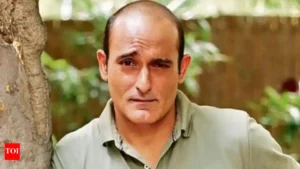

The Anil Ambani Story | More Than Just a Fall From Grace

Anil Ambani. The name once conjured images of power, wealth, and the relentless ambition of a business titan. But let’s be honest, the narrative has shifted. It’s no longer about soaring stock prices and groundbreaking deals. It’s about…well, something far more complex and, dare I say, fascinating.

We’ve all seen the headlines. The debt, the legal battles, the questions about his empire. But here’s the thing: focusing solely on the ‘what’ misses the crucial ‘why’. Why did this happen? What lessons can we, as investors and observers of the Indian business landscape, learn from the Anil Ambani saga? That’s what I want to dive into.

Understanding the Telecom Tumble | What Went Wrong?

The telecom sector in India is brutal. Fiercely competitive. A battleground where only the strongest survive. And that’s where a significant chunk of Anil Ambani’s troubles began. Reliance Communications (RCom), once a major player, found itself struggling against rivals like Airtel and Vodafone Idea.

But it wasn’t just competition. Regulatory changes, aggressive pricing strategies by new entrants (remember Jio’s disruptive entry?), and a mountain of debt all contributed to RCom’s downfall. A common mistake I see people make is underestimating the impact of regulatory shifts on business models. RCom, burdened by legacy debt and unable to adapt quickly enough, simply couldn’t keep up. According to a report by the Telecom Regulatory Authority of India (TRAI) , the telecom sector witnessed unprecedented consolidation during this period.

The Debt Trap | How Leverage Turned Against Him

Leverage. It’s a double-edged sword. When things are going well, debt can amplify returns, turbocharging growth. But when the tide turns, that same leverage can become a crushing weight. Reliance Group companies, under Anil Ambani , heavily relied on debt to fund ambitious projects.

And here’s where the “why” comes in again. Why so much debt? Was it overconfidence? Pressure to live up to his brother Mukesh’s success? A belief that the Indian economy would continue its breakneck growth trajectory indefinitely? Whatever the reasons, the debt proved unsustainable when projects stalled and revenues faltered. Let’s be honest, sometimes even the smartest minds can misjudge risk.

Beyond Telecom | Diversification Dilemmas

The Reliance Group wasn’t just about telecom. It had interests in power, infrastructure, entertainment, and financial services. Diversification, in theory, reduces risk. But in practice, it can stretch resources and dilute focus. And, sometimes, you end up spreading yourself too thin.

What fascinates me is the interplay between these different sectors. When one sector falters (like telecom), it can create a domino effect, impacting other parts of the group. Maintaining profitability across such a diverse portfolio requires exceptional management skills and a deep understanding of each industry. Something, with hindsight, appears to have been lacking.

Personal Guarantees and the Courts | A Rocky Road

Here’s a detail that often gets overlooked: personal guarantees. Anil Ambani provided personal guarantees for some of the loans taken by his companies. This meant that he was personally liable for those debts. When the companies defaulted, creditors came after him.

The legal battles that followed have been long, complex, and very public. The courts have weighed in on issues of bankruptcy, insolvency, and the extent of his personal liability. These legal proceedings have significantly impacted his net worth and reputation. It’s a stark reminder of the risks associated with personal guarantees, especially in highly leveraged businesses.

Lessons Learned | What Can We Take Away?

So, what’s the takeaway from the Anil Ambani story? It’s not just about a single individual’s rise and fall. It’s a cautionary tale about the dangers of excessive leverage, the importance of adapting to changing market conditions, and the need for prudent risk management. And a lesson from today’s bank holiday .

The Indian business landscape is dynamic and unforgiving. Success requires not only vision and ambition, but also discipline, resilience, and a healthy dose of humility. The financial troubles faced by Anil Ambani serve as a critical case study for entrepreneurs, investors, and anyone interested in understanding the complexities of the Indian economy. In the ever-evolving landscape of Indian business, the story of Anil Ambani’s Reliance Group stands as a reminder of the importance of adaptability and strategic foresight. It’s not enough to be brilliant; you also need to be wise. His journey highlights the risks inherent in high-stakes business and the critical need for sound financial planning. And don’t forget to check latest IPO news .

FAQ

What were the primary reasons for Reliance Communications’ downfall?

Aggressive competition in the telecom sector, regulatory changes, disruptive pricing strategies, and a large debt burden all contributed to RCom’s financial struggles.

What is the significance of personal guarantees in this case?

Anil Ambani’s personal guarantees made him personally liable for the debts of his companies, leading to legal battles and impacting his personal wealth.

How did diversification strategies impact the Reliance Group?

While diversification aimed to reduce risk, it may have stretched resources and diluted focus, contributing to challenges when certain sectors underperformed.

What is the biggest lesson from the Anil Ambani story?

The story highlights the dangers of excessive leverage, the importance of adapting to market changes, and the necessity of prudent risk management in business.

Where can I find more information about Reliance Communications’ debt?

Information on RCom’s debt can be found in financial reports, regulatory filings, and news articles covering the company’s financial performance.

What is Anil Ambani’s current net worth ?

Anil Ambani’s current net worth is not clear because the details are always changing, but you can follow the updates about the Reliance Group’s financial situation from different business news media.