Is Disney Stock a Buy, Sell, or Hold? My Honest Take

Let’s be real, folks. Investing in the stock market can feel like navigating a minefield. And when it comes to household names like Disney (DIS) , the stakes feel even higher. You’re not just buying a piece of a company; you’re investing in nostalgia, childhood memories, and the future of entertainment. But is that emotional connection enough to justify putting your hard-earned money into Disney stock ? That’s the million-dollar question, isn’t it?

I initially thought this would be a straightforward analysis, but the more I dug in, the more I realized the situation is more nuanced than simply looking at quarterly earnings. So, let’s dive deep and figure out if Disney stock deserves a spot in your portfolio.

The Magic Kingdom’s Financials | A Rollercoaster Ride

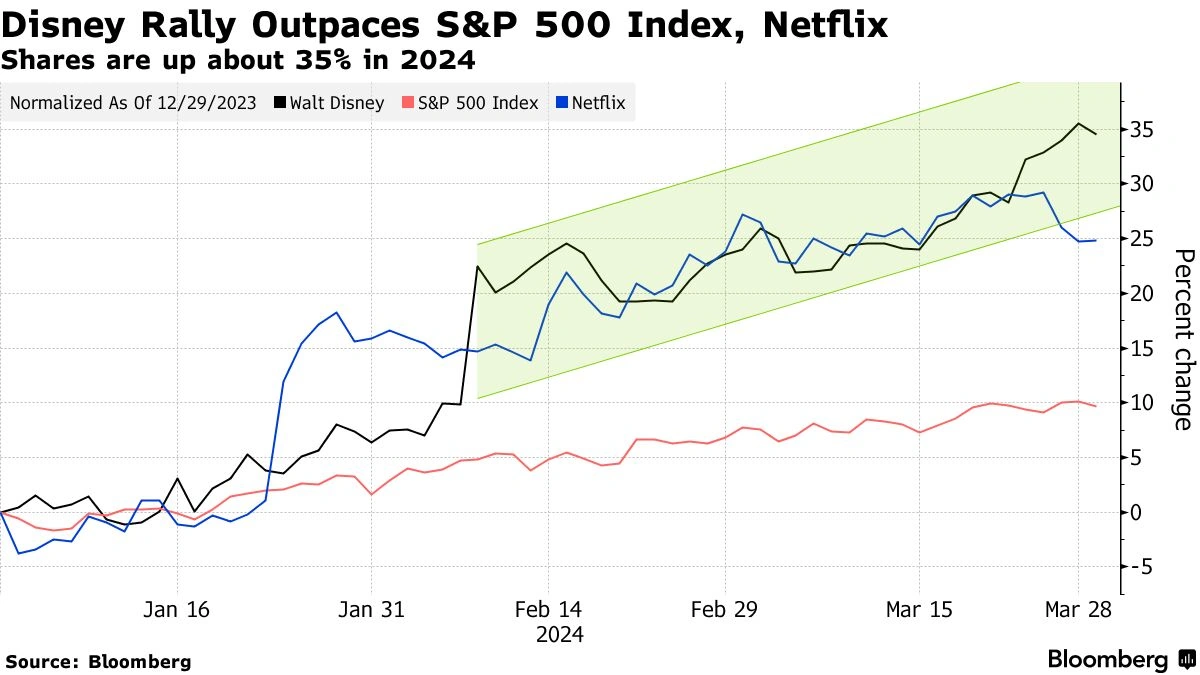

Okay, let’s get down to brass tacks. How is Disney’s financial performance actually looking? Well, it’s been a bit of a mixed bag, to be honest. The pandemic threw a massive wrench into their operations, with theme parks shuttered and movie releases delayed. But here’s the thing: Disney adapted. They doubled down on Disney+ , and that streaming service became their saving grace.

And now? Parks are open again, movies are back in theaters (with the latest box office numbers looking good, by the way!), and Disney+ is still growing – though the rate of growth has slowed. What fascinates me is how they are balancing these different revenue streams. But let’s not forget about cord-cutting trends. Disney’s traditional media networks (like ESPN and Disney Channel) are facing headwinds as more people ditch cable.

Why Disney’s Streaming Strategy is a Double-Edged Sword

Disney+ . It’s the shiny new toy, the future of entertainment, and… potentially a money pit? Hear me out. Building a streaming service from scratch is expensive. Creating original content (think Marvel series, Star Wars spin-offs, and all those animated movies) costs a fortune. And while Disney+ has attracted millions of subscribers, it’s also eating into the profits of Disney’s other businesses. What’s more, the streaming landscape is incredibly competitive, with Netflix, Amazon Prime Video, and a host of other players all vying for your attention (and your subscription dollars). I initially thought that streaming services would be a great revenue generator, but I was wrong.

So, the question becomes: Can Disney make Disney+ profitable enough to offset the decline in its traditional media business? That’s what investors are really keeping an eye on. A common mistake I see people make is just looking at subscriber numbers. You need to dig deeper into the average revenue per user (ARPU) and the cost of acquiring those subscribers.

Theme Parks | The Heart of the Magic (and the Bottom Line)

Let’s be honest, who doesn’t love a trip to a Disney theme park ? From Cinderella’s Castle to Star Wars: Galaxy’s Edge, these parks are a magical experience (and a major revenue generator for Disney ). The one thing you absolutely must understand is that pent-up demand. People were itching to get back to the parks after the pandemic lockdowns, and that translated into huge profits for Disney .

But can that momentum continue? That’s the big question. Theme park attendance is sensitive to economic conditions. If there’s a recession, people are less likely to shell out thousands of dollars for a family vacation. Moreover, parkcapacity, staffing issues, and rising costs could all put a damper on Disney’s theme park profits.

The Bottom Line: Should You Invest in Disney Stock?

Alright, let’s cut to the chase. Should you buy, sell, or hold Disney stock ? Well, it depends on your investment goals and risk tolerance. Disney is a blue-chip company with a strong brand, a diverse portfolio of assets, and a history of innovation. According to recent industry analysis, analysts’ recommendations are cautiously optimistic. But it’s also facing significant challenges, including the cord-cutting trend, the high cost of streaming, and the potential for an economic downturn.

If you’re a long-term investor who’s willing to ride out the ups and downs, Disney stock could be a good fit for your portfolio. But if you’re looking for a quick profit, you might want to look elsewhere.

Ultimately, the decision is yours. Do your research, understand the risks, and invest wisely. And remember, don’t let your emotional attachment to Disney cloud your judgment.

FAQ about Disney Stock

Is Disney stock a good long-term investment?

Disney has historically been a solid long-term investment, but consider current streaming challenges and economic factors.

What are the risks of investing in Disney stock?

Risks include competition in streaming, cord-cutting trends affecting TV networks, and potential economic downturns impacting theme park revenue.

How does Disney+ affect Disney’s overall financial performance?

Disney+ contributes to revenue but also involves high content costs and impacts profits from traditional media.

What’s the outlook for Disney’s theme parks?

Theme parks are recovering well post-pandemic but are vulnerable to economic downturns affecting consumer spending.

Where can I find the latest box office numbers for Disney films?

You can find box office data on sites like Box Office Mojo or Variety.

One final thought: Disney’s true strength isn’t just in its financial reports; it’s in its ability to continually reinvent itself and capture the imaginations of generations. That’s a powerful advantage that shouldn’t be overlooked.