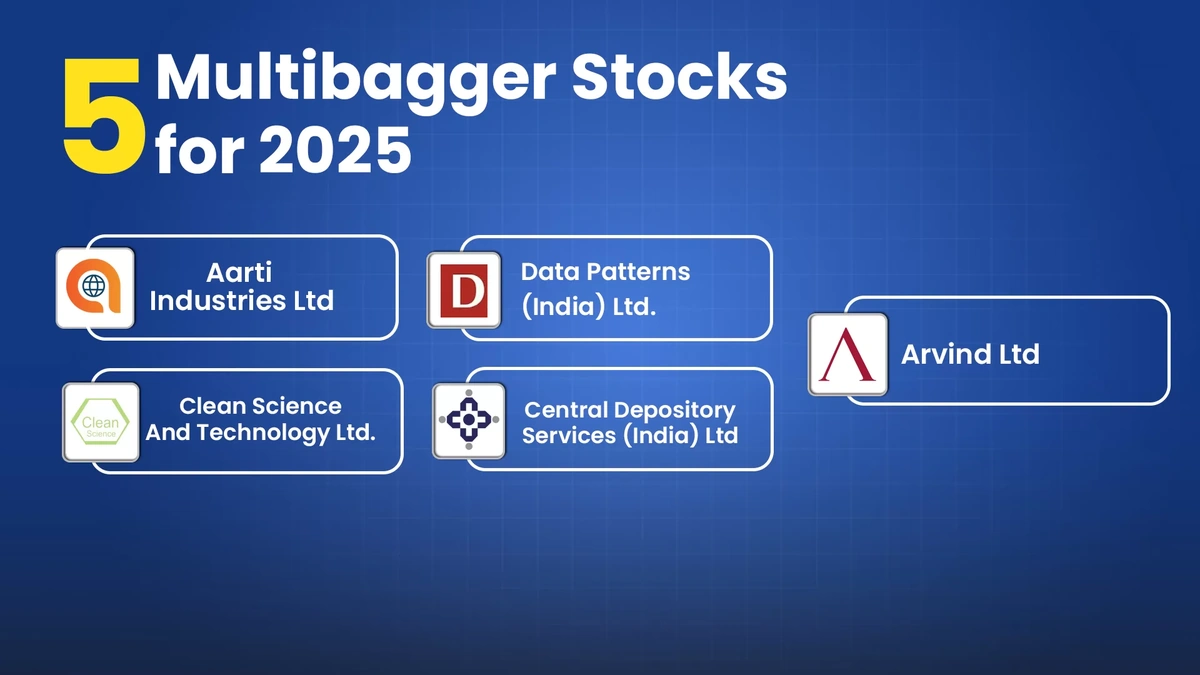

Unlocking the Secrets of Multibagger Stocks: A Beginner’s Guide to Explosive Growth

Okay, let’s be honest. The term ” multibagger stocks ” sounds like something out of a get-rich-quick scheme, right? But the truth is, identifying these potential game-changers is a serious, albeit exciting, part of investing. The idea? Find companies whose stock price can multiply several times over, delivering substantial returns. Finding these companies can be like trying to find a diamond in the rough, but with some knowledge and a little bit of patience, it’s definitely achievable. And trust me, the rewards can be well worth the effort. I’m not just talking about a bit of extra pocket money; I’m talking about potentially life-altering gains.

Why Should You Care About Multibagger Stocks?

Here’s the thing: traditional investments like fixed deposits offer safety, but they rarely deliver the kind of returns that can significantly boost your wealth. Multibagger stocks , on the other hand, have the potential to do just that. But, and this is a big but, they also come with higher risks. So, why bother? Because a well-researched investment in amultibaggercan provide returns that dwarf those of more conventional options, helping you achieve your financial goals faster. Think about it: early investors in companies like Infosys or Reliance reaped massive rewards.

But let me be clear: this isn’t about gambling. It’s about identifying companies with strong fundamentals, growth potential, and a competitive edge – and then holding on for the long haul. Think of it like planting a seed and nurturing it into a mighty tree. It takes time, patience, and a little bit of luck.

How to Spot a Potential Multibagger Stock: My Personal Checklist

So, how do you actually find these elusive multibagger stocks ? Well, after years of sifting through financial statements and company reports, I’ve developed my own checklist. It’s not foolproof (nothing in the stock market is), but it’s a pretty good starting point.

- Strong Fundamentals: This is non-negotiable. Look for companies with healthy revenue growth, consistent profitability, and a manageable debt burden. Check their annual reports (easily available on their website) to scrutinize their financial performance.

- Growth Potential: Is the company operating in a growing industry? Does it have innovative products or services that could disrupt the market? These are crucial questions to ask.

- Competitive Advantage: What makes this company stand out from the crowd? It could be a unique technology, a strong brand, or a cost-effective business model. This is often called a “moat” – something that protects the company from competitors.

- Sound Management: A company is only as good as its leadership. Look for experienced, ethical, and visionary managers who have a proven track record of success.

- Reasonable Valuation: Even the best companies can be overvalued. Make sure you’re not paying too much for the stock relative to its earnings and growth potential. This involves looking at metrics like the price-to-earnings (P/E) ratio and the price-to-growth (PEG) ratio.

Now, I know what you’re thinking: this sounds like a lot of work! And you’re right, it is. But that’s the price you pay for potentially life-changing returns. It’s important to remember that you can use online resources such asThe Economic Timesto research different companies. You don’t necessarily have to do everything on your own.

The Emotional Rollercoaster | Preparing for the Ride

Investing in multibagger stocks isn’t just about analyzing numbers; it’s also about managing your emotions. The stock market can be a volatile place, and there will be times when your investments go down – sometimes significantly. The key is to stay calm, stick to your strategy, and avoid making rash decisions based on short-term market fluctuations.

Remember why you invested in the first place. If you’ve done your research and you believe in the company’s long-term potential, then don’t panic sell when the market dips. Instead, see it as an opportunity to buy more shares at a lower price – a strategy known as dollar-cost averaging. Market capitalization and financial performance are important elements to keep an eye on when you are investing in stocks.

This is where a long-term perspective comes in. Multibagger stocks typically take years, even decades, to reach their full potential. So, you need to be patient and willing to ride out the ups and downs. Think of it as a marathon, not a sprint. Also consider factors like growth stocks and emerging trends .

Common Mistakes to Avoid (Because I’ve Made Them All!)

Let me tell you from personal experience, investing in multibagger stocks is not without its pitfalls. Over the years, I’ve made my fair share of mistakes, and I’ve learned some valuable lessons along the way.

- Chasing Hype: Don’t get caught up in the hype surrounding a particular stock. Just because everyone else is buying it doesn’t mean it’s a good investment. Always do your own research and make your own decisions.

- Ignoring Risk: Every investment carries risk. Don’t put all your eggs in one basket. Diversify your portfolio across different sectors and asset classes to reduce your overall risk. Diversification is key.

- Falling in Love with a Stock: It’s easy to get emotionally attached to a company, especially if it’s been performing well. But don’t let your emotions cloud your judgment. Be willing to sell a stock if the fundamentals change or if it becomes overvalued.

- Not Doing Your Homework: This is the biggest mistake of all. Investing in multibagger stocks requires thorough research and analysis. Don’t rely on tips from friends or social media. Do your own due diligence. Due diligence is a must.

The Future of Multibagger Stocks in India

What fascinates me is the future of the Indian stock market . With a rapidly growing economy, a young and aspirational population, and increasing financial literacy, the opportunities for finding multibagger stocks in India are immense. Sectors like technology, healthcare, and renewable energy are particularly promising. Companies that are leveraging digital technologies, developing innovative healthcare solutions, and promoting sustainable energy practices have the potential to deliver exceptional returns in the years to come.

But, and this is crucial, the Indian stock market is also subject to its own set of risks, including regulatory changes, economic fluctuations, and geopolitical events. So, it’s important to stay informed, adapt to changing market conditions, and always be prepared for the unexpected. Keeping an eye on the stock market trends and investment opportunities is essential.

FAQ About Multibagger Stocks

What exactly defines a multibagger stock?

A multibagger stock is generally defined as a stock whose price increases multiple times its original purchase price, often doubling or tripling (or more) in value.

How long does it typically take for a stock to become a multibagger?

There’s no set timeline. It can take several years, even a decade or more, for a stock to reach its multibagger potential. Patience is key.

Are multibagger stocks only found in small-cap companies?

Not necessarily. While small-cap companies often have higher growth potential, multibagger stocks can also be found in mid-cap and even large-cap companies.

What if I don’t have the time to do all this research?

Consider consulting with a qualified financial advisor who can help you identify potential multibagger stocks based on your risk tolerance and investment goals.

Is it too late to invest in the stock market now?

It’s never too late to start investing, but it’s important to do your research and understand the risks involved. Start small, diversify your portfolio, and invest for the long term.

Can I really get rich by investing in multibagger stocks?

While there’s no guarantee of getting rich, investing in well-researched multibagger stocks can significantly increase your wealth over time. But remember, it’s just one piece of the puzzle. A sound financial plan also includes saving, budgeting, and managing debt.

So, there you have it – my insider’s guide to unlocking the secrets of multibagger stocks . It’s not a guaranteed path to riches, but with the right knowledge, a disciplined approach, and a little bit of patience, you can significantly increase your chances of finding those hidden gems that can transform your financial future. Go forth and invest wisely!