Unlock Your Dreams | How the Mukhyamantri Mahila Rojgar Yojana Can Empower You

Ever dreamt of starting your own business, being your own boss, and contributing to India’s growth story? Let’s be honest, many women in India have incredible ideas and the drive to succeed, but often lack the financial support and guidance to make their dreams a reality. That’s where the Mukhyamantri Mahila Rojgar Yojana (MMRY) comes in – and it’s not just another government scheme. This is about empowerment, plain and simple.

But, here’s the thing: navigating government schemes can feel like wading through treacle. Confusing jargon, endless forms, and the feeling of not knowing where to even begin. Fear not! I’m here to break it down for you, not just telling you what the MMRY is, but showing you how it can genuinely change your life. Think of me as your friendly neighbourhood scheme-navigator.

What’s the Big Deal About the Mukhyamantri Mahila Rojgar Yojana?

So, what is the Mukhyamantri Mahila Rojgar Yojana? In a nutshell, it’s a financial assistance scheme designed to encourage women entrepreneurs in [State Name – this needs to be dynamically updated based on where the scheme is active]. It provides subsidies and low-interest loans to help women start or expand their own businesses. But it’s more than just money. It’s about creating an ecosystem where women can thrive, contribute to the economy, and gain financial independence. Let’s be honest, financial independence is freedom.

I initially thought it was just another scheme with a lot of fanfare and little impact. But digging deeper, I found that the MMRY, if implemented effectively, addresses a crucial need: access to capital for women. According to data from various sources, women-owned businesses often face higher hurdles in securing loans compared to their male counterparts. The MMRY scheme aims to level the playing field. New GST rates.

The “How-To” | Getting Your Slice of the Pie

Alright, enough with the background. How do you actually get your hands on this financial assistance? Here’s the step-by-step guide, broken down into manageable chunks:

- Eligibility Check: First things first, are you eligible? Generally, the scheme is open to women who are residents of [State Name], are above a certain age (usually 18 or 21), and have a viable business plan. There might be income criteria too, so check the official guidelines.

- Project Report: This is crucial. You need a well-prepared project report outlining your business idea, market analysis, financial projections, and how the loan will be utilized. Think of it as your business’s resume.

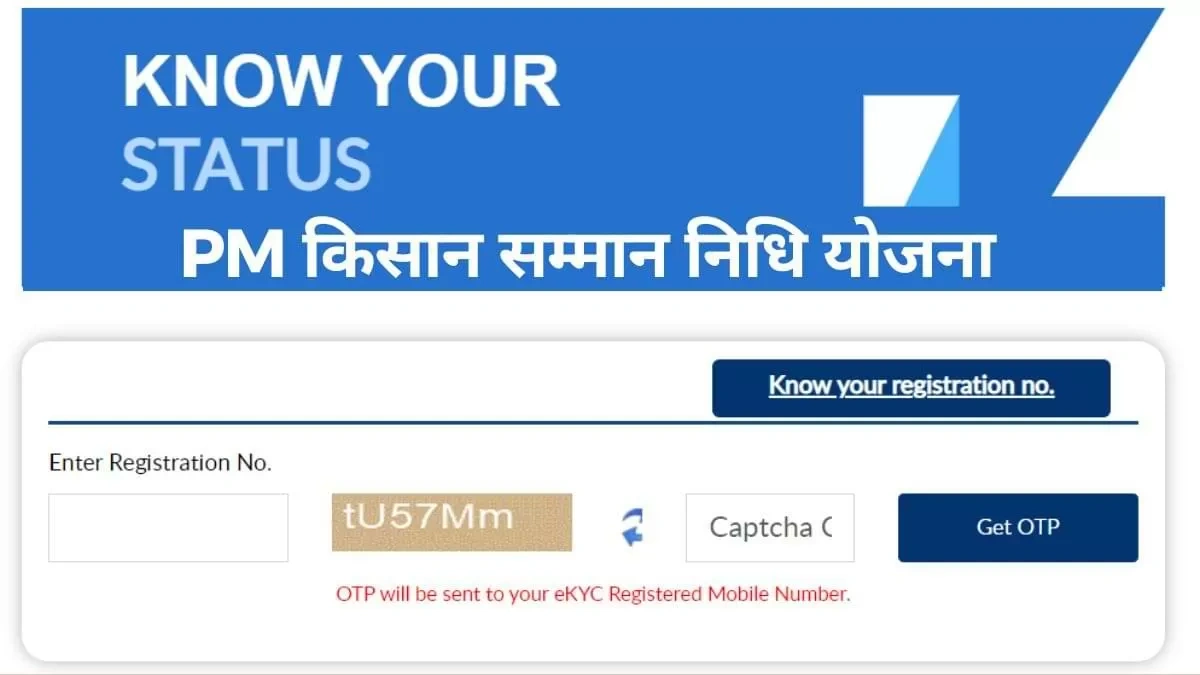

- Application Process: You’ll need to fill out an application form, which is usually available online or at designated government offices. Gather all the necessary documents, including proof of identity, address, age, and your project report.

- Loan Sanction: If your application is approved, the loan will be sanctioned, and you’ll receive the funds to kickstart your venture.

A common mistake I see people make is rushing through the project report. Take your time, do your research, and get help if you need it. There are many resources available, including government agencies and NGOs that offer guidance on business plan preparation. The government also provides skill development programs to boost your potential for the scheme.

Why This Matters | The Ripple Effect of Empowered Women

What fascinates me is the potential ripple effect of the Mukhyamantri Mahila Rojgar Yojana. It’s not just about individual women starting businesses; it’s about creating a more equitable and prosperous society. When women are financially independent, they invest in their families, communities, and the future. They become role models for the next generation, inspiring other women to pursue their dreams.

Think about it: more women-owned businesses mean more jobs, more innovation, and more economic growth. It’s a win-win for everyone. But, and this is a big but, the scheme needs to be implemented effectively and transparently to avoid corruption and ensure that the benefits reach those who need them most.

The application form may ask for personal details like Aadhar card number and other government-issued IDs. Check this link out for additional information.

LSI Keywords and Related Terms for Success

To truly understand and leverage this scheme, it’s useful to be familiar with related terms and concepts. Think of these as keywords to unlock more information and opportunities. Here are a few to keep in mind:

- Subsidy schemes for women entrepreneurs

- Low interest loans for women business owners

- Startup funding for women in [State Name]

- Women empowerment programs in India

- Small business loans for women

- Government schemes for women-led startups

- MSME schemes for women

These terms will help you find relevant resources, connect with other entrepreneurs, and navigate the often-complex world of government schemes.

Expert Insights | Common Pitfalls to Avoid

From what I’ve gathered, a major hurdle is often the lack of awareness about the scheme itself. Many eligible women simply don’t know it exists! That’s why spreading the word is so important. Another challenge is the complexity of the application process. The government needs to simplify the process and provide better support to applicants. I initially thought this was straightforward, but then I realized it’s not that easy to get this loan.

And let’s not forget the importance of financial literacy. Many women lack the necessary skills to manage their finances effectively. Providing financial literacy training is crucial to ensure the success of these businesses. According to sources, the official confirmation regarding the eligibility criteria is still pending. It’s best to keep checking the official portal.

Frequently Asked Questions (FAQ)

FAQ

What if I don’t have a formal business degree?

That’s perfectly fine! The MMRY is designed to support women from all backgrounds. Focus on showcasing your passion, skills, and the viability of your business idea in your project report. Skill development programs can help you develop your skills.

What kind of businesses are eligible for funding?

Generally, most types of businesses are eligible, from manufacturing and services to trading and retail. However, there might be some restrictions on certain types of businesses, such as those that are harmful to the environment. It’s always best to check the specific guidelines.

What if I forgot my application number?

Don’t panic! Contact the relevant government department or agency that handles the MMRY. They should be able to help you retrieve your application number using your other details, such as your name, date of birth, and address.

How long does it take to get the loan approved?

The processing time can vary depending on the volume of applications and the efficiency of the government agencies involved. It’s always a good idea to follow up regularly on the status of your application.

Where can I get help with my project report?

There are many resources available to help you with your project report, including government agencies, NGOs, and private consultants. Consider attending workshops or training programs on business plan preparation.

What are the interest rates charged under the scheme?

Interest rates are typically lower than market rates, making it more affordable for women entrepreneurs to access capital. The exact interest rate will depend on the specific terms and conditions of the loan. Be sure to do a check on interest subsidy .

What’s next? Visit the official website of the department that administers the Mukhyamantri Mahila Rojgar Yojana. Contacting government officials is a great way to learn the latest updates.

The Mukhyamantri Mahila Rojgar Yojana is more than just a scheme; it’s an opportunity for women to take control of their lives, build their dreams, and contribute to a brighter future for India. By understanding the “why” behind it, the “how” to access it, and the potential impact it can have, you can empower yourself and inspire others to do the same. Go forth and conquer!