Muthoot Finance Share | Is This More Than Just a Gold Loan Stock? The Real Story.

Let’s sit down for a minute. Forget the frantic charts and the screaming news tickers. I want to talk about something real. Something quintessentially Indian. I want to talk about gold.

Not as a commodity, but as a silent member of the family. That necklace tucked away in a Godrej almirah, the bangles passed down from a grandmother. It’s not just metal; it’s a safety net, a promise, a last resort. And right at the heart of this uniquely Indian story sits a company with bright red and yellow signboards dotted across every town and city: Muthoot Finance.

So when we talk about the muthoot finance share , we’re not just talking about a stock. We’re talking about a barometer of trust, of middle-class aspirations, and the quiet financial currents that flow beneath the surface of our economy. It’s a fascinating, complex story, and honestly, way more interesting than just watching numbers go up or down.

Is this a simple bet on gold prices? Or is there something much deeper going on? Let’s unpack it together.

The Golden Paradox | Why Muthoot’s Fate is Tied to More Than Just Gold Prices

The common wisdom is simple: Gold prices go up, Muthoot’s stock goes up. Right? It seems logical. Higher gold prices mean the collateral they hold is worth more, and they can lend out bigger sums against the same amount of gold. It’s a neat, clean narrative.

But here’s the thing. It’s beautifully incomplete.

What fascinates me is the demand side of the equation. Think about it. When do people typically pledge their family gold? It’s not when they’re feeling flush with cash. It’s when a sudden need arises a medical emergency, a child’s school fees, a small business opportunity that can’t wait for a bank’s month-long approval process. This need for quick, no-questions-asked liquidity is the real engine of the gold loan business in India .

So, an economic boom might actually mean less demand for gold loans, even if gold prices are high. Conversely, a period of economic stress can drive more people to their nearest Muthoot branch, turning dormant assets into active capital. The muthoot finance share price , therefore, dances to a much more complex tune than just the international price of gold. It’s a delicate interplay between the value of the asset and the urgency of the need.

This is Muthoot’s secret sauce. They understand that the customer isn’t selling their gold; they are leveraging an emotion-laden asset with every intention of getting it back. It’s a transaction built on trust and speed, something traditional banks have always struggled to replicate.

Unpacking the “Muthoot vs. The World” Argument

Okay, so Muthoot has a unique business model. But they’re not alone. The name that always comes up in the same breath is Manappuram Finance. So, what’s the difference?

Think of it like this: Muthoot Finance vs Manappuram is a classic story of different strategies chasing the same customer. Historically, Muthoot has focused on larger ticket sizes and longer tenure loans, often building deep relationships with their customers. Manappuram, on the other hand, carved a niche with shorter-term loans (around three months), which meant faster turnover but also required constant customer re-acquisition. Both models have their merits and risks, but Muthoot’s approach has given it a reputation for stability.

But the real battle isn’t just with other gold loan companies. It’s with the big daddies the banks. Why haven’t ICICI or HDFC just crushed this market? Two reasons: speed and focus.

- The Speed Moat: Walk into a Muthoot branch, and you can walk out with cash in under an hour. Try doing that at a bank. The bureaucratic hurdles, the paperwork, the multi-level approvals—it’s just not their game.

- The Focus Moat: For Muthoot, gold loans are everything. For a bank, it’s a tiny, almost-forgotten product line. Muthoot’s staff are specialists. They can appraise gold purity and value with an expertise that a generalist bank employee simply can’t match.

And then there’s the regulator, the Reserve Bank of India. The RBI keeps a close watch on the Loan-to-Value (LTV) ratio how much you can lend against the value of the gold. A tweak in this rule can instantly change the profitability and risk profile for the entire sector. It’s a constant, looming factor that any serious investor needs to watch.

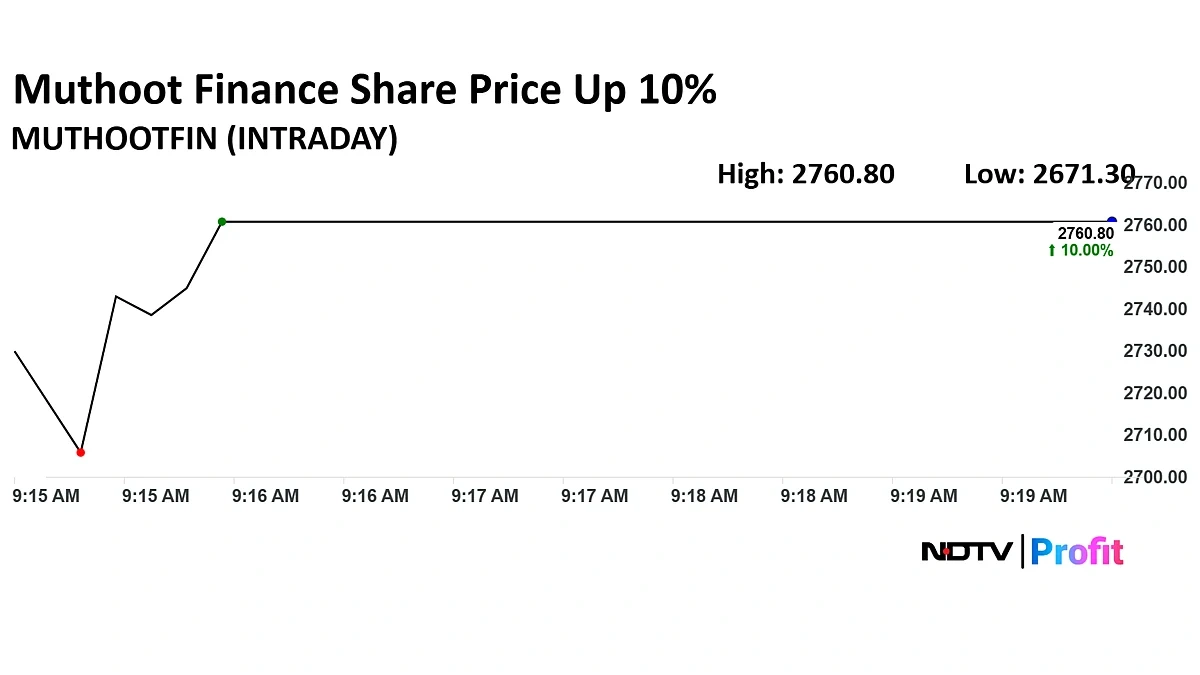

The Elephant in the Room | Decoding the Stock’s Recent Performance

Let’s be honest. If you’ve been tracking the stock, you’ve likely asked, ” Why is Muthoot Finance share falling or staying flat at times?” It’s a valid question, especially when you see the long-term potential. The answer usually lies in a mix of short-term headwinds.

Sometimes it’s a slightly underwhelming quarterly result, where loan growth didn’t meet lofty market expectations. Other times, it’s about rising interest rates in the broader economy. When the cost of borrowing for Muthoot itself goes up, it squeezes their profit margins unless they pass it on to customers, which is a tricky balancing act.

Competition is also intensifying, not just from banks waking up to the opportunity but also from new-age fintech players trying to nibble at the edges. These factors create uncertainty, and the market hates uncertainty. But the key question for a long-term investor is: are these temporary storms or a fundamental change in the weather? For now, the core business the trust, the branch network, the brand recall remains incredibly strong. The recent volatility feels more like the market is re-pricing the risks, which can often present an opportunity for those with a longer horizon. It’s a reminder that even in stable businesses, the market’s mood can be fickle, something we also see in the unpredictable world of digital assets, as seen when a major crypto exchange Binance returns India after a ban.

Beyond the Ticker | Is Muthoot Finance a Good Buy for the Long Haul?

So, we strip away the noise. What are we left with? Is Muthoot Finance a good buy for someone building a portfolio in India?

To answer that, you have to look beyond just gold loans. The management is smart; they know they can’t be a one-trick pony forever. They’ve been cautiously diversifying into other areas like affordable housing finance (Muthoot Homefin), microfinance (Belstar Microfinance), and vehicle loans. The performance of these subsidiaries is becoming increasingly important to the overall valuation of the company.

The success of these ventures will determine if Muthoot can evolve from a pure-play gold loan giant into a diversified financial services powerhouse. It’s a work in progress, and it carries its own set of risks, but it shows foresight.

But the core thesis remains anchored in gold. There are an estimated 27,000 tonnes of gold sitting in Indian households. That’s a national treasure trove, and most of it is unproductive. As India’s economy grows and credit needs become more sophisticated, the potential to monetize even a fraction more of this gold is staggering. Investing in a company like this requires a long-term vision, much like analyzing the fundamentals of the Shanti Gold share price analysis requires patience.

Frequently Asked Questions (FAQ)

What makes Muthoot Finance different from a bank?

The primary difference is speed and focus. Muthoot can process a gold loan in under an hour with minimal paperwork, which is a service most banks can’t match. Their entire business is built around the gold loan ecosystem, making them specialists in appraisal and customer service for this specific need.

How do gold price fluctuations really affect the muthoot finance share?

It’s a dual effect. Rising gold prices increase the value of their collateral and allow for larger loans, which is positive. However, the stock’s performance is more deeply linked to the demand for credit. Economic stress can increase demand for loans regardless of gold prices. So, it’s a balance between collateral value and credit demand.

I see a ‘muthoot finance share price target’ online. Should I trust it?

Treat price targets as one data point, not a guarantee. They are analysts’ educated guesses based on financial models. The real world is full of unpredictable events. It’s better to understand the underlying business fundamentals yourself rather than blindly following a muthoot finance share price target .

What are the biggest risks of investing in Muthoot Finance?

The main risks include: 1) Regulatory changes, especially from the RBI regarding LTV ratios. 2) A sharp and sustained fall in gold prices, which would impact their collateral value. 3) Increased competition from banks and other NBFCs. 4) A slowdown in their non-gold business segments.

Is Muthoot diversifying its business effectively?

They are actively diversifying into housing finance, microfinance, and insurance. Their microfinance arm, Belstar, has been performing well. The success of this diversification is a key factor for the company’s long-term growth and reducing its dependence on a single asset class.

What if I need quick help with my Muthoot loan account?

The best and quickest way is to visit your home branch where you took the loan. They have all your records. Alternatively, you can use their official customer care numbers or the ‘Muthoot Blue’ app for basic queries, payment reminders, and digital transactions.

In the end, analyzing the Muthoot Finance share is a fascinating case study. It’s not a flashy tech stock or a high-growth startup. It’s a company built on a foundation of ancient tradition and modern-day needs.

Investing here isn’t just a bet on the price of gold. It’s a bet on the enduring financial habits of millions of Indians. It’s a bet on the person who needs quick capital to seize an opportunity, on the family that needs a bridge to get through a tough month. And that, in my opinion, is a story far more solid, and far more valuable, than the metal itself.