Decoding the USD to INR Dance | Why Your Wallet Feels the Rhythm

Ever felt like your expenses in India are doing a little jig depending on the day? Chances are, the USD to INR exchange rate is the choreographer. It’s not just some number you see on Google; it’s a force that impacts everything from the price of your imported gadgets to whether your cousin studying in the US can afford that extra pizza this month. Let’s dive into why this matters to you, and I promise, no economics degree is required.

Why the USD to INR Rate Isn’t Just About Travel Plans

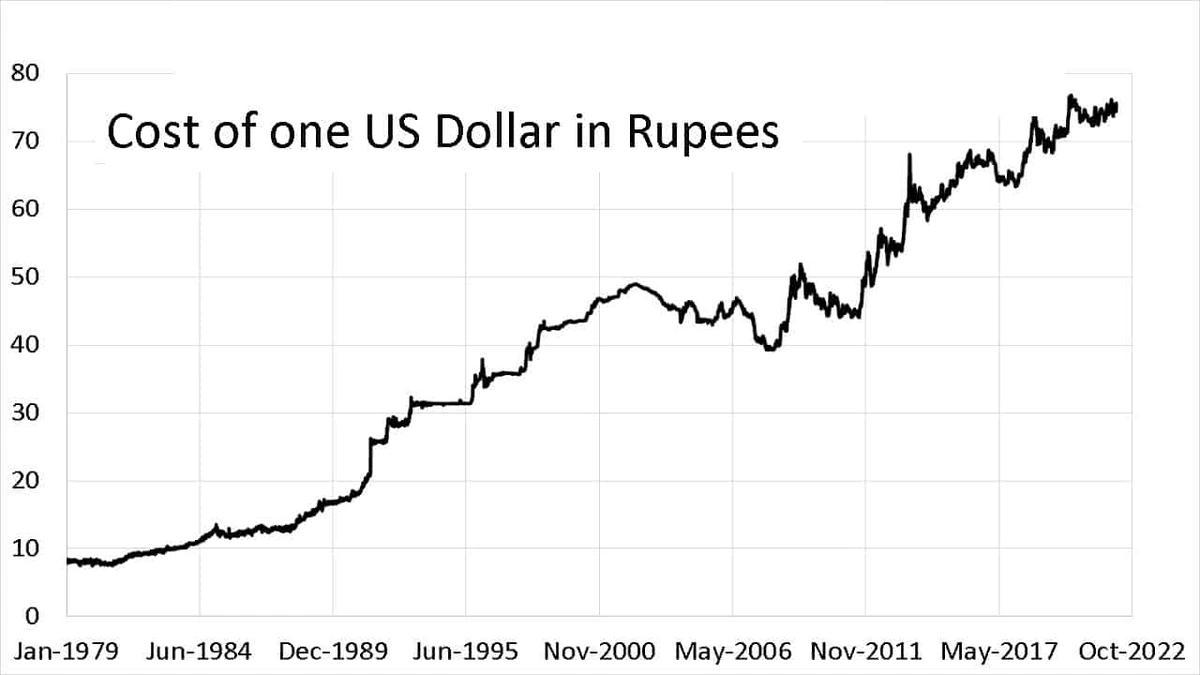

Okay, yes, a strong rupee is great when you’re planning that trip to New York. But here’s the thing: the rupee’s exchange rate impacts far more than just your vacation budget. Think about it – India imports a ton of stuff, from crude oil (the black gold that fuels, well, everything) to fancy electronics. When the rupee weakens (i.e., you need more rupees to buy a dollar), those imports get pricier. And guess who ultimately pays for that? You do, through higher prices at the pump and on store shelves.

But it is also good for the Indian exporters who get more rupees for every dollar earned . And a weaker rupee makes India a more attractive destination for tourists looking for value for money. But the fluctuating INR exchange rate can make it difficult for businesses to plan investments and expansions.

The RBI’s Role | Like a DJ at a Really Important Party

So, who’s in charge of keeping this whole thing from going completely haywire? Enter the Reserve Bank of India (RBI). Their job isn’t to fix the exchange rate at some arbitrary level – that’s a recipe for disaster, trust me. Instead, they try to smooth out the bumps, preventing wild swings that can spook the markets and hurt the economy. According to the latest circular on the Reserve Bank of India website , the RBI uses various tools, like buying or selling dollars, to manage volatility. Think of it like a DJ subtly adjusting the volume to keep the party going without blowing out the speakers. This intervention is important to maintain foreign exchange reserves and overall economic stability.

How Global Events Turn Up the Volume (or Mute It)

Here’s the thing that fascinates me: the USD to INR rate doesn’t exist in a vacuum. It’s constantly reacting to global events. A war in Ukraine? That sends oil prices soaring, weakening the rupee. The US Federal Reserve raising interest rates? That can suck dollars out of India, again weakening the rupee. It’s all connected, like a giant, chaotic Rube Goldberg machine. For example, a major shift in global crude oil prices can lead to immediate volatility.

And, political stability (or instability) plays a big role. A stable government inspires confidence, attracting foreign investment and strengthening the rupee. Political turmoil, on the other hand, can send investors running for the exits, putting downward pressure on the currency. A common mistake I see people make is to ignore these global cues when making financial decisions.

What This Means for Your Pocket (and Your Investments)

Let’s get real: how does all this affect you, sitting in your living room in Mumbai or Delhi? Well, if you’re planning to study abroad, a weaker rupee means your education just got more expensive. If you’re an investor in Indian stocks, a stable rupee generally means a more stable market. A weak rupee impacts importers but benefits exporters. Consider this carefully as you plan your investments.

Now, I know what you’re thinking: is there anything you can do about it? Well, unless you’re the RBI governor, probably not much directly. But understanding the forces at play can help you make smarter financial decisions. For example, maybe delay that big dollar-denominated purchase if the rupee looks particularly weak. Or, if you’re an exporter, take advantage of a strong dollar to boost your sales. Also if you are planning to get into shipping and logistics, take a look at this DG shipping guide India for more details.

Looking Ahead | The Future of the Rupee

So, what’s next for the Indian rupee’s value ? Honestly, anyone who tells you they know for sure is probably trying to sell you something. But, broadly speaking, the rupee’s future will depend on a few key factors: India’s economic growth, global interest rates, and the overall geopolitical climate. If India continues to grow strongly, attracting foreign investment, that will support the rupee. But if global risks rise or India’s growth falters, the rupee could face renewed pressure. These factors affect forex market dynamics and influence long-term trends.

FAQ | Decoding the USD to INR Mystery

What if I forgot my application number?

Contact the relevant authority (e.g., NTA for CSIR NET) immediately and provide as much information as possible to retrieve it.

Where can I find the official notification?

Always check the official website of the exam conducting body (e.g., csirnet.nta.ac.in for CSIR NET).

How often does the USD to INR rate change?

The USD to INR rate fluctuates constantly throughout the day, based on market forces.

What impacts the forex rates in India?

Various global and domestic factors impact exchange rates, including economic growth, interest rates, and political stability.

How can I track the USD to INR rate?

You can track the rate on various financial websites and apps.

Let me rephrase that for clarity, Understanding the ebb and flow of the USD INR exchange rate isn’t about becoming a financial wizard. It’s about being an informed participant in the Indian economy, making smarter decisions for yourself and your family. As the plastics market grows, take a look at this all time plastics share price .