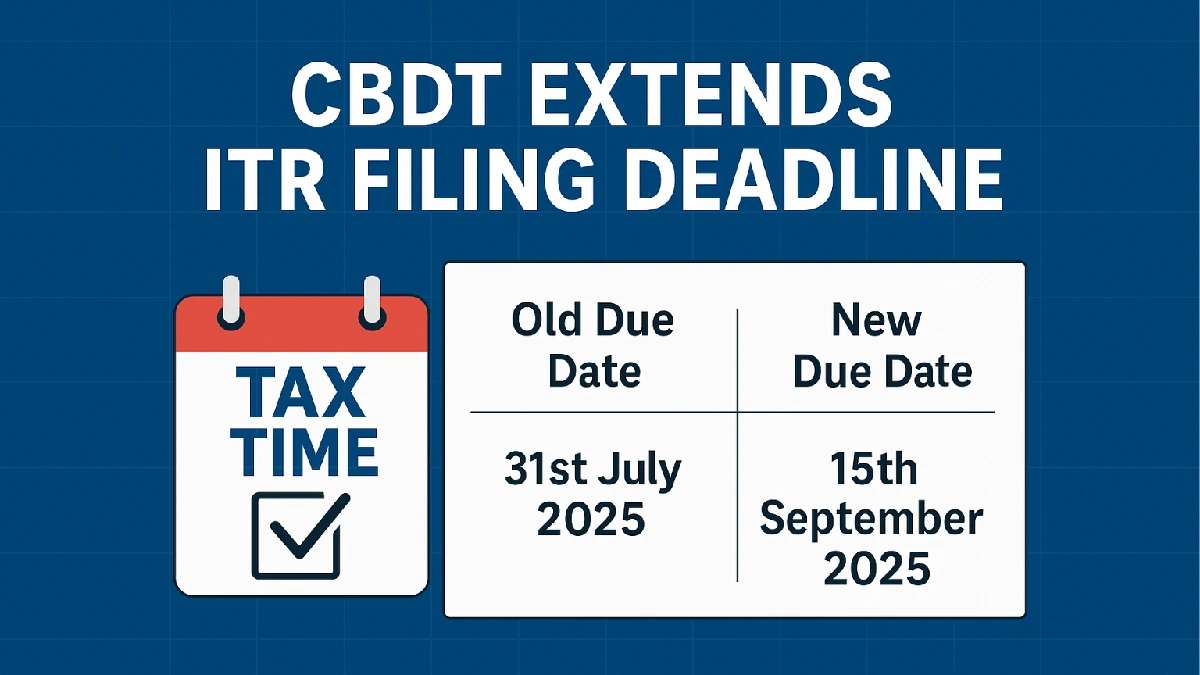

Breaking: CBDT Extends ITR Filing Due Date—But Why?

Okay, deep breaths, everyone. The Central Board of Direct Taxes (CBDT) has done it again – extended the ITR filing due date . But before you breathe a sigh of relief and push it to the back of your mind again, let’s talk about why this matters and what’s really going on. I mean, extensions are great, right? More time to gather those pesky Form 16s and scramble for deductions. But are they a sign of something bigger? That’s what we’re digging into today.

The Real Reason Behind the Extension (It’s Not Always What You Think)

Let’s be honest, sometimes these extensions feel like a yearly ritual. We almost expect them, don’t we? But it isn’t always taxpayer goodwill that drives the decision. More often than not, it’s about system readiness and ensuring a smoother process for everyone. According to official sources , the extension often coincides with the Income Tax Department addressing technical glitches on the e-filing portal or incorporating last-minute changes to the compliance procedures. It’s like when your favorite restaurant suddenly closes for a week – usually means they’re revamping the kitchen, not just taking a vacation. But , this doesn’t diminish the benefit you reap from it.

Think about it: a rushed filing process benefits no one. Overloaded servers, incorrect data entry, and panicked last-minute scrambles lead to errors and increased scrutiny. Extensions provide a crucial buffer, allowing both taxpayers and the department to breathe easier and ensure accuracy. A common mistake I see people make is rushing their filing at the last moment. This usually results in overlooking key deductions or entering incorrect information.

Decoding the Impact | What Does This Mean for You?

So, the ITR filing deadline extended – great news! But what does it actually mean for you, the average Indian taxpayer? Well, for starters, it buys you time. More time to double-check your calculations, consult with a tax advisor (if needed), and gather any missing documents. It also reduces the chances of penalties for late filing. But, and this is a big but, don’t let it lull you into complacency.

See, the extension isn’t an excuse to procrastinate indefinitely. Use the extra time wisely. Consider it an opportunity to get your financial house in order. And , I’ve found that people who file early tend to be more relaxed and less prone to errors.

And here’s something that fascinates me: often these extensions are accompanied by updates to the Income Tax Act itself. The government may introduce new provisions or clarifications that impact your tax liability. Keep an eye out for these announcements and adjust your filing accordingly.

Beyond the Deadline | Long-Term Implications for the Indian Economy

Okay, let’s zoom out for a second. These CBDT notifications aren’t just about individual taxpayers; they have broader implications for the Indian economy. A smooth and efficient tax collection process is crucial for funding government programs, infrastructure development, and social welfare initiatives. When deadlines are unrealistic, it creates bottlenecks and inefficiencies.

What fascinates me is how seemingly small administrative decisions like extending a deadline can have a ripple effect on the entire economy. Think of it like this: if people are stressed and burdened by tax compliance, they’re less likely to invest and contribute to economic growth. But , when the process is streamlined and user-friendly, it encourages participation and fosters a culture of tax compliance.

Moreover, these extensions also provide valuable insights into the government’s priorities. Are they prioritizing revenue collection above all else? Or are they genuinely committed to making tax compliance easier for citizens? The frequency and nature of these extensions offer clues to these underlying policy choices.

Practical Advice | How to Make the Most of This Extension

Alright, enough with the big picture stuff. Let’s get down to brass tacks. How can you, the diligent Indian taxpayer, leverage this extension to your advantage? A common mistake I see people making is waiting until the very last day, even with the extension. Here’s my advice, based on what I’ve seen work:

- Gather all your documents ASAP: Don’t wait until the last minute to hunt down your Form 16, investment statements, and deduction proofs.

- Double-check your calculations: Errors can lead to penalties and scrutiny. Use online tax calculators to verify your figures.

- Consider consulting a tax advisor: If you’re unsure about any aspect of your tax filing, seek professional help.

- Use the online portal effectively: Familiarize yourself with the e-filing portal and its features.

- Don’t procrastinate: Even with the extra time, aim to file well before the deadline.

By following these simple tips, you can transform the ITR filing process from a dreaded chore into a manageable task. Remember, the extension is a gift – use it wisely!

And here’s a pro tip: keep an eye on the official CBDT website for any updates or clarifications. They often release FAQs and guides to help taxpayers navigate the filing process.

The Final Word | An Extension is a Chance, Not a Crutch

So, the income tax return (ITR) filing date has been extended. Great! But it’s more than just a get-out-of-jail-free card. It’s a chance to get your finances in order, understand your tax obligations, and contribute to the nation’s growth. Don’t waste it. Use it to become a more informed and responsible taxpayer.

Consider this as well, while you’re thinking about your finances, Angel One could potentially help with your investments. Or perhaps you’d like to know more about Tata Steel Share.

The due date extension is just one piece of the puzzle. The real story is about how we, as citizens, engage with the tax system and contribute to a better India.

FAQ

What happens if I still miss the extended due date?

You’ll likely face penalties and interest charges on the outstanding tax amount.

Will there be any further extensions?

While it’s impossible to predict the future, relying on further extensions is not a good strategy. Aim to file within the current deadline.

Where can I find the official notification from CBDT?

Check the official website of the Central Board of Direct Taxes (CBDT) here.

What if I already filed my ITR before the extension?

If you filed correctly, no action is needed. If you find errors, you can revise your return.

Does this extension apply to all taxpayers?

Typically, these extensions apply to most individual taxpayers, but it’s best to verify the specific details in the official notification.