Bandhan TVS Credit Loan Details

So, you’re thinking about a loan from Bandhan TVS Credit ? Let’s be honest, wading through the world of finance can feel like trying to navigate a crowded marketplace blindfolded. All the jargon, interest rates, and hidden fees… it’s enough to make anyone’s head spin. But fear not! We are here to break it down, not just telling you what Bandhan TVS Credit offers, but why it might matter to you, especially if you’re an entrepreneur or someone in the rural or semi-urban areas of India.

What is Bandhan TVS Credit?

Bandhan TVS Credit is essentially a collaboration – a strategic alliance, if you will – between Bandhan Bank, a name synonymous with microfinance and reaching the unbanked, and TVS Credit Services, known for vehicle financing. It’s like when your two favourite superheroes team up – you expect something powerful. In this case, it’s about bringing financial solutions to those who might not easily get them from traditional banks. They focus on providing loans for two-wheelers, three-wheelers, and used cars, primarily targeting individuals in rural and semi-urban locations. Think of it as a financial bridge, linking aspirations to opportunities.

Why Bandhan TVS Credit Matters | The ‘Why’ Angle

Here’s the thing: access to credit is often the lifeblood of small businesses and individual entrepreneurship, especially in Bharat. The availability of Bandhan TVS Credit loan products empowers individuals to purchase vehicles for personal or commercial use, which boosts income generation. For instance, a tailor in a village can now afford a scooter to collect and deliver fabrics, increasing his efficiency and earning potential. Or a small shop owner can invest in a used car for deliveries.

But, why Bandhan TVS Credit and not someone else? What fascinates me is their approach. Many traditional lenders shy away from rural and semi-urban markets due to perceived risks and logistical challenges. Bandhan TVS Credit steps right in, leveraging the deep understanding of local markets and customer needs that Bandhan Bank has cultivated over the years. It’s not just about lending money; it’s about building relationships and fostering financial inclusion. This commitment to financial inclusion differentiates them.

And speaking of perceived risks, Bandhan TVS Credit utilizes innovative risk assessment methodologies to evaluate loan applications, making credit accessible to individuals who may not have a formal credit history or collateral. They look beyond traditional credit scores and focus on the applicant’s repayment capacity and potential for income generation. What a refreshing approach!

Loan Products Offered

Now, let’s dive into the nitty-gritty – the specific loan products. While the exact offerings may vary, typically Bandhan TVS Credit focuses on vehicle loans. This includes:

- Two-Wheeler Loans: For purchasing scooters, motorcycles, and other two-wheeled vehicles, either for personal use or as a source of income (e.g., for delivery services).

- Three-Wheeler Loans: Catering to auto-rickshaw drivers and small business owners who use three-wheelers for transportation or commercial purposes.

- Used Car Loans: Providing financing for the purchase of pre-owned cars, making vehicle ownership more affordable for a wider range of individuals.

Bandhan TVS Credit eligibility often requires minimal documentation and offers faster processing times compared to traditional banks. A common mistake I see people make is not gathering all required documents beforehand. Keep your ID proof, address proof, income proof, and vehicle-related documents ready. This will speed up the loan application process. The interest rates are competitive and repayment options are flexible, making it easier for borrowers to manage their finances.

Remember to always compare the Bandhan TVS Credit interest rates with other lenders to ensure you’re getting the best deal. Also, pay close attention to any processing fees or other charges associated with the loan.

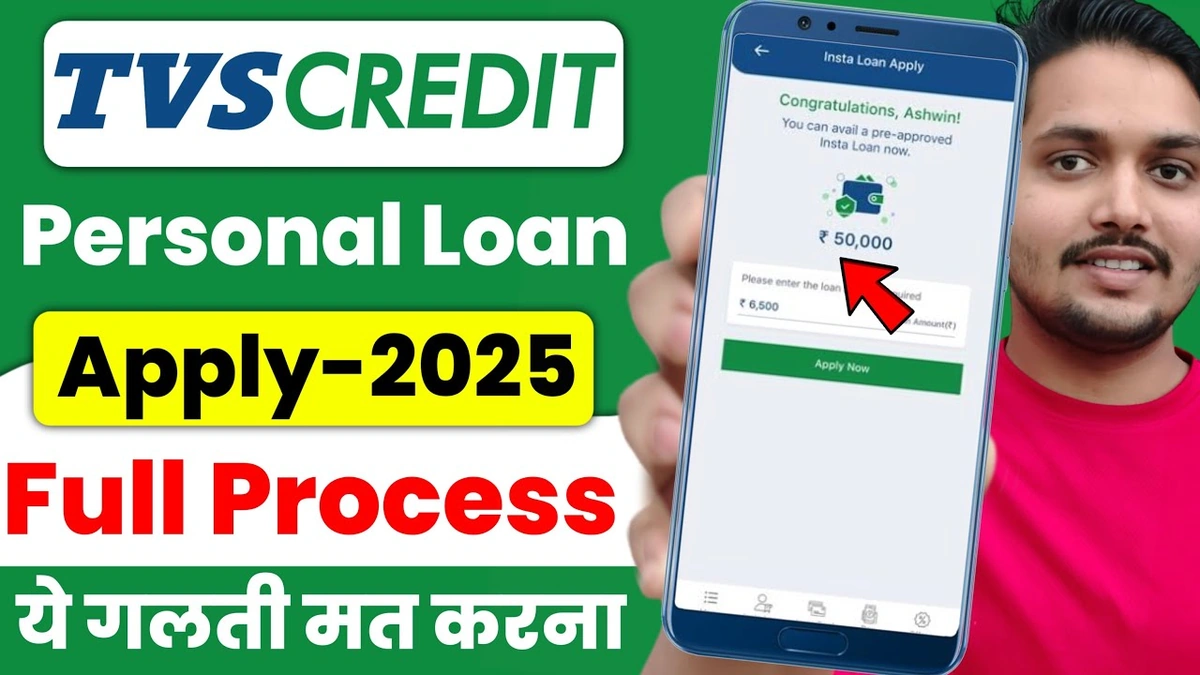

How to Apply for a Loan

So, you’re ready to apply? Here’s a general idea of how it works, though the specifics can vary:

- Visit a Bandhan TVS Credit branch or an authorized dealer.

- Fill out the application form and submit the required documents.

- The loan officer will verify your documents and assess your eligibility.

- If approved, you’ll receive a loan offer with the terms and conditions.

- Once you accept the offer, the loan amount will be disbursed.

I initially thought this was straightforward, but then I realized the importance of being prepared for the documentation. Make sure you have all your documents ready before applying, because this can save you time and hassle. For further information visit TVS Credit Official Website

Factors to Consider Before Applying

Before you jump in, pause for a moment. Getting a loan is a big decision, and it’s crucial to consider a few key factors:

- Affordability: Can you comfortably afford the monthly EMI payments without straining your budget?

- Purpose: Is the loan for a productive purpose that will generate income or improve your quality of life?

- Terms and Conditions: Have you carefully read and understood the loan agreement, including the interest rate, repayment schedule, and any associated fees?

- Alternatives: Have you explored other financing options, such as microfinance institutions or government schemes?

A common mistake I see people make is jumping into a loan without fully understanding the terms and conditions. Bandhan TVS Credit customer care is available to assist with any questions or concerns you may have.

The Future of Rural Finance

What fascinates me is the broader picture. Bandhan TVS Credit is more than just a lender; it’s part of a growing movement to democratize finance and empower individuals in rural India. By providing access to credit, they’re helping to unlock the potential of countless entrepreneurs and small businesses. Financial inclusion is not just a buzzword; it’s a fundamental building block for a more equitable and prosperous society.

According to the latest data on the Reserve Bank of India (RBI) website, the financial inclusion rate in India has been steadily increasing. Initiatives like Bandhan TVS Credit play a crucial role in bridging the gap and reaching underserved communities.

Check out today’s market movers! And, if you’re considering other investment options, explore IPO opportunities! Remember, smart financial decisions require informed choices.

FAQ Section

Frequently Asked Questions

What is the maximum loan amount I can get from Bandhan TVS Credit?

The maximum loan amount varies depending on the type of vehicle and your eligibility. Contact a Bandhan TVS Credit representative for specific details.

What if I have a low credit score?

Bandhan TVS Credit considers factors beyond just your credit score, such as your repayment capacity and income potential.

What documents do I need to apply for a loan?

Typically, you’ll need ID proof, address proof, income proof, and vehicle-related documents.

How long does it take to get a loan approved?

Processing times can vary, but Bandhan TVS Credit aims for faster approval compared to traditional banks.

Can I repay my loan early?

Yes, but there may be prepayment charges. Check with Bandhan TVS Credit for the specific terms.

So, there you have it – a deeper dive into the world of Bandhan TVS Credit. It’s about more than just loans; it’s about empowering individuals and fueling economic growth in rural India. The next time you see a two-wheeler or three-wheeler zipping down a rural road, remember that it might just be a vehicle of opportunity, thanks to initiatives like this. Bandhan TVS Credit loan EMI options are designed to be affordable and manageable, making it easier for borrowers to repay their loans on time.