The Maruti Share Price | It’s Not a Ticker, It’s India’s Pulse

I’m sitting here, staring at a chart. A jagged line of greens and reds. On paper, it’s just the maruti share price . A number. A data point for traders and investors to fuss over. But that’s not right. Not really.

To me, that chart is a story. It’s the smell of the new vinyl in my uncle’s first car a crisp, white Maruti 800 in the late 90s. It’s the collective sigh of relief from a middle-class family finally getting their own set of wheels. It’s the sheer, unadulterated sea of Swifts, WagonRs, and Altos you see when you’re stuck in traffic in any Indian city. That’s what you’re looking at. Not a stock. You’re looking at a piece of the national psyche.

It’s a story about aspiration. And honestly, you can’t understand the financial number without first understanding the human emotion behind it. I keep coming back to this point because it’s crucial. The maruti suzuki india limited share price isn’t just driven by P/E ratios and EBITDA margins; it’s propped up by decades of trust, baked into the very fabric of the country.

So, What’s Really Under the Hood of the Maruti Stock?

Alright, let’s get a bit more concrete. Beyond the nostalgia. What are the nuts and bolts that make this stock tick? It’s a fascinating machine in its own right.

First, there’s the obvious: brute force. Sheer, unassailable volume. For years, Maruti has commanded a staggering market share of the Indian passenger vehicle market. Think about that. For a long time, nearly one of every two cars sold in this country of 1.4 billion people had a Suzuki badge on it. While competitors were fighting for slices of the pie, Maruti pretty much owned the bakery. This is their superpower. It gives them pricing power, an unmatched supplier network, and a service footprint that reaches into the tiniest towns. It’s a moat that others have found incredibly difficult to cross.

But and this is a big but the story has been changing. I initially thought of Maruti as the king of the small, affordable car. The master of the hatchback. And they were. But that’s not where the growth is anymore.

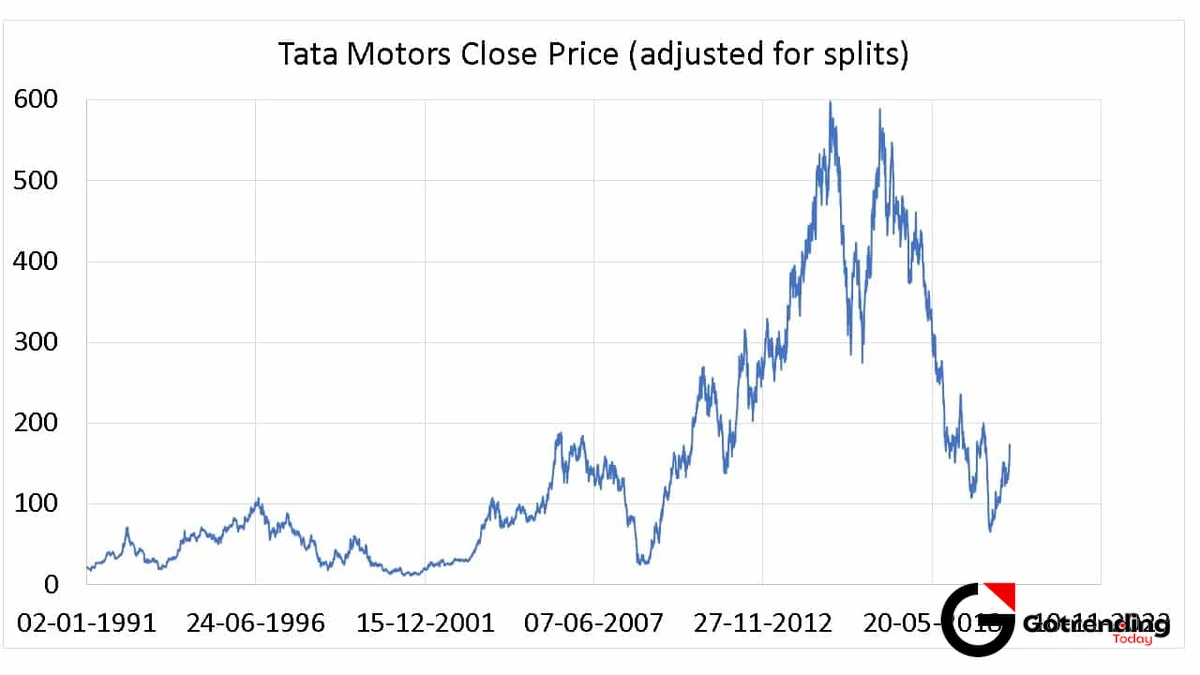

The game shifted to SUVs. And for a while, it looked like Maruti was asleep at the wheel. The Koreans (Hyundai, Kia) and homegrown hero Tata Motors were eating their lunch in this segment. The narrative was, “Maruti has missed the bus.”

Then came the counter-punch. The new Brezza. The Fronx. And the game-changer, the Grand Vitara . Suddenly, Maruti wasn’t just a budget brand. They used their NEXA showrooms to build a premium feel, and it worked. It was a masterclass in reading the room, even if they were a bit late to the party. They proved they could fight in a segment everyone thought they had abandoned. This pivot is a huge part of the recent story of the maruti share price nse listing. It’s a testament to their incredible resilience.

The Big, Looming Question Mark | The EV Transition

Okay, let’s talk about the elephant in the room. Electric Vehicles. The EV conversation around Maruti is… tense. While Tata Motors went all-in, becoming the face of India’s EV revolution, Maruti played it cool. Almost too cool.

They focused on hybrids. CNG. They talked about a “basket of technologies.” For a long time, the market saw this as a massive risk. A potentially fatal miscalculation. Is Maruti the Nokia of the auto world, about to be blindsided by the EV iPhone? It’s a valid, slightly terrifying question for any long-term investor. The frustration for many is that a company so dominant could seem so hesitant about the future.

But let me try to explain this another way. After looking deeper, my perspective has shifted a bit. Maruti’s argument is that India isn’t ready for a full-EV jump. Charging infrastructure is patchy at best, and the total cost of ownership for EVs is still high for their core customer base. Their bet is that strong hybrids are the perfect bridge technology for the next 5-10 years. A pragmatic, if unexciting, solution. A recent deep-dive by Autocar India highlights how they’ve managed to grow market share even with this strategy, which is pretty telling.

Is it a genius move or a strategic blunder? Honestly, nobody knows for sure. It’s the single biggest variable affecting the maruti share price target for the next decade. Their future and a significant chunk of the Indian auto industry hinges on the answer. It’s like they’re playing a long, strategic game, much like one might do in a complex world of PUBG Mobile , waiting for the perfect moment to strike, while others rush into the fray.

The tech behind this, from hybrid systems to the connected car features we now expect, is evolving at a dizzying pace. It’s a world where understanding complex systems, not unlike deciphering the logic of Perplexity AI , becomes key to predicting the next move.

FAQ | Your Questions About Maruti’s Stock, Answered

Why does the Maruti share price seem so high in absolute numbers?

That’s a common one! It’s easy to look at a stock trading above ₹12,000 and think it’s “expensive” compared to one trading at ₹500. But the absolute price doesn’t tell you much. What matters is the company’s valuation its total value divided by the number of shares. Maruti is a massive company with huge revenues and profits, so its per-share value is naturally high. It’s better to look at metrics like the Price-to-Earnings (P/E) ratio to compare its valuation to its peers.

So, is the Maruti stock a good buy for the long term?

This is the million-dollar question, isn’t it? Look, nobody can predict the future, and this isn’t financial advice. But here’s how to think about it: for the long term, you’re betting on India’s growth story. As the economy grows, more people will buy cars. Maruti’s strengths are its distribution and brand trust. The risks are its delayed EV strategy and rising competition. Your decision depends on whether you believe its strengths will outweigh its risks over the next decade.

How much does a good monsoon really affect the Maruti share price?

More than you’d think! A good monsoon leads to a strong harvest, which boosts the rural economy. A huge chunk of Maruti’s sales, especially for models like the Alto and Eeco, comes from rural and semi-urban India. When farmers have more money in their pockets, one of the first things they aspire to is a car. So, a good monsoon often translates directly into better sales figures for Maruti, which the stock market loves to see.

Is Maruti’s late entry into pure EVs really that big of a deal?

It’s the most debated topic. The “pro” side says they are wisely waiting for the market and battery tech to mature, saving massive R&D costs and avoiding early-adopter issues. The “con” side argues that they are giving competitors like Tata Motors an insurmountable head start in building an EV ecosystem and brand identity. The truth is likely somewhere in the middle. It’s a calculated risk. If the hybrid market booms for the next 5-7 years, they’ll look like geniuses. If a cheap, mass-market EV cracks the code tomorrow, they’ll be in a tough spot.

Watching the maruti share price is more than just tracking a financial asset. It’s like having a real-time feed of the Indian auto industry’s health, its anxieties, and its ambitions. It’s a story of an old champion learning new tricks, a story of a nation constantly on the move. And it’s a story that is far, far from over.