Decoding the Rumoured New Income Tax Bill 2025 | What the Government Isn’t Saying Out Loud

Every year, around budget time, the air gets thick with a specific kind of chatter. It’s a mix of hope, anxiety, and a whole lot of jargon. You hear whispers in office corridors and see screaming headlines about tax slabs, deductions, and exemptions. But let’s be honest, most of it feels like noise.

This year, the big phrase doing the rounds is the ” new income tax bill 2025 “. And I get it, your first thought is probably, “Great. More complicated rules to figure out.”

But what if I told you this isn’t just about whether your take-home pay changes by a few thousand rupees? What if this is about something much, much bigger? Let’s sit down, grab a virtual coffee, and unpack the real story. Because what fascinates me isn’t just what might change, but why it might change, and what it signals about the future of your money and the Indian economy.

The Big Picture | Why Bother With a New Tax Bill Anyway?

First things first, why tear down the old house when you can just keep patching it up? Our current tax law, the Income Tax Act of 1961, is exactly that a 60-year-old structure with decades of extensions, patches, and weird additions. It’s become a maze.

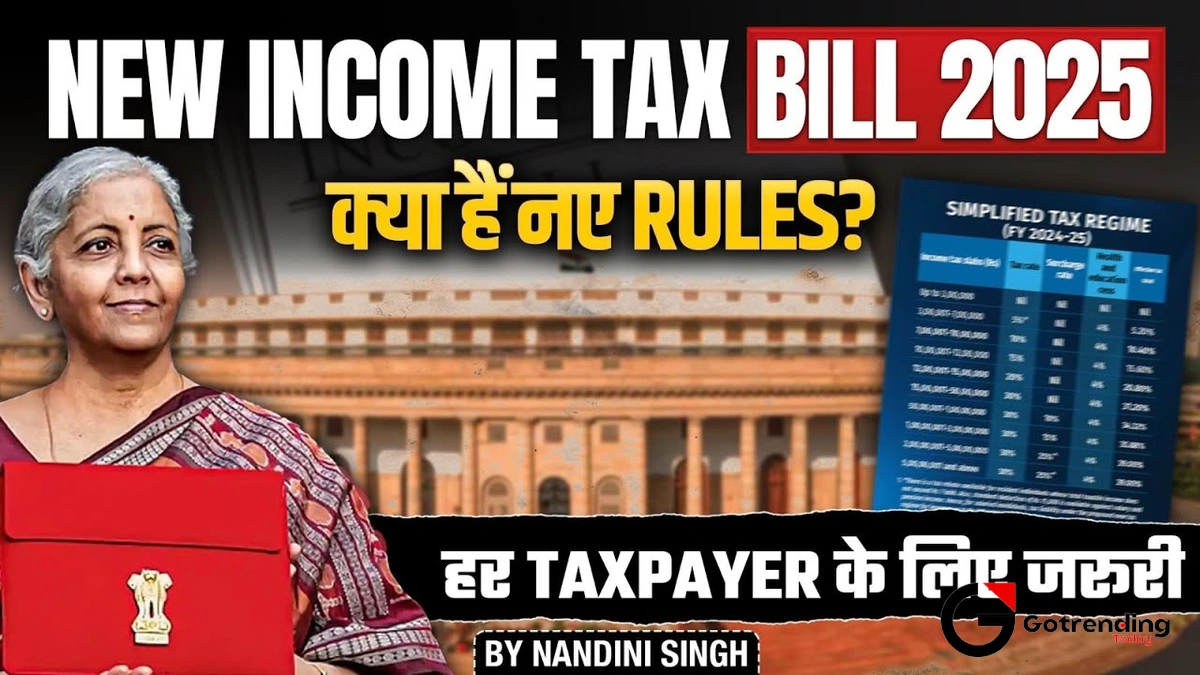

Think about it. We have the “old tax regime,” a labyrinth of deductions under sections like 80C, 80D, and HRA that forces you to become a part-time accountant. Then we have the “new tax regime,” which offers lower rates but asks you to give up most of those deductions. The very existence of this choice is proof that the system is broken. It’s confusing, it’s cumbersome, and it leads to endless debates every financial year.

This is where the idea of a Direct Tax Code (DTC) comes in. It’s been the holy grail of tax reform for over a decade a proposal to scrap the old law and replace it with a single, simplified code. The government’s goal is to make life easier for taxpayers, reduce litigation, and present a cleaner, more attractive system to the world.

So, when you hear talk of a new bill, what you’re really hearing is the drumbeat of a potential DTC 2.0. The government, fresh off an election and with a mandate for economic growth, might finally feel it’s the right time to pull the trigger on this massive overhaul. It’s not just spring cleaning; it’s a complete renovation.

Reading the Tea Leaves | What Could a ‘New Bill’ Actually Change?

Okay, so we know the ‘why’. Now for the juicy part: the ‘what’. Based on committee reports, expert analysis, and the general direction of policy, we can make some educated guesses. And let me be crystal clear here: this is speculation until the Finance Minister officially tables the bill. But understanding the possibilities is key to being prepared.

Possibility 1 | The End of an Era for the Old Tax Regime

This is the big one. There’s a strong chance the government might finally phase out the old, deduction-filled regime. Why? Three reasons.

- Simplicity: A single, default tax system for everyone is the ultimate goal. No more “new tax regime vs old tax regime” calculators.

- Data: When everyone is on a simpler regime, it’s easier for the government to forecast tax collections and analyze economic data.

- Behavioural Economics: The old regime ‘nudged’ you to save in specific instruments (like PPF, ELSS). The new philosophy might be to give you the freedom to choose by putting more cash in your pocket, trusting you to spend or invest it wisely.

The implication? Say goodbye to the annual scramble for 80C proofs. This would be a seismic shift in how the salaried middle class plans its finances.

Possibility 2 | A ‘New and Improved’ Standard Regime

If they do scrap the old system, they can’t just leave the current new regime as it is. It’s not attractive enough for many. So, the next logical step would be to make the default system much sweeter. This could involve:

- Raising the Basic Exemption Limit: Increasing the tax-free income limit from the current ₹3 lakhs to something like ₹5 lakhs or even ₹7 lakhs. This would be a massive, headline-grabbing move to counter the loss of deductions.

- Re-jigging the Slabs: The current tax slabs in India 2025 could be restructured to offer lower rates at different income levels, ensuring that most people feel a net benefit even without exemptions.

This would be the government’s way of saying, “We’re not taking away your benefits; we’re just giving them to you upfront in the form of lower taxes.” It’s a fundamental change in the social contract between the taxpayer and the state.

Possibility 3 | Untangling the Capital Gains Mess

For anyone who invests in stocks, mutual funds, or property, this is a huge deal. Right now, our capital gains tax structure is a mess. We have different tax rates and holding periods for different assets (equity, debt, real estate, etc.). It’s a nightmare to calculate and discourages easy movement of capital.

A new Direct Tax Code would almost certainly aim to unify this. Imagine a simple system: one or two holding periods to define ‘short-term’ and ‘long-term’, and one or two tax rates for each. Such a move would be a massive signal to global and domestic investors that India is serious about creating a stable and predictable investment environment. This is the kind of reform that doesn’t just impact your portfolio, but can boost the entire economy, similar to how major policy shifts can affect everything from big industries like JSW Cement to local markets.

Who Wins, Who Loses? The Real-World Impact on You

Let’s bring this down from 30,000 feet to your living room. What do these potential income tax changes India mean for different people?

- For the Salaried Employee: You might get a higher monthly take-home salary but lose the forced saving habit that 80C created. This means more personal responsibility. You’ll need to be more disciplined about investing for your future without the tax-saving stick.

- For the Freelancer or Business Owner: Life could get much, much simpler. A streamlined tax code means less time spent on compliance and more time spent on your actual work. This is a huge win for the gig economy and small businesses.

- For the Senior Citizen: This is a group to watch. Currently, they enjoy higher exemption limits and benefits like deductions on health insurance. Any new bill would have to be very careful to protect this demographic, perhaps by offering them special, higher exemption slabs.

- For the Investor: A simplified capital gains tax could be a game-changer. It would make tax-loss harvesting easier and portfolio rebalancing a more straightforward affair. It could also influence investment decisions, encouraging a focus on long-term growth across all asset classes, from stocks to property—a sector where values like the Sri Lotus Developers share price are watched closely.

The bottom line is that a shift towards a simpler code favors freedom and personal responsibility over government-guided incentives. It’s a profound philosophical change.

Frequently Asked Questions (The Stuff You’re Really Wondering)

Is a new income tax bill confirmed for 2025?

No, not officially. Right now, it’s strong speculation based on the need for reform and reports from various committees. The final confirmation will only come during the full Union Budget speech. Always rely on official sources like theMinistry of Financefor the final word.

What is the Direct Tax Code (DTC) I keep hearing about?

Think of it as a complete rewrite of India’s direct tax laws. The goal is to replace the old, complicated Income Tax Act of 1961 with a new, simpler, and more modern code that is easier to understand and comply with. It’s a long-pending, major reform.

If this happens, will my 80C investments become useless?

Not useless, but their primary purpose might change. You would invest in PPF, EPF, or insurance for their returns and security, not just for the tax break. The tax benefit would essentially be given to you upfront through a lower tax rate.

Should I stop my tax-saving investments now?

Absolutely not! First, nothing has changed yet. For the current financial year (2024-25), all existing rules apply. Second, these are good investment and insurance products in their own right. Continue your financial planning as usual until there’s an official announcement.

Will standard deduction be removed in the new system?

This is a tricky one. The standard deduction is a key benefit for the salaried class. It’s highly unlikely that it would be removed without a significant corresponding benefit, like a much higher basic exemption limit that more than compensates for its loss.

Ultimately, the talk around the new income tax bill 2025 is more than just an annual budget ritual. It’s a sign that we might be on the cusp of the biggest tax reform in a generation.

It’s a narrative about where India is headed towards a simpler, more transparent, and globally competitive economy that trusts its citizens to make their own financial choices. So, as the budget approaches, don’t just look at the numbers. Look for the story they’re telling. Because that’s the story that will shape your financial future.