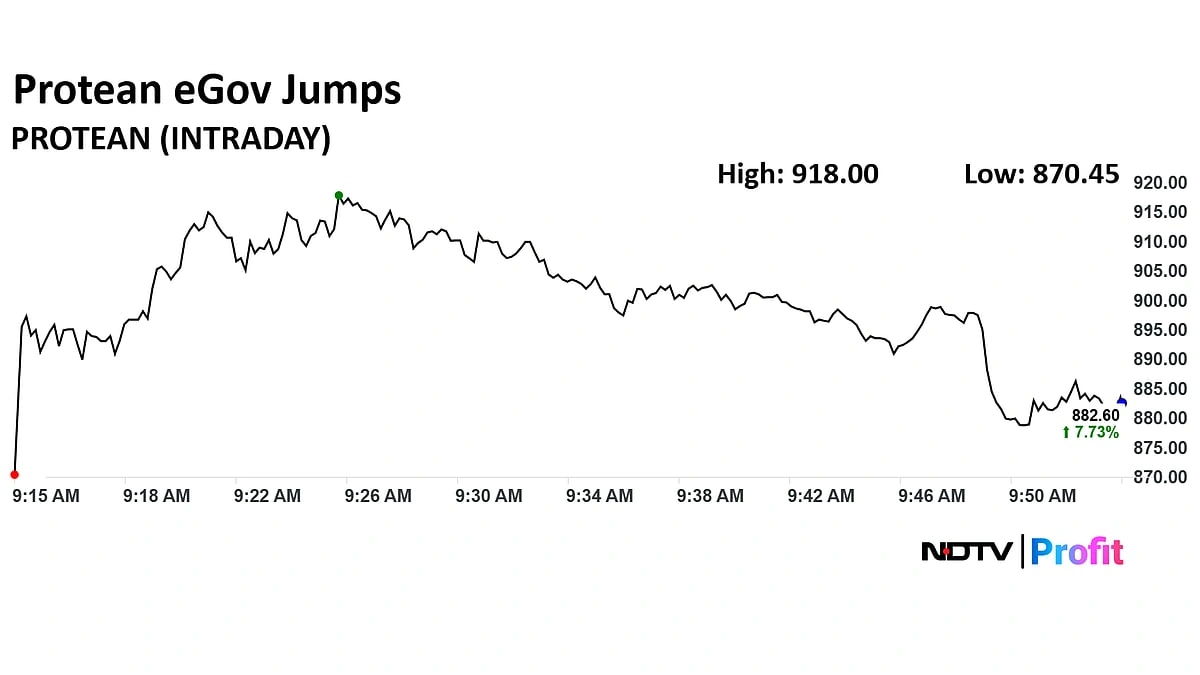

Protean Share Price | Beyond the Ticker – What’s Really Driving This Digital India Stock?

Let’s have a real chat. You’ve probably seen the Protean share price bouncing around and wondered, “What on earth is going on here?” One day it’s green, the next it’s red. It feels a bit like trying to predict Mumbai traffic chaotic and utterly confusing.

If you’re feeling that whiplash, you’re not alone. The story of a newly listed company, especially one as unique as Protean eGov Technologies, is never a straight line. It’s less about the daily ticker and more about understanding the engine under the hood.

And that’s what we’re going to do. Forget the noise. Let’s sit down, grab a virtual chai, and actually figure out what’s driving this company, why its IPO was so different, and what the future might hold. This isn’t just about the price; it’s about the plot.

First, Let’s Unpack What Protean Actually Does (Hint | It’s Not Your Usual IT Firm)

Here’s the thing most people miss: Protean isn’t a flashy tech startup building the next big app. Think of them more like the digital plumbers of India. They build and manage the essential, unglamorous, but absolutely critical pipes that make modern life work.

Ever applied for a PAN card? Chances are, Protean handled the backend. Are you contributing to the National Pension System (NPS)? They’re the central recordkeeping agency. They’re involved in Aadhaar authentication, e-KYC, and even education services. Essentially, if there’s a massive, citizen-scale digital public infrastructure project in India, Protean has its fingerprints all over it.

This is what the fancy analyst reports call a “moat.” Their deep integration with government systems creates a massive barrier to entry. You can’t just code a startup in a garage and decide to manage the nation’s pension records tomorrow. This unique Protean business model is built on decades of trust, scale, and navigating the complexities of public-private partnerships.

So, when you see the Protean eGov Technologies share price , remember you’re not looking at a company that sells products. You’re looking at a company that earns a small fee every time millions of Indians interact with the digital state. It’s a digital toll booth on the information superhighway.

The IPO Hype vs. The Post-Listing Reality Check

Now, let’s talk about the IPO. A lot of the confusion around the share price comes from the nature of its stock market debut in late 2023. Many investors expect an IPO to be a rocket ship, but Protean’s launch was… well, more of a steady climb.

The key detail here is that it was a 100% “Offer for Sale” (OFS). Let me translate that from market jargon into plain English. The IPO wasn’t about Protean raising fresh money to fund some grand expansion. Instead, it was an opportunity for its early investors (like banks and financial institutions) to sell their existing shares to the public and cash out. A detailed breakdown of the Protean IPO details can be found in their official DRHP, but the OFS aspect is crucial.

What does this signal? It’s not necessarily a bad thing, but it’s different. It tells you the company wasn’t starved for cash. It was mature enough for its original backers to exit. However, it also meant there wasn’t a big, exciting “we’re raising 500 crores for this amazing new project!” story to fuel initial hype.

The result was a decent, but not spectacular, listing. The price has been finding its footing ever since, as the market digests the company’s true value without the IPO fanfare. This is the natural process of price discovery, and it’s where the real analysis begins. If you are planning a trip, you might find our ttd online booking guide helpful.

The Triggers to Watch | What Really Moves the Protean Needle?

Okay, so if the daily price is just noise, what are the real signals we should be watching? If you want to understand the Protean future prospects , these are the things that actually matter.

- The Digital India Story: Protean’s fate is directly tied to the government’s push for digitization. Every new initiative is a potential opportunity. A key area to watch is their involvement in the Open Network for Digital Commerce (ONDC). As ONDC gains traction, Protean, being one of the technology providers, stands to benefit. This is far more important than a single day’s stock fluctuation.

- Quarterly Results (The Right Way): Don’t just look at the headline profit number in the Protean Q4 results or any other quarterly report. Dig deeper. How many new NPS subscribers were added? What was the volume of PAN applications? These operational metrics are the true health indicators of their core business. A steady increase in transaction volumes is the lifeblood of this company.

- New Verticals & Diversification: While their government-centric business is stable, it can also be slow-growing. The big question is: can they leverage their tech expertise to expand into new areas? They are already making moves in cloud services and data analytics. Success in these new domains could be a massive re-rating trigger for the stock.

- Valuation and Peer Comparison: This is where the question “is Protean a good buy?” gets interesting. It’s not a high-growth tech stock, so comparing it to one is like comparing an apple to an orange. Instead, it should be looked at alongside other technology infrastructure players. Is it trading at a reasonable price for its stability and market position? According to official data from the BSE India website , investors can track its price-to-earnings ratio and compare it with the industry average.

Watching these fundamental triggers will give you a much clearer picture than staring at a price chart ever will. Making travel easier, our guide on the FASTag annual pass can simplify your highway journeys.

So, Is Protean a Tortoise or a Hare?

I think this is the best way to frame it. In the stock market race, Protean is not the flashy, sprinting hare that grabs all the headlines. It’s the steady, methodical tortoise.

Its growth is unlikely to be explosive. It’s tied to the slow, deliberate, but powerful march of India’s digitization. The revenue is sticky, the business is protected by a strong moat, and its role is critical. But it’s also dependent on government policy and the pace of public adoption.

Investing in a company like Protean is less of a bet on a quarterly earnings surprise and more of a long-term belief in the foundational shift happening across India. It’s a bet that as India becomes more digital, the company managing the pipes of that digital world will inevitably grow with it.

Answering Your Lingering Questions

What is Protean’s main business, in simple terms?

Protean manages the technology backbone for critical national infrastructure. Their main revenue comes from managing services like the PAN card issuance system and the National Pension System (NPS), where they earn fees on transactions and account maintenance.

Why was the IPO an Offer for Sale (OFS)? What does that mean?

An OFS means the company itself didn’t receive any money from the IPO. The money went to the early investors who sold their shares. It signals that the company was financially stable and didn’t need immediate capital, but it also meant less hype compared to IPOs that raise funds for massive growth projects.

What are the biggest risks for Protean?

The two main risks are regulatory changes and competition. Since a large part of their business is linked to government contracts, any change in policy could impact them. While competition is low due to high entry barriers, the emergence of a new, efficient player or the government deciding to in-source these services could pose a threat in the long run.

Where can I find the official and live Protean share price data?

For the most accurate and real-time information, you should always refer to the official stock exchange websites: the National Stock Exchange (NSE) of India and the BSE Ltd. (formerly Bombay Stock Exchange).

Is Protean a good stock for short-term trading?

Given its business model, which is based on slow, steady, transaction-based growth, Protean is generally seen as more suitable for long-term investors. Its stock price is less likely to experience the kind of wild volatility that short-term traders often look for.

Ultimately, analyzing the Protean share price is a lesson in looking past the screen. It’s about understanding the deep, structural story of a company woven into the fabric of a nation’s digital transformation. The real question isn’t what the price will be tomorrow, but whether you believe in the long, steady journey of a more digital India. Because Protean is one of the key players laying the tracks for that future.