IPO Subscription Status | It’s Not Just a Number. It’s the Market’s Loudest Whisper.

Let’s be honest. If you’ve ever applied for an IPO, you know the ritual. The application is in, the money is blocked, and for the next three days, you become a part-time data analyst. Your browser has one tab permanently open, and you find yourself refreshing it with the kind of obsessive energy usually reserved for cricket scores during the last over.

You watch the numbers climb: 1x, 5x, 20x, 100x. A shot of dopamine hits with every big jump. “This is it,” you think. “This is the one.”

But what are we actually looking at? For most of us, the ipo subscription status is just a scorecard. A big number means “good,” a small number means “bad.” Simple. But here’s the thing, and this is what separates a casual punter from a savvy investor: that number isn’t just a score. It’s a story. It’s a real-time, high-stakes conversation the entire market is having about a company, and learning to decode it is one of the most powerful tools you can have.

So, grab your coffee. Let’s pull back the curtain and go way beyond the headline number. Let’s talk about what those figures are really whispering to you.

Decoding the Alphabet Soup | QIB, NII, and RII—Who’s Bidding and Why It Matters

Before we can interpret the story, we need to know the characters. When you check the live ipo subscription page, you see the total, but it’s broken down into three cryptic categories: QIB, NII, and RII. Ignoring these is like watching a movie on mute. You see the action, but you miss the entire plot.

- RII (Retail Individual Investors): This is us. You, me, your neighbour who got a hot tip on a WhatsApp group. We are the retail crowd, investing up to ₹2 lakhs. Our collective power is huge, but our sentiment can often be driven by hype and FOMO (Fear Of Missing Out).

- NII (Non-Institutional Investors): Think of these as the “High Net-worth Individuals” or HNIs. They are the high-rollers, investing more than ₹2 lakhs. They’re often experienced investors, business owners, and folks with deep pockets. Their participation signals strong interest, often with an eye on quick listing gains.

- QIB (Qualified Institutional Buyers): This is the most crucial category. These are the big daddies of the market—mutual funds, banks, foreign institutional investors, insurance companies. They have teams of analysts, they do intense due diligence, and they are investing other people’s money. Their participation isn’t based on a whim; it’s a calculated, long-term bet. This is the “smart money.”

Now, why does this breakdown matter? Because a 50x oversubscription driven entirely by retail investors tells a very different story than a 50x oversubscription led by QIBs. One is hype; the other is conviction.

The Story Behind the Numbers | What High (and Low) Subscription Really Tells You

Okay, so we know who’s who. Now, let’s become market psychologists for a minute. What does the behavior of each group signal?

I used to just look at the final number on Day 3. Big mistake. The real insight comes from watching how the story unfolds over the three-day bidding window.

The QIB Signal: The Stamp of Approval

Here’s a pro tip: QIBs are notoriously late to the party. They often wait until the last few hours of Day 3 to show their hand. So, don’t panic if the QIB portion is barely subscribed on Day 1 or Day 2. But if, by the end of Day 3, that QIB number has gone through the roof (say, 50x, 100x, or more)? That is the market’s strongest vote of confidence.

It means the smartest people in the room, after poring over the company’s financials and future prospects, have decided to put serious money behind it. A massive qib nii rii subscription , especially with a strong QIB showing, is perhaps the best indicator of a potentially strong listing and solid long-term fundamentals.

The NII Frenzy: The Appetite for Gains

NIIs are often chasing momentum. A massive NII subscription suggests that the “big players” expect a significant pop on listing day. They’re often leveraging their capital to get a large allotment, hoping to sell on Day 1. This adds fuel to the fire and is a strong indicator of positive market sentiment and a healthy Grey Market Premium (GMP) .

The RII Wave: The Power of Public Hype

A high retail subscription shows the IPO has captured the public’s imagination. It’s fantastic for generating buzz. However, if the RII portion is subscribed 100x but the QIBs have stayed away, it’s a massive red flag. It could mean the company has a great story for the common person but lacks the solid financial footing that institutions demand. This is a classic “hype over substance” scenario.

So, the dream scenario? A balanced, thunderous response from all three categories. That’s when you know you might be onto something special. It’s like a blockbuster movie that gets rave reviews from both critics (QIBs) and the audience (RIIs).

Beyond the Hype | How to Use Subscription Data Like a Pro

Knowing all this is great, but how do you turn it into a smarter decision? It’s not about blindly following the crowd. It’s about using the ipo oversubscription meaning to inform your own strategy.

- Watch the Trend, Not Just the Total: Don’t just check the final number. Watch how it builds. Did the QIB interest suddenly surge in the last two hours? That’s a powerful signal. A steady, building interest is often more sustainable than a sudden, inexplicable spike.

- Cross-Reference with the GMP: The Grey Market Premium is the unofficial price at which IPO shares are traded before listing. A high subscription status usually pumps up the GMP. If the subscription is massive and the GMP is strong and stable, it reinforces the positive sentiment.

- Don’t Forget the Basics: High subscription is exciting, but it doesn’t magically fix a bad business model. Did you read the Red Herring Prospectus (RHP)? Do you understand what the company does? What are the risks? The subscription status is one powerful data point, not the entire thesis. The market can get it wrong. Remember that even a genius like the Perplexity Founder would have his company’s fundamentals scrutinized before an IPO.

- Manage Your Expectations: A ridiculously high subscription (like 200x) drastically reduces your chances of getting an allotment. It’s a lottery. Celebrate the strong signal, but be mentally prepared that you might not get any shares. You can always check nsdl ipo allotment status later to see if you got lucky.

Where to Find the Real-Time Scoop on IPO Subscriptions

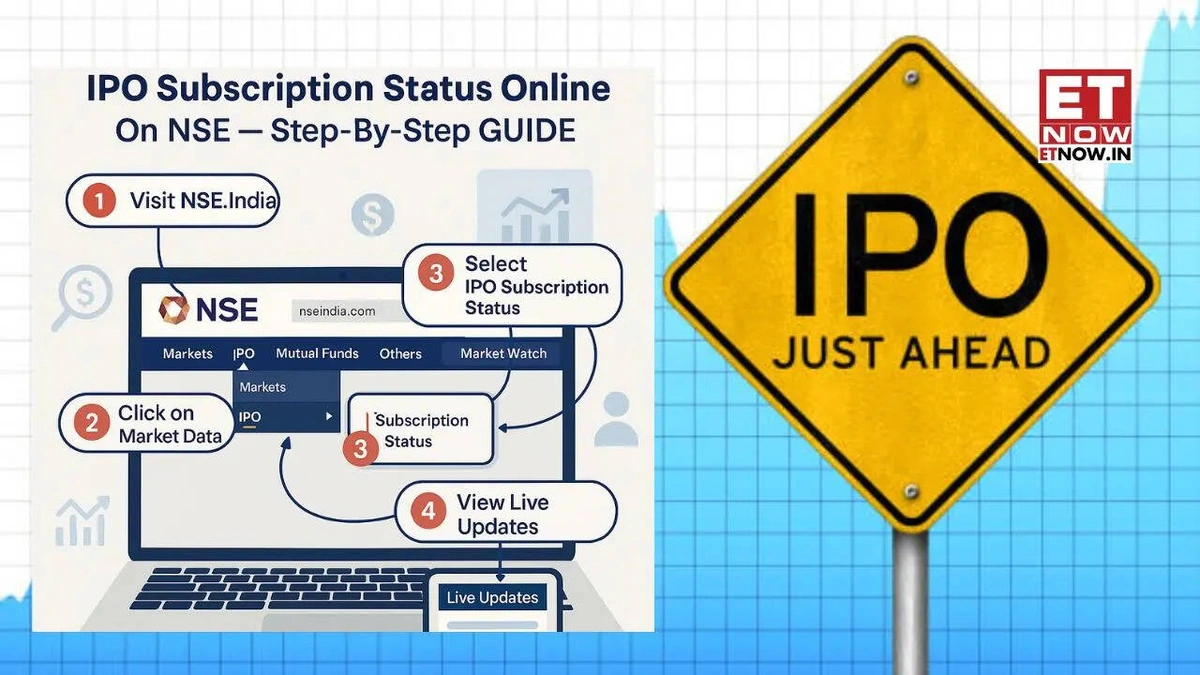

You don’t need a secret source to get this information. The most reliable and authoritative places are the stock exchanges themselves. They provide live, updated data throughout the bidding days.

Your best bets are the official websites of theBSE (Bombay Stock Exchange)and the NSE (National Stock Exchange). Bookmark these pages. Many financial news websites and your own brokerage app also provide a clean, easy-to-read summary of the bse ipo subscription status and nse ipo subscription data.

I personally keep a tab open for both the exchange website and a trusted financial news portal to get the full picture.

Frequently Asked Questions About IPO Subscriptions

What does it mean when an IPO is 100x oversubscribed?

It means that the demand for the company’s shares is 100 times more than the number of shares that were offered in the IPO. It signals massive investor interest but also means the probability of getting an allotment is very low for retail investors.

Does high subscription guarantee I’ll get an allotment?

No, quite the opposite. For the retail (RII) category, if the issue is oversubscribed, the allotment is done via a lottery system. The higher the oversubscription, the more applicants there are for each lot of shares, thus decreasing your individual chances.

Is the QIB subscription more important than the retail (RII) one?

For analytical purposes, yes. While strong retail interest is good, massive QIB participation is considered the “stamp of approval” from sophisticated, well-researched institutional investors. It often indicates a stronger belief in the company’s long-term fundamentals.

Can I check the live subscription status on my broker’s app?

Yes, most major brokerage platforms in India (like Zerodha, Upstox, Angel One, etc.) have a dedicated section for IPOs where they display the live ipo subscription data, which is updated regularly throughout the bidding days.

How does subscription status affect the Grey Market Premium (GMP)?

They have a direct, strong correlation. As the subscription numbers, especially from QIBs and NIIs, start to climb, the GMP usually increases. This is because high demand in the official market signals that there will be strong buying interest once the stock lists, pushing up its unofficial premium.

So, the next time an exciting IPO hits the market, don’t just be a spectator refreshing a page. Be an interpreter. Look past the headline number. Read the story that the QIBs, NIIs, and RIIs are writing with their money.

Because in the chaotic world of the stock market, the ipo subscription status isn’t just noise. If you listen closely, it’s one of the clearest signals you’ll ever get.