Beyond the Headlines: Decoding the Nikkei and What It Means for You

The Nikkei . You’ve probably heard the name, maybe seen it flash across a screen during a news report. But let’s be honest – what is it, really? And more importantly, why should someone sitting in a coffee shop in Bangalore, sipping their filter coffee, care about it?

Here’s the thing: the Nikkei 225 isn’t just some obscure financial index. It’s a window into the soul of the Japanese economy, a bellwether for global trends, and, believe it or not, something that can actually impact your life, even if indirectly. I initially thought understanding it would be straightforward, but then I realized the implications are deep and far-reaching.

The Nikkei 225 | A Beginner’s Guide (Because Everyone Starts Somewhere)

Think of the Nikkei 225 as Japan’s version of the Sensex or Nifty 50. It’s a stock market index that tracks the performance of 225 of the largest and most liquid companies listed on the Tokyo Stock Exchange (TSE). It’s like taking the pulse of Japan Inc. – a quick and dirty way to gauge the overall health of the country’s economic giants.

But — and this is a big but — it’s not just about numbers going up or down. The Nikkei’s movements reflect investor sentiment, global events, and the overall confidence in the Japanese economy. A common mistake I see people make is dismissing it as just a bunch of Japanese companies. It’s so much more intertwined with the global economy than that.

Why the Nikkei Matters to You (Yes, Really!)

Okay, so maybe you’re not planning on investing directly in Japanese stocks anytime soon. Fair enough. But here’s why you should still pay attention:

- Global Economic Barometer: Japan is a major player in the global economy. Its performance impacts everything from international trade to currency valuations. A strong Nikkei often signals a healthy global outlook, while a struggling one can be a warning sign.

- Investment Portfolio Diversification: If you do have investments, understanding global markets like the Nikkei is crucial for diversification. Spreading your investments across different regions can help mitigate risk.

- Geopolitical Implications: The Nikkei can be influenced by (and can influence) geopolitical events. Trade wars, political instability – all of these factors can impact the index and, in turn, the global economy.

And so, the Nikkei Stock Average serves as a useful comparative benchmark.

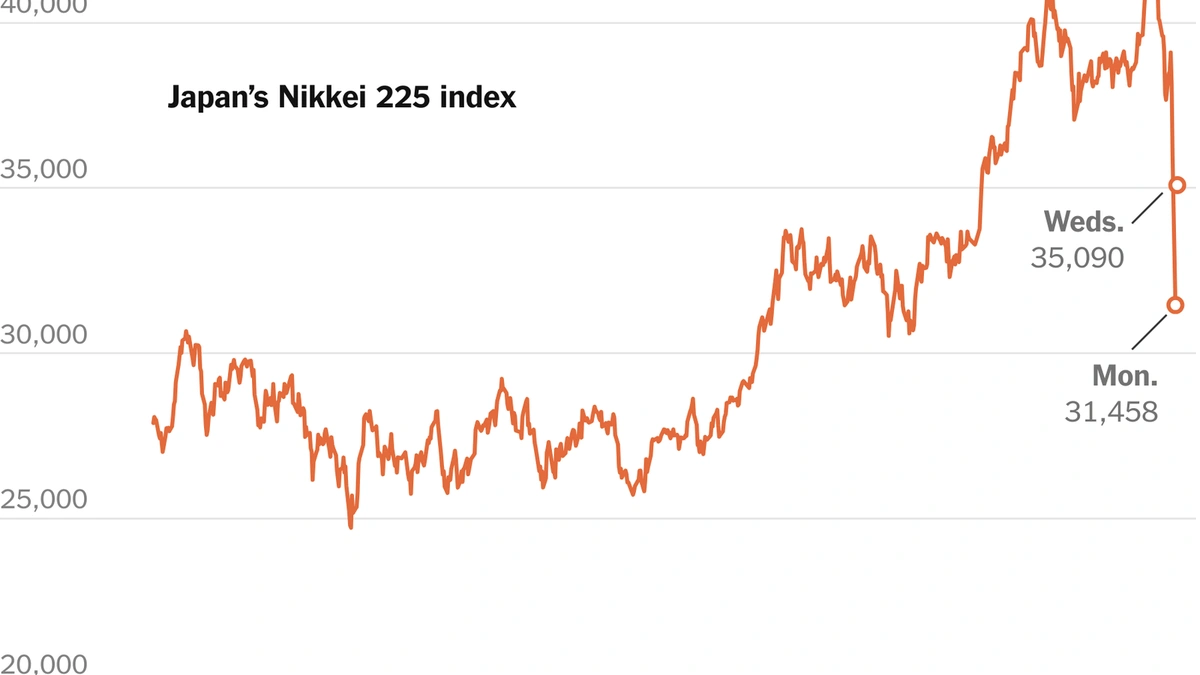

Decoding the Nikkei’s Recent Fluctuations

What fascinates me is how the Nikkei responds to global events. Let’s take recent events, for example. Rising interest rates in the US, coupled with a weakening yen, have created a complex scenario for Japanese companies. While a weaker yen can boost exports, it also makes imports more expensive, potentially leading to inflation. And theBank of Japan’smonetary policy decisions play a HUGE role here. Keeping an eye on the Nikkei can provide early clues about how these factors are playing out.

The Nikkei is also susceptible to global supply chain disruptions. The one thing you absolutely must double-check is the news regarding major geopolitical conflicts because they severely impact the index. The index’s performance also mirrors the performance of the technology sector, and the fluctuations in this sector are important to follow.

Investing in the Japanese Market | A Word of Caution

Now, before you rush out and start buying Japanese stocks, let’s be clear: investing in any foreign market involves risk. Currency fluctuations, political instability, and differences in accounting practices can all impact your returns. It’s essential to do your research and understand the specific risks involved. I initially thought this was straightforward, but then I realized the implications are deep and far-reaching.

That being said, there are several ways to invest in the Japanese market, even from India. You can invest in exchange-traded funds (ETFs) that track the Nikkei 225 , or you can invest in individual Japanese companies through international brokerage accounts. However, always consult with a financial advisor before making any investment decisions.

And what about the Tokyo Stock Market more broadly? Well, a rising tide lifts all boats!

Looking Ahead | The Nikkei’s Future and Its Global Impact

The future of the Nikkei – and, by extension, the Japanese economy – is uncertain. Several factors will play a role, including global economic growth, technological innovation, and demographic shifts. Japan’s aging population and declining birth rate pose significant challenges, but the country is also a leader in robotics and automation, which could help offset these challenges.

The index is influenced by Japanese Stocks and their performance. The performance of these stocks can provide significant insights into the performance of the Japanese economy and related developments. The growth of the Japanese Economy hinges on the factors discussed above, and the country’s ability to innovate.

And here’s why . The Japanese Yen also plays a vital role, especially in relation to other major world currencies.

FAQ | Your Burning Nikkei Questions Answered

What exactly is the Nikkei 225?

It’s a stock market index that tracks the performance of 225 top companies on the Tokyo Stock Exchange. Think of it as a snapshot of Japan’s economic health.

Why should I care about the Nikkei if I live in India?

Japan is a major global economy. The Nikkei’s performance can signal global economic trends that indirectly affect you.

Is investing in the Nikkei a good idea?

It can be, but it involves risks. Do your research and consider consulting a financial advisor first.

What factors influence the Nikkei’s movements?

Global economic conditions, geopolitical events, and the strength of the Japanese Yen are all key factors.

Where can I find the latest Nikkei 225 data?

Major financial news websites like Bloomberg, Reuters, and the Financial Times provide real-time data.

So, there you have it. The Nikkei isn’t just a random number on a screen. It’s a story – a story of economic challenges, technological innovation, and Japan’s place in the world. And while it might seem distant, its ripples can reach all the way to your local coffee shop. Keep an eye on it; you might be surprised what you learn.