Beyond the Ticker | My Unfiltered Thoughts on the Tata Motors Share Price Story

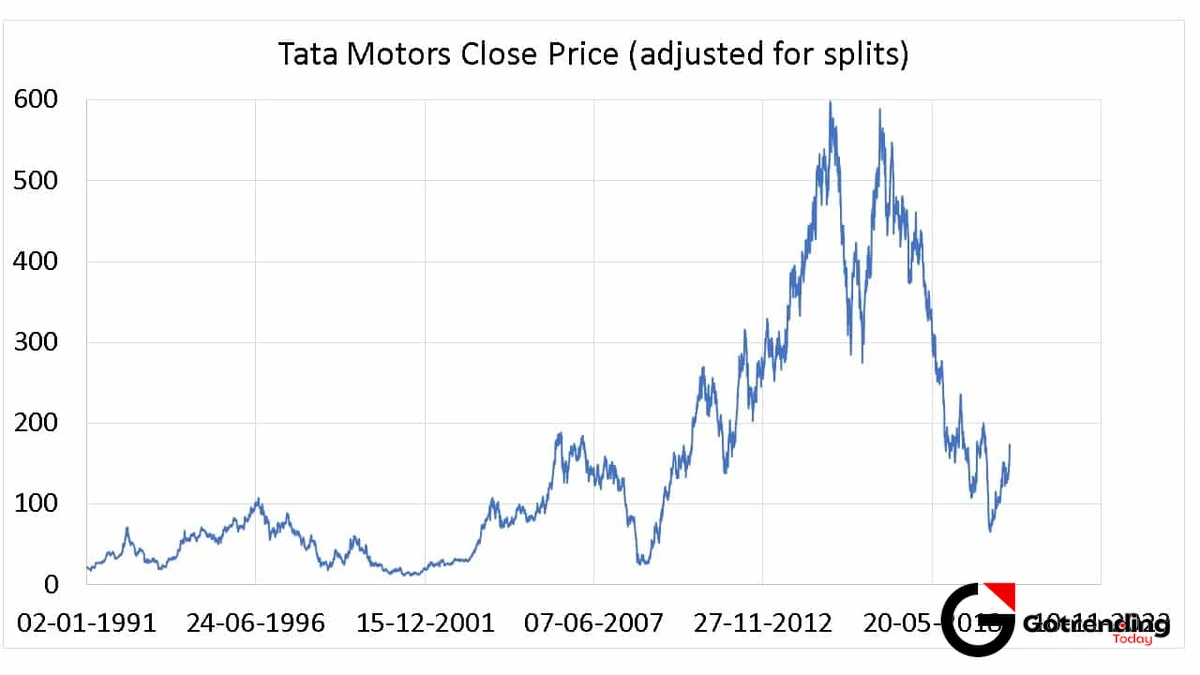

I’ve been staring at the tata motors share price chart for what feels like an eternity. It’s not just a line on a screen for me; it’s a drama. A multi-act play with more twists than a Bollywood blockbuster. One day it’s soaring on electric dreams, the next it’s dipping on global supply chain jitters. And frankly, if you’re just watching the numbers without understanding the chaos and genius underneath, you’re missing the whole show.

This isn’t your typical stock analysis. I’m not going to bore you with P/E ratios you can find anywhere. This is the coffee shop conversation. The ‘here’s what’s really going on’ take from someone who finds this stuff genuinely fascinating. It’s a story about a sprawling, century-old giant learning to dance like a startup.

And it all starts with an elephant. A very sleek, very British, and for a long time, a very expensive elephant.

The JLR Burden (That Became a Booster Rocket)

For years, the conversation around Tata Motors was dominated by two names: Jaguar and Land Rover. The acquisition was bold, a moment of national pride. But almost immediately, it became a massive weight. Debt. Unwieldy operations. A brand that seemed to be struggling with its identity. The JLR performance was the single biggest anchor on the tata motors share price , pulling it down every time a negative sales report came out of Europe or China.

I remember thinking the turnaround would never happen. It felt like a perpetual “jam tomorrow” story. But then, something shifted. It wasn’t loud. It was a change in philosophy under the leadership of N. Chandrasekaran. They stopped chasing volume. Let me repeat that, because it’s crucial. They stopped trying to sell the most cars and started trying to make the most money on the cars they sold. Quality over quantity. Higher margins. A focus on the high-end Range Rover, Defender, and Jaguar models.

Suddenly, JLR wasn’t the anchor anymore. It became the engine. The ‘Reimagine’ strategy wasn’t just corporate jargon; it was a genuine pivot towards a leaner, more profitable, and electric future. The narrative changed, and the stock… well, the stock followed suit. It’s a classic case study in corporate discipline, something that feels as significant in its own sphere as the historical analysis of the Jawaharlal Nehru legacy is in the political one.

But Let’s Talk About the Real Indian Powerhouse

And here’s the thing that gets lost in all the JLR glamour. While everyone was obsessing over Britain, Tata Motors was quietly, methodically conquering India. All over again.

Their commercial vehicle (CV) division is the backbone of the Indian economy. You can’t go a kilometer on an Indian highway without seeing a Tata truck. They are ubiquitous. They are the default. This isn’t the sexiest part of the business, but it’s the most solid. It’s the bedrock. When you think of global truck giants, names like Iveco trucks or Daimler might come to mind, and Tata’s dominance in its home market is just as profound. The Iveco Group itself showcases the scale and complexity of the global commercial vehicle market, highlighting just how impressive Tata’s position is.

Then there’s the passenger vehicle (PV) business. What a comeback story. From a brand struggling with an image problem to a leader in safety and design. The Nexon. The Punch. The Harrier. These aren’t just cars; they’re statements. They aggressively pursued and marketed their 5-star Global NCAP safety ratings, hitting a nerve with a new generation of Indian buyers who valued safety as much as mileage. They completely rewrote their own story. It’s a level of strategic dominance that would be the envy of any major organization, even those dealing with complex regional issues like the Punjab and Haryana High Court .

The Electric Gamble | Is Tata the Tesla of India?

Okay, let’s address the sparkiest part of the story: the EV revolution. Calling Tata the “Tesla of India” is a bit simplistic, but I get the sentiment. They weren’t just the first legacy automaker to go all-in on EVs in India; they did it with a conviction that left competitors scrambling.

Their strategy is what fascinates me most. It’s not just about building an electric car. It’s about building an entire ecosystem. Think about it. Tata Motors makes the car. Tata Power installs the charging stations. Tata Chemicals is exploring battery cell manufacturing. JLR provides the high-end EV tech R&D. It’s a level of vertical integration that no other player in India can match right now. This is their moat. The Tata Motors EV strategy isn’t a product plan; it’s a full-scale industrial maneuver.

Of course, the road ahead isn’t empty. Mahindra is coming in hot with its own impressive EV lineup. Hyundai and Kia are formidable. The competition will be fierce. But Tata’s head start is significant. Investors are betting that this first-mover advantage, combined with the Tata ecosystem, will create a long-term, unassailable lead. The current tata motors share price is, in many ways, a vote of confidence in this electric future.

So, where does that leave us? Watching that ticker. But now, hopefully, seeing more than just a line. You’re seeing a British luxury turnaround, a dominant Indian commercial giant, a resurrected passenger car hero, and a massive bet on an electric future. It’s a complicated, messy, and absolutely brilliant story. And it’s far from over.

FAQ | Your Questions on Tata Motors Stock, Answered

Why does the Tata Motors share price seem so volatile?

It’s all about the moving parts! For a long time, any news from JLR good or bad would send the stock swinging because it was such a huge part of the profit (or loss). Now, you have that, plus the performance of the booming Indian business, plus the hype and uncertainty around the Tata Motors EV strategy . It’s like three companies in one, so news affecting any of them can cause ripples. It’s less volatile than it used to be, but it’s still a dynamic stock because the company itself is in the middle of a massive transformation.

Is Jaguar Land Rover still a big risk?

That’s a great question because the perception is lagging behind the reality. A few years ago, the answer was a definite “yes.” The debt was huge and sales were shaky. Today, it’s a calculated risk, not a blind one. They’ve focused on profitability, their order book for high-margin models like the Defender is strong, and their EV transition is well underway. The risk has shifted from “Will they survive?” to “Can they execute their high-end electric strategy successfully?” It’s a much better problem to have.

How critical is the EV business to the stock’s future?

In a word: incredibly. While the traditional commercial and passenger vehicle businesses provide the stable cash flow today, almost all of the future growth expectation baked into the tata motors share price is tied to their success in the EV space. Their market leadership is a huge plus, but they need to maintain it against incoming competition and manage the massive investment required. The stock’s long-term trajectory will likely mirror its EV market share.

What’s the deal with their commercial vehicles? Are they like Iveco trucks?

In principle, yes, they serve the same purpose they are the workhorses of commerce and industry. Both Tata Trucks and Iveco trucks are major players in their respective core markets (India and Europe). The key difference is Tata’s near-monopolistic dominance in the Indian domestic market, from small city-pickups to massive long-haul trucks. This division is the company’s cash cow; it’s less glamorous than EVs or Jaguars, but it provides the financial foundation for everything else.