The Dmart Share Price | My Obsession with India’s Most Boring, Brilliant Stock

I have a confession. I sometimes go to Dmart on a Saturday morning with no intention of buying anything. I just want to watch. It’s a masterclass in controlled chaos. Carts overflowing with giant bags of rice, the urgent beeping of checkout counters, families debating the merits of one biscuit brand over another with life-or-death seriousness. It’s loud, it’s crowded, and honestly, it’s a little overwhelming. But underneath that chaotic surface is a business so ruthlessly efficient, so brilliantly simple, that it’s become the stuff of legend on Dalal Street. And all that chaos, all that efficiency, gets distilled into one single, endlessly fascinating number: the Dmart Share Price .

You look at that number, and it seems to have a life of its own. It zigs, it zags, it sometimes does absolutely nothing for months on end, frustrating traders who are looking for a quick thrill. But if you zoom out, the story of the Avenue Supermarts share price (that’s the parent company, by the way) is one of the most compelling in the Indian market. It’s a story not of flashy tech or disruptive innovation, but of something far more fundamental: selling dal and detergent cheaper than anyone else, consistently.

The Man in the White Shirt | Decoding the Damani DNA

You can’t talk about Dmart without talking about its founder, the legendary investor Radhakishan Damani . The man is a bit of an enigma, famously media-shy and often seen in his signature all-white attire. But his investing philosophy is woven into every square foot of every Dmart store. He isn’t a retailer who learned to invest; he’s a world-class investor who happened to build a retail empire. And that changes everything.

Think about it. Most retailers get trapped in a cycle of renting expensive properties in prime locations, spending a fortune on fancy interiors, and then having to keep prices high to cover the costs. Damani flipped the script. He used his deep understanding of value to buy the properties, often in slightly out-of-the-way but still accessible locations. This wasn’t just a cost-saving measure; it was a masterstroke. While his competitors are forever beholden to landlords and rising rents, Dmart sits on a mountain of appreciating real estate assets. It’s a real estate play disguised as a grocery store.

This long-term thinking is the key. Damani is known for his patience, for holding onto his convictions for years, even decades. He applied that same logic to Dmart. The goal wasn’t to build something that looked good for the next quarter’s earnings call, but to build an institution with an unshakeable foundation. I keep coming back to this point because it’s crucial to understanding the stock’s behavior. The market isn’t just pricing in the next dmart quarterly results ; it’s pricing in the Damani premium a belief in this slow, steady, and devastatingly effective approach.

Why Dmart’s Stock is Both Boring and Brilliant

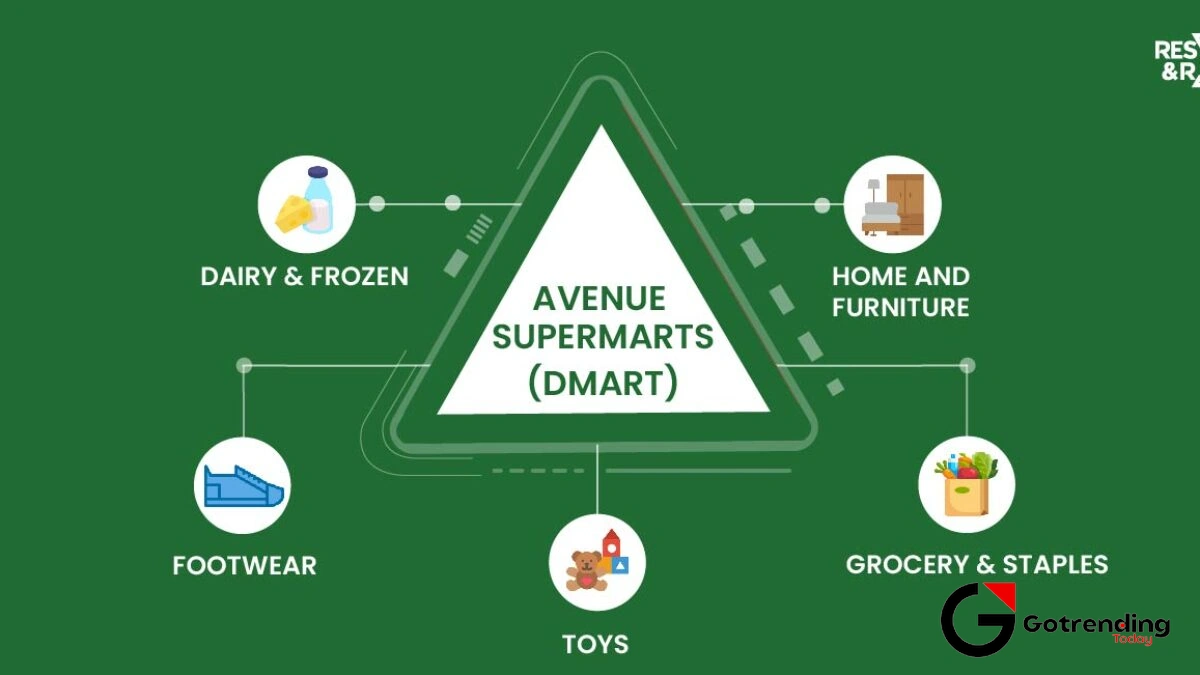

Let’s be honest, the dmart business model is not exciting. It’s “Everyday Low Cost, Everyday Low Price” (EDLC/EDLP). They focus on a curated selection of fast-moving items, buy them in enormous bulk to get the best prices, and pass a chunk of those savings onto the customer. There are no frills. The floors are basic, the shelves are functional, the focus is singular: value. It’s the opposite of a boutique shopping experience.

And that’s why the stock can feel… well, boring. It’s not a tech stock promising to change the world overnight. It’s not making flashy acquisitions. It’s a slow-and-steady compounder. But here’s the brilliant part. This relentless focus on cost creates a moat around the business that is incredibly difficult for competitors to cross. Customers know they will get the best price at Dmart. That trust is an asset you can’t easily quantify. It leads to insane customer loyalty and high inventory turnover, which means Dmart gets cash from its customers before it even has to pay its suppliers. It’s a beautiful, self-sustaining cash machine.

The company’s growth is also methodical. Their dmart expansion plans aren’t about planting a flag in every city overnight. It’s a cluster-based approach, building a deep presence in one region, perfecting the supply chain, and only then moving to the next. It’s the tortoise in a retail race full of hares. While others chase growth at all costs, Dmart chases profitable growth. It’s a crucial distinction that long-term investors cherish. For an interesting contrast in growth strategies, just look at the frenetic pace seen in other sectors, almost like the aggressive England vs India Bazball cricket approach, versus Dmart’s classic, steady Test match innings.

The Elephant in the Room | Competition and That Sky-High Valuation

But let’s not get carried away. There are real risks. The biggest, of course, is competition. The battle of dmart vs reliance retail is a clash of titans. Reliance has deep pockets and an aggressive, multi-format strategy. Then you have the rise of quick-commerce players like Blinkit and Zepto nibbling away at the convenience-driven urban consumer. Can Dmart’s low-price model stand up to the onslaught?

I believe it can, primarily because they are fighting different battles. Quick commerce is about convenience and small-basket purchases. Dmart is about the big monthly shop, the planned, value-driven bulk purchase. They can coexist. The real test is against other large format retailers, and that’s where Dmart’s ownership of its properties and its lean operational culture give it a lasting edge.

And then there’s the valuation. The price-to-earnings (P/E) ratio of Dmart has almost always been in the stratosphere. Critics will scream that it’s overvalued, that no grocery retailer should command such a premium. And they’re not entirely wrong. By traditional metrics, it looks expensive. But the market is paying for quality, consistency, and the sheer size of the opportunity in India’s organized retail space. It’s a bet on the dmart long term investment thesis, a belief that the company will continue to execute flawlessly and grow into its valuation over the next decade. It’s not a stock for the faint of heart, or for those looking for a quick bargain. It’s more like the dixon share price , where you’re paying a premium for a clear market leader in a growing industry.

Ultimately, watching the Dmart share price is a lesson in business itself. It teaches you that moats aren’t always built from fancy technology, but from operational grit. It shows that patience is a superpower. And it reminds you that sometimes, the most brilliant businesses are the ones hiding in plain sight, in the crowded aisles of a store just selling you soap and sugar, but doing it better than anyone else.

Your Dmart Questions, Answered

So, is Dmart a good long-term investment or just hype?

That’s the million-dollar question, isn’t it? From my perspective, the case for a dmart long term investment is strong due to its phenomenal business model, debt-free status, and the massive runway for growth in Indian organized retail. However, the hype has led to a very high valuation. It’s a “buy and hold” for believers in the business, not a “buy and flip” for traders. You have to be willing to stomach periods of no returns and trust the long-term story.

Why does the Dmart share price seem so expensive compared to its earnings?

This is a common and valid concern. The high Price-to-Earnings (P/E) ratio is due to what investors call a “scarcity premium.” There are very few publicly listed companies in India with Dmart’s combination of high growth, clean governance, strong management (hello, Mr. Damani), and a massive, untapped market. Investors are willing to pay a premium today for the profits they expect the company to generate far into the future.

What’s the biggest risk to Dmart’s business model?

While competition from Reliance is the obvious answer, I think a more subtle risk is execution. Dmart’s entire model depends on flawless, low-cost execution. As they scale and expand into new regions with different consumer habits and supply chain challenges, maintaining that same level of ruthless efficiency will be their biggest test. Any slip-up in operations could hurt their margins and, consequently, the stock price.

How do Dmart’s quarterly results actually affect the stock price?

For a stock like Dmart , the market looks beyond just the headline profit and revenue numbers. Analysts zoom in on things like Same-Store Sales Growth (SSSG), which shows how well existing stores are performing. They also scrutinize the gross margins to see if the company is maintaining its pricing power. A miss on these underlying metrics, even with a decent profit, can sometimes lead to a negative reaction in the Dmart Share Price .

Is Radhakishan Damani still actively involved with Dmart?

Yes, absolutely. While he’s not involved in the day-to-day minutiae, he remains the Chairman and the strategic guiding force behind the company. His long-term vision and capital allocation philosophy are the bedrock of Dmart’s strategy. You can read more about his journey and influence on platforms like Forbes , which highlights his status as a veteran investor.