That “Nifty Share Price” You Keep Hearing About? It’s Not What You Think.

I was in a coffee shop the other day, nursing an Americano and trying to untangle a particularly stubborn thought, when I overheard it. The classic, confident declaration from the table next to me: “The Nifty share price is just unstoppable right now.”

I smiled into my mug. It’s a phrase you hear everywhere in elevators, on news channels, from that one uncle at every family gathering. It’s spoken with such authority, as if “Nifty” is a single, monolithic company like a Reliance or a TCS that you can just… buy a piece of.

But here’s the secret. The little bit of trivia that separates the casual observer from someone who’s starting to get it.

There is no such thing as a Nifty share. Not a single one.

And yet, understanding the phantom “price” of this thing is probably the single most important first step anyone can take to make sense of the beautiful, chaotic beast that is the Indian stock market .

So, What Exactly IS the Nifty Then? (Spoiler | It’s Not a Share Price)

Think of the Nifty 50 as a health report. Not for a single person, but for a whole group of people. Let’s say you wanted to know the general academic health of a school’s top 50 students. You wouldn’t just look at the topper’s marks, right? And you wouldn’t just look at the student ranked 50th. You’d take a kind of weighted average of all 50 to get a single number that represents the group’s overall performance.

That’s the Nifty.

It’s a stock market index managed by the National Stock Exchange (NSE). It tracks the performance of 50 of the largest and most liquid Indian companies across various sectors banking, IT, energy, you name it. The “price” you see on your screen, that number flashing red or green, isn’t a price in rupees you can pay for one share. It’s a points value. A score. A market pulse. When the collective value of those 50 giant companies goes up, the Nifty’s score goes up. When they go down, the Nifty follows. It’s that simple, and that complex. For an even deeper dive into the mechanics, the official National Stock Exchange site has all the nitty-gritty details.

So when someone talks about the nifty share price , what they’re really talking about is the overall mood of the market. They’re using a single number as shorthand for a massive, sprawling story about economic confidence, corporate earnings, and investor psychology. It’s less of a price tag and more of a barometer for market sentiment .

The Nifty vs. Sensex Tussle | A Tale of Two Barometers

And just when you get your head around the Nifty, someone inevitably throws another name into the ring: the Sensex. You’ll often hear the two mentioned in the same breath. “Nifty is up 100 points, Sensex is up 300.” It can feel like you’re trying to follow two different games at once.

But it’s not that complicated. Honestly.

The Sensex is just another barometer, like the Nifty. The main differences are pretty straightforward:

- The Home Ground: Nifty lives on the National Stock Exchange (NSE). Sensex lives on the Bombay Stock Exchange (BSE). They’re the two major leagues of the Indian stock market.

- The Team Size: Nifty tracks 50 companies. The Sensex, being the older of the two, tracks 30 of the largest companies on the BSE.

That’s basically it. They are two different measuring sticks for the same thing: the overall health of India’s top-tier public companies. Because they track many of the same heavyweight companies, they almost always move in the same direction. If the Nifty is having a good day, the Sensex is probably having one too. Watching the sensex share price (again, not a real price, but a point value!) alongside the Nifty gives you a slightly different, but highly correlated, view of the market’s pulse. It’s like asking two different doctors to check your vitals; their readings might be slightly different, but they’ll both tell you if you have a fever. Just as individual stocks have their moments, like the ongoing buzz around Jio Finance share price analysis , these indices give us the bigger picture.

Why You Should Care About the Nifty Even If You Don’t Invest

“Okay, fine,” you might be thinking. “It’s a big-picture score. But I don’t own stocks. Why should this number matter to me?”

It’s a fair question. The thing is, the Nifty is more than just a scoreboard for investors. It’s a reflection of the national mood, at least on an economic level. When the Nifty is consistently climbing, it generally means that big businesses are doing well, foreign investors have confidence in the Indian economy, and there’s a general sense of optimism. This can translate into job creation, corporate expansion, and a stronger rupee. It hints at the country’s overall economic health .

Conversely, a sustained fall in the Nifty can be an early warning sign. It can signal that investors are getting nervous, pulling money out, and anticipating tougher times ahead. It doesn’t cause a recession, but it can certainly reflect the anxieties that lead to one. It’s a bit like seeing everyone on the street suddenly opening their umbrellas. It doesn’t make it rain, but it’s a pretty good sign that a storm is coming.

It’s a crucial feedback loop. The performance of these companies affects the economy, and the state of the economy, in turn, affects the companies. The Nifty is just the messenger that delivers this news, good or bad, every single trading day. It’s a living, breathing number that tells a story about our collective financial future, a bit like the anticipation surrounding a big market entry, such as the Aditya Infotech IPO hype .

A Few Questions I Get Asked All the Time (FAQ)

Can I actually buy a “Nifty share”?

Nope, you can’t buy the index directly because it’s just a number, a concept. But and this is the important part you can absolutely invest in it. The most common way is through an “Index Fund” or an “Exchange Traded Fund” (ETF). These are special funds that hold shares of all 50 companies in the Nifty 50, in the exact same proportion as the index itself. So when you buy a unit of a Nifty ETF, you’re essentially buying a tiny slice of all 50 companies at once. It’s the simplest way of investing in Nifty and betting on the Indian growth story as a whole.

Why does the Nifty go up or down?

Oh, a million reasons! It’s a mix of company-specific news (like a huge profit announcement from a major bank), broad economic data (like inflation numbers or GDP growth), government policy changes (a new budget or a change in tax law), global events (a war or a change in oil prices), and pure, simple human emotion what analysts call market sentiment . Sometimes, there’s no clear reason at all. The market just… moves.

Is a high Nifty always a good thing for the economy?

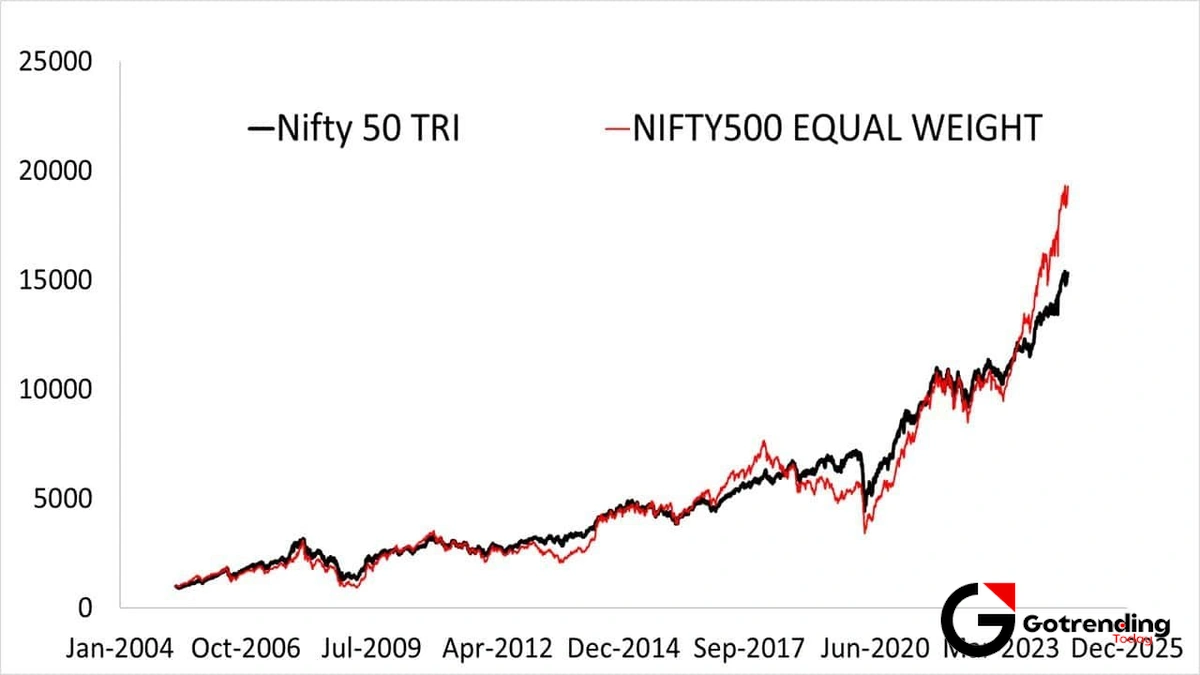

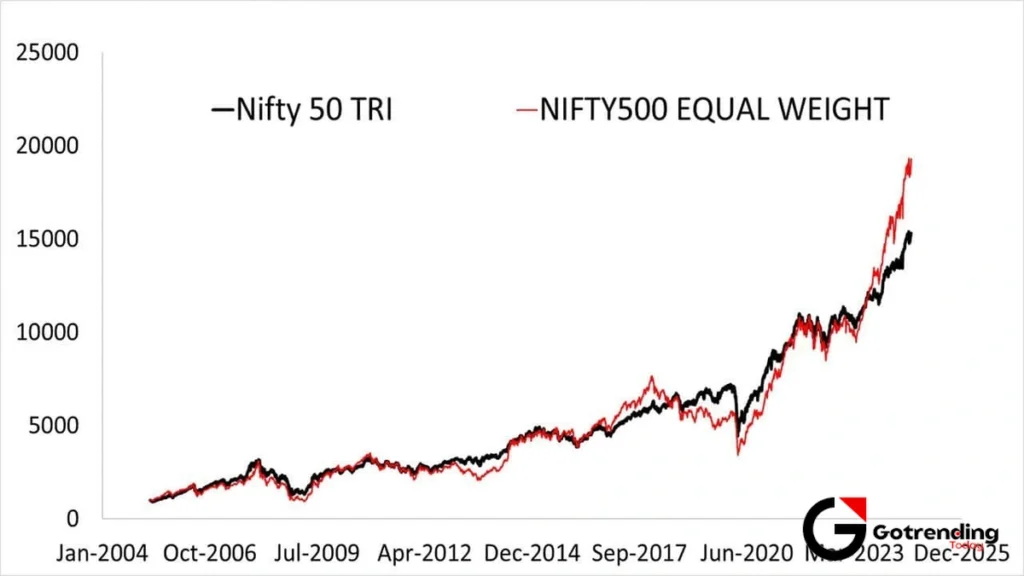

This is a great question and a common misconception. Generally, yes, a rising market is a positive sign. But it’s not the whole story. Sometimes, a market rally can be driven by just a handful of the biggest companies in the index, while smaller companies (and the rest of the economy) might be struggling. So, while a high Nifty today might look great on the surface, experts always look deeper to see if the growth is broad-based or concentrated in just a few hands. It’s an indicator, not a gospel truth.

What’s a “good” Nifty share price level to invest at?

Ah, the billion-dollar question. If anyone knew the answer to this with certainty, they’d be the richest person in the world. Trying to “time the market” by waiting for the perfect low point is incredibly difficult, even for professionals. A more common strategy for regular investors is something called a Systematic Investment Plan (SIP), where you invest a fixed amount regularly. This approach, known as rupee cost averaging, takes the guesswork out of it. You buy more units when the price is low and fewer when it’s high. For most people, consistency beats timing.

At the end of the day, the Nifty isn’t just a number to be tracked; it’s a story to be read. It’s the collective ambition, fear, innovation, and folly of millions of people, all distilled into a single, ever-changing data point. It’s not a price tag for a stock, but a price on our economic confidence. And that, I think, is a far more fascinating thing to watch.