That Chip in Your Pocket | A Real-Talk Guide to NASDAQ | QCOM

Pull out your phone. Go on, do it. Chances are, whether it’s a shiny new flagship or a trusty mid-ranger you bought two Diwalis ago, the tiny, silicon heart beating inside it was designed by a company called Qualcomm . And if you’re someone in India who’s even remotely interested in tech or the stock market, you’ve probably seen its stock ticker: nasdaq qcom . It pops up everywhere. But what does it actually mean? We see the ticker, we hear the name “Snapdragon,” but the real story is so much deeper, and honestly, way more interesting than just a string of letters on a stock exchange.

I’ve been following this company for years, not just as an investor, but as a genuine tech geek. I remember the days when having a “Snapdragon processor” became a badge of honor for Android phones in India, the key differentiator that marketing teams would plaster all over their ads. It was the magic ingredient. But here’s the thing most people miss: selling chips is only half their game. Not even half, sometimes. And understanding that difference is the key to understanding the real value and, frankly, the real risks of QCOM.

So, What’s the Big Deal with NASDAQ | QCOM Anyway?

Alright, let’s break this down. Forget the jargon for a second. Think of Qualcomm as a company with two distinctly different, though deeply connected, personalities. It’s a bit like a famous chef who not only runs a world-class restaurant but also sells his secret spice mix to every other restaurant in town.

The first personality, the one we all know, is the chipmaker. This division is called QCT (Qualcomm CDMA Technologies). They design and sell the famous Snapdragon chips that power a massive chunk of the world’s smartphones, and increasingly, cars, laptops, and those weird-but-cool VR headsets. This is the restaurant. It’s flashy, it gets all the press, and it’s where you see the tangible product.

But then there’s the second personality. The quiet, ridiculously profitable one. This is QTL (Qualcomm Technology Licensing). This is the secret spice mix. See, for decades, Qualcomm has been a pioneer in mobile communication. They hold an absolute treasure chest of fundamental patents for technologies like 3G, 4G, and now, 5G technology . So, any company that wants to make a device that connects to these networks which is, you know, every phone maker on the planet has to pay Qualcomm a licensing fee. A royalty. It’s a brilliant, and at times controversial, business model that provides a steady, high-margin stream of revenue that doesn’t depend on selling a single physical chip. This is the foundation upon which the entire nasdaq qcom story is built.

The Snapdragon Heartbeat of India’s Mobile Market

Now, let’s bring this home to India. Why does this company matter so much here? Because our smartphone market is one of the most dynamic and competitive in the world. From high-end Samsung devices to the countless models from brands like Xiaomi, OnePlus, and Realme, Snapdragon is everywhere. It’s the engine of our digital lives.

Think about the last phone you researched. You probably compared camera specs, battery life, and… the processor. A phone having a Snapdragon 7-series versus an 8-series chip is a major decision point for millions of Indian consumers. It dictates performance, gaming capability, and even battery efficiency. In many ways, the story of the Indian smartphone revolution is inseparable from the story of Snapdragon’s evolution. Brands know this. A phone like the Realme 15 Pro often gets its performance identity from the specific Snapdragon chip it uses. It’s the ultimate co-branding machine.

This deep entrenchment in the Qualcomm India ecosystem gives the company incredible insight and a powerful position. They aren’t just a supplier; they are a core partner in the technological fabric of the nation’s most-used gadget.

Beyond the Phone | A Cautious Look at Qualcomm’s Future Prospects

Okay, so they own the phone space. Great. But in the tech world, if you’re standing still, you’re already falling behind. The big question for any serious QCOM stock analysis is: what’s next? This is where things get really exciting, and a little uncertain.

The company is making huge bets in three key areas:

- Automotive: Modern cars are becoming data centers on wheels. They need powerful chips for infotainment, driver-assist systems (ADAS), and connectivity. Qualcomm is aggressively moving into this space with its “Snapdragon Digital Chassis” concept, competing directly with giants like NVIDIA and Intel.

- IoT (Internet of Things): This is a catch-all for everything from smartwatches and earbuds to smart city sensors and factory automation hardware. It’s a fragmented market, but the sheer volume is staggering. Qualcomm’s low-power, always-connected chips are perfect for this.

- AI On-Device: This, for me, is the real game-changer. For years, AI processing has happened in the cloud. But the push is now towards “on-device AI,” where your phone or laptop can perform complex AI tasks—like real-time translation or image enhancement—without needing an internet connection. Qualcomm’s latest chips are being built with powerful NPUs (Neural Processing Units) specifically for this. It’s a massive shift, and they are right at the forefront.

But and this is a big but they face fierce competition. MediaTek has eaten into their market share in the budget and mid-range phone segment. Apple makes its own world-class chips. And the geopolitical tensions surrounding the semiconductor industry are a constant, looming threat. While the future looks bright, it’s not a guaranteed cakewalk. And as any savvy investor knows, understanding the risks is just as important as drooling over the potential. It’s something to keep in mind when looking at your investment strategy, maybe even while you’re sorting out your finances with something like an ITR filing guide .

Your Burning Questions About QCOM

Is Qualcomm (QCOM) just a smartphone company?

Absolutely not, and that’s the key takeaway! While smartphones are still their bread and butter, they are aggressively diversifying. Think of them as a “connected computing” company. Their chips and technologies are moving into cars (the “Digital Chassis”), laptops (“Snapdragon X Elite”), VR/AR headsets, and a vast range of Internet of Things (IoT) devices. The smartphone business provides the cash flow and the R&D foundation to attack these other, potentially massive, markets.

Why is Qualcomm’s licensing business (QTL) so important?

Because it’s the bedrock of their profitability. Selling chips (QCT) is a high-revenue but more competitive, lower-margin business. The licensing division (QTL), on the other hand, is extremely high-margin. They are essentially monetizing their massive portfolio of essential patents for 3G/4G/5G. This creates a stable, predictable stream of income that is less affected by market share fluctuations in the chip business. It’s the financial engine that makes the whole company run so effectively.

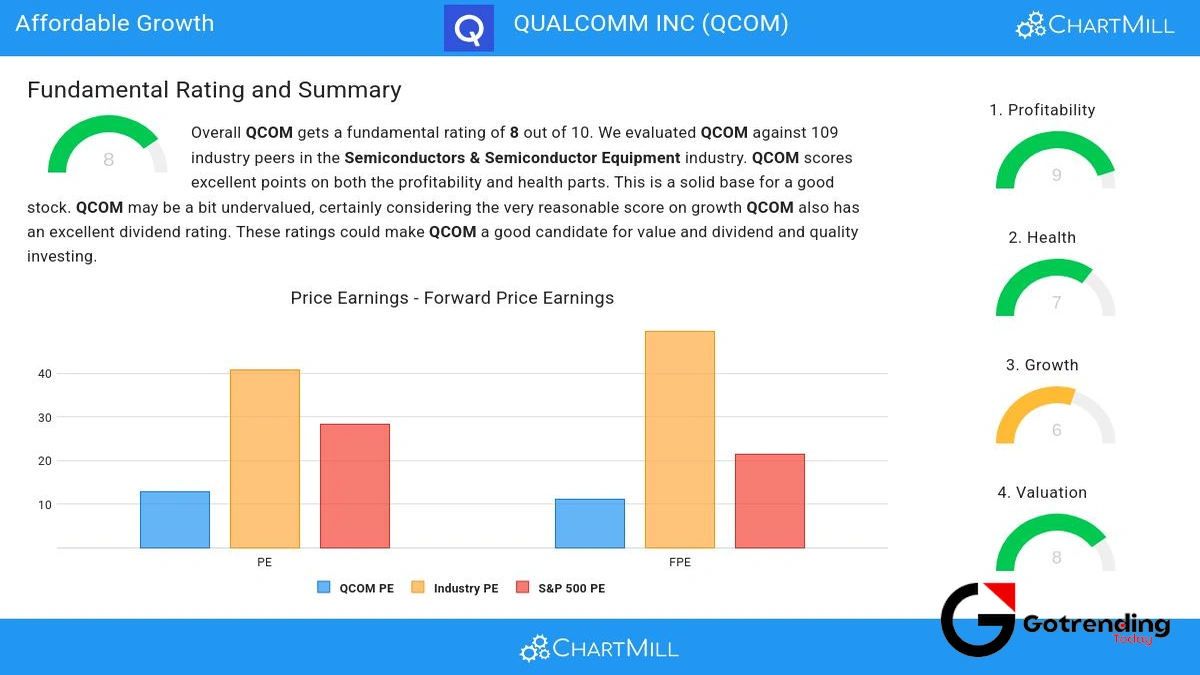

With all the competition, is Qualcomm still a good buy now?

That’s the million-dollar question, isn’t it? It’s impossible to give a definitive “yes” or “no.” On one hand, they have a strong moat with their patent portfolio and a leading position in premium Android phones and emerging tech like on-device AI. On the other, competition from MediaTek is intense, and major customers like Apple are designing their own chips. A smart approach is to look at the valuation, the growth in their automotive and IoT segments, and whether you believe in their long-term strategy beyond just phones.

What’s the biggest risk I should know about before investing in NASDAQ | QCOM?

I’d say the biggest risk is twofold: geopolitical tensions and customer concentration. The semiconductor industry is at the heart of the US-China tech rivalry, and any new regulations or tariffs could significantly impact Qualcomm’s business, as a large chunk of its revenue comes from Chinese handset makers. The second risk is their reliance on a few large customers. If a major partner like Samsung or a large Chinese brand decided to switch suppliers or build its own chips more aggressively, it could materially impact revenue.

So, the next time you see that ticker, nasdaq qcom , floating by on a news channel, you’ll know. You’ll know about the two-headed business model, the quiet power of patents, and the massive bets being made on a future that extends far beyond the phone in your hand. It’s not just a stock; it’s a piece of the technology that connects nearly every aspect of our modern world. And that’s a story worth following. For more details on their official financial reporting, you can always check their investor relations page directly.