GST New Slab | Decoding the Changes and What They Mean for You

Okay, let’s talk GST. Goods and Services Tax, that thing that subtly (or not so subtly) impacts almost every purchase we make in India. The thing is, it’s not a static beast. It evolves. And lately, there’s been a lot of buzz around potential changes to the GST new slab structure. But what does it all mean? That’s what we’re here to unpack.

Forget the dry press releases and government jargon. Let’s be honest, trying to decipher official documents can feel like reading ancient Sanskrit. I’m here to break it down in a way that actually makes sense, especially if you’re running a small business or just trying to budget your household expenses. Because, at the end of the day, GST changes impact your wallet. And understanding why these changes are happening is just as important as knowing what they are.

Why the Constant Tinkering with GST Rates?

So, here’s the thing: GST, while intended to simplify India’s tax system, is still a work in progress. What fascinates me is how often the GST Council meets to discuss revisions. It’s not just about increasing revenue (though that’s definitely a factor). It’s also about ironing out wrinkles in the system, addressing loopholes, and trying to create a fairer playing field for businesses of all sizes. The constant tinkering also reflects the government’s responsiveness to economic fluctuations and industry feedback.

One major reason for rate revisions is to correct what’s called the “inverted duty structure.” This is a situation where the tax on inputs (raw materials, components) is higher than the tax on the finished product. Sounds crazy, right? It puts manufacturers in a tough spot, as they can’t claim full input tax credit. Addressing this inverted tax structure is a key driver behind many of the proposed GST rate changes .

Another important angle is to bring more items under the GST umbrella and reduce exemptions. This aims to broaden the tax base and minimize distortions in the market. You might hear terms like GST council recommendations being thrown around. The GST Council, comprising representatives from the central and state governments, is the key decision-making body when it comes to GST policy. They meet regularly to review rates, address concerns, and propose changes.

Decoding the Proposed GST Slab Restructuring

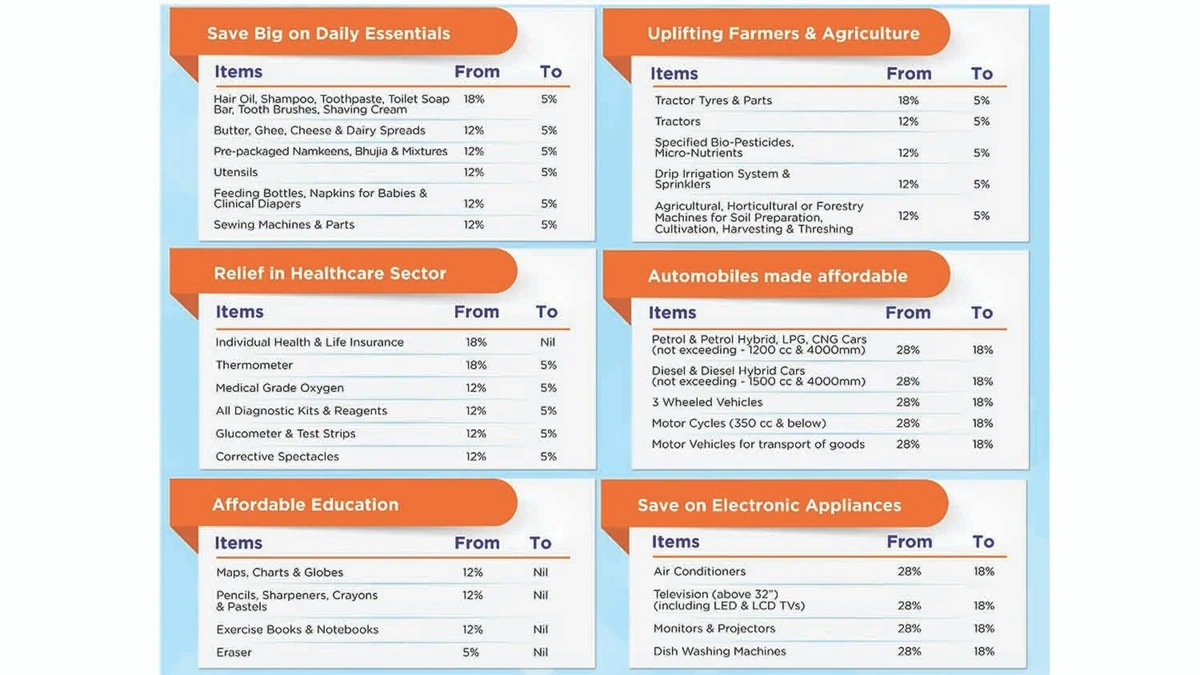

Now, let’s get into the nitty-gritty. The proposed GST slab restructuring generally involves reducing the number of slabs and merging some of the existing ones. For example, there’s been talk of merging the 5% and 12% slabs into a single, higher slab, perhaps around 8% or 9%. The goal is to simplify the system and boost revenue. As per various reports, such a move could significantly increase the government’s GST collections.

However, it’s not without its challenges. Any increase in GST rates, even on lower-taxed items, can impact consumers, especially those in lower-income brackets. This is where the government needs to strike a delicate balance between revenue generation and affordability. The discussions around revised GST rates are always heated, with different states and industries lobbying for their interests.

The impact on small businesses is also a major consideration. Many small businesses operate on thin margins, and any increase in GST rates can affect their competitiveness. That’s where understanding the composition scheme or claiming input tax credit becomes super important – something I’ve seen many struggle with. A common mistake I see small business owners make is not keeping proper records of their input taxes, which then prevents them from claiming the full credit. Make sure you talk to a qualified accountant!

Potential Winners and Losers | Who Benefits from GST Changes?

Let’s face it: in any tax overhaul, there are winners and losers. Certain sectors might benefit from a streamlined GST structure, while others might face increased costs. For example, if the 5% slab is merged with a higher slab, items currently taxed at 5% could become more expensive. This could affect sectors like packaged food, textiles, and pharmaceuticals. Always keep an eye on official notifications from the Central Board of Indirect Taxes and Customs (CBIC) for the most up-to-date information.

On the other hand, some industries might benefit from a reduction in the overall tax burden or a simplification of compliance procedures. Sectors with complex supply chains could see cost savings from a more streamlined GST system. The government’s intention is to boost economic growth and investment by creating a more predictable and business-friendly tax environment.

But, and this is a big ‘but’, the actual impact will depend on the specific details of the new GST structure . What I initially thought was straightforward now seems far more nuanced after considering the wide range of sectors it touches.

Staying Ahead of the Curve | Practical Tips for Businesses and Consumers

So, what can you do to prepare for these potential changes? For businesses, it’s crucial to stay informed about the latest developments and assess the potential impact on your operations. This means regularly checking the official CBIC website, attending industry seminars, and consulting with tax professionals. According to the latest circular on the official CBIC website, businesses need to update their accounting software to reflect the new GST rates once they are notified.

Consumers, too, need to be aware of how GST changes might affect the prices of goods and services. While it’s impossible to predict the exact impact, understanding the underlying principles of GST can help you make informed purchasing decisions. Let’s be real, nobody wants to be caught off guard by unexpected price hikes! As per the guidelines mentioned in the information bulletin, consumers can also file complaints if they are overcharged GST by businesses.

Remember, knowledge is power. The more you understand about the future of GST in India , the better equipped you’ll be to navigate the changes and make smart financial decisions. And make sure to keep an eye out for changes regarding GST compensation cess . Understanding GST is key to adapting to the ever-changing economical environment of the country.

It’s not just about understanding the rates; it’s about understanding the system. And that’s a journey, not a destination.

Frequently Asked Questions (FAQ)

Will the GST rate on essential items increase?

It’s possible. Discussions are ongoing about merging the lower slabs, which could impact the price of some essential goods. However, the government is also mindful of the need to protect consumers from excessive price increases.

How will the GST new slab affect small businesses?

The impact will vary depending on the sector and the specific changes. Some small businesses may face higher input costs, while others may benefit from a simplified tax structure. It’s crucial for small businesses to stay informed and adapt their strategies accordingly.

Where can I find the most up-to-date information on GST changes?

The official website of the Central Board of Indirect Taxes and Customs (CBIC) is the best source of information. You can also consult with tax professionals and attend industry seminars.

What is the GST compensation cess?

The GST compensation cess is levied on certain luxury and demerit goods to compensate states for any revenue losses incurred due to the implementation of GST. The cess is currently set to expire in March 2026.

What if I think a business is charging me the wrong GST rate?

You can file a complaint with the relevant tax authorities. Make sure to keep records of your transactions and any evidence of overcharging.

Ultimately, the ongoing evolution of GST reflects India’s dynamic economic landscape. By staying informed and adapting to the changes, businesses and consumers can navigate the system effectively and contribute to the country’s continued growth. Remember, it is important to keep tabs on GST compliance requirements , as these might change too.