TCS Q2 Results Live | Stable Margins Expected, H2 Outlook Crucial

Alright, let’s talk TCS Q2 Results . It’s not just about numbers, right? It’s about what those numbers mean. What’s the real story behind the percentages and figures flashing across our screens? What does it mean for the average Indian investor, the IT professional, and the overall economy? That’s what we’re diving into today. Forget the surface-level news; we’re going deep.

Decoding the Q2 Expectations | More Than Just Margins

So, everyone’s chattering about stable margins. Big deal, right? But here’s the thing: stability in a volatile market is a victory in itself. Think of it like this: you’re navigating a bumpy road, and maintaining a steady speed is more impressive than briefly accelerating only to slam on the brakes. The expectation of stable margins from Tata Consultancy Services is important because it reflects the company’s resilience and its ability to manage costs effectively even amidst global uncertainties. This suggests solid operational efficiency and a strong understanding of market dynamics.

But, the real kicker is the H2 (second half of the fiscal year) outlook. It’s not just about what TCS did, but what it plans to do. Will they be investing heavily in AI? Expanding into new markets? Or playing it safe? That forward-looking guidance will reveal their confidence in the future. This is where the stock analysis comes into play.

The ‘Why’ Behind the Numbers | A Deeper Dive

Let’s be honest, financial reports can feel like reading another language. So, why should you care about TCS’s Q2 results? Because TCS is a bellwether. What’s a bellwether, you ask? It’s essentially a company whose performance is indicative of the overall health of the IT sector and, to some extent, the Indian economy. If TCS is doing well, it suggests that the broader IT landscape is also likely thriving. Think of it as a giant thermometer for the industry. Furthermore, as discussed on Sanjay Ghodawat , the leadership team at TCS, has recently been making some exciting acquisitions, which could have an impact on future performance.

Now, everyone’s waiting with bated breath for the management commentary. This is where they’ll provide insights into the deals they’ve won, the challenges they foresee, and their overall strategy. This is crucial because it gives us a glimpse into their thought process and how they plan to navigate the ever-changing tech landscape.

The H2 Outlook | Where is TCS Heading?

This is the million-dollar question. What’s TCS’s game plan for the next six months? Are they going to double down on cloud computing? Invest heavily in cybersecurity? Or explore the metaverse? The answer to this question will determine whether TCS remains a leader in the IT space. A cautious outlook might suggest they’re bracing for a slowdown, while an aggressive one could signal they see significant growth opportunities. Understanding their strategy is crucial for investors and anyone interested in the future of the IT sector. According to industry experts, a strong revenue growth is expected by end of year.

Here’s what I’ll be watching for: Specific projects, new client wins, and any commentary on the impact of global economic factors. Don’t just look at the numbers; pay attention to the words they use. Are they confident? Cautious? The devil is always in the details.

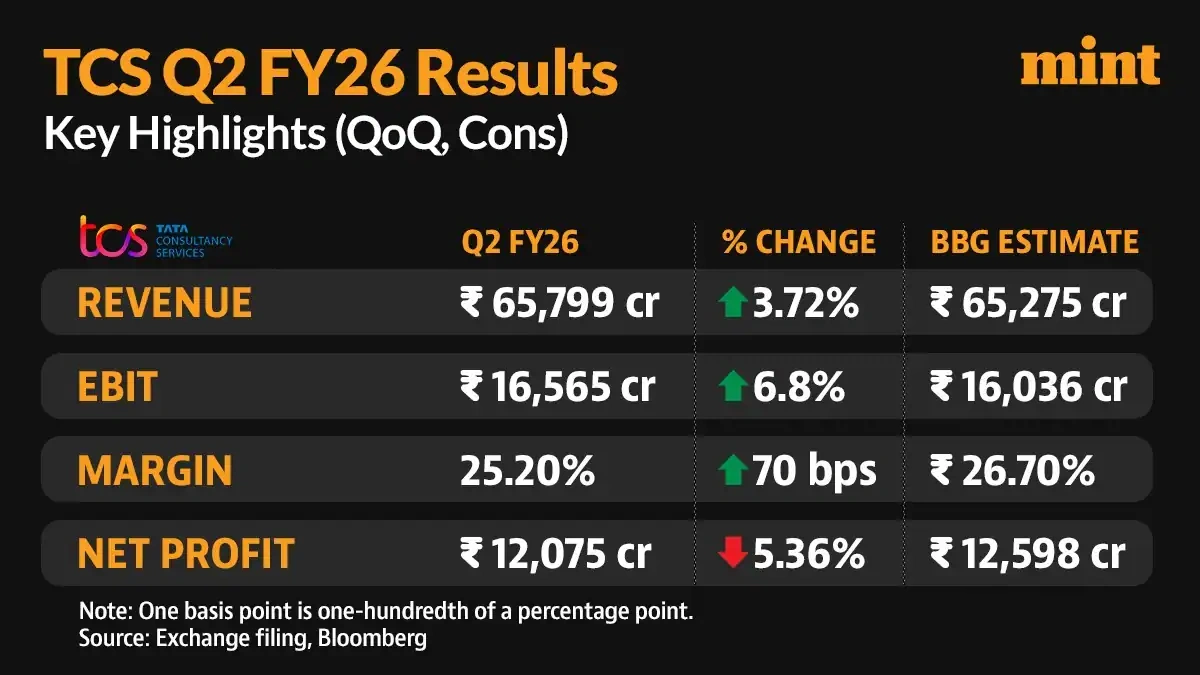

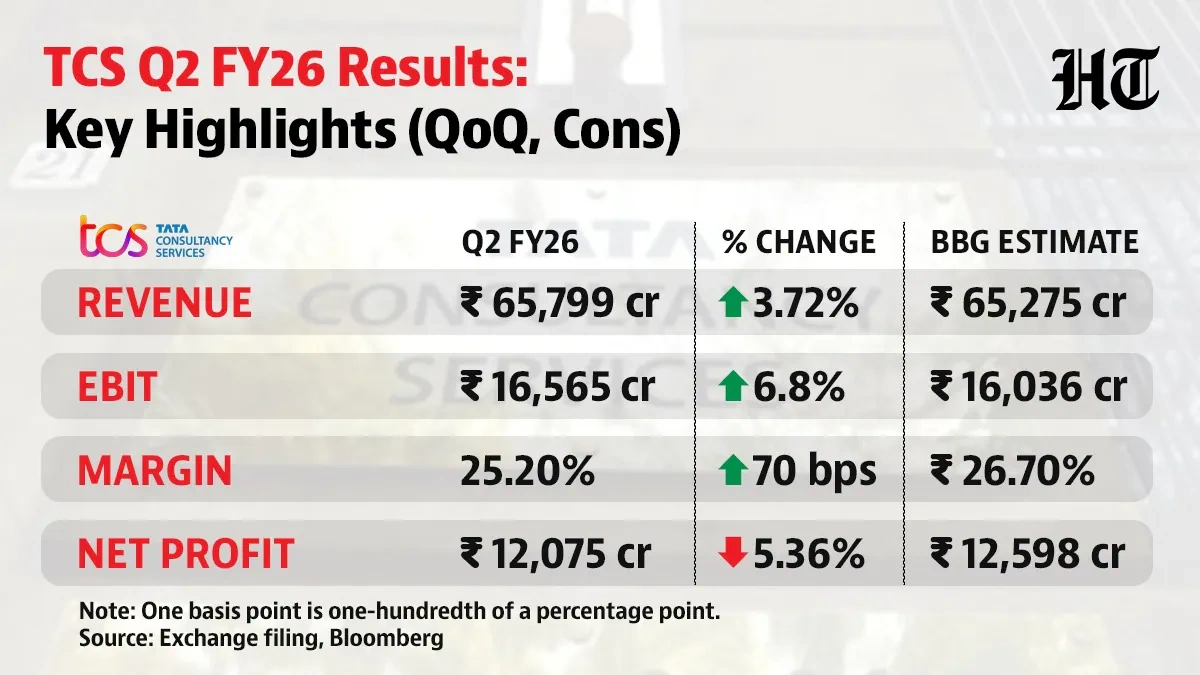

Margins and Profitability | The Core of the Matter

At the heart of any company’s success lies its ability to generate profit, and margins are a key indicator of this. Stable margins for TCS would demonstrate efficient cost management and strong operational performance. However, it’s essential to delve deeper and understand the factors contributing to these margins. Are they a result of increased efficiency, cost-cutting measures, or a favorable exchange rate? Furthermore, how do these margins compare to those of their competitors? Analyzing these aspects provides a comprehensive view of TCS’s financial health. And as discussed on Saatvik Green Energy IPO GMP , the market is highly volatile, so anything can happen.

The Impact on You | Beyond the Balance Sheet

Ultimately, the TCS Q2 results have ripple effects that extend far beyond the company itself. If TCS is thriving, it means more jobs, more investment in India, and a stronger economy. It’s about opportunity, innovation, and the future of India as a global tech powerhouse. That’s the bottom line. A weak performance, on the other hand, could signal challenges for the broader IT sector, potentially leading to job cuts or reduced investment. So, whether you’re an investor, an IT professional, or simply someone who cares about the Indian economy, these results matter.

The digital transformation isalso having a huge impact, which is something to watch closely.

FAQ Section

Frequently Asked Questions

What exactly are “stable margins” and why should I care?

Stable margins basically mean that TCS is managing its costs effectively and maintaining its profitability. It’s a sign of good financial health and efficient operations, which is good for investors and the overall company.

How will global economic conditions affect TCS’s future performance?

Global economic uncertainty (like inflation, recession fears, etc.) can impact IT spending. If companies are worried about the economy, they might cut back on IT projects, which could affect TCS’s revenue.

What if TCS reports lower-than-expected revenue?

Lower revenue could indicate slowing demand for TCS’s services, potentially leading to a drop in the stock price. It could also signal broader challenges for the IT sector.

Where can I find the official TCS Q2 results report?

You can find the official report on the TCS website in the investor relations section. Also keep an eye on major financial news outlets for coverage.

What does the term earnings call mean?

An earnings call is a conference call where TCS management discusses the Q2 results with analysts and investors, answering questions and providing further insights.

Why is the H2 outlook so important?

The H2 (second half of the year) outlook provides a glimpse into TCS’s expectations for the future. It tells you whether they’re confident about growth or anticipating challenges.

So, there you have it. TCS’s Q2 results are more than just numbers; they’re a window into the health of the IT sector and the Indian economy. Keep an eye on those margins, that H2 outlook, and that management commentary. It’s all part of the bigger picture.