Decoding Your BSE IPO Allotment Status | Why It Matters (And What To Do Next)

So, you’ve plunged into the exciting and sometimes nail-biting world of Initial Public Offerings (IPOs) with the Bombay Stock Exchange (BSE). You’ve applied, waited, and now the big question looms: Did you get the BSE IPO allotment ? Let’s be honest, that moment of checking your allotment status can feel like waiting for exam results. But here’s the thing: understanding your IPO allotment status isn’t just about whether you got lucky this time. It’s about understanding the bigger picture of investing in the Indian stock market.

Understanding the “Why” Behind Your Allotment

Let’s dive deeper. Why does allotment matter? Well, beyond the immediate gratification (or disappointment), it’s a mini-lesson in supply and demand. IPOs are often oversubscribed, meaning there are more people wanting shares than there are shares available. So, the BSE IPO allotment process is designed to be fair, usually through a lottery system. Think of it as a high-stakes raffle. The oversubscription rate tells you how hot the IPO was. A high oversubscription rate means more competition and lower chances of getting the shares.

But, what fascinates me is what happens after the allotment. The demand (or lack thereof) then dictates the listing price. A successful listing can mean significant gains for those who got allotted, while a poor listing can lead to losses. The IPO subscription status is a good indicator for the potential listing gains.

Step-by-Step | How to Check Your BSE IPO Allotment Status

Okay, enough with the theory. Let’s get practical. Here’s your guide to checking your BSE IPO allotment status . I’ve broken it down into simple steps because, let’s face it, nobody wants to fumble around when their money is on the line.

- Identify the Registrar: First, figure out who the registrar for the IPO is. This information is usually available on the company’s prospectus or the BSE website. Registrars like Link Intime India Private Ltd or KFin Technologies Limited are common.

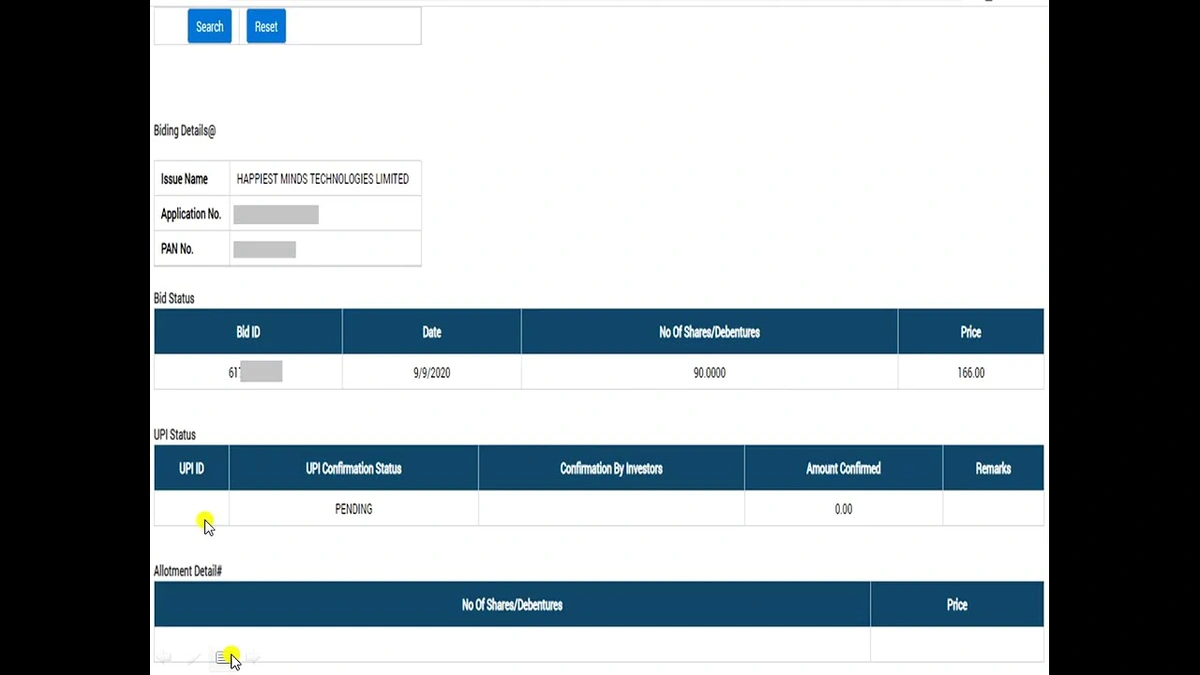

- Visit the Registrar’s Website: Head over to the registrar’s website. Usually, there’s a dedicated section for IPO allotment status.

- Select the IPO: Choose the specific IPO you applied for from the dropdown menu. Make sure you’re selecting the correct one—it’s easy to get mixed up if you’ve applied for multiple IPOs.

- Enter Your Details: You’ll typically need to enter one of the following: your PAN number, application number, or DPID/Client ID. Double-check the information you enter. A common mistake I see people make is mistyping their PAN number.

- Solve the Captcha: Complete the captcha to prove you’re not a robot.

- Check Your Status: Click the submit button and voila! Your allotment status will be displayed. It will show whether you’ve been allotted shares or not.

If you are allotted shares, congratulations! The shares will be credited to your demat account a day or two before the listing date. If not, don’t worry, the money blocked for the IPO will be unblocked and returned to your account.It’s all part of the game.

Alternative Methods | BSE Website and Depository Portals

While the registrar’s website is the most common way to check your allotment, you can also use the BSE website. Here’s how:

- Visit the BSE Website: Go to the official BSE India website.

- Navigate to IPO Section: Look for the ‘IPO’ or ‘Market’ section.

- Enter Application Details: Enter your application number and PAN.

- Check Status: View your allotment status.

Also, you can check through your depository portals (NSDL or CDSL), though this might require a bit more navigation. This method is particularly useful if you want a consolidated view of all your holdings.

And, remember, the process for checking IPO share allotment is generally the same across different IPOs, but always double-check the specific instructions provided by the registrar.

Decoding the Disappointment | What If You Didn’t Get Allotted?

Okay, let’s face it. Rejection is part of the process . Not getting allotted shares can be frustrating, especially if you were really excited about the company. But it’s important to remember that it’s not personal. The oversubscription rate is beyond your control . The good news is, the money blocked in your account will be released back to you. This usually happens within a few days after the allotment date. You can then use that money to explore other investment opportunities.

But, here’s where the learning comes in. Analyze why the IPO was so popular. Was it the sector? Was it the company’s financials? Understanding the factors that drove demand can help you make better investment decisions in the future. Also, consider applying in future IPOs using different categories (retail, HNI) to increase your chances, if eligible.

Furthermore, remember that the IPO is not the only way to invest in a company. Once the company is listed on the stock exchange, you can buy shares in the secondary market. Keep in mind that stock market investments are subject to market risk, read all scheme related documents carefully.

The Emotional Rollercoaster | Managing Expectations and Staying Grounded

Let’s talk about the emotional side of IPOs. It’s easy to get caught up in the hype and the potential for quick gains . But it’s crucial to manage your expectations and stay grounded. IPOs can be volatile, and there’s no guarantee that the share price will go up after listing.

The excitement of a potential windfall can be intoxicating, but it’s essential to remember that investing is a long-term game. Don’t put all your eggs in one basket . Diversify your portfolio and invest in companies you believe in, not just the ones that are making headlines. Don’t invest more than you can afford to lose.

FAQ | Your Burning Questions Answered

What if I forgot my application number?

Don’t panic! You can usually check your allotment status using your PAN number or DPID/Client ID instead. The registrar’s website will provide options .

How long does it take for the money to be unblocked if I don’t get the allotment?

The money blocked for the IPO is usually unblocked within a few days after the allotment date. Check with your bank for the exact timeline.

What does “Basis of Allotment” mean?

The Basis of Allotment is a document that explains how the shares were allocated in the IPO. It’s usually available on the registrar’s website and provides details on the oversubscription rates and the allotment process.

Can I check the BSE IPO allotment status on the BSE mobile app?

While the BSE website offers this feature, the availability on the mobile app might vary. Check the app’s features or the BSE website for confirmation .

What if there is an error in the IPO allotment status?

Contact the registrar immediately. Provide them with your application details and explain the discrepancy. Keep a record of all communication.

The most important thing is to stay informed, stay rational, and view IPOs as just one piece of your overall investment strategy. Understanding the BSE IPO allotment status process empowers you to invest in a more informed and confident manner. Remember, investing is a marathon, not a sprint.