EPF Withdrawal | Step-by-Step Guide to Accessing 100% of Your Funds | Latest News

So, you’re thinking about an EPF withdrawal ? Let’s be honest – navigating the Employees’ Provident Fund (EPF) system can feel like trying to solve a Rubik’s Cube blindfolded. But, fear not! This isn’t just another news article regurgitating the latest circular. We’re diving deep, explaining not only how to withdraw your EPF, but why certain rules exist and what they mean for you, the everyday Indian worker. This is a deep dive on employee provident fund scheme.

The truth is, the EPF is a crucial part of financial planning for many in India. It’s that safety net we often don’t think about until we really need it. Understanding how to access your funds – especially 100% of them – is incredibly empowering. I mean, who doesn’t want control over their own hard-earned money?

The Complete Guide to Withdrawing 100% of Your EPF

Alright, let’s get down to brass tacks. This is the “How” angle, and I promise to make it as straightforward as possible. Consider this your personal, jargon-free guide to EPF withdrawal rules . But, before we jump in, remember this: withdrawing your entire EPF corpus should ideally be your last resort. Think of it as your retirement nest egg – something you crack open only when absolutely necessary.

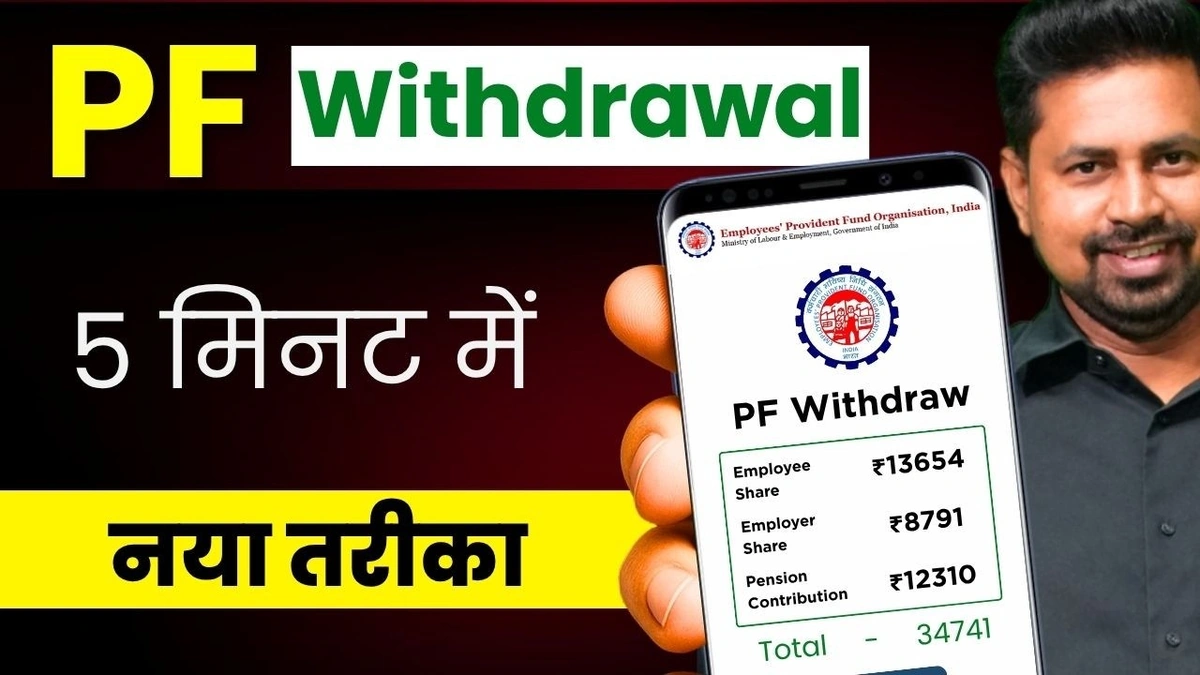

Here’s the step-by-step breakdown:

- Eligibility Check: The golden rule? You can withdraw the full amount, including your contribution and your employer’s contribution, only upon retirement (after the age of 55) or if you’ve been unemployed for more than two months. According to the official EPFO guidelines, you’ll need to provide proof of unemployment.

- Online vs. Offline: Luckily, the EPFO has embraced the digital age. You can initiate your claim online through the EPFO portal if your Aadhaar is linked to your UAN (Universal Account Number) and your KYC details are up-to-date. If not, you’ll have to go the traditional route – filling out forms and submitting them to your EPFO office.

- The Aadhaar Advantage: Let’s be real – linking your Aadhaar makes everything smoother. It’s like having a VIP pass to the EPF withdrawal party. Make sure your Aadhaar is linked and verified on the EPFO portal.

- Form 19: This is your withdrawal form. If you’re doing it online, the portal will guide you. If you’re doing it offline, you can download Form 19 from the EPFO website. Fill it out carefully – any errors can delay the process.

- Bank Details: Double, triple-check your bank account details. A wrong account number can lead to your money landing in someone else’s pocket – not a pleasant scenario!

- Submission & Patience: Once you’ve submitted your claim, it’s a waiting game. The EPFO typically takes 15-20 working days to process your request. Keep an eye on the status of your claim on the EPFO portal.

A common mistake I see people make is rushing through the process and missing crucial details. Take your time, read the instructions carefully, and don’t hesitate to seek help from the EPFO helpline if you’re stuck. Also be mindful of EPFO claim settlement process.

Why the Rules Matter | Unpacking the EPF Logic

Now, let’s get to the “Why.” Why can’t you just withdraw your entire EPF whenever you feel like it? Well, the EPF is designed as a long-term savings scheme to provide financial security after retirement. The government incentivizes this by offering tax benefits and higher interest rates compared to regular savings accounts. Allowing unrestricted withdrawals would defeat the purpose.

Think of it this way: the EPF is like a slow-cooking biryani. The longer it simmers, the richer and more flavorful it becomes. Similarly, the longer you keep your money in the EPF, the more it grows, ensuring a comfortable retirement.

But – and this is a big but – life happens. Unexpected expenses arise, emergencies occur, and sometimes, you need access to your funds. That’s why the EPFO allows partial withdrawals under certain circumstances, such as medical emergencies, marriage, or home construction. But, these partial withdrawals come with their own set of rules and restrictions. It’s also important to understand the tax implications of EPF withdrawal.

The Two-Month Unemployment Clause | Decoding the Fine Print

The two-month unemployment rule is a critical aspect of accessing 100% of your EPF before retirement. But what does it really mean? And how do you prove it?

Essentially, if you’ve been out of a job for more than two months, you can withdraw your entire EPF corpus. The EPFO requires you to submit a self-declaration stating your unemployment. In some cases, they may also ask for supporting documents, such as a letter from your previous employer or an affidavit. Andhere’s the catch: the two-month period must be continuous. You can’t add up shorter periods of unemployment to reach the two-month threshold.

What fascinates me is how this rule reflects the EPFO’s understanding of the realities of the Indian job market. Job security isn’t always a given, and sometimes, people face extended periods of unemployment. This provision provides a crucial lifeline during those tough times.

Beyond the Basics | Maximizing Your EPF Returns

Withdrawing your EPF is one thing, but managing it effectively is another. Here are a few tips to maximize your EPF returns:

- Contribute Regularly: The more you contribute, the more your corpus grows. Consider increasing your contribution if you can afford it.

- Stay Informed: Keep track of the latest EPF interest rates and rules. The EPFO website is your best source of information. You can also follow reputable financial news websites.

- Avoid Premature Withdrawals: As tempting as it may be, avoid withdrawing from your EPF unless absolutely necessary. Remember, it’s your retirement safety net.

Understanding EPF account details and managing them effectively can significantly improve your financial future.

Navigating Common EPF Withdrawal Hurdles

Let’s be real – the EPF withdrawal process isn’t always smooth sailing. Here are some common hurdles and how to overcome them:

- KYC Issues: Mismatched information in your Aadhaar, PAN, or bank account can cause delays. Ensure your KYC details are accurate and up-to-date.

- UAN Activation Problems: Your UAN must be activated to initiate online withdrawals. Contact your employer or the EPFO helpline if you’re facing issues.

- Claim Rejections: Claims can be rejected due to various reasons, such as incomplete information or incorrect documentation. Review your application carefully before submitting it.

FAQ

Frequently Asked Questions About EPF Withdrawal

What if I forgot my UAN?

You can retrieve your UAN from the EPFO portal using your Aadhaar or PAN details.

How long does it take to process an EPF withdrawal claim?

The EPFO typically takes 15-20 working days to process your request.

Can I withdraw my EPF if I’m still employed?

You can only make partial withdrawals under certain circumstances, such as medical emergencies or home construction.

What are the tax implications of EPF withdrawal?

Withdrawals before five years of continuous service are generally taxable. Consult a tax advisor for specific guidance.

Is it better to transfer my EPF to a new employer or withdraw it?

Transferring is generally recommended, as it allows your corpus to continue growing and avoids tax implications.

Where can I find the latest EPF interest rates?

The latest interest rates are usually announced on the EPFO website.

So, there you have it – a comprehensive guide to accessing your EPF funds . Remember, knowledge is power. By understanding the rules, regulations, and nuances of the EPF system, you can make informed decisions about your financial future. Don’t just take my word for it; always verify information with official sources. Because when it comes to your money, it’s always better to be safe than sorry!