Decoding PPF Interest Rates | What It Means for Your Financial Future

The world of finance can feel like navigating a maze, right? So many acronyms, so many fluctuating numbers. Let’s talk about something that affects a huge number of Indians: the PPF, or Public Provident Fund. Now, you might hear about changes to PPF interest rates and think, “Okay, another number to keep track of.” But here’s the thing: those rates have a ripple effect on your long-term financial goals. It is not just numbers, it’s about your future. Let’s dive into why these changes matter and how you can make the most of them.

Why PPF Interest Rates Aren’t Just Numbers

I initially thought understanding PPF rates was straightforward, but it’s deeper than that. The interest rate on your PPF isn’t some arbitrary figure plucked from thin air. It’s influenced by a bunch of factors, primarily the yield on government bonds. See, the government uses the money from PPF to fund various projects. When the yield on those bonds goes up, so does the potential for higher returns on your PPF. And when they drop? Well, you get the idea.

But the real question is: Why should you care? Because your PPF is likely a cornerstone of your long-term savings, especially for retirement. Even small changes in the interest rate can make a significant difference over the 15-year tenure, thanks to the power of compounding. Think of it like this: a tiny stream can carve a grand canyon, given enough time.

Maximizing Your PPF | A Step-by-Step Guide

Okay, so the rates matter. But how do you actually use this information to your advantage? Let’s break it down with a simple guide.

- Stay Informed: Keep an eye on announcements from the Ministry of Finance. They usually review and revise PPF rates quarterly. Several financial websites and news outlets report on these changes, but always cross-reference with official sources if you can.

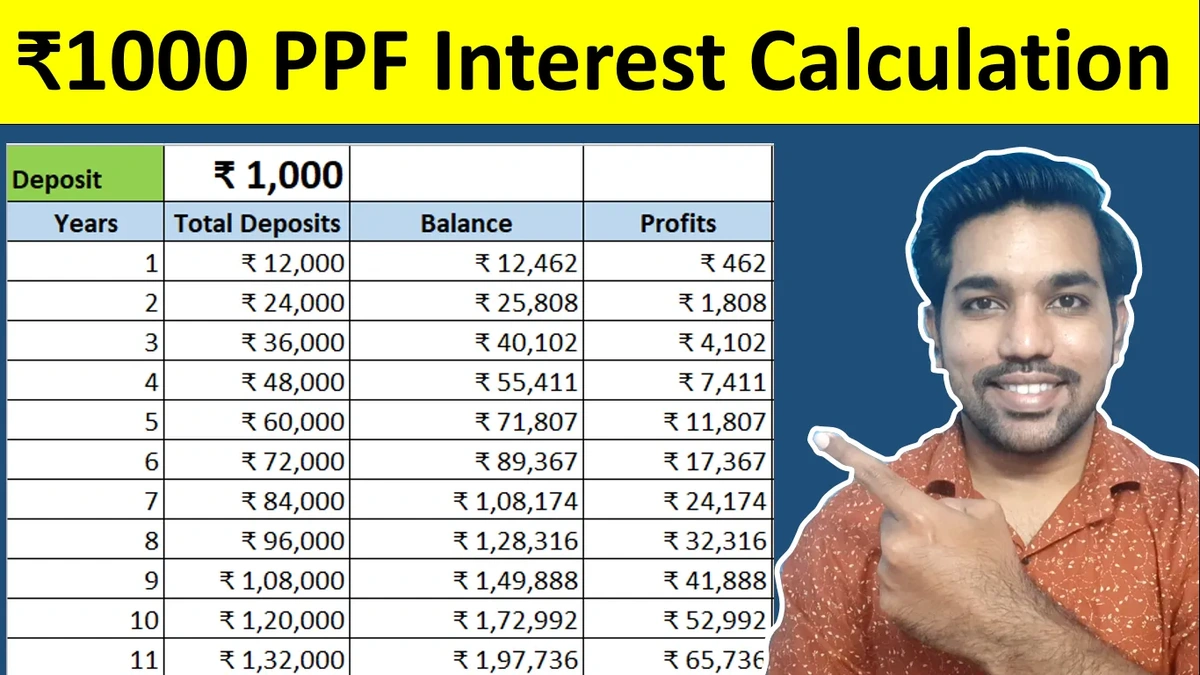

- Invest Early: The earlier you start investing in your PPF, the more time your money has to grow. Even small, consistent investments can add up to a substantial sum over 15 years.

- Maximize Your Contribution: The current maximum annual contribution to PPF is ₹1.5 lakh. If you can afford it, aim to invest the maximum amount to take full advantage of the tax benefits under Section 80C of the Income Tax Act and the power of compounding. A common mistake I see people make is waiting until the end of the financial year to invest. That can be a scramble.

- Understand the Lock-in: PPF has a 15-year lock-in period. While partial withdrawals are allowed after 7 years under certain conditions, it’s best to view PPF as a long-term investment.

And, by the way, did you know that the interest earned on PPF is fully tax-exempt? That’s a triple whammy: tax deduction on investment, tax-free interest, and tax-free withdrawals. Talk about a sweet deal!

The Emotional Side of PPF | Peace of Mind in a Chaotic World

Let’s be honest, the financial world can feel incredibly unstable. There are so many investment options with so many risks. What fascinates me is the PPF offers something increasingly rare: a sense of security. It’s backed by the government, which makes it one of the safest investment options available. This isn’t about getting rich quick; it’s about building a stable financial base for your future. That peace of mind has real value, especially in today’s uncertain times.

Thinking long-term can be daunting, but breaking it down into smaller, manageable steps makes it less overwhelming. Consider setting up a recurring investment in your PPF account. Automating the process makes it easier to stay consistent and avoid the temptation to spend that money elsewhere.

PPF contributions also qualify for deductions under Section 80C of the Income Tax Act, further reducing your taxable income. Remember to consult with a financial advisor to understand how PPF fits into your overall financial plan. For more information on financial planning, you can also check Union Bank India .

Decoding PPF Maturity and Extension Rules

Now, what happens after the 15-year maturity period? You have a few options. You can withdraw the entire amount, extend your PPF account for another 5 years (or more) with or without making further contributions, or close the account. If you choose to extend without making further contributions, the balance will continue to earn interest, and you can make one withdrawal per financial year.

If you decide to extend with contributions, you’ll continue to enjoy the same tax benefits and earn interest on your investments. This can be a great way to boost your retirement savings even further. But, and this is important, make sure to inform the bank or post office where you hold your PPF account about your decision to extend the account before it matures. Otherwise, the account will automatically become inoperative, and you won’t be able to make any further contributions.

Staying updated with the latest PPF scheme guidelines is important. You can find these updates on the official website of the Ministry of Finance and from reputed financial news sources.

PPF vs. Other Investment Options | A Quick Comparison

Let’s be real: PPF isn’t the only investment option out there. So, how does it stack up against others? Here’s a quick rundown:

- Equity Mutual Funds: Potentially higher returns, but also higher risk. Suitable for long-term goals if you’re comfortable with market volatility.

- Fixed Deposits (FDs): Lower risk than mutual funds, but generally lower returns than PPF. Good for short-term goals.

- National Pension System (NPS): A retirement-focused scheme with a mix of equity and debt. Can offer higher returns than PPF, but also comes with market risk.

The best investment option for you depends on your individual circumstances, risk tolerance, and financial goals. PPF is generally a good choice if you’re looking for a safe, tax-efficient, and long-term investment option.

To understand more about stock markets and other financial instruments, you can also check Oracle share price .

FAQ About PPF Interest Rates

Frequently Asked Questions

How often do PPF interest rates change?

The government reviews and revises PPF interest rates on a quarterly basis. This means the rates can change every three months.

Is PPF a good investment for everyone?

PPF is generally a good investment for individuals seeking a safe, tax-efficient, and long-term investment option, especially for retirement planning.

What happens if I don’t contribute to my PPF account every year?

If you don’t make the minimum contribution of ₹500 in a financial year, your PPF account will become inactive. You can revive it by paying a penalty of ₹50 along with the arrears.

Can I have more than one PPF account?

No, you can only have one PPF account in your name.

What are the tax benefits of investing in PPF?

Investments in PPF qualify for deduction under Section 80C of the Income Tax Act, up to ₹1.5 lakh per annum. The interest earned is tax-free, and the maturity amount is also exempt from tax.

So, there you have it. PPF interest rates aren’t just numbers; they’re a key to unlocking your financial future. By staying informed, investing early, and understanding the rules, you can make the most of this powerful savings tool. And remember, it’s not just about the money; it’s about the peace of mind that comes with knowing you’re building a secure financial foundation for yourself and your loved ones.