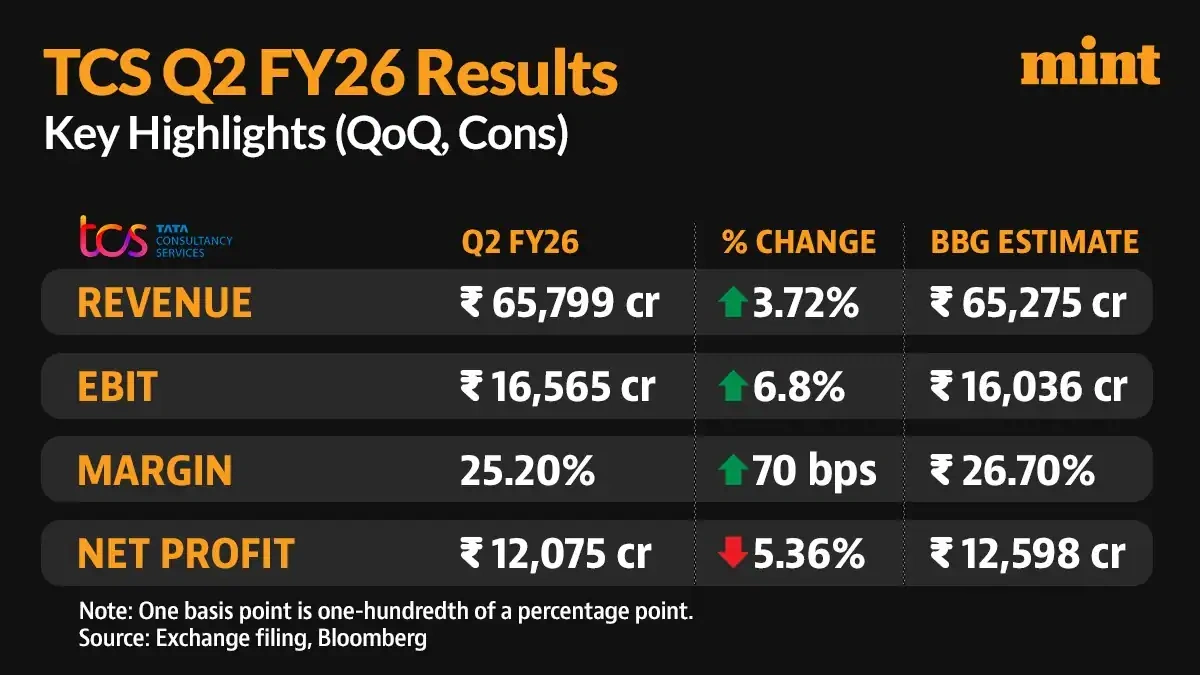

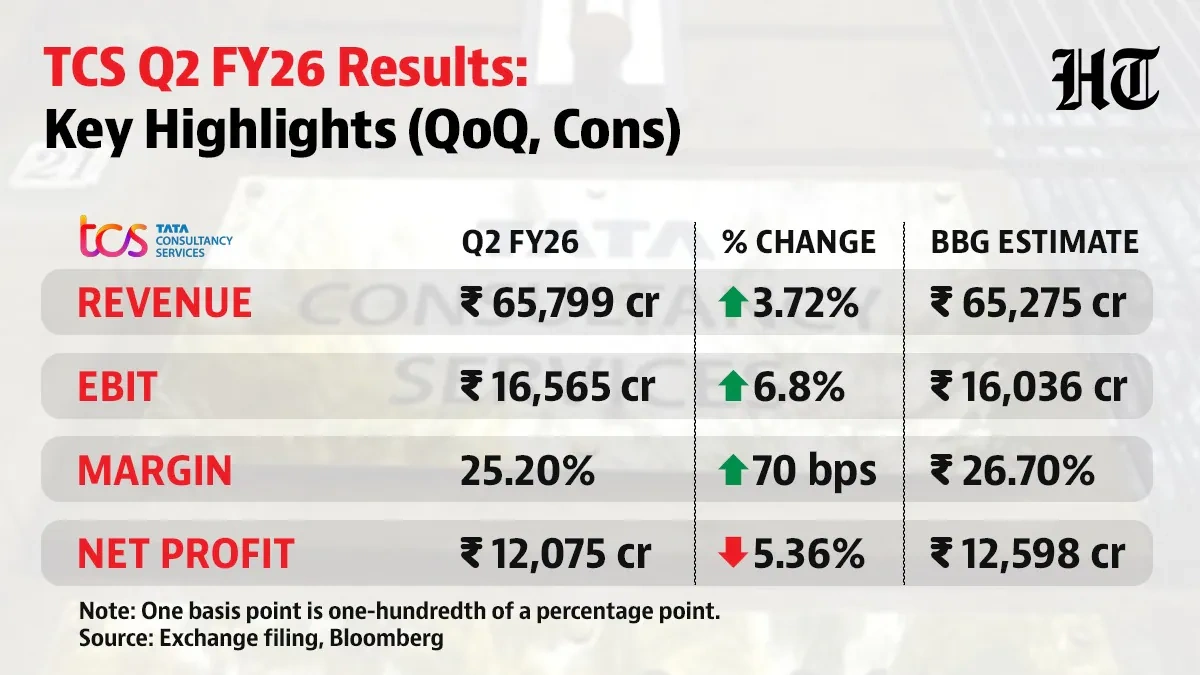

TCS Q2 2025 Results | Profit Up 1% YoY to ₹12,075 Crore, ₹11 Dividend Declared

Okay, let’s be honest. Earnings reports can be a bit… dry. But the TCS Q2 2025 results ? They’re actually pretty interesting when you dig into what they really mean for India’s tech landscape and, more importantly, your investments. We’re not just going to regurgitate numbers here. We’re going to unpack the “why” behind the figures, the hidden context, and what it signals for the future.

Decoding the Numbers | More Than Just a 1% Bump

So, profit’s up 1% year-on-year, landing at ₹12,075 crore. Big deal, right? Well, yes and no. On the surface, 1% might seem underwhelming. But here’s the thing: the global economic climate has been… volatile, to say the least. Considering the headwinds – inflation, geopolitical tensions, and fluctuating currency rates – that little 1% is actually a testament to TCS’s resilience. The ₹11 dividend is icing on the cake, a small but welcome return for investors. What fascinates me is how they managed to navigate these challenges. Did TCS ‘s diverse service offerings play a role? Absolutely. Their strength lies in not putting all their eggs in one basket. Let me rephrase that for clarity; the diversification across different sectors and geographies helped them offset any significant negative impact in a particular area. Market fluctuations can heavily affect tech giants, so keeping diversified is an excellent approach.

The Hidden Story | Digital Transformation is the Key

The real story isn’t just the profit margin; it’s how they achieved it. Digital transformation continues to be a major growth driver. Companies across all sectors are scrambling to modernize their operations, and TCS is right there, providing the tech muscle. Think cloud migration, AI implementation, and cybersecurity solutions. These aren’t just buzzwords; they’re essential for businesses to stay competitive in today’s market. TCS is making strategic moves in AI, and this could be a game-changer. The company is heavily investing in AI-related training, and this will ensure TCS is ahead of the curve when it comes to new projects involving Artificial Intelligence. This is a long game, not a short-term play.

Geographic Performance | Where is TCS Thriving?

While the overall picture is positive, it’s crucial to understand where TCS is seeing the most growth. Are they expanding aggressively in North America? Are there new emerging markets that have contributed significantly? Knowing the regional growth patterns gives us a much better sense of TCS’s strategic priorities and how effectively they are capturing new opportunities. North American markets can heavily determine the global success of tech giants, so how TCS performs in that market can offer insights on their business.

But, something else is quite important here. As per the latest reports, the India market holds immense potential for growth. A common mistake I see people make is assuming that TCS is solely focused on Western markets. The reality is they are strategically tapping into the burgeoning domestic market, which offers huge potential for expansion. I initially thought this was straightforward, but then I realized the importance of not overlooking local Indian opportunities.

And, remember that TCS’s success isn’t just about cutting costs, though that plays a part. It’s about creating value for its clients. This can be achieved through innovation, automation, and offering tailored solutions that address specific business challenges.

Dividend Details and Shareholder Impact

Let’s talk dividends. The ₹11 per share payout is good news, showing the company’s financial health and commitment to rewarding shareholders. For retail investors, this steady income stream makes TCS an attractive long-term investment. But, it’s essential to remember that dividend yields aren’t everything. Share prices are subject to market changes, and it is worth seeking professional financial advice before making investment decisions. Speaking of shareholders, here’s a link to Dr Reddy’s Share Price .

Looking Ahead | Challenges and Opportunities

So, what’s next for TCS? The company faces challenges, no doubt. Competition is fierce, and the tech landscape is constantly evolving. But TCS has a track record of adapting and innovating. Key focus areas will likely include strengthening their AI capabilities, expanding their cloud services, and deepening their expertise in emerging technologies. According to industry experts, TCS will also be focusing on sustainability projects and ensuring that tech is utilized in a way that helps protect the planet.

Ultimately, investing in the stock market involves accepting a level of risk. But, companies such as TCS have strong foundations, making them reliable options.

FAQ Section

Frequently Asked Questions (FAQs)

What exactly does “YoY” mean in this context?

“YoY” stands for Year-over-Year. So, when we say profit is up 1% YoY, it means it’s increased by 1% compared to the same quarter last year.

How does the dividend payout affect TCS’s share price?

Typically, a dividend payout can have a slight positive impact on the share price, as it attracts investors looking for income. However, many factors influence share price, and the dividend is just one piece of the puzzle.

What are the main challenges TCS faces in the current market?

Increased competition, rapidly evolving technology, and global economic uncertainties are some of the primary challenges TCS needs to navigate. Maintaining their innovation edge is crucial.

Where can I find the official TCS earnings report?

You can usually find the official reports on the TCS investor relations website ( TCS Official Site ). Look for the section dedicated to financial results and investor updates.

Is TCS still a good investment, given the modest profit increase?

That depends on your individual investment goals and risk tolerance. A 1% profit increase isn’t spectacular, but considering the global economic headwinds, it shows resilience. Consult with a financial advisor for personalized advice.

How important is talent retention for TCS?

Talent retention is incredibly important. In the IT services industry, a company’s biggest asset is its people. High attrition rates can disrupt projects and increase costs. TCS invests heavily in training and employee development to keep its workforce engaged and motivated.