Decoding the New Tax Regime | Is It Really for You?

The new tax regime . It’s been the talk of the town (or at least, the internet) for quite some time now. But let’s be honest, wading through tax jargon can feel like trying to understand cricket rules for the first time – confusing and slightly overwhelming. So, I thought, let’s break it down, not just as some dry financial update, but as a real conversation between friends over a cup of chai. Is it actually better than the old one? Who benefits? What are the gotchas? That’s what we’re diving into.

Why All the Fuss About the New Tax Regime?

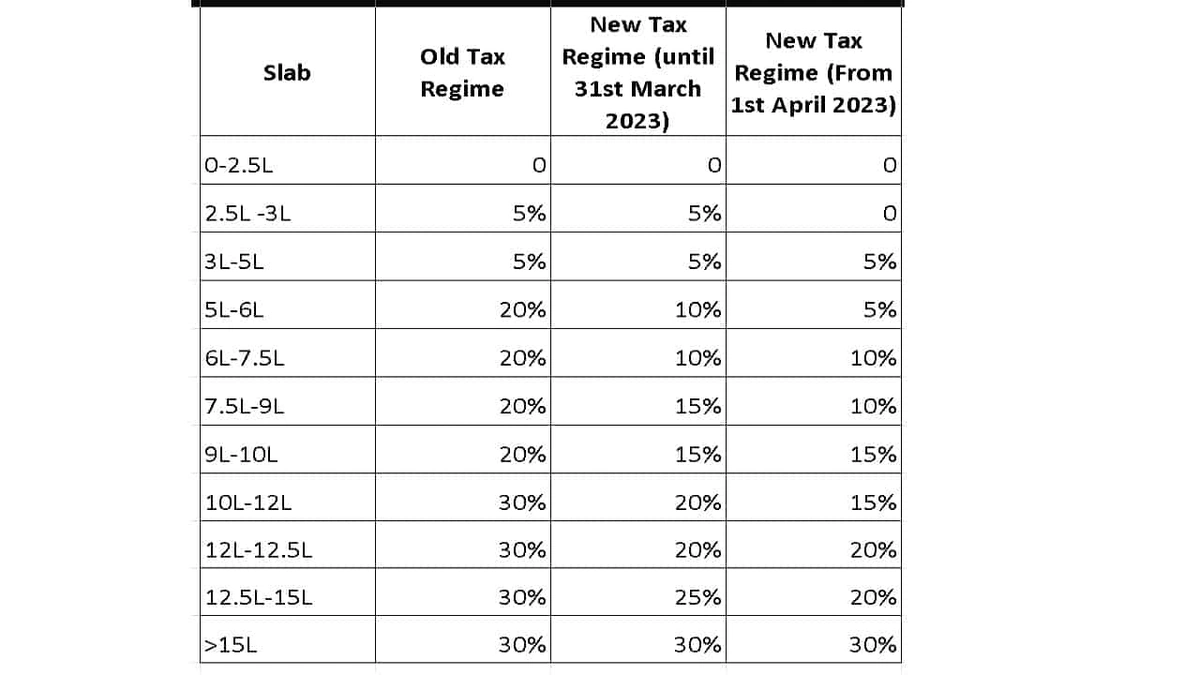

Okay, so here’s the thing. The government introduced the new income tax regime with the intention of simplifying things. The promise? Lower tax rates. Sounds great, right? But – and there’s always a ‘but’ – it comes at the cost of foregoing most deductions and exemptions that many of us have been religiously claiming under the old regime. Think about your HRA, LTA, 80C investments…gone! This is where the real decision-making comes in. The government aimed to make compliance easier and taxes lower, however, taxpayers have to decide what is beneficial for them. This change has significant implications for taxpayers , particularly those who heavily rely on deductions to reduce their tax liability.

What fascinates me is the underlying shift in philosophy. It’s a move towards a system where the government prefers you to spend and invest your money as you see fit, rather than incentivizing specific avenues through tax breaks. I initially thought this was straightforward, but then I realized, the choice depends entirely on your individual financial situation.

Who Actually Benefits From This Tax Shuffle?

This is the million-dollar question, isn’t it? The answer, unfortunately, isn’t a simple one. It boils down to your income level, your investment habits, and the deductions you usually claim. Generally speaking, individuals who don’t have many deductions to claim might find the revised tax slabs under the new regime more attractive. Let me rephrase that for clarity: If you’re someone who doesn’t bother much with tax-saving investments and exemptions, this could be a win for you.

But if you’re a diligent planner who maximizes deductions like 80C (PPF, ELSS, etc.), HRA (House Rent Allowance), and other exemptions, you might find that sticking with the old regime results in a lower tax outgo. It’s a delicate balancing act. A common mistake I see people make is assuming lower rates automatically mean lower taxes. Always do the math!

Crunching the Numbers | New Tax Regime vs. Old Tax Regime

Time for some real talk. The only way to figure out if the new tax regime works for you is to run the numbers. Create a simple spreadsheet (or grab one online – plenty are available) and calculate your tax liability under both regimes. Factor in your income, all possible deductions under the old regime, and then compare the final tax amount. Remember to account for standard deduction also which is applicable to both regimes.

I initially thought this was straightforward, but then I realized the importance of considering long-term financial goals. For instance, foregoing 80C deductions might seem appealing now for lower taxes, but what about your retirement savings? Are you adequately investing through other avenues? It’s not just about saving taxes today; it’s about securing your future. This is where understanding the tax implications becomes crucial. Many online calculators can assist you in determining which regime is more beneficial based on your income and deductions.

Common Pitfalls and How to Avoid Them

Okay, so you’ve crunched the numbers and made a decision. Great! But before you finalize your choice, here are a few common pitfalls to watch out for. First, remember that once you opt for the new regime, switching back to the old one might not always be possible (especially if you have business income). The one thing you absolutely must double-check is the applicable forms and procedures for opting in or out of the new regime. According to the latest guidelines, specific forms need to be submitted to the Income Tax Department to officially declare your choice.

Another area where people often stumble is underestimating the value of deductions. They might see the lower rates and assume it’s a no-brainer, without actually calculating the total value of their deductions. Don’t fall into this trap! Do your homework, and if needed, consult a tax professional. It’s worth the investment to ensure you’re making the right decision. Explore insurance options that could provide tax benefits under the old regime.

The Future of Taxation in India | What’s Next?

The government’s push for the simplified tax system signals a broader trend towards streamlining the tax landscape in India. Whether the new regime will eventually become the default option remains to be seen, but it’s clear that the focus is on reducing complexity and encouraging individual financial responsibility. However, understanding the nuances of the income tax structure is crucial for making informed decisions.

What fascinates me is the potential impact on investment behavior. Will people start prioritizing other investment avenues beyond those that offer tax benefits? Will there be a shift towards more market-linked instruments? It’s an interesting space to watch. As per experts, further simplifications and clarifications may be introduced in future budgets to enhance the attractiveness of the new regime.

FAQ | Your Burning Questions Answered

Frequently Asked Questions (FAQ)

What if I forgot to opt-in for the new tax regime?

If you haven’t explicitly opted in, you’ll generally be considered to be under the old regime by default. Check with your HR department or consult a tax advisor.

Can I switch between the old and new tax regimes every year?

For salaried individuals without business income, switching is allowed every year. However, those with business income face restrictions on switching back and forth.

Is the new tax regime compulsory for everyone?

No, it’s optional. You can choose to continue with the old regime if it suits you better.

Are there any deductions available under the new tax regime?

Very few. The major selling point of the new regime is lower tax rates in exchange for foregoing most deductions, with very few exceptions like employer’s contribution to NPS.

Where can I find official information about the new tax regime?

The official website of the Income Tax Department ( incometax.gov.in ) is the best source for accurate and updated information.

In conclusion, the latest tax regulations offer a chance to re-evaluate your tax strategy. So, take a deep breath, grab a calculator, and figure out what truly works best for you. Because, let’s be honest, understanding your taxes is a superpower in itself. And a well informed taxpayer is an empowered citizen. Remember to review recent updates regarding financial markets and investments for a holistic financial strategy.