TCS Q2 Results | Net Profit Down 5% to ₹12,075 Crore, Dividend Announced

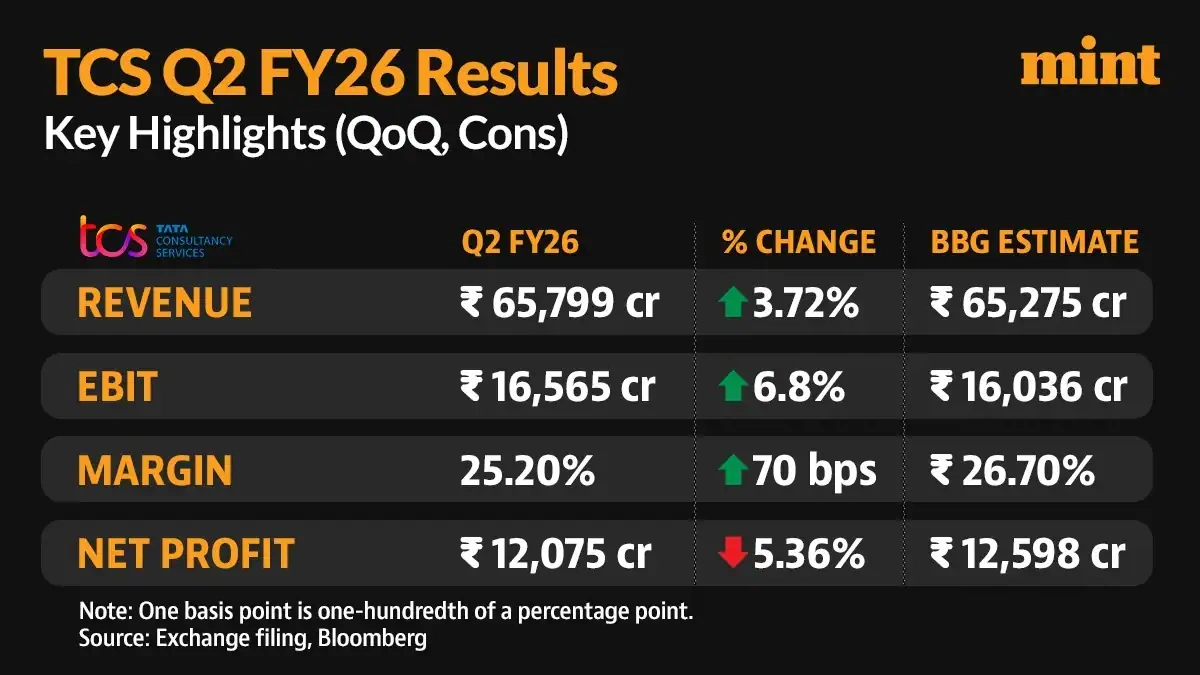

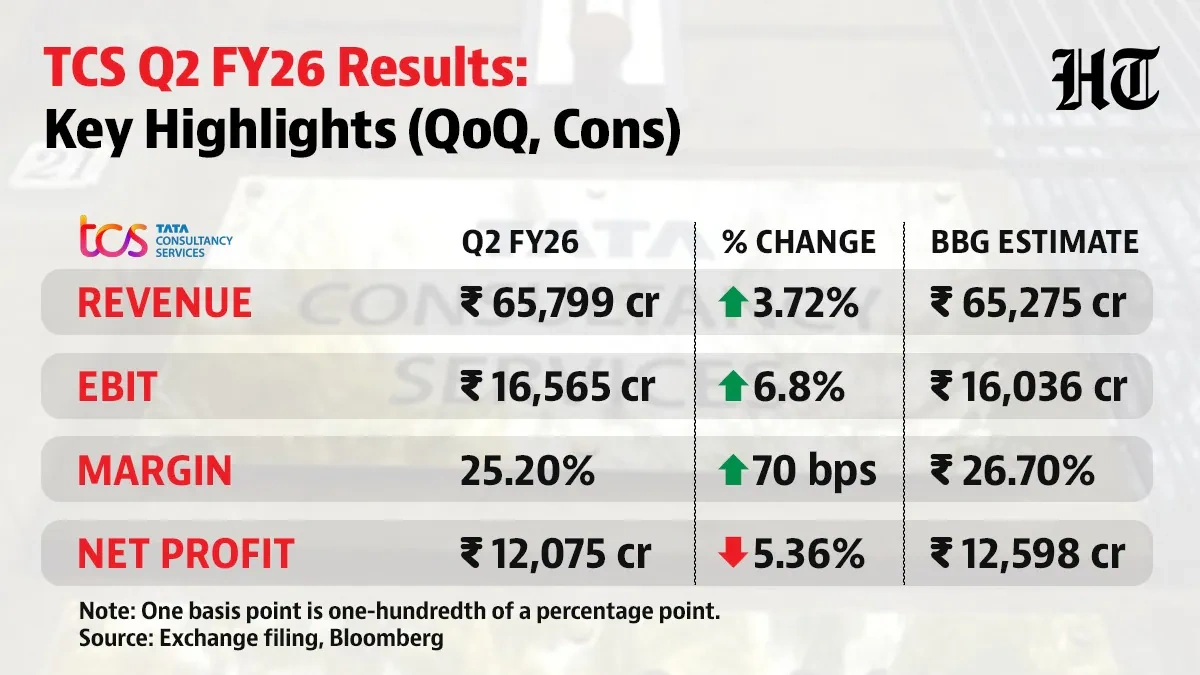

Okay, let’s talk TCS. The news is out: TCS Q2 results are here, and while the company announced a hefty dividend, the net profit took a dip. Down 5% to ₹12,075 crore. Now, the headlines shout the numbers, but what do those numbers really mean? More importantly, what does it mean for you, the average investor, or even someone considering a career in the ever-evolving tech landscape of India?

Forget the sterile reports. Let’s be honest, poring over spreadsheets isn’t exactly everyone’s idea of a good time. Here’s the thing: this isn’t just about TCS; it’s a snapshot of the broader IT sector, a bellwether of the Indian economy, and a glimpse into the future of tech jobs. So, grab a cup of chai, and let’s break this down.

Decoding the Dip | Why the Profit Decline Matters

The 5% drop in net profit – that’s the headline grabber. But context is king. The truth? We’re not living in a vacuum. The global economic slowdown is impacting everyone, and TCS, despite its size and clout, isn’t immune. Factors like currency fluctuations, increased operating costs, and a slightly cautious approach from clients (who are also feeling the pinch) all contribute. As per reports byLivemint, experts had already predicted a tempered growth for IT giants due to global uncertainties. The key is not just the dip itself, but how TCS is navigating these headwinds. Are they cutting corners, or are they investing in long-term growth? That’s what we need to understand.

But, and this is a crucial but, the dividend announcement is a significant counterpoint. A dividend is essentially a reward to shareholders, a slice of the profits. Announcing a dividend, even in the face of a profit dip, signals confidence. It says, “We’re still solid, we’re still profitable, and we’re committed to delivering value.” Think of it like this: even if your monthly income dipped a bit, but you still managed to put some money into your savings account – that’s a sign of resilience. TCS is doing something similar.

Dividend Details and Investor Implications

Speaking of dividends, let’s get into the specifics. While the exact dividend per share will vary depending on your holdings, the announcement itself is a positive sign for investors. It provides a tangible return, a bit of sugar to offset any potential sourness from the profit decline. For long-term investors, this is particularly reassuring. It reinforces the idea that TCS is not just chasing short-term gains, but is building a sustainable business model that rewards loyalty.

Let me rephrase that for clarity. If you’re someone who’s been holding TCS shares for a while, this dividend is a welcome bonus. If you’re considering investing, it’s a factor to weigh in. But don’t just blindly jump in based on the dividend alone. Look at the bigger picture: the company’s long-term strategy, its investments in new technologies, and its ability to adapt to the changing market landscape. The one thing you absolutely must remember is that past performance is not indicative of future results.

Beyond the Numbers | TCS and the Future of Tech

What fascinates me is how TCS is positioning itself for the future. They’re not just resting on their laurels, churning out the same old services. They’re actively investing in areas like cloud computing, artificial intelligence, and cybersecurity – the very technologies that are shaping the future of business. This is crucial. Because in the tech world, you either innovate or you evaporate. Companies like TCS need to continuously adapt and evolve to stay ahead of the curve.

So, what does this mean for someone looking to break into the tech industry? Well, it means that skills in these emerging areas are in high demand. If you’re a student, a recent graduate, or even someone looking to switch careers, focusing on these areas can significantly boost your job prospects. As per the guidelines mentioned in various tech forums, continuous upskilling is a mandatory requirement to stay relevant in this field. TCS, like other major IT companies, is actively hiring talent in these fields. They are constantly looking for people with expertise in cloud solutions, AI development, and cybersecurity. ITR Filing

Now, you might be thinking, “But I don’t have a computer science degree!” That’s okay. There are plenty of online courses, bootcamps, and certifications that can help you acquire these skills. The key is to be proactive, to be curious, and to be willing to learn. The IT industry is constantly evolving, and the ability to learn and adapt is just as important as having a specific set of skills.

TCS Share Price and Market Sentiment

Of course, the TCS share price is always a topic of discussion. After the Q2 results announcement, we might see some short-term fluctuations. That’s normal. The market reacts to news, both good and bad. But it’s important not to get caught up in the day-to-day noise. Focus on the long-term fundamentals of the company. Is it well-managed? Is it profitable? Is it investing in the future? If the answer to these questions is yes, then short-term fluctuations are just that – short-term.

A common mistake I see people make is to panic sell when the market dips. That’s often the worst thing you can do. Instead, use these dips as an opportunity to buy more shares at a lower price. But, and this is a big but, only do so if you’ve done your research and you believe in the long-term potential of the company. Don’t just follow the herd. Think for yourself. Look at the underlying data, the long-term strategies, and the overall market trends. ITR Filing Deadline . That’s what separates successful investors from the rest.

Looking Ahead | Key Takeaways from TCS Q2

So, what’s the bottom line? The TCS Q2 results are a mixed bag. The profit dip is a concern, but the dividend announcement is a positive sign. More importantly, TCS’s investments in emerging technologies and its commitment to innovation suggest a bright future. For investors, it’s a reminder to focus on the long-term and to avoid getting caught up in short-term market noise. For those looking to break into the tech industry, it’s a signal that skills in areas like cloud computing, AI, and cybersecurity are in high demand. In the end, it’s about understanding the underlying trends, adapting to the changing landscape, and making informed decisions based on solid data and a healthy dose of common sense.

What initially appeared as just another corporate earnings report reveals a complex tapestry of economic forces, strategic decisions, and future opportunities. The slight dip in profit is less about failure and more about adaptation in a turbulent global market. It’s a testament to the resilience of a company navigating unprecedented challenges while simultaneously rewarding its shareholders and investing in its future. In this light, TCS’s Q2 results are not just a snapshot of the present but a compass pointing toward the future of the Indian IT sector.

FAQ Section

Frequently Asked Questions About TCS Q2 Results

What exactly does “net profit” mean in the context of TCS results?

Net profit is the revenue a company has left after paying all of its expenses, including the cost of goods sold, operating expenses, interest, and taxes. It’s a key indicator of profitability.

Why is TCS announcing a dividend important for shareholders?

A dividend is a portion of the company’s earnings that is distributed to its shareholders. It’s a tangible return on investment and a sign of financial health.

How do global economic conditions affect companies like TCS?

Global economic slowdowns can lead to reduced spending by businesses on IT services, impacting revenue and profitability for companies like TCS.

What are the emerging technologies TCS is investing in, and why are they important?

TCS is investing in areas like cloud computing, artificial intelligence, and cybersecurity. These are crucial because they represent the future of technology and are driving innovation across industries. They also increase revenue growth.

How can I learn more about investing in the stock market?

There are many resources available online and through financial advisors. Start with basic financial literacy and gradually learn about investment strategies and risk management. Don’t forget to research financial performance.

Where can I find the official TCS press release regarding the Q2 results?

The official press release can be found on the TCS website under the “Investor Relations” section. It’s also often available on major financial news websites.