Sensex Today | Stock Market LIVE | Tata Capital Debuts with Modest 1.2% Gain

Alright, let’s talk Sensex . You’ve seen the headlines: Tata Capital’s debut, a modest gain, the stock market doing its thing. But here’s the thing – what does it mean for you, sitting there in your chai-stained pajamas, maybe thinking about dipping your toes into the market? Let’s get beyond the noise and break this down. We’re going with the “Why” angle today – because knowing why something is happening is way more powerful than just knowing what is happening.

Why Tata Capital’s Debut Matters (And Doesn’t)

Tata. The name itself carries weight, doesn’t it? So, when Tata Capital lists on the stock exchange, it’s a big deal. Or is it? A 1.2% gain might seem…meh. But here’s where the analyst hat comes on. It’s not just about the percentage. It’s about the signal it sends. Tata Capital’s initial performance reflects investor sentiment towards the NBFC sector in general, and potentially the strength of the Tata brand even in financial services. A strong debut builds confidence, even a “modest” one. But… let’s not get carried away. Initial gains don’t always predict long-term success. Several factors can impact the stock prices such as market volatility and macroeconomics .

So, why might a modest debut actually be a good thing? Well, runaway initial gains can lead to a bubble, followed by a painful correction. A steady, sustainable climb, even if it starts slow, is often a sign of a company with solid fundamentals and realistic expectations. It shows, to some degree, a good stock valuation.

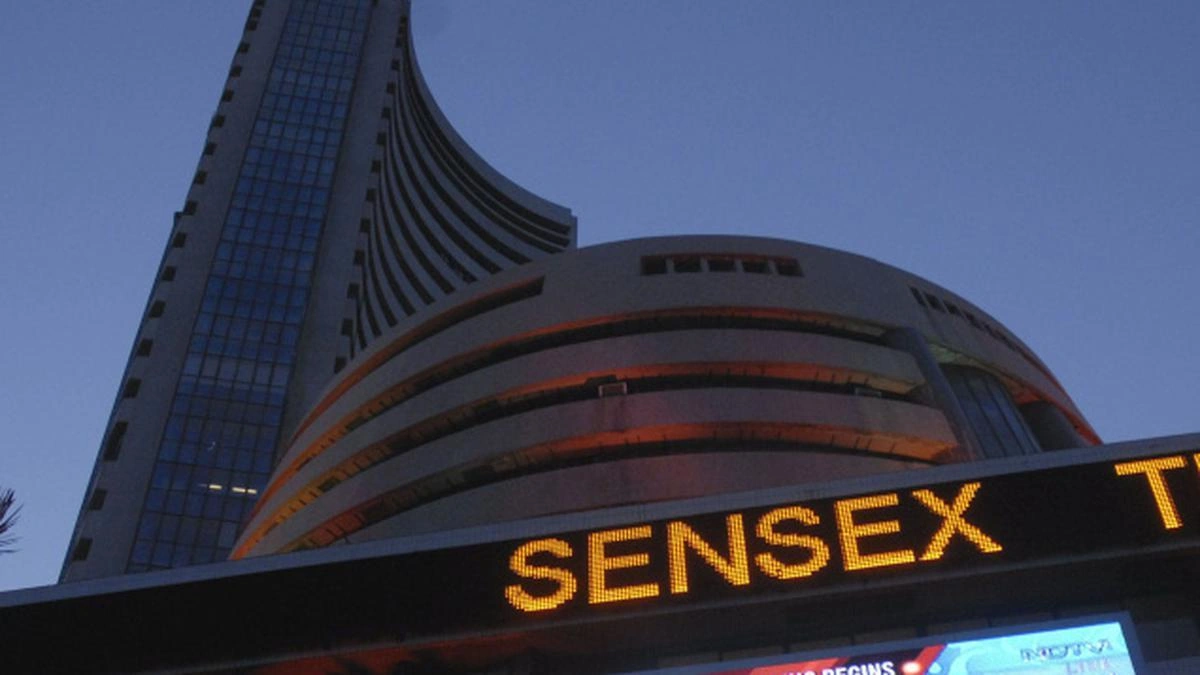

Decoding the Sensex Rollercoaster | Beyond the Numbers

The Sensex itself – that magical number that everyone throws around. What does it really tell you? It’s not a crystal ball, that’s for sure. It’s a snapshot, a weighted average of the top 30 companies listed on the Bombay Stock Exchange (BSE). It is impacted by global cues such asglobal market trends . When the Sensex goes up, it generally means those 30 companies are doing well, and investor confidence is high. When it goes down… well, you get the idea. But the stock market index isn’t the whole story.

What fascinates me is how the Sensex reflects broader economic trends. Interest rate changes, inflation figures, government policies – they all ripple through the market, affecting those 30 companies and, consequently, the Sensex. So, when you see the Sensex jump, it’s not just about those companies; it’s about the overall health (or perceived health) of the Indian economy. And conversely, share prices falling isn’t necessarily doom and gloom.

Sensex, Nifty, and You | What to Actually Pay Attention To

Now, let’s rephrase that. You’ve also probably heard about the Nifty 50. Think of the Nifty as the Sensex’s slightly younger, slightly cooler cousin. It tracks the top 50 companies on the National Stock Exchange (NSE). Both are important benchmarks, and they usually move in the same direction, but they’re not identical. Here’s the thing: as an individual investor, obsessing over the daily fluctuations of either index is a recipe for anxiety. Instead, focus on the long-term trends. Is the Indian economy generally growing? Are companies reporting healthy earnings? These are the questions that matter.

Consider using tools like a stock market tracker to follow the BSE index and understand market movements. Don’t get swayed by every little blip. Remember that investing in the Indian stock market should be viewed as a long-term game.

Navigating Market Volatility | Staying Calm in the Storm

Volatility is the name of the game in the Indian stock market . There will be ups and downs. Days when you feel like a genius, and days when you want to hide under the covers. The key is to not panic. As someone with experience, I’ve seen countless market corrections, crashes, and recoveries. A common mistake I see people make is selling low out of fear. The legendary investor Warren Buffet said “Be fearful when others are greedy and greedy when others are fearful”.

Have a plan. Know your risk tolerance. Diversify your portfolio (don’t put all your eggs in one basket, as they say). And most importantly, invest for the long term. The stock market is not a get-rich-quick scheme; it’s a wealth-building machine, but it takes time and patience. Also, do your homework. Don’t just blindly follow the advice of so-called “experts”. Learn about the companies you’re investing in. Understand their business models, their financials, and their competitive landscape. Knowledge is your best defense against market volatility.

Final Thoughts | The Sensex as a Thermometer, Not a Fortune Teller

The Sensex is a useful tool, but it’s just one piece of the puzzle. Don’t treat it like a fortune teller, predicting your financial future. Think of it as a thermometer, giving you a sense of the overall health of the Indian economy. Stay informed, stay calm, and invest wisely. And remember, it’s a journey, not a destination. And don’t forget to keep that chai handy.

FAQ About the Sensex and Stock Market

What exactly is the Sensex?

The Sensex is a stock market index comprised of the top 30 largest and most actively traded companies on the Bombay Stock Exchange (BSE). It’s a key indicator of the Indian stock market’s overall performance.

How does the Sensex affect my investments?

The Sensex reflects the overall market sentiment. While it doesn’t directly dictate the performance of individual stocks, it can influence investor confidence and market trends.

What if I’m new to investing? Should I care about the Sensex?

Understanding the Sensex can be helpful, but don’t let it overwhelm you. Focus on learning the basics of investing, understanding your risk tolerance, and diversifying your portfolio.

Is investing in the stock market risky?

Yes, all investments carry some level of risk. The stock market can be volatile, and you could lose money. That’s why it’s crucial to do your research, invest for the long term, and not invest more than you can afford to lose.

Where can I get reliable Sensex information?

You can find Sensex information on reputable financial websites, news outlets, and the official BSE website. Always verify information from multiple sources.

How does the Tata Capital initial public offering affect the Sensex?

New stocks coming into the index can impact the overall index. When a company like Tata Capital goes public, it can influence the market capitalization which can indirectly cause volatility. But the immediate effect depends on its performance.