The Nifty 50 | More Than Just a Number Flashing on Your Screen

You know the feeling. You’re trying to watch the cricket highlights, or maybe just catch the weather, and there it is. That relentless, blinking ticker at the bottom of the screen. SENSEX UP 300 POINTS. NIFTY 50 HITS NEW HIGH. It’s like a constant, low-grade hum of financial anxiety or euphoria that we’re all just supposed to understand.

But what does it actually mean?

For years, I just nodded along. “Ah, yes, the Nifty. Good, good.” But it was all just noise. It wasn’t until I really dug in that I realized the Nifty 50 isn’t just a number. It’s a story. A drama, really. It’s the closest thing we have to a real-time report card for corporate India. And let’s be honest, it’s way more interesting than most of the stuff they’re reporting on.

So, What Exactly Is This Nifty 50 Everyone’s Talking About?

Okay, let’s break it down. Forget the jargon for a second.

Think of the Indian stock market as a massive, sprawling universe of thousands of companies. Trying to track every single one to see how “the market” is doing would be impossible. You’d go mad.

So, the smart folks at the National Stock Exchange (the NSE ) came up with a shortcut. They decided to create an exclusive club, a sort of A-list of the biggest, most important, and most frequently traded companies. They picked 50. Not 49, not 51. Fifty. And they called it the Nifty 50.

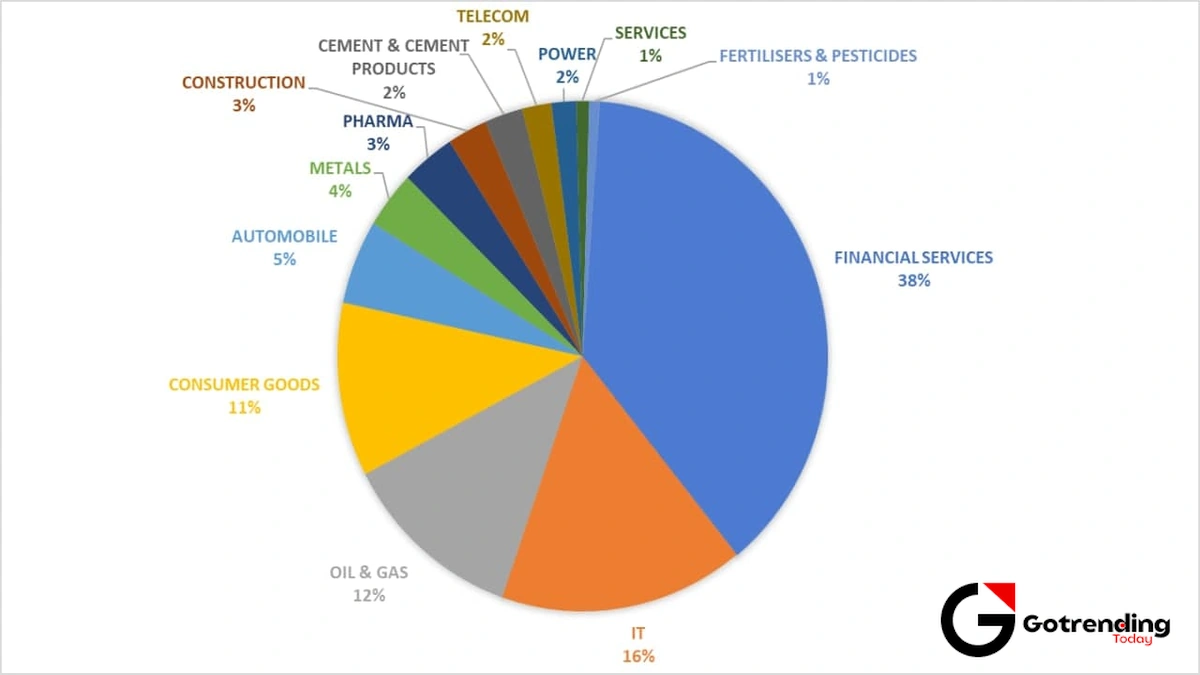

It’s like the starting lineup for Team India Inc. These are the heavy hitters, the blue-chip behemoths from across a dozen different sectors – banking, IT, energy, consumer goods, you name it. The performance of this elite group is then mashed into a single number, an index, that gives you a pretty solid snapshot of how the biggest players in the Indian stock market are faring. When you hear “the market is up,” it usually means the collective value of these 50 companies has increased.

Simple, right? Well, mostly. The “how” it’s calculated gets a bit nerdy, involving something called free-float market capitalization , but the core idea is that bigger companies have a bigger say in the index’s movement. It’s a weighted average, not a simple one.

The Nifty 50 vs. The Sensex | The Original Rivalry

Now, you might be thinking, “Wait, what about the Sensex ?” Ah, the great Indian market debate. It’s like the Mumbai vs. Delhi of finance.

The Sensex (a portmanteau of Sensitive Index) is the old guard. It’s run by the Bombay Stock Exchange (BSE), the original big boy of Indian exchanges, and it tracks 30 companies. The Nifty 50 is the slightly younger, more expansive rival from the National Stock Exchange (NSE).

Is one better? Honestly, it’s less about “better” and more about “different.” The Sensex is the OG, the one our parents probably talked about. The Nifty, with its 50 companies, is arguably a broader, more diversified snapshot of the economy. But here’s the thing: if you plot their charts over time, they move in almost perfect harmony. They’re like two different thermometers measuring the temperature of the same room. One might read 25.1 degrees and the other 25.2, but you get the same message: it’s warm.

So when you see the Sensex today flashing green, you can be almost certain the Nifty 50 is having a good day too. They are two different windows looking out onto the same economic landscape.

Why It’s More Than Just a Number on Your Screen

I keep coming back to this point because it’s crucial. The Nifty 50 isn’t just for day traders and men in suits screaming into phones. Its influence seeps into our lives in ways we don’t even realize.

For one, it’s a massive barometer of economic health . When these 50 giants are doing well expanding, hiring, making profits it’s generally a good sign for the economy as a whole. Conversely, when they stumble, it can be an early warning sign of trouble ahead. The government and the RBI watch it like hawks for this very reason. Its movements are scrutinized under regulations laid out by bodies like the Securities and Exchange Board of India (SEBI) to ensure fairness and transparency.

And here’s something even more direct: the rise of index funds . This is where it gets really interesting for regular people like you and me. Instead of trying to pick individual winning stocks (a notoriously difficult game, as anyone who has tried to figure out something like the KPIT share price can attest), you can just buy a slice of the entire Nifty 50. An index fund or an ETF (Exchange Traded Fund) simply buys all 50 stocks in the same proportion as the index. You’re not betting on one horse; you’re betting on the whole race. It’s become one of the most popular, and frankly, sensible ways for people to start investing.

The list of companies isn’t static, either. It’s re-evaluated every six months. Companies that are underperforming get kicked out, and rising stars get brought in. This constant churn is a fascinating, real-time story of India’s economic evolution. Remember when tech companies were the new kids on the block? Now they dominate. This constant refresh keeps the index relevant, unlike some initial public offerings that fizzle out after the initial hype, a concern for anyone looking at something like the Indiqube Spaces IPO GMP . The Nifty 50 is a living, breathing thing.

So, next time you see that ticker flashing, don’t just see a number. See the collective pulse of 50 of India’s biggest corporate stories, all rolled into one. It’s a messy, unpredictable, and endlessly fascinating narrative. And it’s happening right in front of us, every single day.

FAQ | Your Nifty 50 Questions, Answered

How do companies get into the Nifty 50?

It’s not an easy club to join! The National Stock Exchange has a strict set of criteria. A company needs to be highly liquid (meaning its shares are traded frequently and easily), have a large market capitalization, and be a leader in its sector. There’s a formal review every six months where underperformers can be dropped and new, deserving companies can be added. It’s a very dynamic process.

Is investing in a Nifty 50 index fund a safe bet?

“Safe” is a tricky word in investing. No investment is 100% risk-free. However, investing in a Nifty 50 index fund is generally considered one of the safer ways to get equity exposure. Why? Because you’re diversifying your risk across 50 of the largest, most stable companies in India. You’re protected from the collapse of a single company. But remember, if the entire market goes down, your investment will go down too. It’s safer, but not without risk.

I heard the Nifty 50 doesn’t represent the real India. Is that true?

That’s a very valid point and a common misconception to clear up. The Nifty 50 represents the top end of the formal, listed corporate sector. It doesn’t capture the vast unorganized sector, small businesses, or agriculture, which are huge parts of the Indian economy. So, while it’s an excellent indicator of corporate health and investor sentiment, it’s not a complete picture of the entire Indian economic experience. Think of it as a very important chapter, but not the whole book.

What’s the difference between Nifty 50 and Nifty Next 50?

Great question! The Nifty Next 50 is exactly what it sounds like: it’s a collection of the 50 companies that are waiting in the wings, right behind the main Nifty 50 in terms of market cap and liquidity. They are the potential future members of the main index. Investing in the Next 50 is a bet on the “challengers” – companies that are large and successful, but not quite in the top tier yet.