That Slippery, Vexing Thing Called Money Control

Let’s be honest for a second. You know that feeling, right? It’s the 25th of the month, you glance at your bank account, and a cold wave of existential dread washes over you. Where did it all go? You had a plan. Sort of. The plan was basically “don’t run out of money,” and yet, here we are again. It feels less like you’re controlling your money and more like you’re politely asking it not to leave so quickly.

For years, I thought having money control was a passive activity. A defensive game. It meant checking my balance, wincing a little, and vowing to “be better” next month. But “being better” is a vague, useless goal. It’s like telling a ship without a rudder to “sail better.” It doesn’t work. This isn’t about just stopping the leaks; it’s about actually steering the boat.

The Great Illusion | Passive vs. Active Money Control

The biggest mistake we make and I made this for a very, very long time is confusing financial awareness with financial control. Knowing you have ₹10,000 left is awareness. Deciding exactly what that ₹10,000 is supposed to do for you… now that is control.

It’s a fundamental mindset shift. Passive control is reactive. It’s the panic-induced Maggi dinners at the end of the month. Active control, on the other hand, is proactive. It’s about giving your money a job description before it even hits your account. You’re the CEO of Your Money Inc., and you need to start acting like it. You wouldn’t hire an employee and just hope they do something useful, would you? So why do we do it with our hard-earned cash?

This isn’t about creating a spreadsheet so complicated it could launch a satellite. It’s about simple, conscious direction. And honestly, it’s the lack of this direction that leads to so many common money mistakes . We drift. And when you drift, you inevitably end up somewhere you didn’t plan to be.

Giving Your Money a Job | Beyond Just Budgeting

Okay, so we’re moving from passive observer to active manager. What’s the first order of business? You have to tell your money where to go. This is where everyone groans and says “budgeting,” but let’s reframe it. Forget the restrictive, joy-killing budgets for a moment. Think of it as creating a payroll for your income.

Before the month even starts, you decide:

- “Alright, ₹X, your job is to cover the rent and bills. Don’t be late.”

- “₹Y, you’re the ‘Chai and Samosa’ fund. Your only job is to be spent on small joys without guilt.”

- “And you, ₹Z, you’re the most important employee this month. Your job is to go into the ‘Future Me’ fund.”

That ‘Future Me’ fund is where the magic really happens. This is the core of investment planning . It’s the difference between just getting by and actively building a better future. It’s the shift from pure saving vs investing . Savings are for emergencies, a cushion. Investments are your money’s long-term career path. They’re meant to grow, to work for you while you sleep. This could mean putting money into mutual funds, stocks, or other assets. It’s about making your money work as hard as you do. Doing a bit of reading, like a Dmart share price analysis , is a good way to start understanding how this world works. It’s not about gambling; it’s about informed decisions. Another company to look into might be something like the Dixon share price , just to see how different sectors operate.

The goal isn’t to become a stock market genius overnight. The goal is to develop financial discipline by consistently assigning some of your income to a growth-oriented job. This principle is something even government bodies advocate for. As highlighted by SEBI’s initiatives on their investor awareness portal , becoming an informed investor is the first step toward true financial security.

The Tools Can Help, But They Can’t Do the Thinking For You

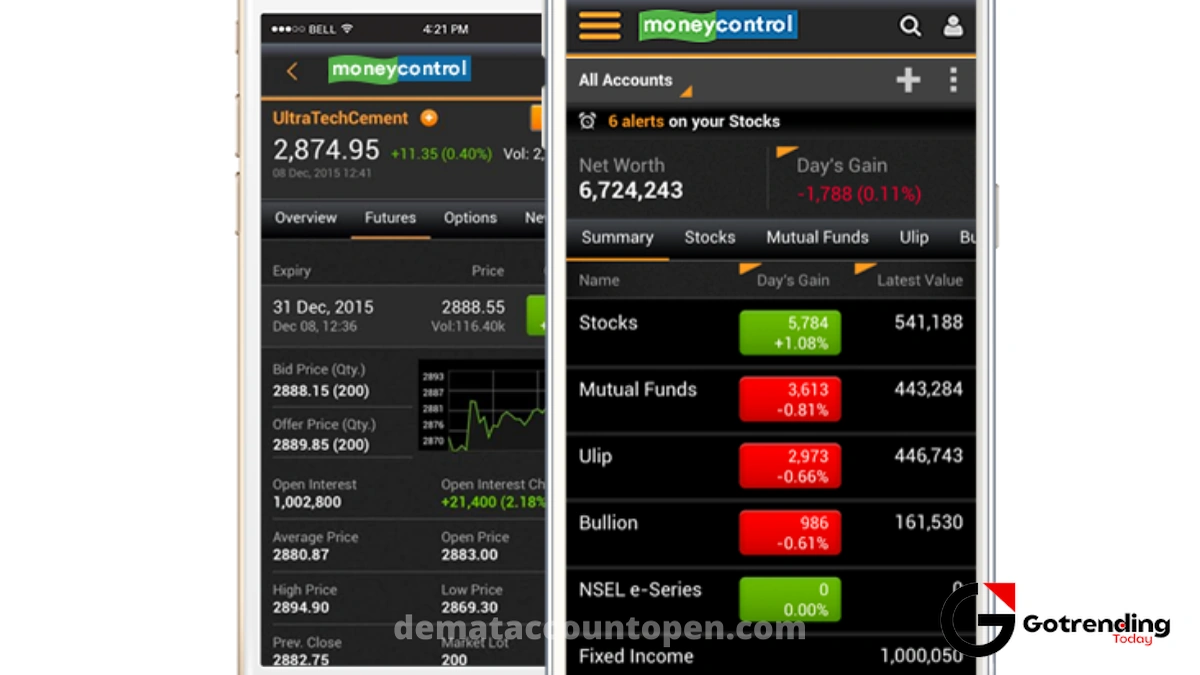

We live in an age of apps for everything, including personal finance . And some of them are genuinely brilliant. They can automate tracking, categorize your spending, and show you in painful, technicolor detail where your money is vanishing. They are fantastic for the ‘awareness’ part.

But here’s the trap: no app can give you the ‘why’. It can’t instill the discipline or help you define your financial goals . An app can tell you that you spent ₹4,000 on Zomato, but it can’t tell you whether that was “worth it” for your overall happiness and long-term plans. That part is, and always will be, on you.

I’ve found the most effective system is a hybrid one. Use an app to do the heavy lifting of tracking. But once a week maybe Sunday morning with your coffee sit down for 15 minutes and actually look at the data. Don’t just see the numbers. Ask yourself questions. “Was I happy with this spending? Does this align with my goals? What’s one small change I can make next week?” That 15-minute weekly meeting with yourself is more powerful than a thousand automated notifications. It’s how you truly begin to manage finances with intent.

Ultimately, money control isn’t a destination. It’s not a finish line you cross where everything is perfect forever. It’s a practice. A messy, ongoing, completely human process of making conscious choices. It’s about trading short-term impulse for long-term peace of mind. And that, I can tell you from experience, is a trade worth making every single day.

Frequently Asked Questions About Taking Control of Your Money

Is ‘money control’ just another word for strict budgeting?

Not at all! That’s a common misconception. Strict, joyless budgeting is about restriction. True money control is about direction. It’s not about saying “no” to everything you enjoy; it’s about consciously saying “yes” to the things that matter most, both now (like a guilt-free dinner out) and in the future (like your long-term financial goals ). Think of it as a spending plan, not a spending prison.

What’s the very first step I should take to manage my finances better?

Just track. Don’t even try to change anything for the first month. Just get a simple app or a small notebook and write down every single rupee you spend. From your rent to that ₹10 chai. The goal is to get a brutally honest picture of where your money is actually going. This raw data is the foundation for every other decision you’ll make. You can’t make a good plan without a good map of the territory.

How do I stay motivated with my financial goals?

Make them visual and emotional. “Save ₹1,00,000” is a boring goal. “Save for a 10-day solo trip to the mountains where I can finally relax” is a powerful, motivating vision. Create a vision board, change your phone’s wallpaper to a picture of your goal, or write it down and stick it on your mirror. Connect your financial actions to a real, tangible, emotional outcome. That’s how you build lasting financial discipline .

Are all those personal finance apps in India actually useful?

They can be, but with a big caveat. They are brilliant for automating the tedious task of tracking your spending. But they are just tools. An app can’t force you to make better choices. The risk is becoming reliant on notifications and getting lost in charts without ever changing your underlying habits. Use them for data collection, but reserve the actual decision-making for a weekly, intentional review session with yourself.