Decoding Apple Stock | Why It’s More Than Just a Fruit Company

Okay, let’s talk apple stock . But not in that boring, numbers-only way. Forget the daily tickers for a minute. What fascinates me is the why behind the movements. Why does apple stock performance trigger such intense reactions, both positive and negative? And more importantly, what can Indian investors learn from it?

The thing is, Apple isn’t just a tech company; it’s a cultural phenomenon. It’s about brand loyalty, ecosystem lock-in, and that feeling you get unboxing a new iPhone. That’s the secret sauce that makes Apple different.

The Apple Ecosystem | More Than Just Gadgets

We often hear about Apple’s product lines: iPhones, iPads, Macs, and now, even cars rumored to be on the horizon. But here’s the key: it’s the integration that keeps people hooked. Think about it – your photos seamlessly sync across devices, your passwords are saved in iCloud Keychain, and everything just…works. Well, mostly. This tightly knit ecosystem is a massive moat protecting Apple’s market share.

Consider the impact of Apple services . Apple Music, Apple TV+, iCloud, and the App Store generate recurring revenue. This diversification away from solely relying on hardware sales is a smart move, especially as smartphone innovation plateaus. But how does this translate to apple stock value ? Predictable revenue streams are Wall Street’s darlings. They provide stability and allow for better forecasting.

The Genius of Tim Cook | Supply Chains and Strategic Vision

Let’s be honest, when Steve Jobs passed away, many wondered if Apple could maintain its innovative edge. Tim Cook has proven to be a master strategist, focusing on operational efficiency and expanding into new markets. His expertise in supply chain management has been crucial in navigating global challenges like chip shortages and trade tensions. This operational excellence is a significant reason for the sustained share price of Apple .

And, of course, Apple’s forays into India are noteworthy. The company is aggressively expanding its retail presence and manufacturing capabilities in the country. India represents a massive growth opportunity. As disposable incomes rise, more Indians are willing to splurge on premium devices. This market expansion is absolutely critical for long-term growth. Link 1

What Wall Street Is Really Watching (And You Should Be Too)

I initially thought understanding Apple’s financial reports was straightforward, but then I realized how much Wall Street analysts focus on specific metrics. One is the average selling price (ASP) of iPhones. A higher ASP indicates that consumers are opting for more expensive models, which boosts revenue. Another key indicator is gross margin, which reveals how efficiently Apple is producing its goods.

Don’t just look at the headline numbers. Dig deeper into the earnings reports and analyst calls. What are the key risks and opportunities management is highlighting? What are the trends in customer acquisition and retention? According to a recent report by Morgan Stanley (Morgan Stanley Website) , Apple’s ability to innovate in services will be a major driver of future growth. Keep in mind stock market analysis Apple , demands a thorough and comprehensive approach.

The Risks | Innovation, Competition, and Regulatory Scrutiny

Of course, it’s not all sunshine and roses. Apple faces several challenges. One is the increasing regulatory scrutiny over its App Store practices. Regulators around the world are questioning whether Apple is using its market power to stifle competition.

The competitive landscape is also fierce. Samsung, Google, and other rivals are constantly launching new devices and services. And while Apple has been relatively successful in defending its market share, there’s no guarantee it will continue to do so. And Link 2 , don’t underestimate the risk of a major product flop. Apple’s track record is impressive, but even the best companies make mistakes.

Consider also the future of apple and the technological advancements in the industry. While Apple is a giant, it must continue to innovate and adapt to changing consumer preferences. The rise of AI and augmented reality presents both opportunities and threats. Can Apple stay ahead of the curve?

FAQ About Apple Stock

Frequently Asked Questions

Is Apple stock a good investment for beginners?

Apple is generally considered a stable investment, but like all stocks, it carries risk. Diversify your portfolio.

What factors can affect the price of Apple stock?

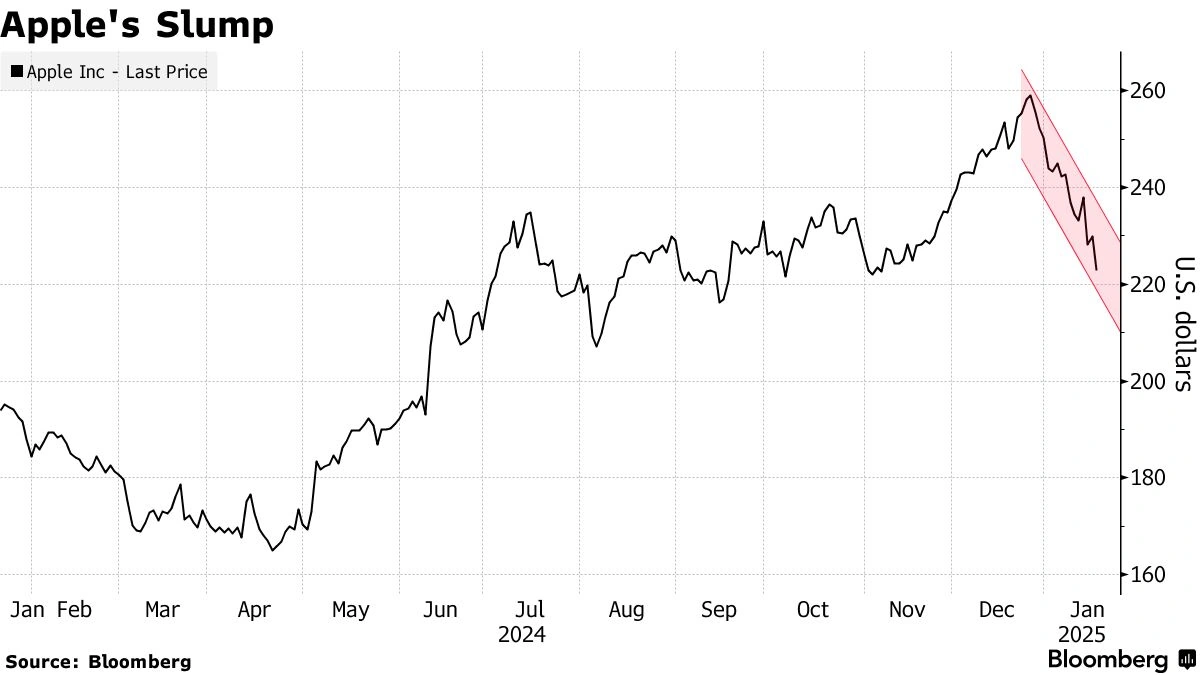

New product launches, economic conditions, and competition all influence Apple’s stock price.

How often does Apple pay dividends?

Apple typically pays dividends quarterly.

Where can I buy Apple stock in India?

You can buy U.S. stocks, including Apple, through online brokerage accounts that offer international trading.

What are the risks of investing in Apple stock?

Competition, regulatory issues, and economic downturns pose risks to Apple’s stock performance.

How do I stay updated on Apple stock news?

Follow reputable financial news sources and analyst reports for the latest updates.

So, is investing in apple stock a good idea? It depends on your individual circumstances and risk tolerance. But understanding the company’s ecosystem, strategic vision, and potential risks is essential for making informed decisions.

Ultimately, Apple’s story is about more than just tech. It’s about the power of branding, the importance of customer loyalty, and the never-ending pursuit of innovation. And that’s why apple stock analysis is relevant to anyone interested in understanding the dynamics of the modern economy.