Decoding the RBI Grade B Exam | Why This Year Is Different

Alright, so you’re eyeing that sweet RBI Grade B officer position, huh? Let’s be honest it’s a climb. But here’s the thing: simply knowing the syllabus isn’t enough. Understanding the why behind the exam, the subtle shifts in its design, and the unspoken expectations? That’s what separates the candidates who just try from the ones who actually succeed. What fascinates me is how the RBI Grade B exam evolves each year, reflecting the changing landscape of the Indian economy. This year feels…different.

The Unspoken Strategy Behind the Syllabus Shift

You see, many treat the syllabus as a static document. Big mistake. The Reserve Bank of India (RBI) subtly tweaks it, not just to test knowledge, but to signal the skills they value right now. For instance, an increased emphasis on fintech or data analytics isn’t just a random addition. It’s a clear message: “We need officers who understand the future of finance.” And what fascinates me is how many candidates miss this subtle signal, focusing instead on rote learning old concepts. Let’s be honest – that’s a recipe for disaster. That’s why understanding the RBI Grade B syllabus is more than just ticking boxes; it’s about understanding the RBI’s vision.

I initially thought that this year’s focus on sustainable finance was just another buzzword being thrown around. But then I dug deeper into the RBI’s recent circulars and realized the depth of their commitment. They are actively pushing for green initiatives and requiring banks to integrate environmental considerations into their lending practices. A common mistake I see people make is underestimating the importance of this section. It’s not enough to simply know the definition of sustainable finance; you need to understand its practical implications for the Indian banking sector.

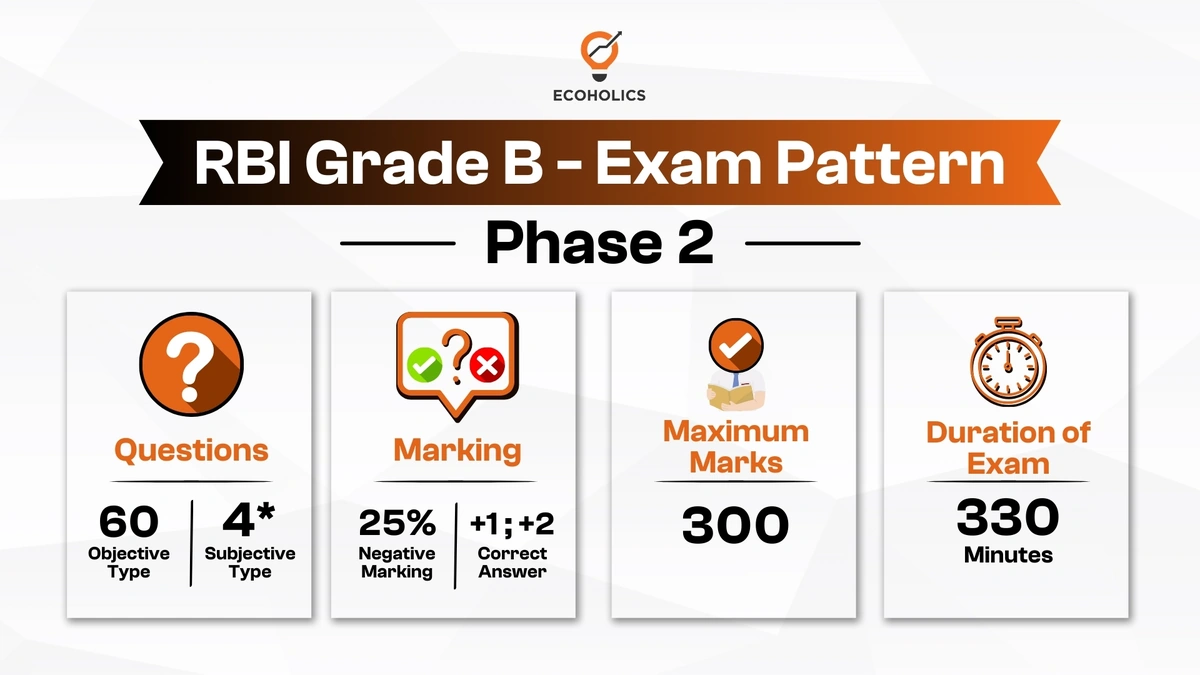

Decoding the Exam Pattern | More Than Just Marks

The exam pattern itself is a puzzle. And it’s not just about the number of questions or the time allotted. The way the questions are structured, the weightage given to different sections they all tell a story. A story about the kind of analytical thinking the RBI wants in its officers. I initially thought this was straightforward, but then I realized that the seemingly random distribution of marks across sections isn’t random at all. It’s a reflection of the RBI’s priorities. An increased weightage on economic and social issues, for instance, sends a clear message: they want officers who understand the real-world impact of monetary policy. Let me rephrase that for clarity: The RBI isn’t just looking for bookworms; they’re looking for problem-solvers who can connect theory with practice. What’s more important is to get a good score to secure your name in the RBI Grade B result .

But there’s something else at play here too – speed and accuracy. A common mistake I see people make is focusing too much on answering every single question. But here’s the thing: it’s better to answer fewer questions correctly than to attempt everything and end up with a bunch of silly mistakes. Focus on your strengths, manage your time effectively, and don’t be afraid to skip questions that are too difficult. Remember, it’s a marathon, not a sprint.

The Psychological Game | Handling Pressure and Expectations

Let’s be honest – the pressure of the RBI Grade B exam can be immense. The competition is fierce, the syllabus is vast, and the stakes are high. And that pressure can do funny things to your mind. It can lead to anxiety, self-doubt, and even panic. Here’s why you need a strategy for managing that pressure. The psychological aspect of this exam is often overlooked, but it’s just as important as your academic preparation. I have a friend who aced all the mock tests but crumbled under pressure on the actual day. The key is to build mental resilience, practice mindfulness, and develop a positive self-talk routine. Remember, you’ve come this far; you’ve put in the hard work. Believe in yourself, and trust your abilities. According to the latest trends, the cut off is expected to be higher this year for RBI Grade B Cut Off .

Experience Matters | Why Past Papers Are Your Best Friend

The one thing you absolutely must do is solve previous year’s question papers. Not just to understand the exam pattern, but to get a feel for the RBI’s mindset. How they frame questions, the kind of answers they’re looking for, the subtle nuances in the language it’s all there in the past papers. Consider them your secret weapon. A common mistake I see people make is treating past papers as just another set of practice questions. But they’re so much more than that. They’re a window into the RBI’s soul. So, dust off those old papers, analyze them meticulously, and learn from the mistakes of those who came before you.

And what fascinates me is how many candidates ignore this invaluable resource. They spend hours poring over textbooks and coaching materials, but they neglect the one thing that can actually give them an edge. Trust me, if you want to crack the RBI Grade B exam, past papers are your best friend.

Speaking of friends, check out this article on ICAI Representation to CBDT , you might learn something new!

Beyond the Books | What the RBI Really Wants

Ultimately, the RBI isn’t just looking for brilliant minds. They’re looking for well-rounded individuals who possess a unique blend of technical expertise, analytical skills, and emotional intelligence. They want officers who can think critically, communicate effectively, and lead with integrity. The exam is just the first step in a long and challenging journey. But it’s a journey that’s well worth taking. What fascinates me is the potential for impact that an RBI Grade B officer can have on the Indian economy. You have the power to shape policies, influence markets, and improve the lives of millions of people. That’s a responsibility, yes, but it’s also an incredible opportunity. And here’s some food for thought: you can improve your chances for selection by joining a RBI Grade B online course .

What truly excites me is the idea that someone reading this right now could be one of those future leaders. That’s the power of knowledge, the power of preparation, and the power of belief. Now, go out there and make it happen. But, before that, you can check this amazing article .

FAQ Section

What if I forgot my application number?

Don’t panic! Most application portals have a ‘forgot application number’ option. You’ll usually need to provide your registered email or phone number.

Is there any negative marking in the RBI Grade B exam?

Yes, there is negative marking. Typically, 0.25 marks are deducted for each wrong answer.

What are the key topics to focus on for the ESI section?

Focus on topics like Indian economic reforms, sustainable development, and current government schemes related to economics and social issues.

How important is the interview stage in the selection process?

The interview is extremely important. It carries significant weightage and is your chance to showcase your personality, communication skills, and understanding of the role.

Where can I find authentic study material for the RBI Grade B exam?

Refer to official RBI publications, standard economics textbooks, and reputable online learning platforms. Be wary of unverified sources.

What’s the best approach for time management during the exam?

Allocate time for each section based on your strengths and the weightage of the section. Practice with mock tests to improve your speed and accuracy.