Bitcoin Price | Stop Staring at the Number. Here’s What’s Really Driving It.

Let’s be honest. You’ve done it. I’ve done it. We’ve all pulled out our phones, opened an app, and stared at that number next to “BTC”. Maybe it’s a glorious, vibrant green, and your heart does a little flutter. Maybe it’s a soul-crushing red, and you start questioning all your life choices.

That number the bitcoin price feels like the whole story. But it’s not. It’s the last page of a very complicated, very human book.

Here’s the thing: obsessing over the daily price is like trying to understand a movie by only watching the last five seconds. You see the outcome, but you have no clue about the plot, the characters, or the drama that led to that moment. What fascinates me is the why. What are the invisible strings pulling that number up and down? What’s the real game being played behind the scenes?

So, grab your coffee (or chai). Let’s pull back the curtain. Because understanding the why is the difference between being a gambler and being a savvy observer. And in the wild world of crypto, that’s a superpower.

The Global Tug-of-War | Wall Street Suits vs. The Cypherpunk Dreamers

Imagine a giant tug-of-war. On one side, you have the new kids on the block: massive, multi-trillion dollar institutions from Wall Street. Think BlackRock, Fidelity, and their friends. These are the guys in slick suits who, for years, called Bitcoin a scam. Now? They’re selling it to their richest clients through a shiny new product: the Spot Bitcoin ETFs .

An ETF, or Exchange-Traded Fund, is basically a way for traditional investors to buy Bitcoin as easily as they’d buy a share of Reliance. They don’t need to worry about crypto wallets or private keys; they just click a button in their regular brokerage account. The launch of these ETFs in the US in early 2024 was a monumental event. It was like opening the floodgates, allowing a torrent of “big money” to pour into the crypto market for the first time.

But on the other side of the rope are the originals. The believers. The cypherpunks who saw Bitcoin not as a get-rich-quick scheme, but as a revolution. For them, Bitcoin is about decentralization, freedom from banks, and creating a new kind of financial system. They’ve been holding on for dear life (or “HODLing,” in crypto-speak) through brutal bear markets, fueled by belief in the technology.

So, what happens when these two worlds collide? Volatility. The suits see Bitcoin as just another asset on a spreadsheet, influenced by things like interest rates and market sentiment. They might sell big if they get spooked. The believers see it as the future, and they tend to buy the dips. This constant battle between short-term institutional profit-taking and long-term ideological holding is one of the biggest forces jerking the bitcoin price around every single day. For more on how market sentiment can affect asset prices, you might want to look at the dynamics of something like the Indusind Bank share to see parallels in traditional markets.

The ‘Halving’ Hype Machine | Is It All Just a Self-Fulfilling Prophecy?

You’ve probably heard the term “Bitcoin Halving.” It sounds technical, but the idea is simple.

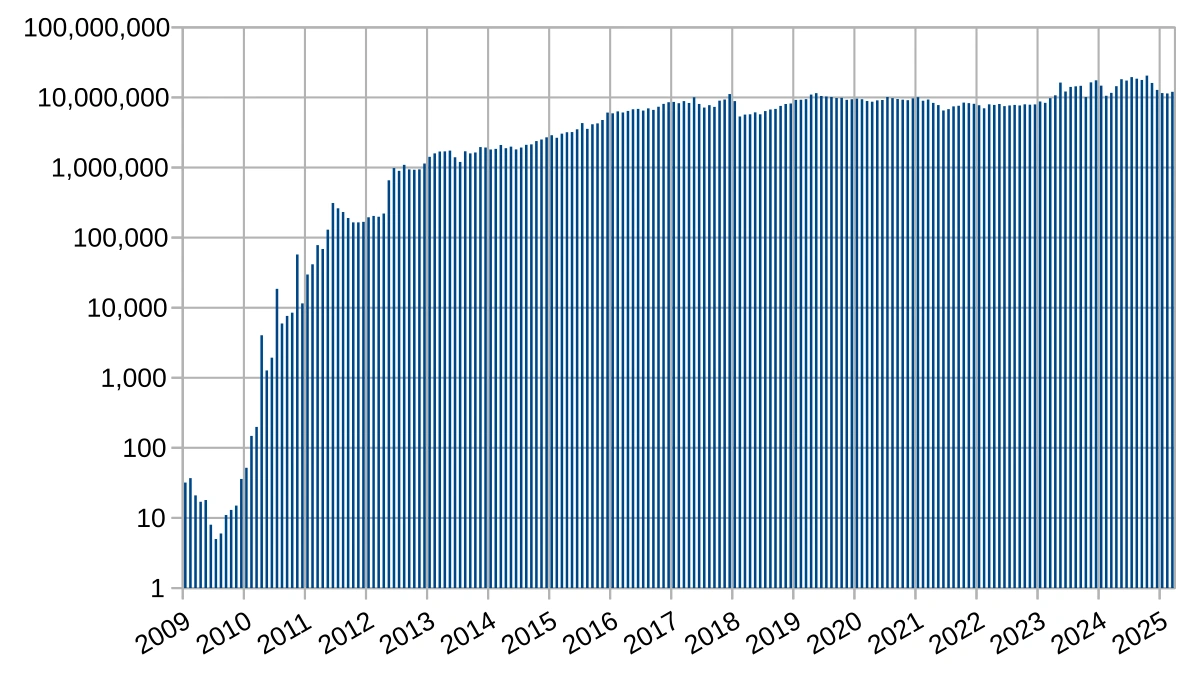

New Bitcoins are created by “miners” people with powerful computers who solve complex puzzles to validate transactions on the network. As a reward, they get a certain amount of new Bitcoin. The Bitcoin Halving is an event programmed into Bitcoin’s code that happens roughly every four years, and it cuts this reward in half.

Think of it like an oil well that automatically reduces its output by 50% every four years. Simple supply and demand, right? Less new supply coming onto the market should, in theory, make the existing supply more valuable. And historically, that’s what we’ve seen. The price has tended to surge in the months following a halving event.

But here’s the analyst’s take: I used to think it was purely a supply-shock mechanism. Now, I believe it’s become something more: a massive, global, self-fulfilling prophecy. Because everyone expects the price to go up after the halving, a huge number of people buy in anticipation. This wave of buying itself drives the price up. The narrative becomes the catalyst. The latest halving in April 2024 has been a major topic in all cryptocurrency news , and its true effects are still playing out.

Is the price rise due to the code, or due to human psychology? The answer is probably a bit of both. And that ambiguity is what makes it so fascinating.

Beyond the Hype | The ‘Boring’ Stuff That Actually Moves Markets

While ETFs and Halvings get all the headlines, the real puppet master is often the global economy. These are the “boring” factors that professional traders watch like hawks.

First up: Interest Rates. Specifically, what the US Federal Reserve does. When interest rates are low, borrowing money is cheap. Investors have more “risk-on” appetite, meaning they’re happy to put money into speculative assets like tech stocks and, yes, Bitcoin. When the Fed raises rates to fight inflation (as they have been doing), borrowing becomes expensive. “Safe” investments like government bonds look more attractive, and money flows out of risky assets. So, when you hear news about the Fed’s decisions, know that it has a direct, and often immediate, impact on the bitcoin price .

Next is Regulation. Governments around the world, especially the US SEC, are still figuring out how to handle crypto. Every announcement, every lawsuit against an exchange, every hint of new rules sends shockwaves through the market. This creates FUD Fear, Uncertainty, and Doubt which can cause panicky sell-offs. In India, we have our own regulatory reality with the 30% tax and 1% TDS, which also shapes local sentiment.

Finally, there’s the big picture: Macroeconomics. Is there a war? Is inflation out of control? Is a major bank about to collapse? During times of global instability, some people flock to Bitcoin, seeing it as a “digital gold” a safe haven asset that isn’t controlled by any single government. Its role in this context is still being debated, but it’s undoubtedly a factor in its price movements. For a deeper dive into financial instruments, you can check out this explanation of a spot market , which is highly relevant to the new Bitcoin ETFs.

So, What Does This Mean for You in India?

Okay, we’ve talked about Wall Street, halving cycles, and the US Fed. But how does this translate to you, sitting in Mumbai, Bangalore, or Delhi, looking at the Bitcoin price in INR ?

First, it means you must think globally. The price on Indian exchanges like WazirX or CoinDCX is directly tied to these international forces. The Rupee-Dollar exchange rate adds another small layer, but the big moves are dictated by the global story.

Second, it underscores the importance of having a clear strategy. Are you day-trading? If so, you need to be glued to macroeconomic news. Are you investing in Bitcoin for the long term (5-10 years)? If so, the daily noise of Fed announcements and ETF flows becomes less important. Your focus should be on the bigger picture: technology adoption, network security, and the long-term narrative.

A common mistake I see people make is mixing these two approaches buying with a long-term belief but panicking based on short-term news. Understand the game you’re playing. Given India’s tax structure, which heavily penalizes short-term trading, a long-term perspective might be more prudent for most. Understanding financial news, like a BEL dividend record date , can help you appreciate the difference between short-term events and long-term value in any asset class.

Frequently Asked Questions (The Coffee Shop Q&A)

So, is it a good time to buy Bitcoin now?

That’s the million-dollar question, isn’t it? The honest answer is: nobody knows for sure. Instead of asking “when” to buy, a better question is “why” you are buying. If you believe in the long-term potential and have done your research, a strategy called Dollar-Cost Averaging (DCA), where you invest a fixed amount regularly, can be a way to manage volatility.

What is the biggest risk to the Bitcoin price?

Right now, the biggest risk is arguably regulatory uncertainty. A severe, coordinated crackdown by major governments like the US could have a significant negative impact. The other is a potential failure in the broader crypto ecosystem (like a major exchange collapsing), which can damage trust across the board.

Why does the price sometimes crash for no reason?

It almost always has a reason, it’s just not always obvious. A “flash crash” can be caused by a large “whale” (a person or entity holding a lot of Bitcoin) selling a massive amount at once, triggering a cascade of automated sell orders. It can also be a reaction to a rumour or a piece of news from the other side of the world that you haven’t seen yet.

How does the Bitcoin price in India differ from the US price?

There can be slight differences due to local demand, supply, and exchange fees, a phenomenon known as “arbitrage.” However, these gaps usually close quickly. The main difference for you is the conversion from USD to INR, which means the Rupee’s strength or weakness against the Dollar also plays a small role.

The bitcoin price is more than a number on a screen. It’s a real-time reflection of human hope, fear, technological innovation, and old-school economics clashing on a global scale.

Watching the price is fine. But understanding the forces behind it? That’s where the real power lies. It turns you from a passenger on a rollercoaster into someone who can at least read the map of the tracks ahead. And in this crazy market, that makes all the difference.