The Sun Pharma Puzzle | What I’ve Learned Watching This Pharma Giant

I’ve been staring at stock charts for more years than I’d care to admit, and if there’s one thing I’ve learned, it’s that not all stocks are created equal. Obvious, right? But I mean in personality. A tech stock is all frantic energy, a sugar rush of hype and potential. An FMCG stock is your steady, reliable friend. And then there are pharma stocks. Pharma stocks are different. They’re the brooding, intellectual type. They don’t care about your impatience. They move on their own schedule, dictated by clinical trials, patent cliffs, and inscrutable regulatory bodies. And at the heart of the Indian market, there’s no better case study for this than the Sun Pharma share price .

Watching this stock is an education in itself. It’s a journey into the complex world of global pharmaceuticals, and honestly, it’s fascinating. It’s not just a ticker symbol; it’s a story of ambition, science, and the relentless pressure of a market that wants results. Yesterday.

Decoding the Sun Pharma Share Price | More Than Just a Number

So, what actually makes the Sun Pharma share tick? If you’re new to this, you might look at the price and think it’s just about sales. And you’re not wrong, but you’re not entirely right either. It’s much more layered than that. For a pharma giant like Sun, the price is a reflection of a delicate, often chaotic, balance.

First, you have the bread-and-butter generics business. This is the foundation. Sun Pharma became the beast it is by mastering the art of making affordable versions of drugs once patents expired. It’s a volume game, and they play it incredibly well. But it’s also a business of brutal price erosion, especially in the US market. So, while it provides a stable base, it’s rarely the source of exciting growth anymore.

And that’s where the second, more interesting piece of the puzzle comes in: specialty pharma . This is Sun’s big bet on the future. These are complex, high-margin drugs for chronic conditions like psoriasis (Ilumya) or dry eye disease (Cequa). This is where the real growth and the real risk lies. Getting a specialty drug to market is a long, expensive gamble. But the payoff? It can be monumental. The market’s perception of Sun’s ability to transition from a generics-first company to a specialty powerhouse is a massive driver of its valuation. I keep coming back to this point because it’s crucial: it’s a bet on their R&D, not just their manufacturing.

Actually, there’s a third major pillar, and that’s its sprawling international presence, including its majority stake in the Israeli company Taro Pharma . This isn’t just an Indian story; it’s a global one. Every currency fluctuation, every regional healthcare policy change, it all funnels back into the consolidated numbers that investors scrutinize every quarter.

The USFDA Elephant in the Room

You can’t talk about the Indian pharma sector without talking about the big, scary elephant in every boardroom: the United States Food and Drug Administration. The USFDA. For Sun Pharma, with its huge exposure to the US market, this is everything.

Think of the USFDA as the world’s strictest, most unpredictable quality inspector. They can show up at a manufacturing plant in, say, Halol, Gujarat, and if they find anything and I mean anything that doesn’t meet their impossibly high standards, they can issue a warning. That warning can halt all new drug approvals from that facility. For a company’s stock, that’s like hitting a brick wall. The market hates uncertainty, and USFDA regulations are a giant cauldron of it.

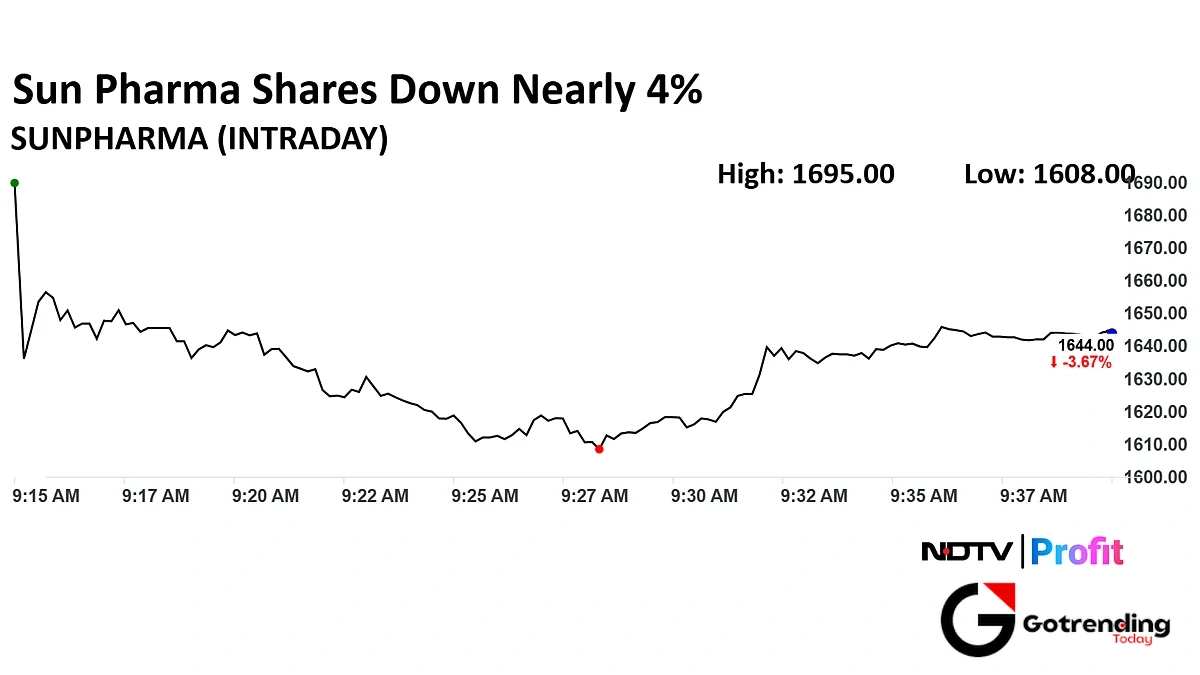

I remember periods when the entire sector was depressed because of a string of negative USFDA observations. The frustrating thing is that resolving these issues takes time. A lot of time. And all the while, the market waits, and the Sun Pharma share price can languish. These aren’t just friendly check-ins; they are rigorous audits of manufacturing practices. You can get a sense of their scope directly from the source on theU.S. Food and Drug Administration’sown website. So when you see a sudden drop in the share price, one of the first questions you should ask is: “Any news from the FDA?”

So, Is the Sun Pharma Share a Good Buy?

This is the million-dollar question, isn’t it? The one everyone wants a straight answer to. But it’s the wrong question. A better question is: “Does an investment in Sun Pharma align with my risk appetite and time horizon?”

The case for optimism is pretty clear. You have a company led by a visionary founder, Dilip Shanghvi , who built an empire from scratch. It has a fortress-like balance sheet, able to weather storms and make strategic acquisitions. A company with this kind of financial strength has a certain resilience, a historical sturdiness you can almost feel, much like the enduring Soul of Chittorgarh . The growing R&D pipeline in specialty drugs holds the promise of future blockbusters. If even one or two of their pipeline drugs become a major success, the impact on the bottom line could be huge.

But let’s be real. The risks are just as clear. The concentration of power at the Halol and Mohali plants means any regulatory issue there has an outsized impact. The US generics market continues to be a tough nut to crack, with relentless pricing pressure. And the transition to specialty pharma is a long, winding road with no guarantee of success. A deep dive into the company’s fundamental analysis shows a mature business trying to pivot, and pivots are never easy.

Ultimately, investing here isn’t a short-term fling. It’s a long-term commitment. It’s a bet that science, a solid management team, and a growing global need for healthcare will win out over regulatory hurdles and pricing wars. And if you do end up making a profit on a long-term hold, that’s a good problem to have just don’t forget the taxman. Making sense of capital gains can feel like it requires its own specialized ITR filing guide .

Your Questions About Sun Pharma, Answered

Why does USFDA news affect the Sun Pharma share price so much?

Because the U.S. is one of Sun Pharma’s biggest markets. A negative observation (like a “Form 483” or a “Warning Letter”) from the USFDA for a key manufacturing plant can stop new drug approvals from that site. This directly impacts future revenue and creates massive uncertainty, which investors hate. A clean chit, on the other hand, can send the stock soaring because it removes that uncertainty.

What’s the difference between Sun Pharma’s generic and specialty business?

Think of it this way: the generics business is like a high-volume restaurant selling classic, popular dishes at a competitive price. The specialty business is like its a fine-dining section, serving complex, unique creations that took years to develop and which command a very high price. Generics are the foundation; specialty is the high-risk, high-reward growth engine.

Is Sun Pharma a good stock for beginners?

This is a tough one. On one hand, it’s a blue-chip Nifty 50 company, so it’s not some fly-by-night operator. On the other hand, the pharma sector is complex and volatile, driven by news (like clinical trial results or FDA audits) that can be hard for a beginner to understand. If you’re just starting, it’s crucial to understand you’re in for a potentially bumpy ride and not expect smooth, linear growth.

How do I find the latest Sun Pharma quarterly results?

The best place is always the source. Go to the “Investor Relations” section of Sun Pharma’s official website. They post all their quarterly results, annual reports, and presentations there. You can also find them on the websites of the major stock exchanges like the NSE and BSE immediately after they are announced.

I didn’t start watching the Sun Pharma share price to get rich quick. I started watching it to understand an industry. To see how a giant navigates a world of patents, patients, and profits. And what I’ve concluded is that it’s a stock that demands patience. It’s a bet on the long, slow, but powerful march of medicine itself. And in a world obsessed with the next big thing, there’s something strangely comforting about that.