Decoding the Sensex Index | What It Really Means for You

Okay, let’s talk Sensex index . You see it flashing on TV, hear about it in the news. But what is it, really? And more importantly, why should you, sitting here in India, even care? Let’s be honest, the financial world can seem like a completely different planet sometimes. I initially thought it was straightforward, but then I realized most explanations are filled with jargon. So, let’s ditch the Wall Street talk and break it down in a way that actually makes sense.

Here’s the thing: the Sensex isn’t just a number; it’s a snapshot. A snapshot of the overall health of the Indian stock market. Think of it as a barometer for the Indian economy. If it’s rising, generally speaking, things are looking good. If it’s falling… well, you get the idea. But there’s more to it than just up and down arrows.

The “Why” Behind the Numbers | Beyond the Headlines

So, why does the Bombay Stock Exchange (BSE) even have a Sensex? It’s not just for show, you know. It exists as a benchmark. A way for investors, both big and small, to gauge how their investments are performing relative to the market as a whole. As per theBSE’s official website, the Sensex comprises the 30 largest and most actively traded stocks on the BSE. These companies represent various sectors of the Indian economy, making the Sensex a diversified indicator. This is not financial advice, I’m just explaining.

But, and this is a big but, it’s crucial to understand that the Sensex isn’t a perfect representation of the entire Indian economy. It only tracks 30 companies. There are thousands of companies listed on the BSE. However, those 30 companies are market leaders. They’re the big boys, and their performance has a significant impact on overall market sentiment.

Think of it like this: it’s like sampling a dish. You don’t need to eat the whole thing to know if it’s tasty, right? The Sensex is a taste of the Indian stock market. A quick way to get a feel for the overall flavor. But, you know, sometimes you need to check the ingredients to be sure.

How the Sensex Impacts Your Investments (Even if You Don’t Realize It)

Even if you don’t directly invest in the stock market, the Sensex can still affect you. How? Through mutual funds! Many mutual funds use the Sensex as a benchmark. They aim to outperform it. So, if the Sensex is doing well, your mutual fund investments are likely to be doing well too. And that’s a good thing, obviously.

A common mistake I see people make is to blindly follow the Sensex. They see it going up and think it’s a green light to invest in anything and everything. But that’s where you can get burned. It’s always important to do your own research. Understand the companies you’re investing in, and don’t just chase the hype. What fascinates me is how much people are now using things like theNational Stock Exchange.

The Sensex and the broader market movements can even have an impact on interest rates and the overall cost of borrowing. A rising Sensex often reflects increased economic confidence, which can lead to higher interest rates. Conversely, a falling Sensex can signal economic uncertainty, potentially leading to lower interest rates. These fluctuations can directly affect your home loan EMIs, car loan rates, and even the interest you earn on your fixed deposits.

Navigating Market Volatility | Staying Calm in the Storm

Let’s be real, the stock market can be a rollercoaster. There will be ups and downs. Days when the Sensex soars and days when it plummets. It’s crucial to stay calm during these times. Don’t panic sell when the market dips. And don’t get overly greedy when it’s booming. Having a long-term investment strategy is key. Remember, investing is a marathon, not a sprint. Think long-term investment strategies , folks. It helps.

So, what causes these fluctuations? Well, a whole bunch of things. Global economic events, political news, corporate earnings, and even something as simple as investor sentiment can all play a role. It’s a complex interplay of factors. That’s what makes it so darn interesting!

But here’s what I learned: It’s about riding the wave and, most importantly, understanding the “why” behind those waves. Don’t just react to the news, try to understand the underlying reasons. This will empower you to make informed decisions. What I think is important is that you track the market capitalization of key firms, as well as their dividend yield. This can help inform your understanding of the market!

The Future of the Sensex | What Lies Ahead?

Predicting the future is impossible. But we can look at trends and make educated guesses. With the Indian economy growing rapidly, the Sensex is likely to continue its upward trajectory in the long term. But there will be bumps along the way. Volatility is inevitable. Also, the BSE index may change, due to increased digitization. I have been pondering it for some time.

The rise of fintech and online trading platforms has made it easier than ever for Indians to participate in the stock market. This increased participation could lead to even greater market volatility, but it also presents opportunities for long-term growth.

And that’s a good segue to talk about stock market trends .

But, and this is crucial, it’s also important to consider the risks. The Indian stock market is still relatively young. It’s susceptible to global economic shocks and political instability. Diversification is key to mitigating these risks. Don’t put all your eggs in one basket.

Ultimately, the Sensex is more than just a number. It’s a reflection of the Indian economy’s past, present, and future. By understanding what it represents, you can make informed decisions about your investments and your financial future.

So, next time you see the Sensex flashing on TV, don’t just glaze over it. Take a moment to think about what it really means. It’s a story of India’s economic journey. A story that you are a part of. What I see is something that could be huge! Make sure to check out this article to learn more! And for another article, consider this piece .

FAQ About the Sensex

What if I’m completely new to the stock market?

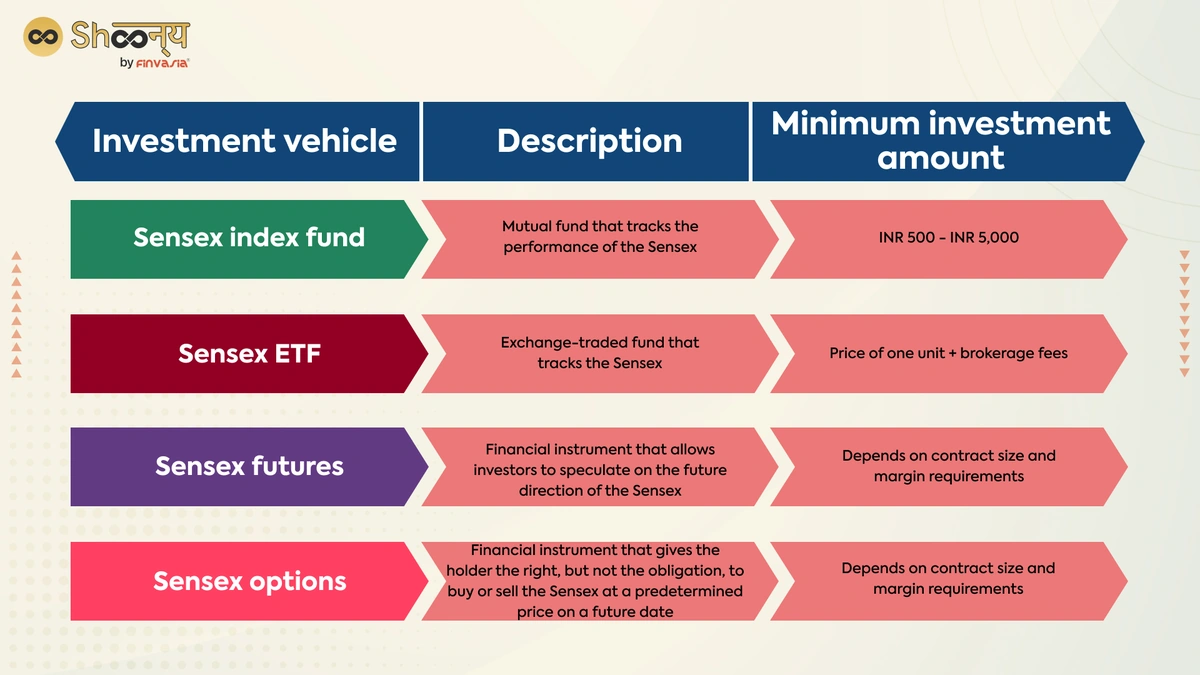

Start small! Invest in mutual funds or ETFs that track the Sensex. It’s a low-risk way to get your feet wet and learn the ropes.

How often is the Sensex updated?

The Sensex is updated in real-time during trading hours, so you can track its movements throughout the day.

What happens if one of the 30 companies in the Sensex performs poorly?

The Sensex is weighted by market capitalization, so larger companies have a greater impact. A poor performance by a smaller company won’t have as much of an effect.

Is the Sensex the only indicator of the Indian stock market?

No! There are other important indices like the Nifty 50. It’s always good to look at multiple indicators to get a more complete picture.

Can the Sensex predict the future of the economy?

The Sensex is a good indicator, but it’s not a crystal ball. It can be influenced by a variety of factors, and it’s always best to consult with a financial advisor before making any investment decisions.

What exactly is a stock market index and how does it work?

A stock market index is a measurement of a section of the stock market. It is computed from the prices of selected stocks (typically a weighted average). The Sensex is just such an index.