Dixon Share Price | The Story Stock That Has India Hooked

There are some stocks you watch, and then there are stocks you feel. The Dixon share price chart isn’t just a line on a screen; it’s a shot of adrenaline. It’s the market equivalent of a high-stakes cricket match, with wild swings, moments of sheer brilliance, and periods of nerve-wracking silence. For years, I’ve watched this ticker, and I’ve got to admit, few companies encapsulate the new-age Indian growth story with such gut-punching clarity.

You look at the numbers, and they can make you dizzy. The valuation seems to defy gravity. The volatility can give you whiplash. And yet, it keeps climbing, keeps capturing our imagination. Why? Because Dixon isn’t just a company. It’s a proxy. It’s a bet on a much bigger idea.

An idea that the next great manufacturing story won’t just have a ‘Made in China’ label on it. It’ll have a ‘Made in India’ one.

So, What on Earth Does Dixon Actually Do?

This is the first question I always get. And it’s a fair one. Dixon Technologies isn’t a brand you see on a billboard. You can’t walk into a Dixon store. They are, for all intents and purposes, the biggest company you’ve probably never heard of, but whose products you almost certainly use every single day.

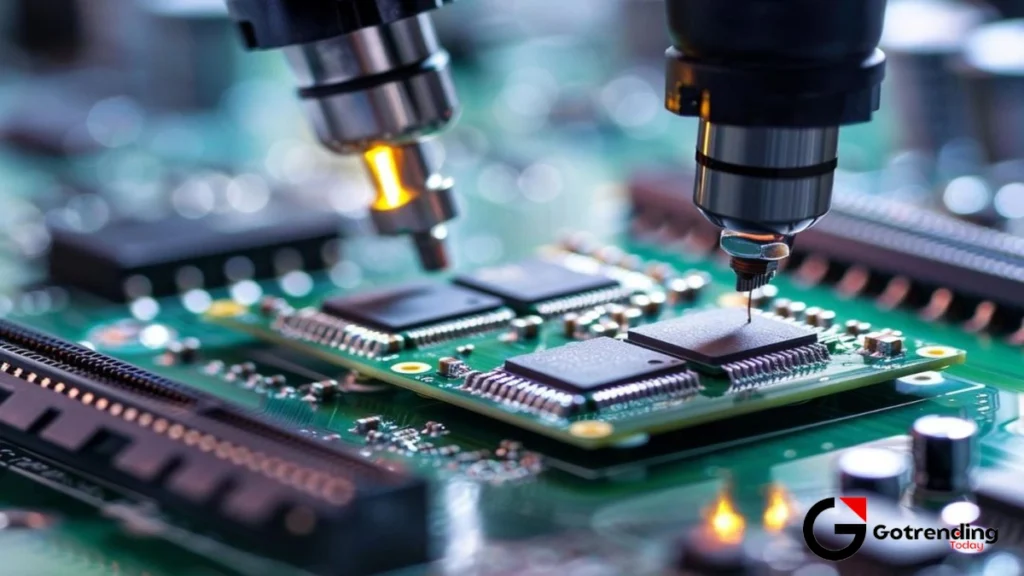

Think about it this way. That slick LED TV from Xiaomi on your wall? The Samsung washing machine in your utility room? The Motorola smartphone in your pocket? There’s a very good chance Dixon’s hands built it. They are India’s largest homegrown contract manufacturing player. They are the wizards behind the curtain, the invisible factory that brings the visions of global (and Indian) brands to life.

I initially thought of them as just an assembler. Sticking part A into slot B. But that’s not quite right. Over the years, they have moved relentlessly up the value chain from basic assembly to designing entire circuit boards and building key components. This is crucial. This is the difference between being a simple labour provider and becoming a genuine technology partner.

And then, the government threw rocket fuel on this fire. It’s called the PLI scheme (Production-Linked Incentive). In simple terms, the government said, “Hey, if you make stuff here, in India, and hit certain targets, we’ll give you a cash bonus.” For a company like Dixon, this was like a turbocharger being bolted onto an already powerful engine. It supercharged their growth and made them the undisputed poster child for the Make in India narrative. You can see how this policy focus impacts high-growth sectors by looking at other market darlings; a quick look at a Titan share price analysis shows how a strong brand and favourable market conditions can create immense value.

The Elephant in the Room | That Sky-High Valuation

Okay, let’s talk about the price. The part that makes traditional, value-focused investors break out in a cold sweat. At any given time, the Dixon share price trades at a P/E (Price-to-Earnings) multiple that can seem, well, insane. We’re talking numbers that are usually reserved for high-growth tech startups, not manufacturing companies.

So, is the market crazy? Or is it seeing something else?

Here’s the thing. You’re not paying for what Dixon is today. You’re paying for what the market believes it will become tomorrow. You’re buying a ticket to the future of Indian manufacturing. The bet is that as global supply chains shift away from China (a trend called China+1), Dixon will be one of the biggest beneficiaries. The bet is on them entering new, high-margin verticals like telecom equipment, laptops, and IT hardware. They’ve already started. This isn’t just a dream; it’s in their quarterly reports and investor calls, which you can often track on platforms like Moneycontrol.

But and this is a big but the risks are just as real. Contract manufacturing is a notoriously thin-margin business. Your fortunes are tied directly to the success of your clients. What happens if a major client, say a big smartphone brand, decides to build its own factory or switch to a competitor? That’s a huge chunk of revenue gone, just like that. This dependency is the Sword of Damocles that hangs over the stock.

Beyond the Hype | The Real Risks and The Real Story

I find that the most interesting part of the Dixon Technologies story isn’t the roaring bull case, but the tightrope it has to walk. It’s a constant balancing act. They need to keep their clients happy, invest heavily in new factories (which costs a fortune), and constantly innovate to stay ahead, all while trying to protect their paper-thin profit margins.

The frustration for an investor is that the share price can be divorced from fundamentals for long periods. A bit of bad Dixon Technologies news can send it tumbling 10%. A new client announcement can send it soaring 15%. It’s a momentum stock driven by a powerful narrative, much like the buzz around a hot new listing; the excitement is similar to what you might see with something like the Smartworks IPO GMP discussions.

So, looking at the dixon share price isn’t just about financial analysis. It’s about gauging sentiment. It’s about understanding geopolitics and government policy. It’s about believing that the company’s management, led by the very sharp Sunil Vachani, can navigate these treacherous waters.

It’s not a stock for the faint of heart. It’s a high-conviction bet. You’re either a believer in the long-term structural story of Indian manufacturing, or you’re not. There’s very little middle ground here. And that, I think, is what makes it so utterly compelling to watch.

Frequently Asked Questions

So, is the Dixon share price going to crash? It feels so expensive.

Expensive? Yes. Going to crash? That’s the billion-dollar question. High-growth stocks like Dixon live on a different planet of valuation. They often correct sharply (20-30% drops are not uncommon) when there’s bad news or a general market downturn. But a “crash” implies a permanent loss of value. For that to happen, the core “Make in India” story would have to fall apart. It’s more likely to be a volatile ride than a straight-up crash.

What does this PLI scheme mean for me as an investor?

Think of the PLI scheme as a safety net for Dixon’s profits and a catalyst for its growth. It gives the company a direct financial incentive to produce more, which boosts revenue. More importantly, it reduces the risk of setting up new production lines, encouraging them to enter new product categories faster than they would have otherwise. It essentially underwrites their expansion plans, which is a massive positive for investors.

Is Dixon a good buy for a first-time investor?

I would be very cautious here. While the story is fantastic, the volatility can be brutal for a newcomer. Seeing your investment drop 15% in a week can be terrifying if you’re not prepared for it. A stock like Dixon is probably better suited for investors who have a bit more experience, a higher risk appetite, and a genuinely long-term outlook (think 5+ years).

Forget the price, what’s the biggest actual risk to the company?

Client concentration. Without a doubt. While they have a diverse list of customers, a significant portion of their revenue comes from a handful of big names in the mobile and consumer electronics space. If their relationship with even one of those key clients sours, or if that client underperforms globally, it would have a direct and painful impact on Dixon’s top and bottom lines. That’s the key risk to watch.