Decoding the Japan Nikkei Index | Why It Matters to You

The Japan Nikkei Index – you’ve probably heard of it, maybe even seen it flash across a screen. But what is it, really? And more importantly, why should someone sitting in India care about what’s happening in the Japanese stock market? That’s what we’re going to unravel here. Let’s be honest, finance can feel intimidating, like some exclusive club. But I promise to break it down in a way that’s actually useful, maybe even a little fascinating.

What Exactly Is the Nikkei? A Quick Explainer

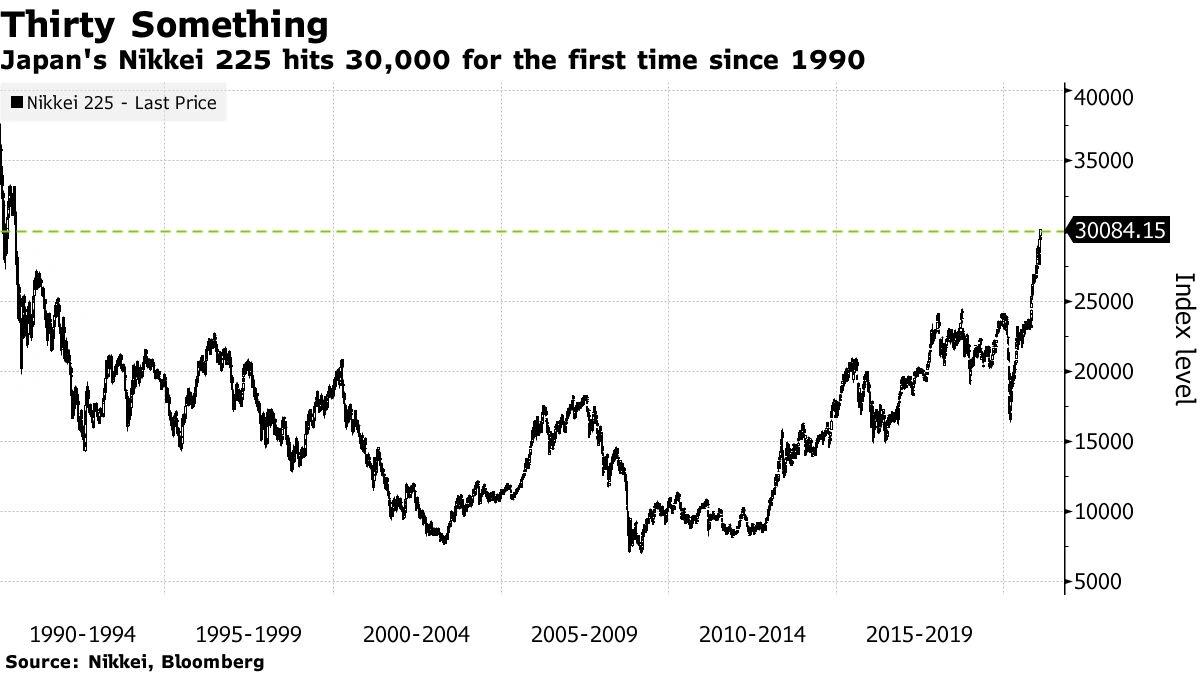

Think of the Nikkei 225 as the Japanese equivalent of India’s Sensex or the American Dow Jones. It’s a stock market index that tracks the performance of 225 of the largest and most liquid companies listed on the Tokyo Stock Exchange. But, and this is crucial, it’s not just a list of company names. It’s a barometer of the overall health of the Japanese economy. Here’s the thing: when the Nikkei is doing well, it generally signals that Japanese businesses are thriving. When it dips, it often means there are economic headwinds. A common mistake I see people make is thinking it’s only about those 225 companies. It’s a much broader indicator than that.

The “Why” Angle | Global Interconnectedness and You

So, why should you, an Indian reader, bother with this faraway index? Because in today’s interconnected world, what happens in Japan doesn’t stay in Japan. The global financial system is like a giant spiderweb – tug on one strand, and the whole thing vibrates. Let me rephrase that for clarity. A strong Japanese economy, reflected in a healthy Nikkei, can boost global trade, including trade with India. Japanese companies invest in India, buy goods and services from India, and contribute to the overall economic ecosystem. According to Investopedia , changes in global indices often impact investor sentiment worldwide. Conversely, a struggling Nikkei can signal trouble for the global economy, potentially impacting investment flows and trade. This is especially important considering the increasing trade relations between India and Japan.

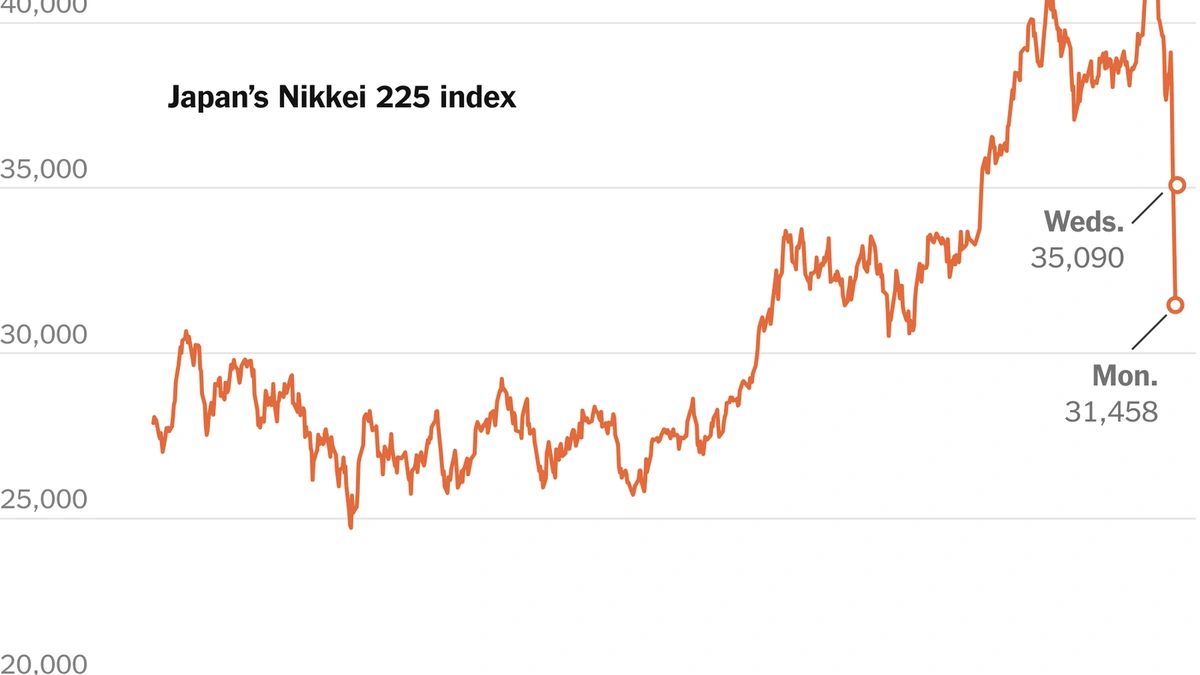

But here’s the thing: The Nikkei is particularly sensitive to global economic shifts. What fascinates me is how even minor policy changes in the US or Europe can send ripples through the Japanese market. This volatility makes it a key indicator to watch, even if you aren’t directly invested in Japanese stocks. For instance, look at currency exchange rates. A weaker Yen (Japanese currency) can make Japanese goods cheaper, boosting exports and potentially helping the Nikkei.

So, the Nikkei’s performance isn’t just some abstract number – it reflects real-world events and can even hint at future opportunities or risks. Understanding it is like gaining a small edge in understanding the global economic landscape.

How to Actually Use This Information

Okay, I’ve convinced you it’s important. But how do you use this knowledge? You don’t need to become a day trader overnight. Start small. Follow major financial news outlets that cover the Nikkei. The one thing you absolutely must double-check is the reliability of your sources. Don’t rely on random internet forums. Look for reputable news organizations like the Financial Times or Bloomberg. Pay attention to trends: Is the Nikkei generally trending upwards or downwards? What are the major factors influencing its movement? This will help you get a sense of the overall economic climate. A common mistake I see people make is reacting to every little fluctuation. Zoom out and look at the bigger picture.

Consider the impact on related markets. For example, a strong Nikkei might be a positive sign for other Asian markets, including India. This might influence your investment decisions, even if you don’t directly invest in Japan. Japanese monetary policy can also impact global interest rates, influencing borrowing costs for businesses and individuals. Understanding these connections can give you a more informed perspective on your own financial planning.

But, remember – this is just one piece of the puzzle. Don’t make investment decisions solely based on the Nikkei’s performance. Consult with a financial advisor and do your own research.

Factors Influencing the Nikkei | A Deeper Dive

Several factors can significantly impact the Nikkei 225. Understanding these can provide a clearer picture of market movements:

- Global Economic Conditions: As mentioned earlier, the Nikkei is highly sensitive to global economic trends. Economic slowdowns in major economies like the US or China can negatively impact Japanese exports and corporate earnings, leading to a decline in the index.

- Currency Exchange Rates: The value of the Japanese Yen (JPY) plays a crucial role. A weaker Yen generally benefits export-oriented companies, boosting their profits and the Nikkei. Conversely, a stronger Yen can hurt exports and weigh on the index.

- Domestic Economic Policies: The Bank of Japan’s (BOJ) monetary policies, such as interest rate adjustments and quantitative easing, can significantly influence the Nikkei. Government fiscal policies and structural reforms also play a role.

- Corporate Earnings: The profitability of the companies listed on the Nikkei 225 is a key driver. Strong earnings reports can boost investor confidence and drive the index higher.

- Geopolitical Events: Geopolitical tensions, trade disputes, and political instability can create uncertainty and volatility in the market, impacting investor sentiment and the Nikkei’s performance.

The Japanese stock market can be sensitive to international relations, a fact investors should keep in mind.

FAQ About the Nikkei 225

Frequently Asked Questions

What are the trading hours for the Tokyo Stock Exchange?

The Tokyo Stock Exchange (TSE) operates from 9:00 AM to 11:30 AM and 12:30 PM to 3:00 PM Japan Standard Time (JST).

How often is the Nikkei 225 updated?

The Nikkei 225 is updated in real-time during trading hours, reflecting the changing prices of the constituent stocks.

Can I invest directly in the Nikkei 225?

No, you cannot directly invest in the index itself. However, you can invest in exchange-traded funds (ETFs) or index funds that track the performance of the Nikkei 225.

What is the difference between the Nikkei 225 and the TOPIX?

The Nikkei 225 tracks 225 of the largest companies, while the TOPIX (Tokyo Stock Price Index) tracks all companies listed on the TSE’s First Section. TOPIX offers a broader representation of the Japanese stock market.

How does the Nikkei affect global markets?

The Nikkei 225 is a key indicator of Asian market sentiment and the health of the Japanese economy. Its performance can influence global investor confidence and investment flows.

So, there you have it. The Nikkei 225, demystified. It’s not just a number – it’s a window into the global economy and a potential source of valuable insights. Keep an eye on it, do your research, and stay informed. And remember, even small pieces of knowledge can add up to a big advantage.

Want to read more? Check out Bihar News: Why it Matters and college rankings .