Call for RBI Action on Scale-Based NBFC Framework

Ever feel like the financial world is speaking a different language? Acronyms flying left and right, regulations changing faster than you can say ‘market correction’? Yeah, me too. And right now, there’s a bit of a buzz around something called the scale-based NBFC framework – specifically, a call for the RBI to maybe, possibly, tweak it. Let’s unpack this, shall we? Because it’s not just about finance jargon; it’s about how your access to credit, your investments, and even your local kirana store might be affected.

So, What’s the Deal with this Framework?

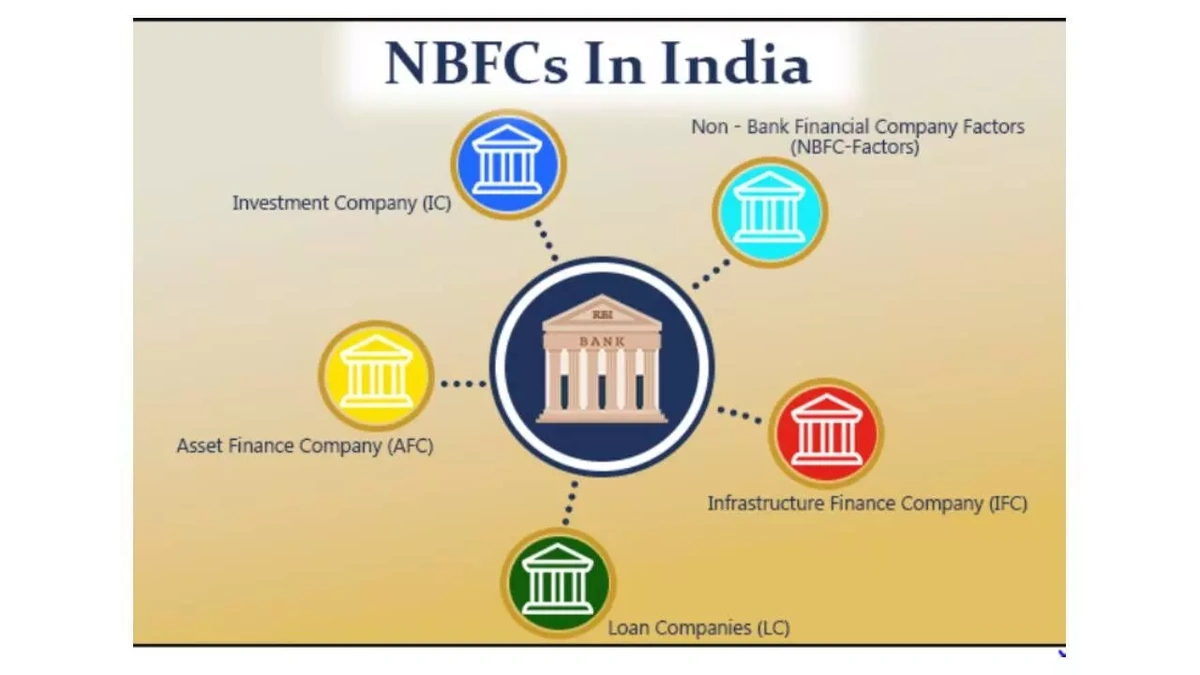

First things first: NBFC stands for Non-Banking Financial Company. Think of them as banks, but not quite. They lend money, offer investment options, and generally grease the wheels of the economy, especially in areas where traditional banks might not reach. Microfinance institutions, gold loan companies, investment firms – they all fall under the NBFC umbrella.

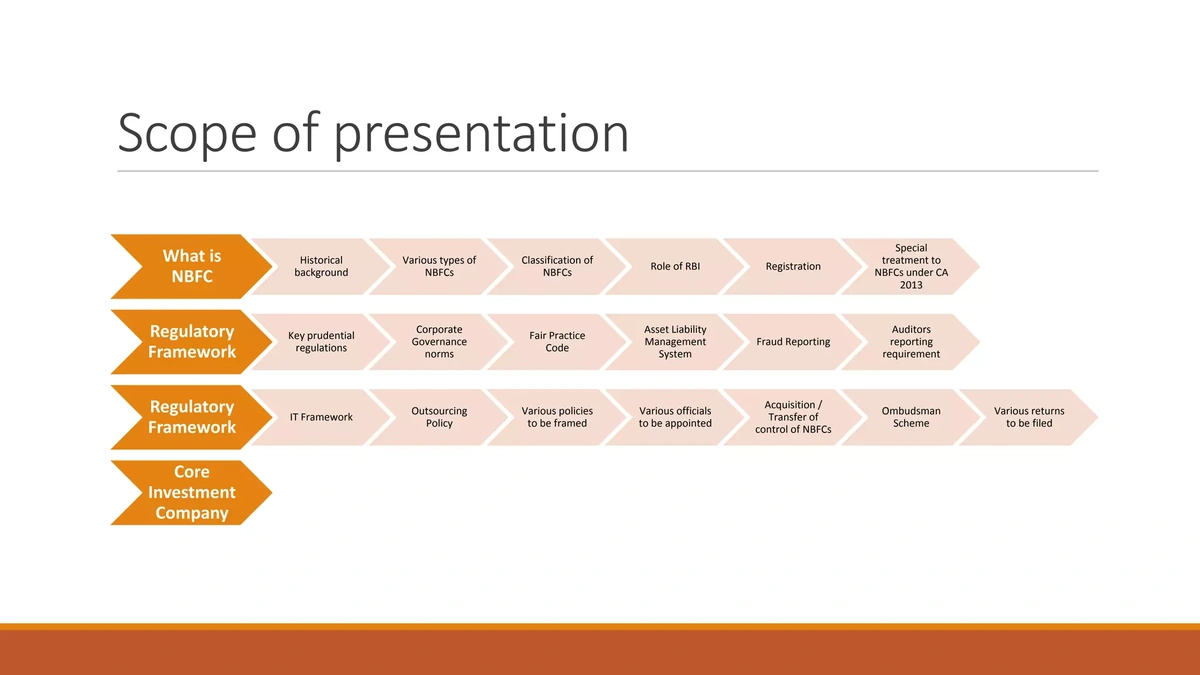

Now, the RBI – that’s the Reserve Bank of India, our central bank – introduced this scale-based regulatory framework a while back. The idea? To categorize NBFCs based on their size, activity, and risk profile. Makes sense, right? A tiny NBFC doling out small loans in a village shouldn’t be regulated the same way as a massive, nationwide player dealing with complex financial instruments.

But here’s the thing: this framework isn’t set in stone. It’s been tweaked, adjusted, and debated ever since its inception. And right now, there’s a growing chorus suggesting it might need another look. Especially considering the changing landscape of the Indian financial sector.

Why the Fuss Now? The ‘Why’ Angle Explained

Okay, let’s get to the heart of the matter. Why are people calling for the RBI to act? What’s the big deal? Well, it boils down to a few key factors. One common mistake I see people make is to assume that regulations are static; they’re not. They’re living, breathing things that need to adapt to the times.

Economic Growth and Financial Inclusion : India’s economy is on the move, and NBFCs are playing a crucial role in fueling that growth. They’re often the go-to lenders for small businesses, entrepreneurs, and individuals who might not have access to traditional bank loans. The framework needs to ensure these entities have access to funding, fostering economic growth . Too strict, and growth could be stifled. Too lax, and you risk financial instability.

Risk Management and Stability : On the flip side, the RBI is also responsible for maintaining the stability of the financial system. NBFCs, by their very nature, can be a bit riskier than traditional banks. The framework needs to have robust risk management protocols in place to prevent defaults and protect investors. A recent report highlighted that more nimble risk management is key for NBFC longevity.

But, the current framework, some argue, might be a bit too rigid, especially for smaller NBFCs. It could be hindering their ability to innovate and reach underserved populations. As per the guidelines mentioned in the information bulletin, the aim is to promote stability without stifling innovation.

The Fintech Factor : Let’s be honest, the rise of fintech has thrown a wrench into everything. New technologies are disrupting the financial landscape, and NBFCs need to adapt. The framework needs to be flexible enough to accommodate these innovations while still ensuring consumer protection. This is something that those involved in stocks and AI are very aware of.

The Potential Impact | What’s at Stake?

So, what happens if the RBI does tweak the framework? What are the potential consequences?

For NBFCs : A more flexible framework could mean easier access to capital, more room for innovation, and the ability to reach a wider customer base. However, it could also mean increased competition and the need to adapt to new technologies and regulations.

For Consumers : For you and me, it could mean better access to credit, more competitive interest rates, and a wider range of financial products and services. On the flip side, it could also mean increased risk if NBFCs aren’t properly regulated. More specifically, this could effect milk prices from places such as Amul .

For the Economy : A well-functioning NBFC sector is crucial for India’s economic growth. It can help to channel funds to productive sectors, create jobs, and boost overall economic activity. But a poorly regulated sector could lead to financial instability and even a crisis. The RBI’s role is to walk this tightrope, balancing growth with stability. According to a new paper, NBFC liquidity is paramount for sustained market health.

The Road Ahead | What to Expect?

What fascinates me is how the RBI will navigate this complex situation. It’s a delicate balancing act, and there’s no easy answer.

I initially thought this was straightforward, but then I realized the amount of factors that the RBI needs to consider. We can expect to see more consultations, discussions, and potentially some pilot projects to test new approaches. The RBI is likely to take a cautious approach, gradually tweaking the framework rather than making sweeping changes. It will also look to ensure NBFC compliance .

And honestly? That’s probably a good thing. Financial regulations are complex, and unintended consequences can be devastating. The RBI needs to get it right, not just for the sake of NBFCs, but for the sake of the entire Indian economy. As sources suggest, regulatory arbitrage is a danger if changes are too rapid. Remember that maintaining asset quality is an important component of this decision.

FAQ Section

Frequently Asked Questions

What exactly is the Scale-Based NBFC Framework?

It’s a set of regulations from the RBI that categorizes NBFCs based on size, activity, and risk, applying different rules to each category.

Why is there a call for the RBI to act on it?

Some argue the framework is too rigid, hindering growth and innovation, especially for smaller NBFCs. There needs to be more focus on NBFC supervision .

How could changes to the framework affect me?

Potentially through better access to credit, more competitive interest rates, and a wider range of financial services. But be aware that it also comes with the caveat of increased risk.

What are the key concerns about NBFCs?

The primary concerns are around NBFC risk management , financial stability, and consumer protection. A default cascade could result in considerable market upsets.

What does the RBI hope to achieve with any changes?

To foster economic growth while maintaining the stability of the financial system and promoting responsible lending practices. The balance between flexibility and supervision is delicate, to be sure.

Ultimately, the future of the NBFC framework is uncertain. But one thing is clear: it’s a crucial piece of the puzzle when it comes to India’s economic future. And it’s something we should all be paying attention to. What fascinates me is not the technical details, but the human element – how these regulations impact real people, their dreams, and their livelihoods. That’s the story worth telling.