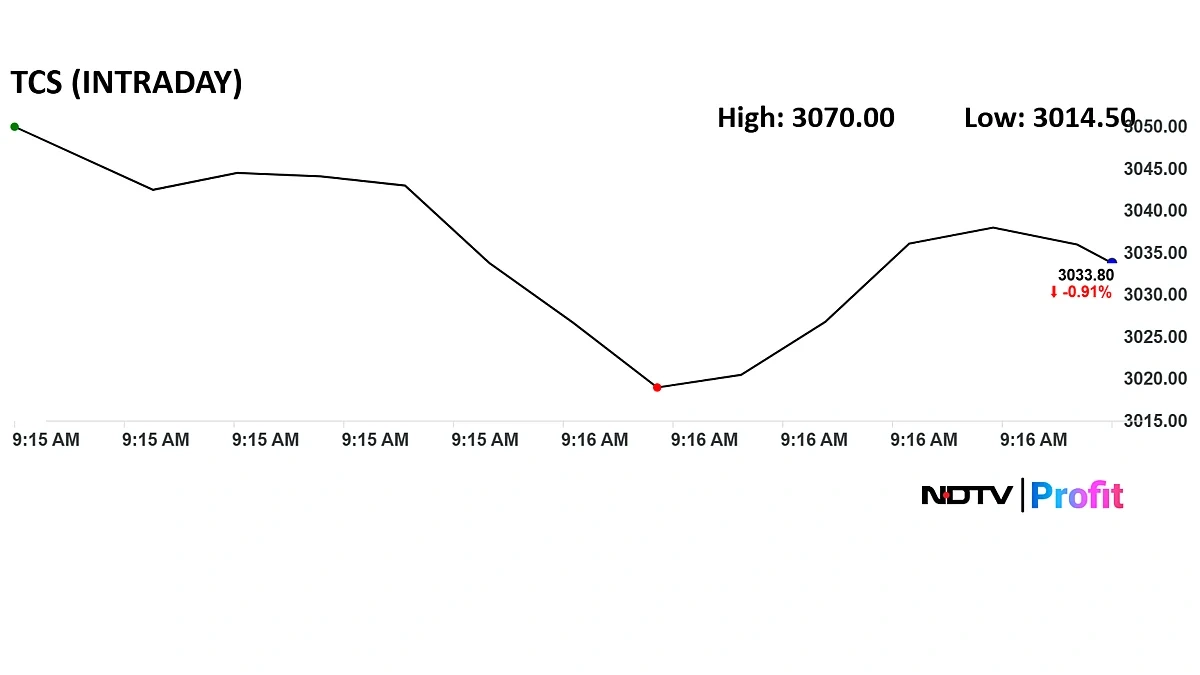

TCS Stock Update | Share Price Drops 1% – Analyst ‘Buy’ Rating

Okay, so the TCS share price dipped a bit – about 1% – and analysts are still saying ‘Buy.’ What does that even mean for you? Let’s be honest, stock market news can feel like another language. It’s not just about the numbers; it’s about the why behind them and how it impacts your potential investments. Here’s the thing: I’m not going to just parrot the headlines. I want to break down why this small drop, coupled with a ‘Buy’ rating, is actually pretty interesting. We will also delve into the TCS stock analysis to give you a better understanding of the current performance.

The Analyst’s Confidence | Why the ‘Buy’ Rating Matters

Analysts aren’t just throwing darts at a board. (Well, hopefully not!) When a firm slaps a ‘Buy’ rating on a stock like TCS, it’s based on a whole heap of research. We’re talking deep dives into the company’s financials, projections for future growth, and an assessment of the overall market conditions. So, even with the 1% dip in TCS share price , the analyst’s ‘Buy’ rating suggests they believe the stock is undervalued and poised for growth.

Think of it this way: they’re essentially saying, “Hey, this is a temporary blip. The fundamentals are strong, and this is a good time to get in.” But — and this is a big but — it’s crucial to understand why they think that. What specific factors are driving their optimism? Is it TCS’s expansion into new markets? Their strong track record of innovation? Or maybe something else entirely? It’s also important to consider other perspectives with investment recommendations from different analysts.

Let’s also consider the overall market sentiment. Is the Indian stock market generally bullish or bearish? This prevailing mood can significantly influence individual stocks, even giants like TCS.

Decoding the 1% Drop | A Blip or a Trend?

A 1% drop in TCS share price – is it the end of the world? Nah. But ignoring it completely isn’t wise either. It’s about understanding the context. Was there a specific event that triggered the dip? A negative news report? A broader market correction? Or was it simply a case of profit-taking by investors after a period of strong growth?

Sometimes, these small dips are nothing more than noise in the market. Other times, they can be early warning signs of a larger correction. The trick is to differentiate between the two. I initially thought this was straightforward, but then I realized how much external factors are at play. For example, global economic uncertainties or changes in government regulations could also impact TCS stock performance .

TCS and the Indian IT Sector | A Bigger Picture

TCS isn’t just a company; it’s a bellwether for the entire Indian IT sector. Its performance often reflects the health and outlook of the industry as a whole. If TCS is doing well, it’s generally a good sign for other IT companies and for the Indian economy. However, if TCS is struggling, it could signal broader challenges for the sector.

So, when we look at the TCS share price , we’re not just looking at one company. We’re getting a glimpse into the overall state of the Indian IT industry. And that’s a pretty big deal. This is also where understanding equity research can be particularly beneficial. Examining reports from various firms can reveal trends and insights not immediately apparent.

Investing in TCS | What You Need to Consider

Okay, so you’re thinking about buying TCS shares? Great! But before you jump in, let’s talk about what you need to consider. I’ve seen people make some pretty big mistakes by not doing their homework, so I’ll share some tips.

First, what’s your risk tolerance? Are you a conservative investor who prefers steady, long-term growth, or are you more willing to take risks for the potential of higher returns? TCS is generally considered a relatively stable stock, but all investments carry some degree of risk.

Second, what’s your investment horizon? Are you planning to hold the stock for a few months, a few years, or even longer? Long-term investors are generally less concerned about short-term fluctuations in the share price. Understanding stock market trends is also important to make informed investment decisions. Remember to also research TCS future growth potential .

Third, do you understand the company’s business model? Do you know what TCS actually does? (Hint: it’s more than just writing code!) Understanding the company’s core strengths and weaknesses is crucial for making informed investment decisions. Check out Tata Capital IPO Price to get a view of Tata companies. And if you’re interested in how other companies are performing, PNB share might be insightful.

The Future of TCS | Beyond the Share Price

Ultimately, the TCS share price is just one piece of the puzzle. To truly understand the company’s potential, we need to look beyond the numbers and consider its long-term vision. Where is TCS headed? What are its strategic priorities? And how is it adapting to the rapidly changing technological landscape? I’m talking about things like AI, cloud computing, and the Internet of Things. The company is also keen on its digital transformation .

As per a report byWikipedia, TCS is expanding its operations in many new areas, and it may be a good long-term investment. Also, keeping an eye on any dividend announcements could be beneficial for those seeking regular income.

So, while the 1% drop in TCS share price might seem like a minor setback, the analyst’s ‘Buy’ rating suggests that the company’s long-term prospects remain bright. But, like any investment, it’s crucial to do your research, understand your risk tolerance, and make informed decisions. Don’t just follow the herd – think for yourself!

FAQ

Is TCS a good long-term investment?

TCS is generally considered a stable and reliable long-term investment due to its strong market position and consistent performance. However, like any investment, it carries risks, so conduct thorough research before investing.

What factors affect the TCS share price?

Various factors can affect the TCS share price, including company performance, overall market conditions, industry trends, and global economic factors.

Does TCS pay dividends?

Yes, TCS has a history of paying dividends to its shareholders. The amount and frequency of dividends may vary.

Where can I find more information about TCS?

You can find more information about TCS on its official website, financial news websites, and brokerage platforms. Always consult reputable sources for accurate data.

What are the risks of investing in TCS?

Risks of investing in TCS include market volatility, economic downturns, and company-specific challenges such as competition or changes in technology.

How do I buy TCS shares?

You can buy TCS shares through a stockbroker or an online brokerage account. Ensure the broker is registered with SEBI.