TCS Q2 Results Live | USD Revenue Awaited; Deal Wins Meet Expectations

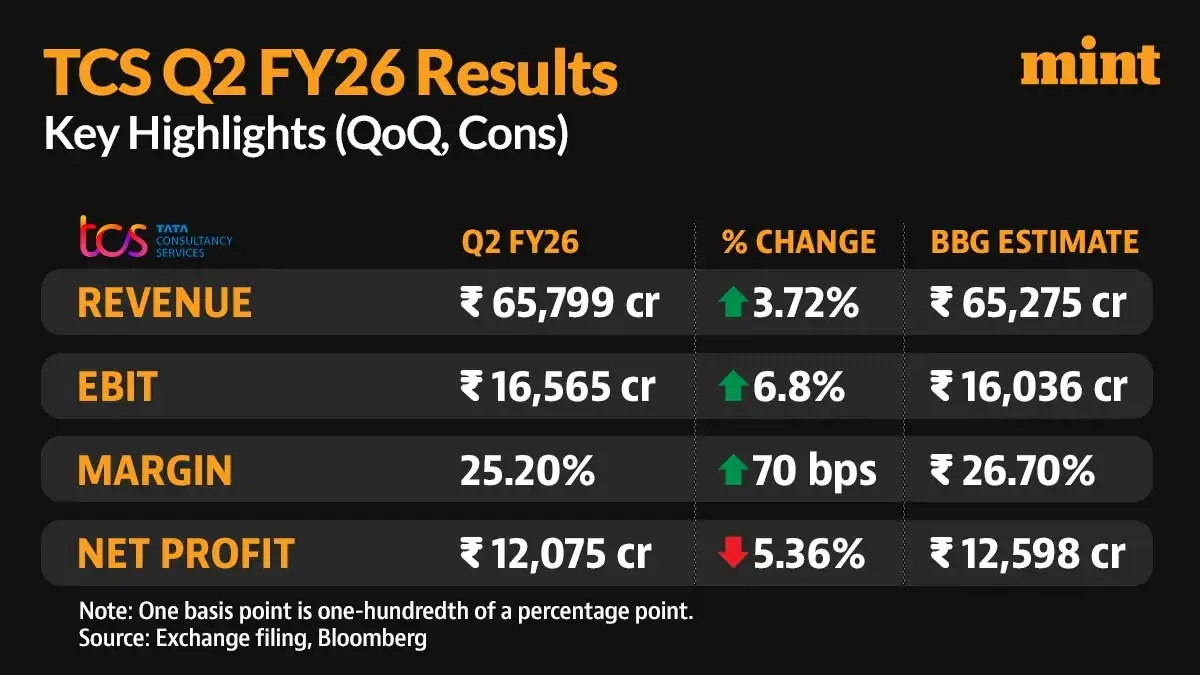

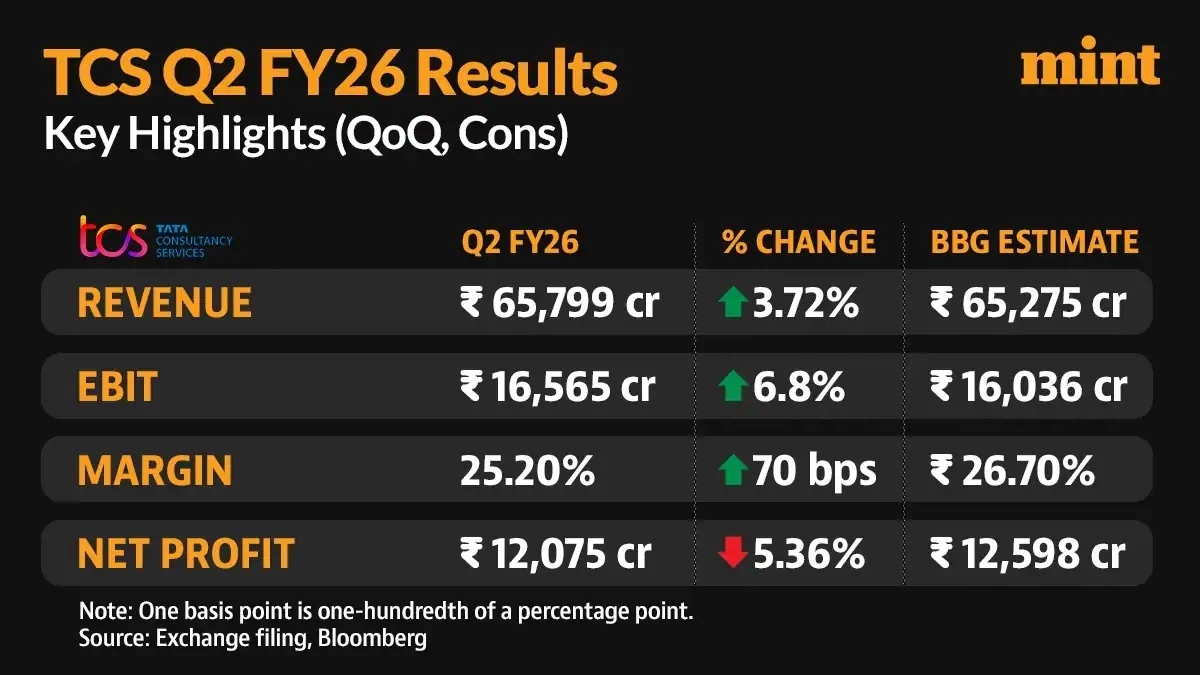

Alright, folks, earnings season is upon us, and that means it’s time to dissect the numbers and figure out what’s really going on. Today, we’re diving deep into the TCS Q2 results . It’s not just about the revenue and profit figures; it’s about understanding the underlying trends, the strategic moves, and what it all means for TCS’s future in a rapidly evolving tech landscape. Let’s be honest, the market is volatile, and tech companies are under immense pressure to deliver. So, what are the key takeaways? Did TCS hit it out of the park, or are there some underlying concerns we should be aware of?

The Big Picture | Meeting Expectations, But What About Growth?

So, the headline is that TCS has, broadly speaking, met expectations. But that’s the headline. The real story is always in the details. Deal wins are a critical metric for TCS, signaling future revenue streams and market positioning. Meeting these expectations suggests a healthy sales pipeline and continued client confidence. Now, here’s the thing: meeting expectations isn’t always enough. In a high-growth sector, companies need to consistently outperform to maintain investor enthusiasm. The question is, are these deal wins translating into sustained, above-average growth, or are they simply keeping TCS afloat in a competitive sea? I mean, you have to think about the Indian software industry as a whole.

We need to look beyond the headline figures. Let’s consider the USD revenue , which is a crucial indicator of TCS’s performance in international markets. Fluctuations in currency exchange rates can significantly impact reported revenue, so it’s important to adjust for these factors to get a true sense of underlying growth. A strong dollar can make TCS’s services more expensive for international clients, potentially impacting demand. Were there currency headwinds this quarter? And if so, how did TCS mitigate their impact? These are the questions that separate a superficial analysis from a truly insightful one. I think it’s worth pointing out that it’s also about TCS growth strategy.

The ‘Why’ Behind the Numbers | Decoding the Strategic Moves

This is where it gets interesting. It’s not enough to just know the numbers; you need to understand why they are what they are. What strategic decisions did TCS make that influenced these results? Did they invest heavily in a particular technology or market segment? Did they make any significant acquisitions or partnerships? Understanding these strategic moves provides context for the financial performance and helps us assess the long-term sustainability of TCS’s growth trajectory. As per the official reports, TCS is heavily invested in AI, but AI impact on TCS is not yet fully visible in the numbers.

For example, maybe they doubled down on cloud computing services, anticipating increased demand from businesses migrating their infrastructure to the cloud. Or perhaps they expanded their presence in a specific geographic region, targeting emerging markets with high growth potential. The key is to identify these strategic bets and assess their effectiveness in driving revenue and profitability.

Digging Deeper | Key Performance Indicators (KPIs) to Watch

Beyond the headline numbers, there are several key performance indicators (KPIs) that provide a more granular view of TCS’s performance. One crucial KPI is the attrition rate , which measures the percentage of employees who leave the company. A high attrition rate can signal issues with employee satisfaction, compensation, or career development opportunities. It can also disrupt project delivery and increase recruitment costs. So, what’s TCS’s attrition rate, and how does it compare to industry averages? Are they implementing any strategies to retain top talent? This is important for understanding TCS employee retention.

Another important KPI is the client satisfaction score , which measures how happy clients are with TCS’s services. High client satisfaction is essential for repeat business and positive word-of-mouth referrals. How does TCS measure client satisfaction, and what are they doing to improve it? Are they investing in training programs to enhance the skills of their workforce? This is more telling than it sounds; it’s not just about the work being done.

The Analyst’s Take | What Does This All Mean for the Future?

Okay, so we’ve crunched the numbers, analyzed the strategic moves, and examined the key performance indicators. Now, let’s zoom out and consider the big picture. What does all of this mean for the future of TCS? Is the company well-positioned to capitalize on emerging opportunities and navigate potential challenges? What are the key risks and uncertainties that could impact its performance? Let’s be real, TCS competitive landscape is constantly shifting.

One potential risk is the increasing competition from other IT services providers, both domestic and international. To stay ahead of the curve, TCS needs to continue to innovate and differentiate its offerings. This means investing in research and development, developing new solutions for emerging technologies, and building strong relationships with key clients. Another risk is the potential for economic slowdown in key markets. A recession could lead to reduced IT spending, impacting TCS’s revenue and profitability. This is why it is so important to look at the insurance sector.

Final Thoughts | Beyond the Numbers, It’s About Adaptability

In the end, the success of TCS hinges on its ability to adapt to a rapidly changing business environment. The tech industry is constantly evolving, and companies that can’t keep up will be left behind. TCS needs to embrace new technologies, cultivate a culture of innovation, and empower its employees to think creatively and solve complex problems. The Q2 results provide a snapshot of the company’s current performance, but they also offer insights into its long-term potential. Keep watching; the game is far from over.

FAQ Section

What exactly does “meeting expectations” mean in the context of TCS’s Q2 results?

It generally indicates that TCS’s financial performance (revenue, profit, etc.) aligned with what analysts and the company itself had predicted. However, it’s crucial to look at the specifics: were expectations high to begin with? Meeting low expectations isn’t necessarily a cause for celebration.

How are deal wins related to TCS’s future performance?

Deal wins are new contracts or projects secured by TCS. They represent future revenue and growth potential. A strong quarter for deal wins suggests a healthy pipeline of work and positive momentum for the company.

What happens if I want to invest in TCS?

Investing in the stock market carries risk, and you could lose money. Consult a financial advisor!

Why is attrition rate such an important KPI for IT companies like TCS?

High attrition can disrupt projects, increase recruitment costs, and potentially signal underlying issues with employee satisfaction. It directly impacts a company’s ability to deliver quality services and maintain a competitive edge.

How does currency fluctuation affect the TCS results?

Currency fluctuations affect the TCS results, because the dollar amount reported will change according to how the currencies fluctuate against each other.