HDFC Bank’s Share Price | The Elephant in Every Investor’s Portfolio. Let’s Talk.

Alright, pull up a chair. Let’s be honest with each other for a minute. If you’re an Indian investor, there’s a good chance you’ve either owned HDFC Bank shares, thought about owning them, or have a friend who won’t stop talking about them. For years, it was the Sachin Tendulkar of the Indian stock market reliable, consistent, a true blue-chip performer.

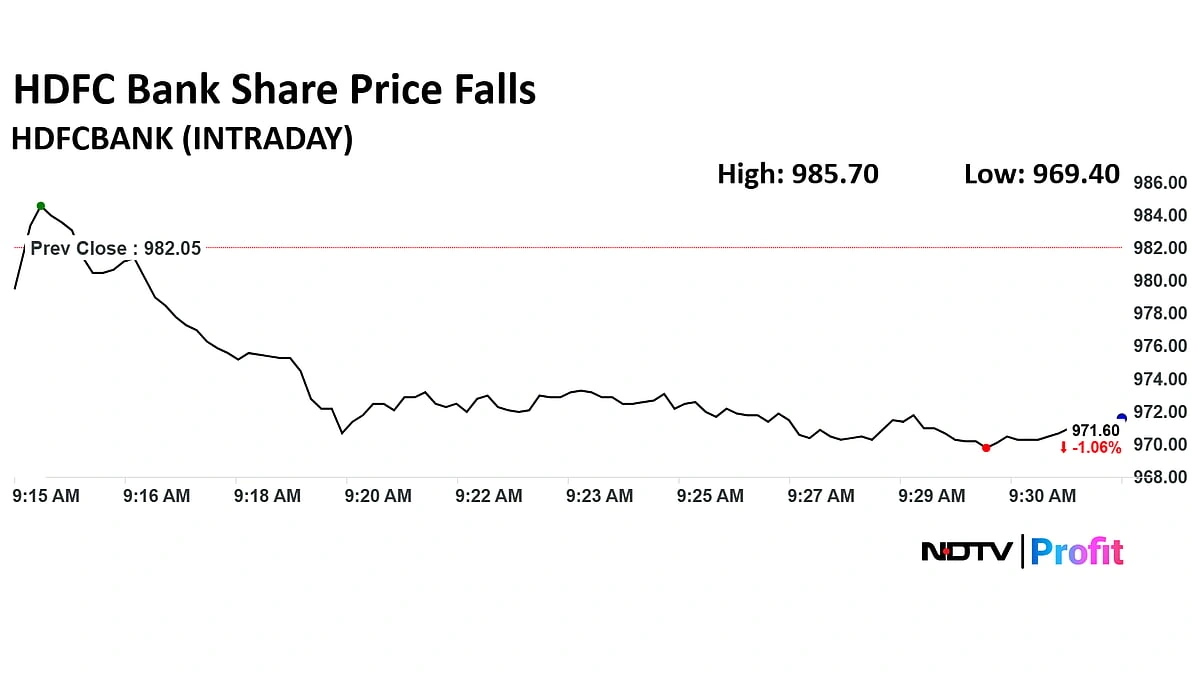

But lately? Lately, watching the hdfc bank share price has felt… frustrating. It’s like seeing your star player stuck in a rut. The rest of the market seems to be hitting sixes, while HDFC Bank is cautiously defending. You see the daily price, you read the headlines, but the real question nagging you is why? Why is this behemoth, this titan of Indian banking, acting like a mid-cap stock with an identity crisis?

Forget the noise and the one-line TV expert opinions. Let’s actually break down what’s going on under the hood. Because the story behind the current stock price isn’t about one single thing; it’s a complex cocktail of a massive merger, confused foreign investors, and a market that has the patience of a toddler.

The Great Merger Hangover | Why Bigger Isn’t (Immediately) Better

Remember the fanfare around the HDFC Ltd. and HDFC Bank merger? It was hailed as the creation of a financial services powerhouse, a monster entity that would dominate everything from savings accounts to home loans. And it is! But here’s the thing about mega-mergers: they come with a massive, throbbing hangover.

The core of the problem lies in something bankers love to talk about: Net Interest Margin, or NIM. Think of NIM as the bank’s core profitability score. It’s the difference between the interest it earns on loans and the interest it pays on deposits. For years, HDFC Bank had a fantastic, healthy NIM.

But HDFC Ltd., the parent company, was a different beast. It was a housing finance company, dealing primarily in lower-margin, long-term home loans. When you suddenly blend that massive, lower-margin loan book into the bank’s high-margin portfolio, what happens? Your average profitability, your NIM, gets diluted. It’s like mixing a perfectly brewed espresso with a large cup of hot water. You have more coffee, sure, but the kick isn’t the same.

This “NIM compression” spooked the market. Investors, used to HDFC Bank’s predictable, high-quality earnings, suddenly saw a cloud of uncertainty. The bank now needs a colossal amount of low-cost deposits (your savings and current account money, known as the CASA ratio) to fund this giant new loan book profitably. And raising those deposits in a competitive environment isn’t a walk in the park. This is the central challenge stemming from the hdfc bank merger impact .

The FII Enigma | Why Foreign Investors Hit the ‘Sell’ Button

Now, let’s talk about the other big factor: the Foreign Institutional Investors (FIIs). These are the large, overseas funds whose buying and selling can literally move markets in India. For them, HDFC Bank has always been a top holding.

So, why is hdfc bank share falling when it comes to FIIs? It’s a bit of a technical puzzle. Before the merger, FIIs could own a piece of HDFC Bank and a separate piece of HDFC Ltd. After the merger, their entire holding was converted into a single stock: the new, larger HDFC Bank. For many funds, this automatically pushed their holding in the single stock above their own internal limits or the limits set by index providers like MSCI.

Imagine you have a rule that you can’t have more than 10% of your money in any one stock. Suddenly, your 7% holding in HDFC Bank and 5% in HDFC Ltd. becomes a 12% holding in the new HDFC Bank. You’re forced to sell that extra 2%, whether you like the company’s future or not. This wave of forced, technical selling created immense pressure on the stock price. This is a classic case of market mechanics overriding business fundamentals, a key reason for the recent fii selling in hdfc bank .

It wasn’t necessarily a vote of no-confidence in the bank’s long-term story, but a structural adjustment that needed to happen. And it hurt. A lot.

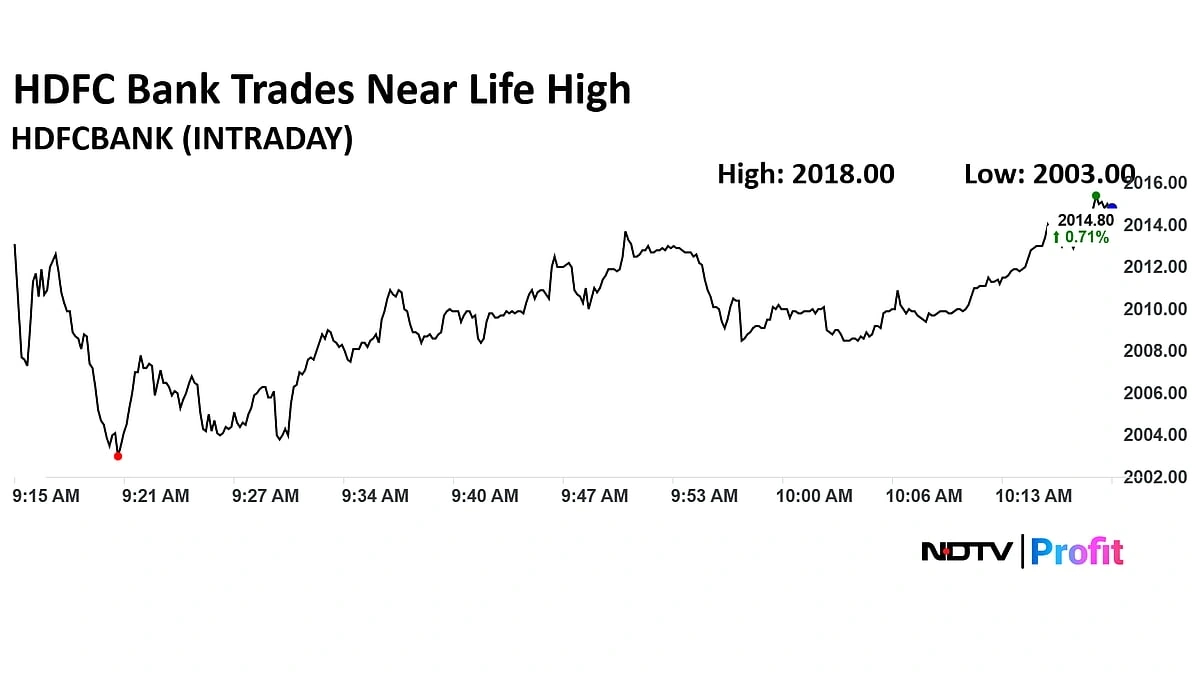

The Valuation Conundrum | Is It a Trap or a Generational Opportunity?

This brings us to the most interesting part of the conversation. Because of all this pressure, the hdfc bank share price is now trading at valuations we haven’t seen in over a decade. Its Price-to-Book (P/B) ratio, a key metric for valuing banks, is at a historic low. For more context on market movements, you might find this piece on the inox wind share price interesting.

So, the million-dollar question is: is this a value trap or a golden buying opportunity? Let’s look at both sides.

The Bear Case (The Skeptics): The bears argue that the integration challenges are real and will take at least another year or two to resolve. They point to the intense competition from a nimble ICICI Bank, a resurgent Axis Bank, and the ever-present threat of fintech players. They believe the bank’s growth will remain sluggish as it digests the merger, and the stock will continue to underperform. The path to restoring those high margins is long and uncertain.

The Bull Case (The Optimists): The bulls, on the other hand, are practically salivating. They say, “This is HDFC Bank we’re talking about!” They see the unparalleled brand, the 8-crore-plus customer base, and a distribution network that is the envy of the industry. They argue that the merger, despite its short-term pain, creates an incredible long-term platform for cross-selling offering home loans to banking customers and banking products to home loan customers. They believe the management, led by Sashidhar Jagdishan, has the capability to navigate these challenges. For them, buying HDFC Bank at these valuations is a long-term no-brainer and they have a positive view on the hdfc bank future .

So, What’s the Real Story Here? Looking Beyond the Ticker

Here’s what I think. The market is treating HDFC Bank like a startup that needs to prove itself. It has forgotten that this is a mature, deeply entrenched institution. The current share price reflects all the problems the merger hangover, the FII selling, the margin pressure but very little of the potential.

The story of the hdfc bank share price is no longer a simple one of quarterly growth. It’s a complex, multi-year transformation story. The key things to watch for in the upcoming quarters aren’t just profits, but the leading indicators:

- Deposit Growth: Is the bank able to attract low-cost CASA deposits at the required pace? This is priority number one.

- NIM Trajectory: Is the Net Interest Margin stabilizing or, even better, starting to inch upwards?

- Loan Book Mix: Are they successfully growing their high-margin retail loan book (personal loans, credit cards) to offset the lower-margin mortgage book?

This is a test of patience. The regulatory oversight from theReserve Bank of India (RBI)ensures stability, but the market demands performance. Anyone looking for a quick pop in the hdfc bank share target might be disappointed. This isn’t a T20 match; it’s the first day of a 5-day Test series. The pitch is tricky, the conditions are tough, but the batsman is one of the all-time greats.

The ultimate question you have to ask yourself as an investor isn’t just about the numbers today. It’s about your belief in the bank’s ability to execute this monumental integration and emerge, in a few years, as the undisputed, even more powerful leader it was meant to become. The stock price will eventually follow that story.

Frequently Asked Questions (FAQs)

Why did the HDFC Bank share price fall so much after the merger was completed?

The fall was primarily due to two factors. First, the merger diluted the bank’s high profitability metrics (like Net Interest Margin), causing concern about short-term earnings. Second, technical selling pressure from Foreign Institutional Investors (FIIs) who had to rebalance their portfolios after the two companies became one entity. A good comparison to understand results impact can be seen in the sbi po prelims result post.

Is HDFC Bank a good stock to buy right now?

That depends on your investment horizon. The stock is trading at historically low valuations, which is attractive for long-term investors who believe in the bank’s fundamental strengths and its ability to overcome the merger challenges. However, short-term volatility and underperformance could continue for a few more quarters.

What is Net Interest Margin (NIM) and why is it so important for HDFC Bank?

NIM is a measure of a bank’s profitability. It’s the difference between the interest income it generates from loans and the interest it pays out to depositors, calculated as a percentage of its assets. It’s crucial because the merger with the lower-margin HDFC Ltd. has temporarily suppressed HDFC Bank’s historically high NIM, and the market is waiting to see it recover.

How long will it take for the benefits of the HDFC merger to become visible?

Most analysts believe it will take at least 18-24 months (from mid-2023) for the “synergies” and benefits of the merger to fully reflect in the bank’s financial performance. This is a long-term integration process, not an overnight fix.

Who are HDFC Bank’s main competitors now?

HDFC Bank’s main competitors are other large private sector banks like ICICI Bank and Axis Bank, which have become very aggressive. It also faces competition from the State Bank of India (SBI) in the public sector and increasingly from agile fintech companies in specific product segments like payments and small-ticket loans.