Unlock Your EPFO Passbook Lite | The Ultimate Guide for Indian Employees

Let’s be honest, wading through the Employees’ Provident Fund Organisation (EPFO) can feel like navigating a bureaucratic maze. But, here’s the thing: understanding your EPFO passbook lite is crucial. It’s not just some document; it’s a real-time snapshot of your retirement savings, allowing you to monitor contributions, track interest, and plan your financial future with confidence. But, how do you even access the passbook lite, and what does it all mean? Let’s dive in, shall we?

Decoding the EPFO Passbook Lite | Why It Matters to You

So, why should you care about this digital ledger? The EPFO passbook lite isn’t just a record of transactions; it’s a powerful tool for financial planning and transparency. What fascinates me is the real-time access it provides. In the past, employees had to wait for annual updates, creating uncertainty. Now, you can see your contributions as they’re made, ensuring accuracy and identifying any discrepancies immediately. According to the EPFO website, regular monitoring of your passbook can prevent fraud and ensure employers are remitting contributions on time.

This transparency is especially important in India, where the gig economy is booming and job mobility is increasing. Keeping tabs on your PF balance and contributions across multiple employers is now easier than ever, all thanks to the convenience of the passbook lite. But it’s important to note that the passbook lite is not a replacement for the comprehensive passbook, which can be downloaded with more detailed information. Here’s why accessing the full version might also benefit you in the long run.

Step-by-Step | Accessing Your EPFO Passbook Lite

Okay, let’s get practical. How do you actually access this digital treasure trove? There are two primary methods:

- Via the EPFO Portal: The most direct route is through the official EPFO website. You’ll need your Universal Account Number (UAN) and password. If you’ve forgotten your UAN, don’t panic! You can retrieve it from the portal using your member ID or Aadhaar number. Once logged in, navigate to the “Passbook” section and download the EPFO passbook lite. It’s a straightforward process, but a stable internet connection is key.

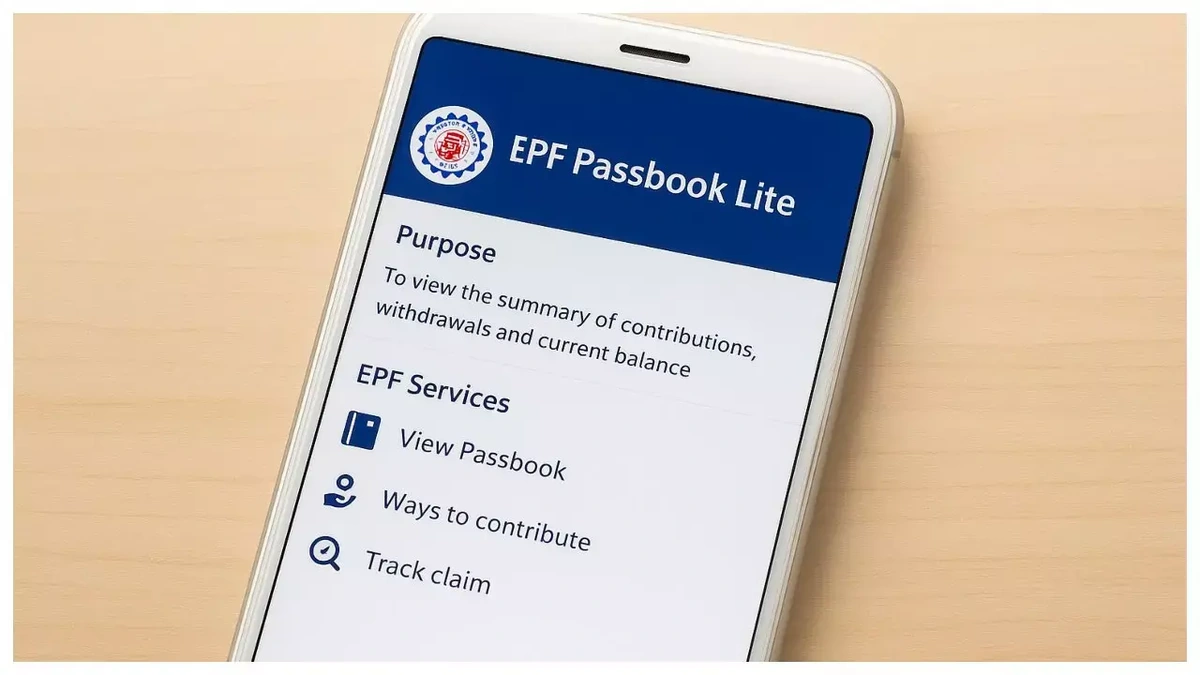

- Via the UMANG App: For those who prefer mobile access, the UMANG (Unified Mobile Application for New-age Governance) app is a lifesaver. After downloading the app, search for “EPFO services” and select the “View Passbook” option. Again, you’ll need your UAN and password. The app is incredibly user-friendly, making it ideal for checking your PF account status on the go.

A common mistake I see people make is entering incorrect login credentials. Double-check your UAN and password before hitting that “Submit” button. And, remember, the EPFO portal may experience occasional glitches due to high traffic. If you encounter an error, try again later – patience is a virtue, especially when dealing with government websites!

Troubleshooting Common Passbook Lite Issues

Let’s be real – things don’t always go smoothly. What happens if you encounter an error while accessing your epfo member passbook ? Here are a few common issues and their solutions:

- Error: “UAN Not Activated”: This is a frequent problem for new employees. You need to activate your UAN on the EPFO portal before accessing the passbook. The activation process requires providing your Aadhaar number and other personal details.

- Error: “Passbook Not Available”: This usually occurs if there’s a delay in updating your passbook. Give it some time and try again later. If the problem persists, contact your employer or the EPFO helpline.

- Error: Login Issues: If you’re having trouble logging in, ensure your UAN is active and your password is correct. If you’ve forgotten your password, use the “Forgot Password” option to reset it.

What fascinates me is how the EPFO is continuously working to improve its online services and address these common issues. But, remember, if you’re stuck, don’t hesitate to reach out for help. The EPFO has a dedicated helpline and online support system to assist you.

Maximizing the Benefits of Your EPFO Passbook Lite

Now that you can access your epfo passbook lite , let’s talk about how to make the most of it. This isn’t just about checking your balance; it’s about actively managing your retirement savings.

- Regular Monitoring: Make it a habit to check your passbook regularly – at least once a quarter. This allows you to track your contributions, verify interest credits, and identify any discrepancies promptly.

- Nomination Details: Ensure your nomination details are up-to-date. This is crucial for ensuring your loved ones receive your PF benefits in case of an unforeseen event.

- KYC Compliance: Keep your KYC (Know Your Customer) details updated on the EPFO portal. This includes your Aadhaar number, PAN card, and bank account details. KYC compliance is essential for seamless withdrawals and other transactions.

And here’s a pro tip: use the epfo e passbook to plan your future. See how your savings are growing and how different contribution levels will impact your retirement corpus. Financial planning shouldn’t be scary; it should be empowering!

Remember that your epfo passbook lite download is only as good as the data within it. If you spot errors, act fast.

Navigating the Nuances | Understanding Interest Rates and Tax Implications

Let’s talk about the elephant in the room: interest rates and taxes. The interest rate on EPF contributions is determined by the government and is subject to change. Keeping an eye on these fluctuations is crucial for understanding the growth of your retirement savings. It’s currently around 8.15%, which is a pretty sweet deal compared to other fixed-income options.

As for taxes, EPF contributions are eligible for tax deductions under Section 80C of the Income Tax Act. This means you can reduce your taxable income by investing in EPF. The interest earned on EPF contributions is also tax-free, provided you meet certain conditions. However, withdrawals from your EPF account may be taxable, depending on the circumstances. It’s always a good idea to consult a tax advisor for personalized guidance.

Here’s the thing: understanding the tax implications of your PF account status can save you money in the long run. Don’t shy away from seeking professional advice to optimize your tax planning.

FAQ | Your EPFO Passbook Lite Questions Answered

Frequently Asked Questions (FAQ)

What if I forgot my UAN?

You can retrieve your UAN from the EPFO portal using your member ID or Aadhaar number.

How often should I check my EPFO passbook?

It’s recommended to check your passbook at least once a quarter to monitor your contributions and interest credits.

Is the EPFO passbook lite the same as the comprehensive passbook?

No, the passbook lite provides a summary of your transactions, while the comprehensive passbook contains more detailed information.

What if I find an error in my passbook?

Contact your employer or the EPFO helpline to report the error and request a correction.

Is it safe to access my EPFO passbook online?

Yes, the EPFO portal and UMANG app are secure platforms for accessing your passbook. However, always practice safe online habits, such as using a strong password and avoiding suspicious links.

So, there you have it – a comprehensive guide to understanding and utilizing your EPFO passbook lite . Remember, it’s not just a document; it’s a tool for financial empowerment. Embrace it, understand it, and use it to build a secure financial future. Happy saving!

One final thought: The real power of the passbook isn’t just in seeing the numbers; it’s in understanding what those numbers mean for your future. Don’t just check it – analyze it, plan with it, and let it be your guide to a comfortable retirement.