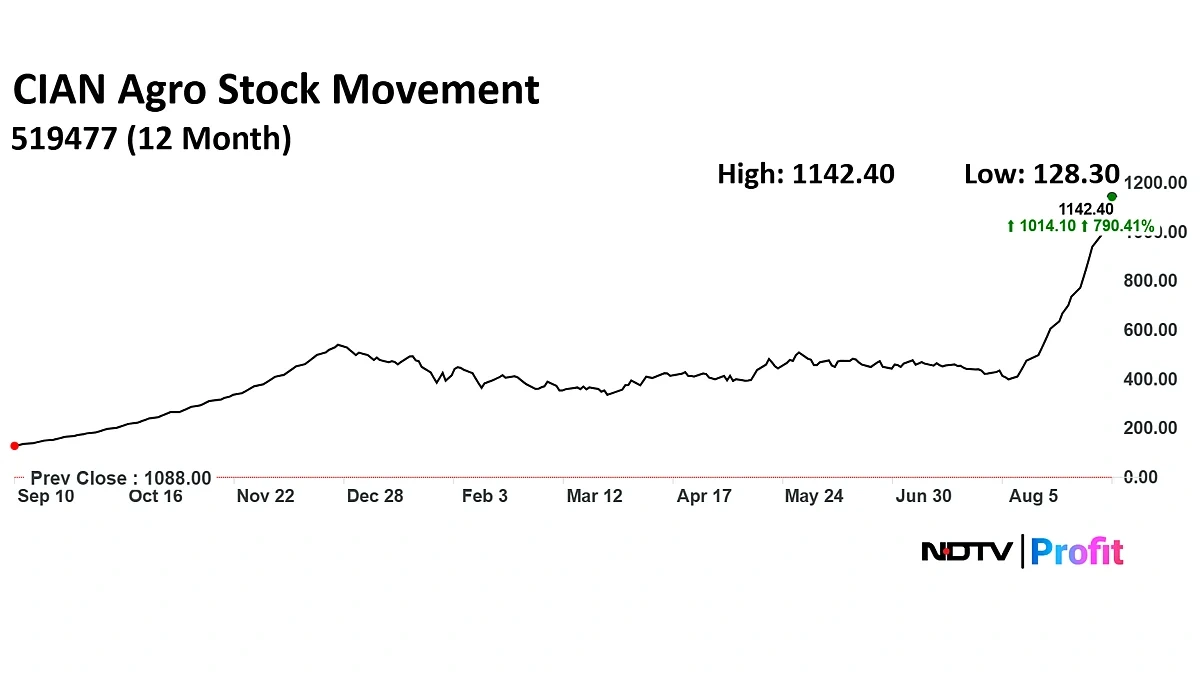

Decoding the Cian Agro Share Price | What’s Really Going On?

Alright, let’s talk Cian Agro share price . You’ve probably seen the numbers bouncing around, maybe even felt a little thrill (or a little dread) depending on when you bought in. But here’s the thing: just looking at the price is like reading the last page of a novel and thinking you know the whole story. Let’s dive into the “why” behind the numbers. What are the fundamental forces at play, and what does it all mean for you?

The Seeds of Growth | Cian Agro’s Business Model

Cian Agro isn’t just another company; it’s a key player in India’s agricultural landscape. Their core business revolves around providing high-quality seeds, fertilizers, and other essential inputs to farmers. But, and this is crucial , they also offer value-added services like soil testing and advisory, which makes them more than just a supplier. This integrated approach – providing both products and knowledge – sets them apart. Understanding this is essential before diving into Cian Agro stock analysis .

The Indian agricultural sector, as a whole, is undergoing a massive transformation. Government initiatives promoting sustainable farming, coupled with increasing awareness among farmers, are creating a fertile ground (pun intended!) for companies like Cian Agro. But, like any investment, there are risks involved. Changes in government policy, fluctuating commodity prices, and unpredictable weather patterns can all impact the company’s performance.

The Market’s Mood | Factors Influencing the Share Price

So, what actually moves the Cian Agro share price today ? It’s a complex interplay of factors, both internal and external. Obviously, the company’s financial performance – revenue, profit margins, and earnings per share – plays a significant role. But investor sentiment, which is often driven by broader market trends and news headlines, is equally important.

For example, if there’s a general buzz about a good monsoon season, investors might become more optimistic about the agricultural sector, leading to increased demand for Cian Agro shares. Conversely, a negative news cycle – say, a report on rising fertilizer costs – could trigger a sell-off. Keeping an eye on these external factors, in addition to the company’s financials, is crucial for making informed decisions.

Moreover, keep in mind that share price targets for Cian Agro are often projections based on analysts’ estimates. These targets are not guarantees. They are educated guesses that can be influenced by various unforeseen events. Always do your own research, and don’t rely solely on analyst recommendations.

Decoding the Financials | A Quick Look at the Balance Sheet

Let’s be honest, wading through financial statements can feel like trying to decipher ancient hieroglyphics. But understanding some key metrics can give you a clearer picture of Cian Agro’s financial health. Look at their revenue growth: is it consistent, or is it fluctuating wildly? What about their debt levels? Are they managing their finances responsibly, or are they taking on excessive risk? According to information available at the Investopedia , evaluating a company’s debt levels helps determine risk factors.

Also, pay attention to their cash flow. A company with strong cash flow is better positioned to weather economic storms and invest in future growth. These are some of the things I look at when doing Cian Agro stock analysis , but it is essential to consult with a financial advisor.

The Future Harvest | Growth Prospects and Challenges Ahead

What’s next for Cian Agro? The company’s future prospects are closely tied to the growth of the Indian agricultural sector. As the demand for food continues to rise, driven by a growing population, companies like Cian Agro are poised to benefit. But, it’s not all smooth sailing. The company faces several challenges, including intense competition, rising input costs, and the need to adapt to changing climate conditions. Staying ahead of the curve by investing in research and development and adopting sustainable practices will be crucial for their long-term success.

Beyond the Price Tag | Investing with Intention

Investing in the stock market, including considering the Cian Agro share price , shouldn’t be treated like a quick gamble. It requires careful analysis, a long-term perspective, and a healthy dose of common sense. Remember, the stock market can be volatile, and there are no guarantees of success. But by understanding the underlying business, assessing the risks and rewards, and investing with intention, you can increase your chances of achieving your financial goals.

FAQ Section

Frequently Asked Questions (FAQ)

What factors affect Cian Agro’s share price?

Cian Agro’s share price is influenced by company performance, market trends, industry developments, and investor sentiment.

Where can I find the latest share price information?

You can find the latest share price information on financial websites, brokerage platforms, and stock market trackers. Be mindful when searching for Cian Agro share price NSE .

Is Cian Agro a good long-term investment?

Whether Cian Agro is a good long-term investment depends on your individual financial goals, risk tolerance, and investment strategy. It’s recommended to do thorough research.

How can I buy Cian Agro shares?

You can buy Cian Agro shares through a stockbroker, either online or offline. You will need to open a demat account and a trading account.

What is the outlook for the agricultural sector in India?

The outlook for the agricultural sector in India is generally positive, driven by increasing demand for food, government support, and technological advancements.

Where to find additional Cian Agro share price news?

You can find information regarding share prices on Google Finance, financial news websites, and the company’s investor relations page.