The Suzlon Share Price | More of a Comeback Story Than a Stock Chart

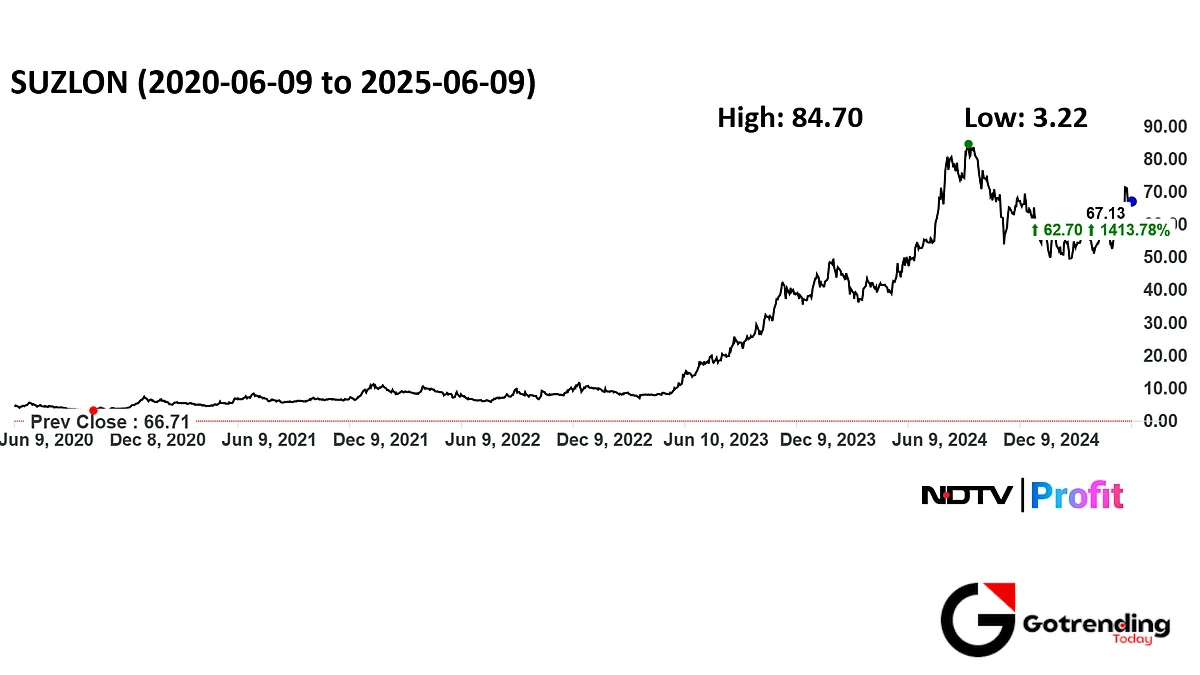

Let’s be honest. For the longest time, mentioning the suzlon share in any serious investment circle would get you either a pitying look or a cynical laugh. It was the poster child for wealth destruction, a ghost of the 2008 market crash that just refused to be exorcised. I remember seeing it trade at prices that felt like a typo, a grim reminder of a glorious past. For years, it was a penny stock pariah. And yet, here we are, talking about it again. Seriously talking about it.

The recent surge in the suzlon share price isn’t just a flicker on a trading screen; it’s the culmination of a brutal, painful, and frankly, fascinating corporate saga. It’s a story about debt, ambition, tragedy, and a potential second wind. If you’re just looking at the numbers, you’re missing the entire movie.

I keep coming back to this point because it’s crucial: you can’t understand where Suzlon is going without appreciating the absolute abyss it climbed out of. It’s a context that changes everything.

The Ghost of Ambition Past | A Quick History Lesson

Before it became a cautionary tale, Suzlon was a market darling. Founded by the visionary (and perhaps overly ambitious) Tulsi Tanti , the company rode the first green energy wave in India like a champion. The stock soared, investors were euphoric, and Suzlon went on an aggressive global acquisition spree. The future was bright, windy, and profitable.

And then 2008 happened. The global financial crisis hit, and it hit capital-intensive businesses like a sledgehammer. But Suzlon’s problems were compounded. Their biggest acquisition, REpower (now Senvion), turned into a financial black hole. Debt mounted to catastrophic levels. Think of it like a marathon runner who, halfway through the race, decides to pick up a refrigerator and carry it on their back. For over a decade, that’s what Suzlon was doing. Every bit of energy, every rupee earned, went into servicing that crushing debt. The actual business of making and selling a wind turbine became a secondary concern to just staying alive.

The share price reflected this grim reality. From a peak that feels mythical now, it crumbled into single digits, becoming the kind of stock you warn your relatives about. It wasn’t just a bad investment; it was a lesson.

The Turnaround: Unpacking the New Suzlon Energy Share Price Story

So what changed? How does a company that was on corporate life support suddenly become one of the most talked-about stocks on the Dalal Street? It wasn’t one thing, but a painful, slow alignment of several crucial factors.

The first, and most important, was the Suzlon debt reduction . Through a complex and often dramatic restructuring process, the company managed to shed a significant portion of that refrigerator it was carrying. It wasn’t clean, and it wasn’t easy, but it worked. This move was the single most important catalyst. It allowed the company to breathe again, to focus on its core operations rather than just appeasing lenders.

Wait, there’s something even more interesting here. At the same time, the world was changing. The narrative around renewable energy shifted from a “nice-to-have” to a “must-have.” India, in particular, set aggressive renewable energy targets. Suddenly, the entire renewable energy sector India got a massive tailwind from government policy. You can see the government’s commitment on the Ministry of New and Renewable Energy’s website , and it’s clear this isn’t just talk. This created a fertile ground for a company like Suzlon, if it could get its house in order.

And it seems they have been. The Suzlon order book started swelling. Large, significant orders began to roll in, signaling that customers were regaining faith in the company’s ability to actually deliver. This is the evidence that the turnaround isn’t just financial wizardry; it’s rooted in a genuine operational revival. It’s one thing to clean up your balance sheet; it’s another thing entirely to convince people to buy your products again. Suzlon seems to be doing both.

But Is It All Smooth Sailing From Here? (Let’s Be Real)

Okay, so it’s a great comeback story. But does that automatically make the suzlon share a golden ticket? Hold on. The optimism needs a healthy dose of realism.

Execution is everything. Having a massive order book is fantastic, but delivering on those orders profitably and on time is a whole different ball game. Suzlon’s past is littered with execution missteps, and they need to prove, consistently, that those days are behind them. Any hiccup in project timelines or quality control could spook investors fast.

And the stock itself is, let’s just say, volatile. It’s become a favourite of retail investors, which means its price movement can be driven more by sentiment and social media buzz than by staid fundamentals. This isn’t necessarily bad, but it means you have to have the stomach for wild swings. It’s a world away from the slow-and-steady growth you might see in other sectors. The enthusiasm for green energy is palpable, seen not just in wind but in the EV space with companies like the upcoming Tata Harrier EV or the global giant’s plans for Tesla India . But enthusiasm can sometimes lead to bubbles.

I initially thought the story was just about debt. But after looking deeper, it’s about trust. The company needs to rebuild trust not just with its customers, but with the market. It needs to prove that this new chapter is sustainable and not just another false dawn. Every quarterly result will be scrutinized, every announcement picked apart. The rope is still tight, even if they’re walking on it with more confidence now.

Ultimately, the story of the Suzlon Energy share price is a microcosm of the Indian market itself: a blend of high risk, immense potential, and unforgettable drama. It’s a testament to the fact that sometimes, the most beaten-down names can script the most incredible comebacks. Whether this one has a storybook ending, however, is a chapter yet to be written.

Frequently Asked Questions About the Suzlon Share

Why was the Suzlon share price so high before 2008 and what happened?

Ah, the glory days! Before 2008, Suzlon was a pioneer in India’s wind energy space and a global player. Investor optimism was sky-high, pushing the stock to incredible valuations. But a combination of the 2008 global financial crisis, which dried up credit, and a hugely expensive, debt-fueled acquisition of Germany’s REpower, created a perfect storm. The debt became unmanageable, and the company’s profits evaporated, leading to a catastrophic and prolonged crash in its share price.

Is Suzlon debt-free now?

This is a common misconception. No, Suzlon is not completely debt-free. However, they have undergone a massive and successful Suzlon debt reduction and restructuring process. They’ve slashed their debt from crippling levels to something far more manageable. The key takeaway isn’t that the debt is zero, but that it’s no longer the existential threat it once was, allowing the company to focus on growth.

What are the biggest factors driving the suzlon share price today?

It’s mainly three things. First, the cleaned-up balance sheet we just talked about. Second, a very strong Suzlon order book , which gives visibility on future revenues and shows customer confidence is back. Third, and this is the big one, the massive policy push from the Indian government towards renewable energy, creating a huge and growing market for companies like Suzlon. It’s a classic case of internal turnaround meeting external opportunity.

So, is Suzlon a good long-term investment?

That’s the million-dollar question, isn’t it? This is not financial advice, but here’s how to think about it. Suzlon has transformed from a high-risk, near-bankrupt company to a high-growth, potential turnaround story. The potential reward is high, but so are the risks related to execution and its inherent volatility. It’s for investors with a high-risk appetite who believe in the long-term potential of India’s green energy story and Suzlon’s ability to capture a piece of it. It’s definitely not a “buy and forget” kind of penny stock anymore, but one that requires close monitoring.