Coal India Share Price | What’s Fueling the Rally?

Okay, let’s talk Coal India share price . You’ve probably seen it buzzing in the news, maybe even felt a little FOMO creeping in. But before you jump on the bandwagon, let’s dig deeper than just the headlines. What’s really going on, and more importantly, is this a sustainable surge or just a flash in the pan?

What fascinates me is how a company so deeply rooted in a seemingly “old” industry can still generate so much buzz. Isn’t coal, well, a bit yesterday in the age of renewable energy? That’s what I initially thought, but then I realized there’s a whole lot more at play here. And if you’re even remotely interested in the Indian stock market, this is a story you need to understand.

Decoding the Coal India Surge | It’s More Than Just Coal

So, what’s behind this upward climb of the Coal India stock ? It’s not solely about increased coal demand, although that plays a part, especially with India’s growing energy needs. Think of it as a perfect storm of factors coming together. But the price is also influenced by the overall sentiments of the stock market .

One key driver is the company’s consistent performance and dividend payouts. Investors love predictability, and Coal India has been delivering. But, and this is a big but, it’s also about broader economic trends. Rising global energy prices, supply chain disruptions (thanks, in part, to geopolitical tensions), and a renewed focus on energy security have all contributed to a resurgence in coal demand, at least for now. The company’s market capitalization has been growing.

Let me rephrase that for clarity: It’s not just that India needs more coal; it’s that the world is facing an energy crunch, and Coal India is a major player in filling that gap. However, it is crucial to remember that the energy transition is underway. One must also look at companies like Netweb which are driving advancements in high performance computing.

The Government’s Role | A Double-Edged Sword?

Here’s the thing: Coal India is a public sector undertaking (PSU), which means the government is a major shareholder. This has pros and cons. On one hand, it provides stability and backing. On the other, government policies and decisions can significantly impact the company’s operations and stock performance. For example, changes in environmental regulations or coal pricing policies can send ripples through the market.

But – and this is a crucial point – the government is also pushing for increased coal production to meet domestic demand and reduce reliance on imports. This support acts as a tailwind for Coal India, at least in the short term. So keep an eye on governmental policies regarding the energy sector.

Risks and Rewards | Is Coal India a Good Investment?

Now, for the million-dollar question: Should you invest in Coal India? Well, as with any investment, there are risks involved. The biggest one, in my opinion, is the long-term viability of coal in a world increasingly focused on renewable energy. While coal demand is currently strong, what happens in 10, 15, or 20 years? That’s the elephant in the room.

However, the company is taking steps to diversify its business, exploring opportunities in renewable energy and coal gasification. But the transition has been slow. The question is whether these efforts will be enough to offset the eventual decline in coal demand. Moreover, factors like analyst recommendations can influence the stock performance .

A common mistake I see people make is focusing solely on the current share price and ignoring the bigger picture. It’s essential to consider the company’s fundamentals, the industry trends, and your own investment goals and risk tolerance. The future also depends on global coal demand .

Looking Ahead | Factors to Watch

So, what should you watch out for if you’re following the Coal India share price target ? Keep an eye on these:

- Global energy prices: A significant drop in oil or gas prices could reduce the demand for coal.

- Government policies: Changes in environmental regulations or coal pricing could impact Coal India’s profitability.

- Renewable energy adoption: The faster the world transitions to renewable energy, the sooner coal demand will decline.

- Company’s diversification efforts: The success of Coal India’s renewable energy and coal gasification projects will be crucial for its long-term survival.

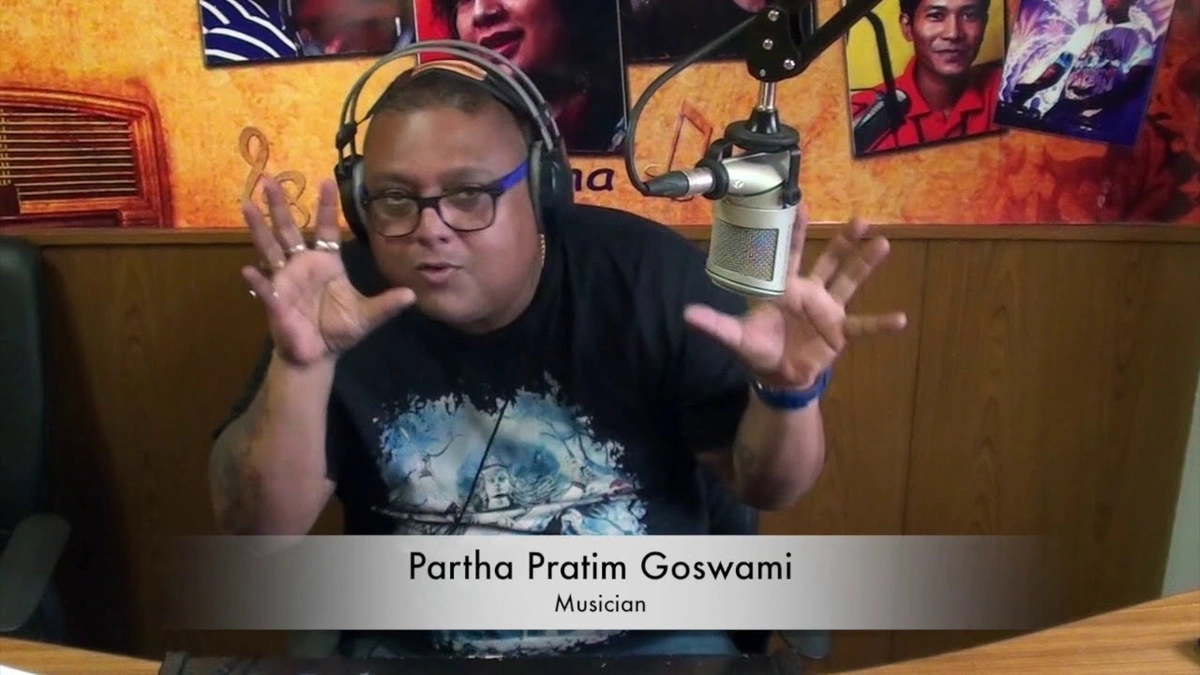

Ultimately, investing in Coal India is a bet on whether the company can successfully navigate the energy transition and remain relevant in a changing world. It’s a complex story with no easy answers. What fascinates me about Nithin Kamath , for example, is his ability to look at the energy transition as an opportunity to educate people about smart investment strategies.

FAQ About Coal India Share Price

What factors influence Coal India’s share price?

Coal India’s share price is influenced by a mix of factors, including global energy prices, government policies, domestic coal demand, company performance, and investor sentiment.

Is Coal India a good long-term investment?

That depends on your risk tolerance and belief in Coal India’s ability to adapt to the energy transition. The long-term future of coal is uncertain, so it’s crucial to consider the risks before investing.

How does the government affect Coal India?

As a PSU, Coal India is subject to government policies and directives, which can significantly influence its operations and financial performance.

Where can I find the latest Coal India share price information?

You can find the latest Coal India share price information on financial websites like the National Stock Exchange (NSE) (NSE India) and Bombay Stock Exchange (BSE). You can also find information from financial news outlets.

What is Coal Gasification?

Coal gasification is the process of converting coal into gas fuel, typically referred to as syngas.

Does the company give dividends?

Yes, Coal India often has good dividend payout policies, so many investors will want to keep an eye on dividend yield.

In conclusion: Coal India’s story is far from over. It’s a fascinating case study in how a traditional industry grapples with disruption, government influence, and the ever-changing demands of the modern world. Don’t just look at the share price; understand the forces shaping it.