Decoding the ATGL Share Price Puzzle | What’s Really Going On?

Alright, let’s talk Adani Green Energy Limited (ATGL). Specifically, the ATGL share price . You’ve probably seen the headlines, the fluctuations, maybe even felt a little dizzy trying to keep up. But here’s the thing: simply knowing the price isn’t enough. We need to understand why it’s moving, and what that means for the bigger picture, especially considering India’s ambitious renewable energy goals. Let’s be honest – it’s more than just numbers on a screen; it’s about the future of energy in our country.

The Rollercoaster Ride | Understanding Market Sentiment

The stock market , especially when it comes to green energy, can feel like a rollercoaster. One day, everything’s up; the next, it’s a nosedive. A major factor influencing the ATGL share price is market sentiment. News, government policies related to renewable energy , and even global economic trends can create waves of optimism or pessimism. For instance, announcements about new solar projects or favorable regulations can send the price soaring. But, whispers of policy changes or economic uncertainty? Brace yourself.

But here’s where it gets interesting. It’s not always rational. Sometimes, the market overreacts, driven by fear or greed. Understanding this emotional undercurrent is crucial. Are investors genuinely assessing the company’s long-term potential, or are they just jumping on the bandwagon?

Digging Deeper | ATGL’s Fundamentals and Future Prospects

Beyond the daily fluctuations, let’s look at the fundamentals. Is ATGL actually a solid company? What’s its growth potential? Key factors to consider include its project pipeline, technological advancements, and financial health. According to the company’s latest annual report (check the official Adani Green Energy website for the most up-to-date information), they are aggressively expanding their renewable energy capacity. What fascinates me is how quickly they are scaling up.

Let me rephrase that for clarity: the size and scope of their projects are impressive, but that also brings challenges. Financing these massive undertakings requires significant capital, which can impact profitability in the short term. The Adani Group ‘s overall financial health also indirectly impacts investor confidence in ATGL. And let’s not forget about the competition. The renewable energy sector in India is becoming increasingly crowded, with both domestic and international players vying for market share.

It’s a complex equation, and that’s something I’ve learned after years of analysis. I initially thought this was straightforward, but then I realized the importance of government incentives for green energy. The government’s support is paramount. Without favorable policies and subsidies, renewable energy projects simply wouldn’t be viable. The recent increase in import duties on solar panels, for example, could have a ripple effect on the entire sector. Adani Green is heavily invested in Solar projects, so it is likely to be affected by such policies.

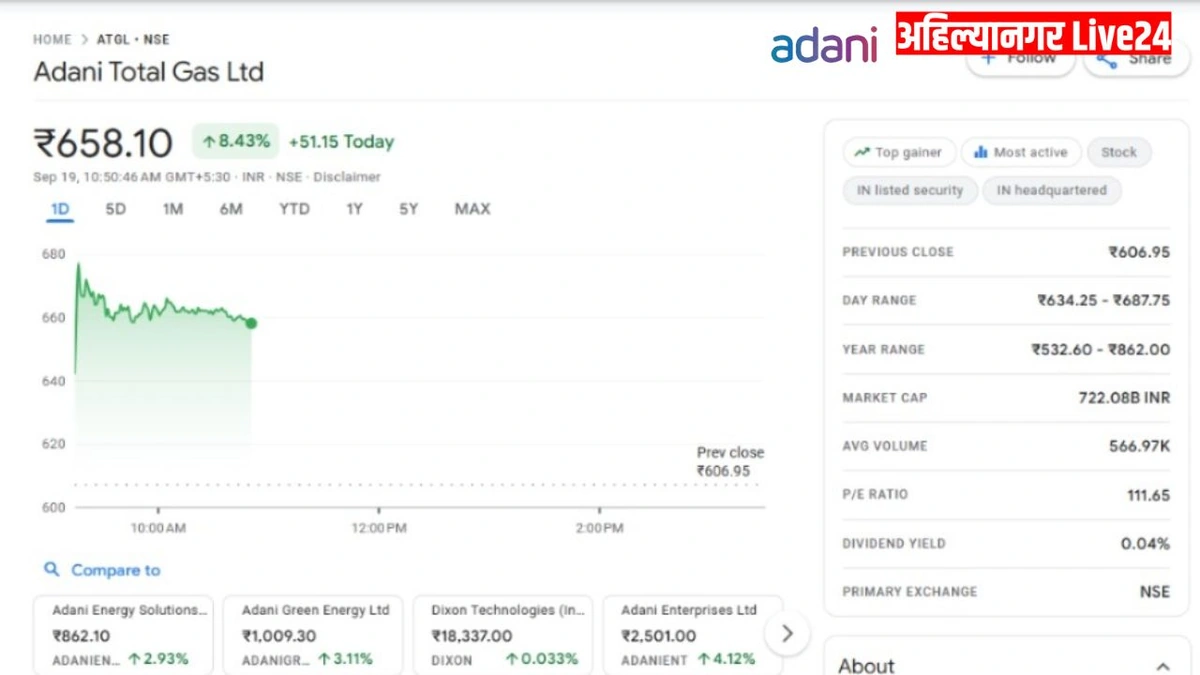

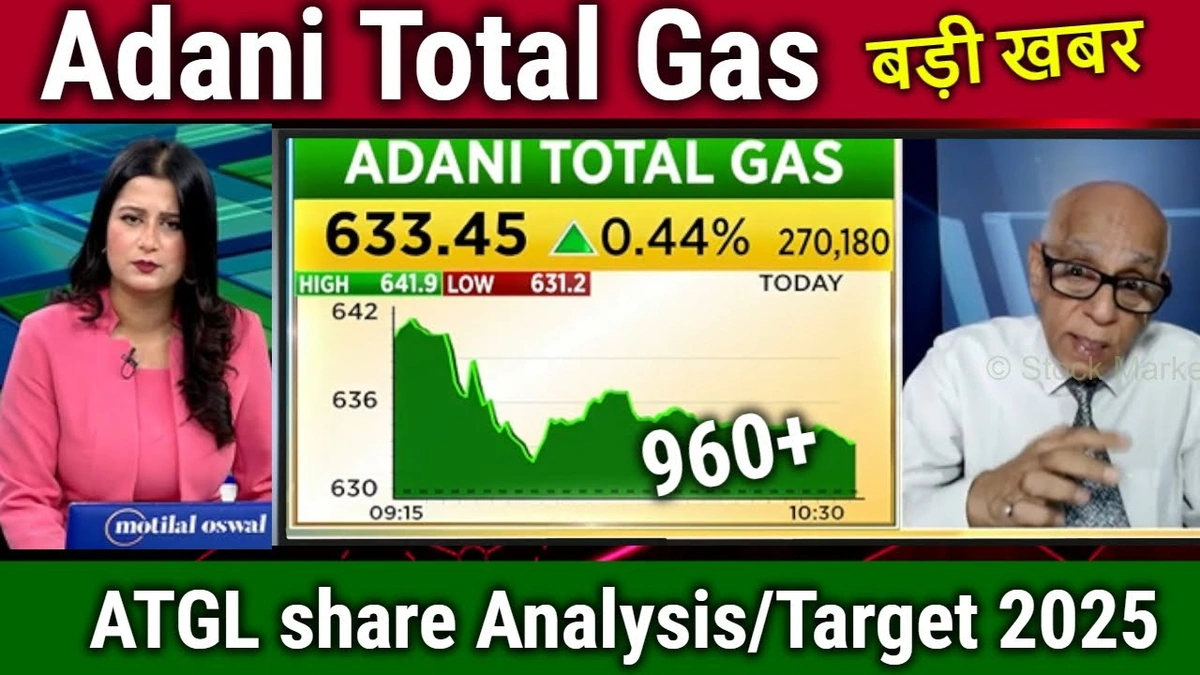

Reading the Tea Leaves | Technical Analysis and Trends

Now, for those who are a little more technically inclined, let’s talk about technical analysis. This involves studying charts and patterns to predict future price movements. Things like moving averages, support and resistance levels, and trading volume can provide clues about the direction of the ATGL stock .

But here’s the thing: technical analysis is not foolproof. It’s more of an art than a science. A common mistake I see people make is relying solely on technical indicators without considering the underlying fundamentals. The best approach is to combine both fundamental and technical analysis for a more well-rounded perspective. For example, a sudden surge in trading volume could indicate strong buying pressure, but it’s essential to understand why investors are suddenly interested. Is it based on concrete news, or is it just a speculative bubble?

And so, keeping up with stock market trends is vital for making informed investment decisions.

The Long Game | Investing in a Sustainable Future

Ultimately, investing in ATGL is not just about making a quick buck. It’s about investing in a sustainable future for India. As per the guidelines mentioned in the Indian government’s climate change action plan, the country has committed to ambitious renewable energy targets. This creates a massive opportunity for companies like ATGL. However, it also comes with risks. The renewable energy sector is still relatively young, and technological advancements are constantly disrupting the landscape.

One thing you absolutely must double-check when evaluating any green energy investment is the company’s commitment to environmental, social, and governance (ESG) factors. Are they truly committed to sustainability, or are they just greenwashing? Dig deep, read their reports, and see if their actions match their words. Remember, true value comes not just from financial returns, but also from making a positive impact on the planet. Check out trending today for more information.

Navigating the Volatility | Practical Tips for Investors

Okay, so what does all of this mean for you, the potential investor? Here are a few practical tips for navigating the volatility of the ATGL share price:

- Do your research: Don’t just rely on hearsay or tips from friends. Understand the company, its industry, and the overall market trends.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different sectors and asset classes.

- Have a long-term perspective: Don’t panic sell when the market dips. Investing in renewable energy is a long-term game.

- Seek professional advice: If you’re unsure, consult a financial advisor who can help you make informed decisions.

The one thing you absolutely must double-check on your portfolio before investing in a new stock, is the level of risk you are willing to take.

FAQ

Frequently Asked Questions About ATGL Share Price

What factors influence the ATGL share price?

Market sentiment, government policies related to renewable energy, company financials, and global economic trends all play a role.

Is ATGL a good long-term investment?

ATGL has potential given India’s renewable energy goals, but requires careful consideration of the company’s financials and sector risks.

How can I stay updated on the ATGL share price?

Track it through financial websites like Google Finance, the Bombay Stock Exchange (BSE), or the National Stock Exchange (NSE).

Where can I find reliable information about ATGL’s financials?

Review their official annual reports and investor relations section on the Adani Green Energy website.

Should I invest in ATGL now?

Investment decisions should be made based on your individual risk tolerance, financial goals, and thorough research. Consult with a financial advisor if needed.

So, there you have it. The ATGL share price is a complex puzzle, but by understanding the underlying factors, you can make more informed decisions. Remember, it’s not just about the numbers; it’s about the future of energy and our planet. It is also imperative to remember to always perform due diligence before investing in any stock.