Is Tata Investment Share the Next Big Thing? A Deep Dive for Indian Investors

The stock market can feel like a rollercoaster, can’t it? One minute you’re up, the next you’re wondering if you should have just kept your money under the mattress. But let’s be honest, who wants to miss out on potential growth? That’s where Tata Investment Share comes in. It’s been making waves, and you’re probably wondering if it’s worth the hype.

Why Tata Investment Share is More Than Just a Stock

Here’s the thing: Tata Investment Corporation isn’t your typical investment company. It’s a non-banking financial company (NBFC) with a rich history, primarily focused on long-term investments in equity shares, debt instruments, and mutual funds. But what fascinates me is its connection to the Tata Group – one of India’s most respected and trusted conglomerates. That association gives it a certain credibility and access that many other investment firms simply don’t have. It’s not just about the numbers; it’s about the legacy.

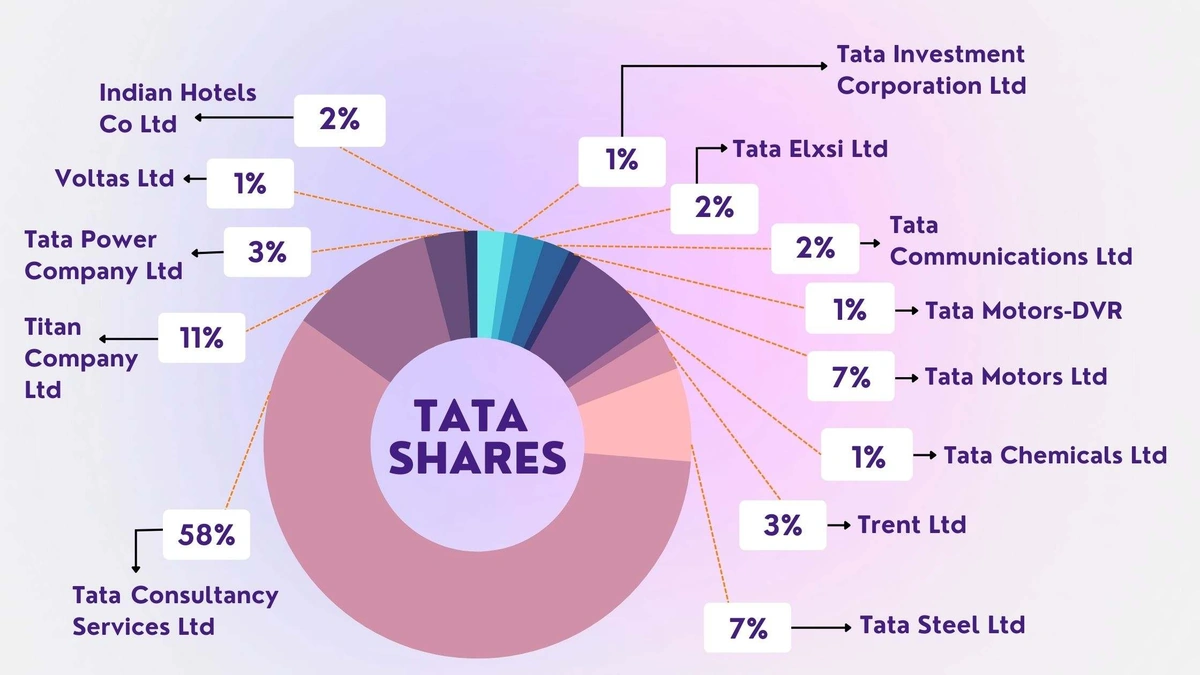

And that’s where the “why” comes in. Why should you even consider Tata Investment Share? Because it offers a way to tap into the potential of the Tata Group’s diverse portfolio without directly investing in each individual company. Think of it as a diversified investment vehicle within a larger, well-established ecosystem.

Decoding the Investment Strategy

So, how exactly does Tata Investment Corporation operate? It’s not about quick gains. They’re in it for the long haul, focusing on companies with strong fundamentals and growth potential. This means they’re less likely to be swayed by short-term market fluctuations, which can provide a sense of stability for investors like you and me. A common mistake I see people make is to panic sell during market dips. But with a long-term investment like this, it’s crucial to stay the course.

Let me rephrase that for clarity: They’re not chasing the latest fads. They’re building a portfolio of companies they believe will thrive over the next decade and beyond. That’s a strategy I can get behind.

You can check their latest investments and financial performance in their quarterly reports, which are available on their website or through stock market news sites.

Navigating the Risks and Rewards

Now, let’s be real. No investment is without risk. The stock market is inherently volatile, and even the most well-managed companies can face unexpected challenges. The key is to understand these risks and assess whether they align with your own risk tolerance. One thing you absolutely must double-check before investing: your own financial goals. Are you looking for long-term growth, or do you need quicker returns?

I initially thought this was straightforward, but then I realized the importance of considering your investment horizon. If you’re planning to retire in five years, a long-term investment might not be the best fit. However, if you’re in your 20s or 30s, it could be a valuable addition to your portfolio.

Furthermore, while the Tata Group’s reputation is a significant asset, it doesn’t guarantee success. Market conditions, regulatory changes, and unforeseen events can all impact the company’s performance. It’s essential to do your own research and not rely solely on brand recognition. According to expert analysis on various financial news platforms, the long-term growth potential of Tata Investment hinges on its ability to adapt to changing market dynamics.

Consider consulting a financial advisor who can assess your individual circumstances and provide personalized recommendations. Remember that past performance is not indicative of future results.

How to Invest in Tata Investment Share

Stuck figuring out how to actually buy the shares? I’ve seen it all. Here’s the process, broken down step-by-step:

- Open a Demat and trading account with a reputable broker. Most major banks and online platforms offer these services.

- Fund your account. You’ll need to transfer money from your bank account to your trading account.

- Search for “Tata Investment Corporation” or its stock symbol (TATAINVEST) on your trading platform.

- Place your order. You can choose to buy the shares at the current market price (market order) or set a specific price you’re willing to pay (limit order).

- Monitor your investment. Keep an eye on the share price and track the company’s performance.

A common mistake I see people make is not understanding the different types of orders. A market order ensures you get the shares quickly, but you might pay a slightly higher price. A limit order gives you more control over the price, but your order might not be filled if the market doesn’t reach your target level.

The Future Outlook for Tata Investment

What’s next for Tata Investment ? Well, that’s the million-dollar question. The company’s future is closely tied to the overall performance of the Indian economy and the Tata Group’s strategic initiatives. As per the guidelines mentioned in various financial reports, keep an eye on their diversification strategies to be sure about the investment decisions.

Given the current economic climate, many analysts predict continued growth for the Indian stock market, which could benefit Tata Investment. However, global uncertainties and potential regulatory changes could also pose challenges. It’s a complex picture, to be sure.

But, here’s the bottom line : Tata Investment Share offers a unique opportunity to participate in the growth of the Tata Group and the Indian economy. It’s not a guaranteed path to riches, but it’s a potentially rewarding investment for those willing to take a long-term view and do their homework. And remember, diversification is key . Don’t put all your eggs in one basket.

FAQ About Tata Investment Share

Is Tata Investment a good investment?

Whether it’s a good investment depends on your individual financial goals, risk tolerance, and investment horizon. Consider consulting a financial advisor.

What is the current Tata Investment Share price?

You can find the latest share price on any major stock market tracking website or app, such as Google Finance or the National Stock Exchange (NSE) website.Check reliable sources for up-to-date information.

How do I buy Tata Investment Shares?

You can buy shares through a Demat and trading account with a registered broker. The process is fairly straightforward and they will guide you through it.

What are the risks of investing in Tata Investment Share?

The risks include market volatility, economic downturns, and company-specific challenges. All investments have risk; evaluate your comfort level carefully.

What is the long-term outlook for Tata Investment?

The long-term outlook depends on the performance of the Tata Group, the Indian economy, and global market conditions.

What are some similar investment options in the market?

Alternatives include other investment companies, mutual funds, and direct investments in individual stocks. Conduct thorough research before investing.