TCS Q2 Results Live | Stock Hits High, Margins Steady, Deal Wins Expected

Alright, folks, let’s talk TCS. Not just the numbers – anyone can read a press release. We’re diving into the why behind these TCS Q2 results . What do these earnings really mean for India’s tech landscape, and, more importantly, for your investments and career prospects? Let’s unpack this.

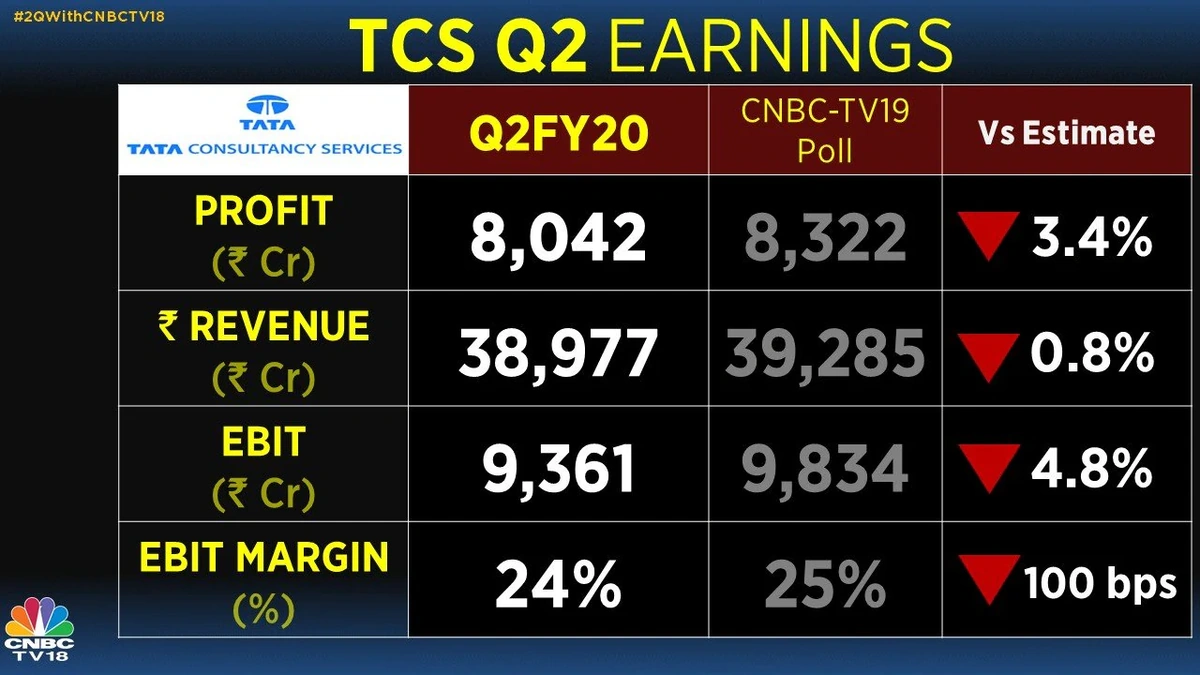

Decoding the Numbers | More Than Just Growth

So, TCS has reported its Q2 numbers, and the stock’s reacting positively. But here’s the thing: markets are often driven by sentiment, and sentiment can be fickle. We need to look deeper than just the headline figures. What’s crucial is the quality of that growth. Is it sustainable? Is it driven by strategic wins, or simply by a rising tide lifting all boats? Let’s be honest – understanding the underlying drivers is way more important than just seeing a stock price jump. We need to analyze quarterly performance metrics . And that’s where we need to focus. TCS has had a great run in terms of its deal wins , this is because their approach has become more client friendly and also very fast in its deployment cycle, something that companies like Infosys have been struggling with in the current environment.

The Margin Mystery | Steady as She Goes?

Margins. The unsung heroes of any earnings report. While TCS’s margins are holding steady, that’s not always a reason to pop the champagne. Let me rephrase that for clarity: in a highly inflationary environment, ‘steady’ might actually mean ‘slightly underperforming’. Companies like Knowledge Realty Trust are already seeing the effects of this across their board. The big question is whether TCS can maintain these margins in the face of rising employee costs and increasing competition. Is it a temporary blip, or a sign of long-term challenges? The market will be watching this closely in the coming quarters. And what fascinates me is how TCS is handling the attrition rate, a factor that directly impacts margins. This is another area to observe closely as they release subsequent results. The company’s management of their profit margins is crucial for sustainable growth.

Deal Wins | The Lifeblood of TCS

Now, the deal wins – this is where things get interesting. TCS is securing significant deals, and that’s undeniably good news. But, and this is a big ‘but’, what kind of deals are they? Are they high-margin strategic projects, or are they simply volume-based contracts that could be vulnerable to pricing pressure? What I initially thought was a straightforward win is actually a very layered, very complex scenario. For example, TCS’s recent partnership with a major European telecom firm could signal a stronger push into the 5G space. However, the long-term profitability depends on successful execution and navigating regulatory hurdles. So, pay attention to the type of deals TCS is winning. It’s not just about the quantity, but also the quality and long-term impact. Be sure to understand the impact of the new contracts .

The Indian IT Landscape | TCS in Context

TCS doesn’t exist in a vacuum. What fascinates me is how its performance stacks up against its peers – Infosys, HCL, Wipro. Are they all experiencing similar trends? Is TCS outperforming or underperforming the industry average? Understanding this context is crucial for assessing TCS’s true strength. As per Wikipedia’s profile of TCS, the company remains a bellwether for the entire Indian IT sector. The other point is, Indian IT is adapting to cloud computing, AI, and data analytics. Companies not investing seriously in these fields will be left behind and TCS is ahead of the curve and will be investing more, especially in generative AI.

The rise of disruptive technologies can also have an impact. If one studies reports about IndiaMart for example, one realizes that in today’s landscape, companies that innovate and adopt new technologies faster are the companies that win.

Looking Ahead | What to Watch For

So, what should you be watching for in the coming quarters? I’d say focus on these key indicators: margin trends, the nature of new deal wins, attrition rates, and TCS’s investment in emerging technologies. A common mistake I see people make is focusing solely on the stock price. Instead, become a student of the business. Understand the underlying dynamics, and you’ll be in a much better position to make informed decisions. Don’t forget to check the future projections . Make sure the management is on track to make those projections real.

FAQ Section

Frequently Asked Questions About TCS Q2 Results

What exactly does “margins steady” mean?

It means the difference between TCS’s revenue and costs hasn’t significantly increased or decreased. However, in an inflationary environment, maintaining steady margins can be seen as a challenge.

How do deal wins impact TCS’s future?

Deal wins provide revenue visibility and indicate TCS’s competitiveness. However, the profitability of these deals depends on their type and execution.

Why is attrition rate important?

A high attrition rate can increase costs (due to recruitment and training) and disrupt projects. Monitoring TCS’s ability to retain talent is crucial.

Where can I find the official TCS Q2 results?

You can find the official results on TCS’s investor relations website.

What if I don’t understand all the financial jargon?

Don’t worry! Focus on the key trends discussed here and consult financial news sources for explanations of specific terms.

So, there you have it. Not just the numbers, but the story behind them. Now it’s up to you to do your research and find out more. Remember, successful investing is about more than following the herd; it’s about understanding the underlying dynamics and making informed decisions based on knowledge, not just hype.