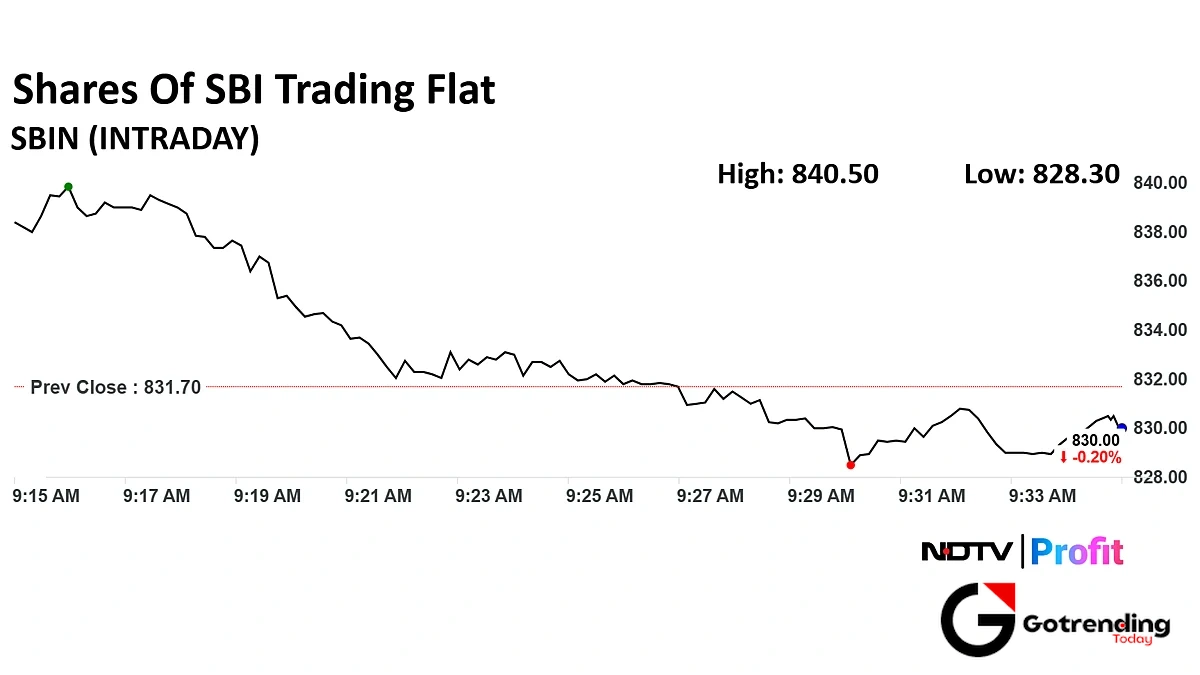

Decoding the SBI Share Price | What the ‘Big Bull’ of Indian Banking is Really Telling Us

Let’s grab a virtual coffee. You and me. You’ve probably done it today. Pulled out your phone, opened your trading app, and glanced at the sbi share price . It’s up. It’s down. It’s flat. But here’s a question that probably nags you late at night: what does that number actually mean?

Let’s be honest. For millions of Indians, from seasoned investors to uncles in the family WhatsApp group, the State Bank of India isn’t just another stock. It’s a national institution. It’s the “sarkari” bank that’s everywhere, the one your parents trusted for their first fixed deposit. It’s a behemoth, an elephant that, when it moves, the whole jungle notices.

So, when its share price moves, it’s not just a ticker symbol changing. It’s a signal. A story. It’s a barometer for the health of the entire Indian economy. And today, we’re not just going to look at the number. We’re going to look through the number. Forget the noise and the 24/7 news flashes. Let’s figure out the ‘why’ behind the price, and what this giant is really telling us about our money and our country.

The Engine Room | What Really Drives the SBI Share Price?

It’s easy to think of SBI as a “government stock” that just moves on political news or a budget announcement. That’s part of the story, but it’s the most superficial layer. The real drivers are deep in the bank’s engine room, and understanding them is key to a proper sbi stock analysis .

Here’s the thing. A bank, at its core, is a simple business: it borrows money cheaply and lends it out at a higher rate. The difference is its profit. For SBI, three metrics are crucial:

- Net Interest Margin (NIM): Fancy term, simple idea. This is the profit margin on its lending business. When SBI’s NIM expands, it means it’s earning more on its loans compared to what it pays for deposits. For a bank with a loan book worth lakhs of crores, even a tiny 0.1% increase in NIM translates to thousands of crores in profit. This is the first thing analysts look at.

- Non-Performing Assets (NPAs): You’ve heard this one before. It’s the ghost that has haunted Indian banking for a decade. NPAs are basically loans that have gone bad. For years, SBI was weighed down by a mountain of them. The recent surge in its stock price is a direct result of the bank aggressively cleaning up its books. Lower NPAs mean less money set aside for losses and more flowing to the bottom line. It’s a sign of health, and the market loves it.

- The CASA Ratio: This is SBI’s superpower. CASA stands for Current Account and Savings Account. This is the cheapest source of funds for a bank because it pays very low (or no) interest on this money. Thanks to its unbelievable reach—from a branch in a remote village to a corporate office in Mumbai—SBI has a massive pool of CASA deposits. A high CASA ratio is like having a secret recipe for low-cost raw materials. It gives SBI a massive, almost unfair, advantage over its competitors.

So when you see the sbi share price tick up, it’s often because the market is reacting to good news on one of these fronts. It’s not magic; it’s math.

It’s Not Just a Bank; It’s a Financial Universe

Here’s something that many casual investors miss. When you buy a share of SBI, you’re not just buying a piece of the core banking business. You’re buying into a sprawling financial conglomerate. It’s like buying a slice of a thali you don’t just get the roti, you get the dal, the sabzi, the raita, everything.

What fascinates me is how the market is slowly waking up to the massive, often hidden, value of SBI’s subsidiaries:

- SBI Life Insurance: A publicly listed, giant insurance company in its own right.

- SBI Cards and Payment Services: Another listed behemoth in the high-growth credit card space. You can check out their own impressive story here .

- SBI Asset Management Company (SBI Mutual Fund): The largest mutual fund house in India, managing the life savings of millions.

- SBI General Insurance, SBI Capital Markets… the list goes on.

For a long time, the value of these incredible businesses was buried inside the parent company. Analysts call this a “holding company discount.” But now, as these subsidiaries have grown and listed on their own, investors are forced to do the math. They’re realizing that the sum of SBI’s parts might be worth significantly more than the current share price reflects. This re-evaluation is a powerful undercurrent lifting the stock.

Reading the Economic Tea Leaves

Okay, let’s zoom out from the bank’s balance sheet to the 30,000-foot view of the Indian economy. SBI’s stock is a fantastic indicator of broader economic trends. It’s the canary in the coal mine, or perhaps more accurately, the elephant in the jungle.

When foreign institutional investors (FIIs) are bullish on India, where do they park their first big check? You guessed it. SBI is often their first port of call. It’s big, it’s liquid, and it’s a direct proxy for the country’s growth. So, a rising sbi share price is often a sign of strong foreign capital inflows, which in turn strengthens the Rupee and signals confidence in the Indian growth story. It’s all connected. The decisions made by the central bank have a massive impact on this flow of money and the bank’s profitability, which is why understanding the role of the RBI is so crucial if you’re an investor. You can learn more about it with this detailed guide on why the RBI matters .

When the government talks about a massive infrastructure push or a boom in manufacturing, who is going to fund it? SBI will be at the front of the queue. Its credit growth the rate at which it’s giving out new loans is a real-time indicator of economic activity on the ground.

So, Is SBI a Good Buy? The Million-Rupee Question

This is where I have to put on my responsible friend hat and say: this is not financial advice. Predicting a stock’s next move is a fool’s errand. But what we can do is analyze the situation like a strategist, weighing the pros and cons.

The Bull Case (Why it could go higher): The arguments are compelling. The NPA cycle has turned, the subsidiaries are unlocking value, and the bank is the single biggest beneficiary of India’s long-term economic growth. Most analysts have a positive outlook, with a strong sbi share price target for the coming year. The bank is seen as “too big to fail,” enjoying implicit government backing, which adds a layer of safety.

The Bear Case (The risks to watch): The biggest risk is also its biggest strength: its government ownership. This can be a double-edged sword. A populist move, like a large-scale farm loan waiver, could be forced onto SBI, hurting its bottom line. Secondly, nimble private-sector banks are constantly chipping away at its market share with better technology and customer service. Finally, as a barometer of the economy, it’s also highly vulnerable to any major economic downturn.

Ultimately, the decision to invest is deeply personal. For a new investor dipping their toes into the market, a guide can be invaluable. If you’re just starting out, this share market guide for India might be a helpful resource.

Frequently Asked Questions about SBI Stock

Why is the SBI share price so important for the whole stock market?

SBI is a heavyweight stock in the Nifty 50, India’s benchmark index. This means its movement has a significant impact on the overall direction of the market. A strong SBI often lifts the entire banking index and, consequently, the Nifty itself.

What does ‘PSU Bank’ mean and why does it matter for SBI?

PSU stands for Public Sector Undertaking. It means the bank is majority-owned by the Government of India. This provides a sense of security (“too big to fail”) but also brings the risk of government intervention in its business decisions, which can sometimes be at odds with shareholder interests.

How do SBI’s quarterly results affect the stock price?

Immensely. Every three months, the bank releases its financial report card. If the profits, NIM, and NPA numbers are better than what the market expected (the “analyst estimates”), the stock price usually jumps. If the results are disappointing, the price falls. It’s a quarterly test of performance.

I’m a new investor. Is SBI a safe stock to start with?

While no stock is 100% “safe,” SBI is considered a relatively stable, blue-chip stock due to its size, market leadership, and government backing. However, like any equity investment, it carries market risks and its price can be volatile. It’s often recommended for long-term investors who believe in the India growth story.

Where can I find the official sbi share price nse data?

For the most accurate, real-time data, you should always refer to the official source. You can find the live sbi share price nse data directly on the National Stock Exchange website atwww.nseindia.com.

In the end, the SBI share price is more than just a number on a screen. It’s a conversation. It’s a debate about policy, a bet on growth, and a reflection of our collective economic future. Watching it is not just about tracking an investment; it’s about having a finger on the pulse of India itself. And that, more than any daily gain or loss, is what makes it truly fascinating.