The Kaynes Share Price | Unpacking the Story Behind the Ticker

You ever get that feeling you’ve stumbled onto a secret? That’s how I feel about Kaynes Technology . It’s not one of those flashy, front-page tech giants. It’s a quiet workhorse. A company that, for years, was just… there. Building complex things for other people. And then, suddenly, it wasn’t so quiet anymore. The IPO hit, the market woke up, and suddenly everyone was asking about the kaynes share price . It’s a fascinating ride. And if you’re just looking at the daily stock chart, I think you’re missing the best part of the story.

I spend a lot of my time trying to understand the ‘why’ behind a number. Why does a stock move? What’s the real narrative? Is it just hype, or is there something solid, something tangible, underneath it all? With Kaynes, the more I dug, the more I realised it’s a perfect microcosm of a much bigger shift happening in India. It’s more than just a stock; it’s a bet on a new kind of Indian manufacturing. A high-tech, high-stakes bet.

So, What Does Kaynes Actually Do?

Right, let’s get this out of the way. Kaynes is in the EMS business. Electronics Manufacturing Services. I know, I know. It sounds terribly boring. Corporate jargon at its finest. But stick with me. Let me try to explain it this way: think of a master chef’s kitchen. It’s got every single high-end tool, gadget, and specialised oven you could imagine. The team knows how to use everything, perfectly, to create any dish from any cuisine.

Now, imagine you’re a brilliant food innovator. You’ve just created a recipe for the world’s greatest cronut. You don’t want to build a whole bakery from scratch just to produce it. So, you take your recipe to the master kitchen. They source the finest ingredients (components), use their state-of-the-art equipment (manufacturing lines), and produce your cronuts (electronic products) for you, flawlessly and at scale. That’s Kaynes. They are the master kitchen for some of the biggest names in automotive, aerospace, medical, and industrial tech. They don’t just assemble stuff; they offer the whole suite, from initial design collaboration to prototyping and full-scale production. It’s a critical, often invisible, part of the global supply chain. This is a very different beast from the kind of stock analysis you might do for a retail giant, which you can read more about in this Dmart share price analysis .

And this is where the Make in India narrative becomes less of a slogan and more of a balance sheet reality. For decades, this kind of high-complexity work was the domain of China, Taiwan, or Vietnam. But now, with global supply chains shifting and the Indian government pushing hard with initiatives like the PLI schemes , the game is changing. And Kaynes is standing right in the middle of the field, ready to play.

The Rollercoaster Ride of the Kaynes Share Price

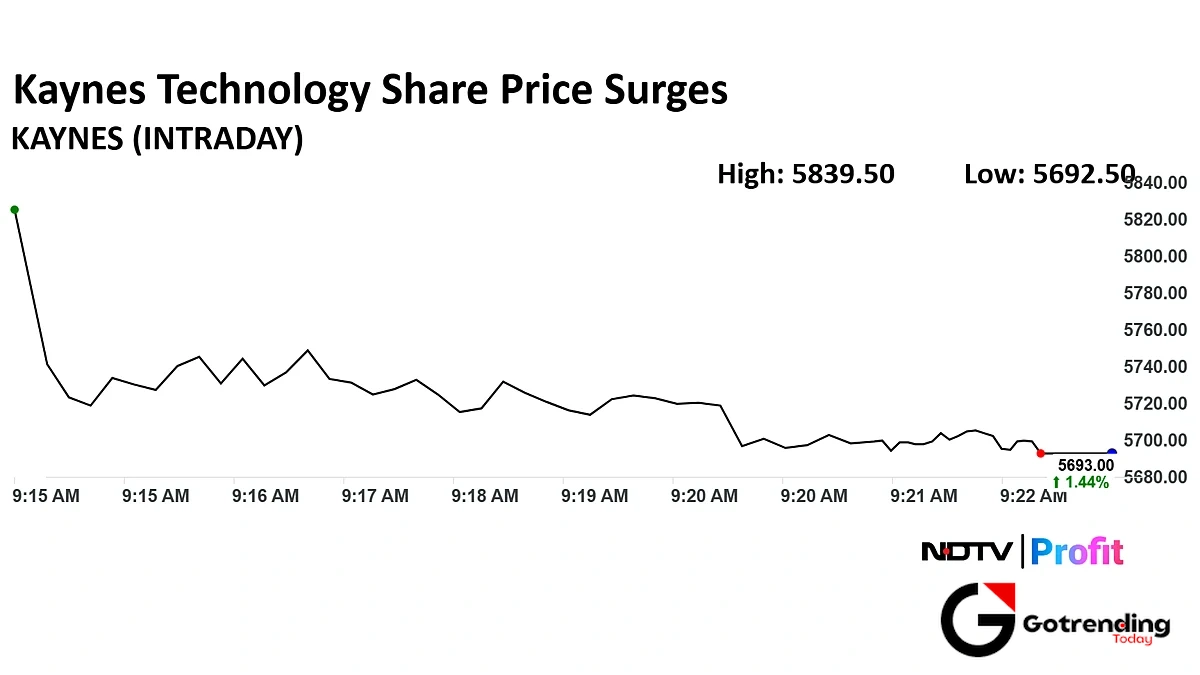

Let’s talk about the price itself. The Kaynes Technology IPO landed in late 2022, and it listed at a healthy premium. The market was hungry for a pure-play, high-end EMS company. But the journey since then hasn’t been a straight line up. Far from it. There have been sharp rallies, followed by gut-wrenching corrections. It’s the kind of volatility that can make a short-term trader chew their fingernails down to the bone.

And that’s the frustrating part, isn’t it? When you believe in the long-term story of a company, watching the daily market gyrations feels like noise. The valuation is, admittedly, a point of contention. It’s not a cheap stock by any traditional metric. The P/E ratio has often been in the stratosphere, which screams “overpriced!” to value investors. But here’s the thing… the market isn’t pricing Kaynes on what it earned last year. It’s pricing it on its future prospects . It’s pricing in the massive expansion of the EMS industry in India and Kaynes’s potential to capture a huge slice of that pie. You can get a sense of market sentiment by using tools discussed in this Money Control overview.

I keep coming back to this idea: are you investing in the photograph (today’s price) or the movie (the company’s journey)? With a company like Kaynes, I feel you have to be watching the movie.

Beyond the Hype | The Real Growth Engines

Okay, so if we ignore the daily noise, what’s the actual engine driving this thing forward? I see a few key pillars.

First, diversification. They aren’t tied to a single industry. One quarter, the auto sector might be booming; the next, it might be a big order in medical devices or railway signalling. This spread helps insulate them from the cyclicality of any one sector. They have a particularly strong foothold in aerospace and defence, which is a high-margin, high-trust business. You don’t just give the contract for a missile’s guidance system to the lowest bidder.

Second is their move up the value chain. Kaynes isn’t just a simple assembler. They are increasingly involved in the design and development process (ODM – Original Design Manufacturing). This is crucial. It makes them a stickier partner and allows for much higher margins. They’re not just the hired kitchen; they’re helping write the recipe.

And finally, there’s that big government push. The Production Linked Incentive (PLI) schemes are basically the government saying, “Please, build high-tech electronics here, and we will literally give you money to do it.” It de-risks capital expenditure and makes Indian manufacturing globally competitive. For a deeper dive into how these policies are structured, the Invest India portal on ESDM is an incredible resource. For Kaynes, this isn’t just a bonus; it’s a massive tailwind.

But and this is a big but the competition is real. Companies like Dixon, Syrma SGS, and a host of others are all vying for the same prize. Success isn’t guaranteed. It will come down to execution. Can they manage their rapid expansion? Can they maintain quality at scale? Can they continue to win the trust of global clients? Those are the billion-dollar questions.

So when I look at the kaynes share price , I see more than a number. I see a story of ambition, a bet on India’s manufacturing future, and a whole lot of execution risk. It’s not a simple story, and that’s precisely what makes it so compelling.

Answering a Few Things You’re Probably Wondering

So, is the current Kaynes share price a good entry point?

That’s the million-rupee question, isn’t it? Look, I can’t give financial advice. But I can tell you how I think about it. The stock is often priced for perfection, meaning a lot of future growth is already baked in. A better question might be, “Does my investment horizon match the company’s growth story?” If you’re looking for a quick flip, the volatility might be too much. If you’re investing for the next 5-10 years based on the expansion of the Indian EMS sector, then dips and corrections might look more like opportunities than crises. It’s all about your own risk appetite and time frame.

What’s the biggest risk I should know about with Kaynes Technology?

For me, it’s two-fold: valuation and execution. The high valuation means the stock is vulnerable to sharp falls if the company misses earnings estimates or if market sentiment sours. There’s very little margin for error. Secondly, execution risk is huge. They are expanding rapidly, and managing that growth hiring the right talent, maintaining quality control across new facilities is incredibly difficult. Any stumbles here could spook investors quickly.

How is Kaynes different from its competitors like Dixon or Syrma?

It’s a great question because it gets to the heart of the business. While they are all in the EMS space, they have different focuses. Dixon, for example, is very strong in high-volume consumer electronics like TVs and mobile phones. Kaynes, on the other hand, has historically focused on what’s called “High Mix, Low Volume” products. This means more complex, specialised products for industries like automotive, aerospace, and medical, where the production runs are smaller but the technical requirements are much higher. This often leads to stickier client relationships and better margins.

I hear a lot about ‘PLI schemes’. Why do they matter so much for Kaynes?

Think of the PLI scheme as a powerful tailwind. It’s a direct financial incentive from the government that rewards companies for increasing their domestic production. For a capital-intensive business like Kaynes Technology , which needs to invest heavily in plants and machinery, this is huge. It reduces the cost of setting up new manufacturing lines and makes their final products more cost-competitive on the global stage. It essentially lowers the financial risk of expansion and accelerates their growth plans.

Is Kaynes just an assembler, or do they actually design things?

This is a common misconception and a key part of their story. They started more as a pure-play assembler (Electronics Manufacturing Services – EMS). However, they have been moving aggressively into Original Design Manufacturing (ODM). This means they collaborate with clients on the actual design of the products, not just the manufacturing. This is a massive step up the value chain. It transforms them from a hired hand into a strategic partner, which is far more valuable and profitable in the long run.